No CrossRef data available.

Published online by Cambridge University Press: 20 March 2017

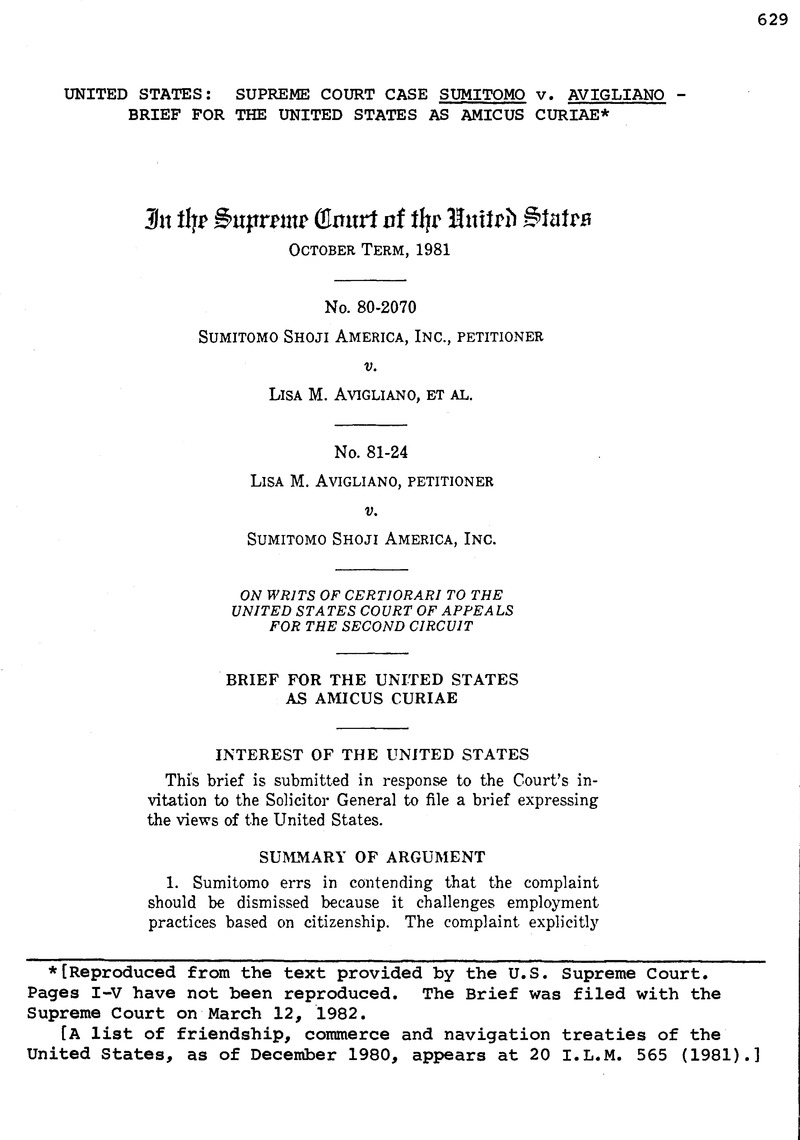

[Reproduced from the text provided by the U.S. Supreme Court. Pages I-V have not been reproduced. The Brief was filed with the Supreme Court on March 12, 1982.

[A list of friendship, commerce and navigation treaties of the United States, as of December 1980, appears at 20 I.L.M. 565 (1981).]

1 Article 1(b) further provides that nationals of one Party may enter the territories of the other “for the purpose of developing and directing the operations of an enterprise in which they have invested, or in which they are actively in the process of investing, a substantial amount of capital.” Aliens seeking to enter the United States for this purpose must qualify as a “treaty investor” under the 8 U.S.C. 1101(a)(15)(E)(ii). See also 8 U.S.C. 1101(a)(15) (L) (intra-company transfers).

2 See also id. at 5a, fi 6 (“an applicant coming to head one of [the] operation's bureaus or departments (e.g., accounting, loans, etc.) could probably be deemed destined to an executive or supervisors position and therefore entitled to E-l issuance”).

3 This argument also is inconsistent with Sumitomo's answer of “no” to an interrogatory asking whether it has. since 1969, “utilized an employee's country of national origin, for example, Japanese citizenship, as a criterion for eligibility to hold certain jobs with the Corporation” (J.A. 44a) (emphasis added).

4 Among other things, respondents might be able to show that Sumitomo waives its citizenship requirement for American citizens of Japanese national origin and that the citizenship requirement therefore is being used as a pretext for national origin discrimination. Espinoza, supra, 414 U.S. at 92. Even without such evidence, respondents might be able to show that a Japanese citizenship requirement has the effect of selecting employees on the basis of national origin. Such a requirement would then violate Title VII unless Sumitomo could show as a factual matter that it is jobrelated (id. at 92-93; Griggs v. Duke Power Co.. 401 U.S. 424 (1971)) or unless Article VIII(1) of the Treaty is construed to constitute a legislative-type validation of the job-relatedness of the citizenship requirement for the particular positions involved. See page 26, infra. In addition, although respondents did not so allege in their complaint, because the population of Japan is racially homogeneous, it may be that a Japanese citizenship requirement would have the purpose or effect of discriminating on the basis of race by favoring orientals over others.

5 Spiess V. C. Itoh & Co. (America), Inc., 643 F.2d 353, 357 (5th Cir. 1981).

6 Walker, Treaties for the Encouragement and Protection, of Foreign Investment: Present United Stales Practice, 5 Am. J. Comp. L. 229 (1956).

7 Walker, Provisions on Companies in United Slates Commercial Treaties, 50 Am. J. Int. L. 373, 380 (1956). Walker referred to Article XXIK3) of the Japanese Treaty as exemplifying the standard definition of the t-erm “company” in FCN treaties. Id. at 380 n.34.

8 Moreover, as Herman Walker explained, the place-of-incorporation test of corporate nationality is consistent with the treatment of a vessel, whose nationality is that of the flag it flies, not its owners. Art. XIX(2); see Walker, supra note 7, 50 Am. J. Int. L. at 382. This rule is consistent as well with the practice of United States courts of regarding a corporation as a citizen of the place of its incorporation. Id. at 382; see 28 U.S.C. 1332(e) ; Steamship Co. V. Tug man, 106 U.S. 118 (1882) ; Thomas V. Board of Trustees, 195 U.S. 207 (1904).

9 In addition, Article VII(4) grants enterprises controlled by nationals and companies of one Party, like the nationals and companies themselves, most-favored-nation status in matters treated in Article VII. This guarantee is of importance where the host Party grants rights to foreign individuals and companies that it does not grant to its own.

The Treaty also carefully distinguishes between nationals and companies of a Party and enterprises in which such nationals and companies have an interest for purposes of protections against the taking of property. Article VI(3) provides that property of nationals and companies of one Party within the territories of the other cannot be taken except for a public purpose and unless just compensation is promptly paid. Article VI(4), in contrast, affords the enterprises only national and most-favored-nation treatment in such matters, without, e.g., an explicit guarantee to the enterprise of just compensation. Paragraph 2 of the Protocol accompanying the Treaty (4 U.S.T. 2082) does protect the interest of nationals and companies in their enterprises, however, by stating that the provision for payment of just compensation extends to interests held by them “directly or indirectly” in property taken within the territories of the other Party. Once again, however, this is a right of the parent, not of the controlled enterprise itself. Compare the second Sentence of Article VIII(11 discussed at page 12, supra; compare also Art. V(l).

10 Sumitomo also relies (Br. 37-38) on a passage from a letter sent by Herman Walker to an official of the U.S. Embassy in the Netherlands in 1955 regarding the negotiation of the Treaty of Friendship, Commerce, and Navigation with the Netherlands, Mar. 27, 1956, 8 U.S.T. 2043. See J.A. 288a. The passage concerns a draft proviso prepared by the State Department for possible inclusion in the paragraph of the Dutch Treaty that corresponds to Article XXII (3) of the Japanese Treaty. Under the proviso, which was to be added at the request of the Dutch, controlled companies would have been afforded the same rights as their parents. J.A. 287a-288a. The Dutch apparently found the wording of the proviso unacceptable because they believed it left the impression that Dutchcontrolled enterprises in the United States would be unable to claim greater protection than their parents where such protection was otherwise available. Ibid.

The Dutch eventually withdrew their insistence on a provision of this type, apparently accepting the legitimacy of the concerns of the United States that a general extension of all of the parent's rights to its controlled enterprises might have certain undesirable consequences. J.A. 303a, 305a. Further, they apparently assumed that, even without a provision in the Treaty, a Party, as a matter of domestic law, would not give less favorable treatment to a controlled company than to the parent. Ibid.

Thus, the Parties in the Dutch negotiations recognized that the Dutch Treaty, like the Japanese Treaty, provided only certain rights to controlled enterprises and that an extension of greater rights to them would require an amendment. There was, moreover, no reference to the employment right in Article VIII (1) of the Dutch Treaty; the controversy centered instead on property rights covered by another Article. J.A. 280a. This exchange of letters, which occurred more than two years after the Japanese Treaty was ratified, therefore concerned a distinct subject matter, a different treaty, and a proposed provision thereof that was not adopted. To the extent it has any relevance here, it corroborates our position rather than Sumitomo's contention.

11 As the last two documents lodged with the Clerk by respondents show, MFA had expressed the same view informally to the American Embassy in Tokyo in 1979 in connection with this case. Sumitomo refers (Br. 20) to the brief amicus curiae filed by the Ministry of International Trade and Industry (MITI) of the Government of Japan in this case. The MITI brief does not spe- of Japan for purposes of the Treaty. But because MITI's brief might be understood to support Sumitomo's position on this issue, and in order to assist the Court by resolving any resulting confusion regarding the position of the Government of Japan on this issue we requested the State Department to seek clarification from MFA. The February 26, 1982 statement of MFA, reiterating its previous view (App. B, infra), is the result of that inquiry. That statement takes the position that MFA is the Office of the Government of Japan responsible for interpretation of the Treaty. It also explains that MFA's position had been made known to MITI, which posed no objection, although the MFA position is not a joint statement of the two Ministries.

12 The record is not yet sufficiently developed to permit an analysis of this issue, in part because it is not clear what role Sumitomo's parent actually played in its employment decisions. Counsel for Sumitomo stated in an affidavit filed with the motion to dismiss in the district court that Sumitomo's parent corporation had assigned “many” Japanese nationals to it. J.A. 74a. However, an affidavit of counsel is not a substitute for a record on this point, and even that affidavit does not indicate how many employees were so assigned or which positions they occupy.

Although we have not yet reached a final conclusion on the question, it could be argued that the parent's right to engage Japanese nationals in connection with the operations of its U.S. subsidiary is limited to the category of “executive personnel” mentioned in Article VIII(l) of the Treaty, whose functions reasonably could be said to be essential to effectuate the parent's Article VII(1) right to “control and manage” the subsidiary; understood in this manner, the parent's rights would not necessarily extend in full force to the other categories of personnel mentioned in Article VIII (1) who, although perhaps highly qualified technicians, would not be responsible for directing Sumitomo's operations. Because respondents apparently all are present or former clerical personnel, it seems unlikely that they would qualify for or could be trained within a reasonable time to occupy the sorts of “executive” (top-level management) positions to which the parent's Article VIII(l) Treaty right would attach under this view.

13 Another issue that would have to be addressed on remand is the interaction between Title VII and the treaty trader provisions of the INA. As explained above, under the treaty trader regulations, a person may be admitted only to occupy a top-level management position with a trading firm or to occupy another position with such a firm if he is a specialist who is truly essential to the firm's operations in the United States. We have considerable doubt that these standards, properly applied, would cover the full range of respondent's managerial and sales positions at issue in this suit, and it is not clear that respondent intends to assert that all of these positions are or even could be occupied by persons holding treaty trader visas. Counsel stated in his affidavit only that “many” of Sumitomo's employees have treaty trader visas. J.A. 74a.

If the treaty trader standards are correctly applied, they would probably be entirely consistent with the requirements of Title VII in the vast majority of cases. It might well be, for example, that a company could demonstrate a business necessity under Title VII standards for requiring that top-level management in a Japaneseowned trading firm be familiar with Japanese custom, language, culture, and business practices. In lower level positions, the treaty trader requirement that the alien have special skills that are not available in the United States and are essential to the effective performance of the company's business similarly would tend to justify the selection of Japanese nationals under Title VII standards.

Of course, issuance of a treaty trader visa to an alien, based on the determination by a consular officer stationed in Japan regarding the need for a Japanese national to occupy a particular position in the United States, does not immunize a Japanese-owned employer from a Title VII claim pertaining to that position. The consular officer cannot (and does not purport to) make the type of thorough inquiry into the company's employment practices that a court would make in a Title VII suit. However, the court in a Title VII suit would not have jurisdiction to review the propriety of issuing the visa or to direct the deportation of an alien. Those are matters within the exclusive jurisdiction of the State Department and the Immigration and Naturalization Service (8 U.S.C. 1103(a), 1104(a) and 1252), although an order of deportation is subject to judicial review pursuant to 8 U.S.C. 1105a.

14 This is clear from the background of Article VIII(l). Article VIII(1) was drafted against the background of “percentile” restrictions that required American companies operating abroad to hire a certain percentage of their work force from the host country's labor force. Restrictions of this kind inhibited investment abroad because they prevented American companies from hiring those individuals in whom they had the most confidence. By the same token, a number of States in this country had laws restricting or banning employment of aliens. The purpose of Article VIII (1) was to override these percentile restrictions so that American businesses operating abroad would be able to select U.S. nationals for (1979). Thus, as explained by Herman Walker, Article VIII(l) confers a right to hire executive and technical personnel “regardless of their nationality, without legal interference from percentile restrictions and the like.” Walker, Treaties for Encouragement and Protection of Foreign Investment: Present United States Practice, 5 Am. J. Comp. L. 229, 234 (1956); see also J.A. 182a. The Executive Report submitting the Japanese Treaty to the Senate similarly stated, with respect to Article VIII ( 1 \ that “laws regarding the nationality of employees are not to prevent such nationals and companies from carrying on their activities in connection with the planning and operation of the specific enterprises with which they are connected.” S. Exec. Rep. No. 5, 82 Cong.. 1st Sess. 3-4 (1953). See also Commercial Treaties: Hearings Before the Subcomm. of the House Comm. on Foreign Relations. 83d Cong.. 1st Sess. 9 (1953) (referring to a right to hire executive and technical personnel “regardless of nationality”).

15 The complaint can, of course, be read to allege intentional discrimination specifically on the basis of national origin. If that were shown, the BFOQ exception might then be invoked by Sumitomo. However, even then we would have serious reservations about the court of appeals' formulation of the BFOQ exception in this setting. Most of the factors cited by that court in its BFOQ analysis are not inextricably intertwined with a person's national origin as such, but instead are aspects of an expertise that could readily be acquired by persons not of Japanese national origin e.g., knowledge of Japanese products, markets, and business practices, and familiarity with the parent enterprise. Pet. App. 15a. The unsuitability of BFOQ analysis here is further illustrated by the fact that it might permit Sumitomo to prefer U.S. citizens of Japanese national origin over other U.S. citizens, even if they have no specific knowledge of the factors just listed. We also are troubled by the court of appeals' suggestion that Japanese national origin might be a BFOQ because employees of Japanese national origin might be more acceptable to persons with whom the company does business. Pet. App. 15a. This would not. ordinarily be a legitimate reason to select employees on the very bases that are prohibited by Title VII. Fernandez v. Wynn Oil Co., 653 F.2d 1273 (9th Cir. 1981); cf. 29 C.F.R. 1604.2(a)(2).

16 As we explain (see note 18, infra), it is not clear that any of Sumitomo's employees would fall in any of the other categories of personnel enumerated in Article VIII (1). and. indeed, the only one even mentioned by Sumitomo is that of “specialists.” These other categories of personnel might be distinguishable from “executive personnel” for present purposes in any event. Article VII (1) of the Treaty gives nationals and companies of Japan the right to “control and manage” their enterprises in the United States, and it could be argued that the discretion to select top-level “executive personnel” in whom the nationals and companies have confidence is a necessary component of that right. For other categories of personnel enumerated in Article VIII(l), however, it could be argued that the principal concern underlying that Article is to ensure free access to qualified persons. The treaty trader regulations ordinarily would require a showing that such an alien has special qualifications not available in the American labor market in any event. Moreover, the second sentence of Article VIII(l) makes clear that in the ordinary case, professionals entering on treaty trader visas are not exempt from domestic laws regarding licensing and other requirements. This might suggest that, even if a company of Japan had largely unfettered discretion to select Japanese nationals to fill “executive” positions, it would not be inconsistent with the purposes of Article VIII (1) to subject, employment practices affecting other positions enumerated in Article VIII (1) to scrutiny under the. “business necessity” standard of domestic civil rights laws.

17 At some places in its brief, Sumitomo uses the term “managerial” interchangeably with “executive” or lumps “supervisory” positions with “executive” ones. See Br. 9, 23, 26, 27, 29, 41. However, the term “executive” as used in Article VIII(1) cannot be read to embrace all personnel who might be said to have some managerial or supervisory functions, as Sumitomo implies. That term connotes only top-level management officials who are responsible for making policy and directing the firm's affairs and whose services therefore can be thought to be necessary to effectuate the Article VIICI) right, of a Japanese-owned corporation to "control and manage" its operations (emphasis added).

This relatively limited scope of the category of “executive personnel” mentioned in Article VIII (1) of the Treaty is consistent with the administration of the treaty trader section of the INA. The treaty trader regulations, which (unlike Article VIII(D) refer to both executive and supervisory positions, nevertheless make clear that only top-level management positions are covered. See pages 3-6, supra. Because any Japanese nationals who would occupy the “executive” positions mentioned in Article VIII(1) presumably must be admitted to the United States under the treaty trader (or investor) provisions of the INA, the Article VIII(1) category of “executive personnel” must, be limited to top level management.

Even Sumitomo's own answers to interrogatories in district court , do not characterize all positions at issue here as “executive” in nature. Only the positions of General Manager, Assistant General Manager, and (in some cases) Department Manager are placed in that category'- J-A. 40a. Similarly, Sumitomo's EEO-1 forms for 1975 and 1976 state that 30 employees in the New York offices were “Officials and managers.” The remainder of the positions at issue in those offices were classified as “Professionals” or “Sales workers.” J.A. 61a, 67a.

18 Although the question presented by Sumitomo in its brief (at i) mentions only the category of “executive” personnel, Sumitomo refers at several places in the body of its brief (at 10, 14, 20) to the category of “other specialists” mentioned in Article VIII (1). It is not clear, however, which (if any) of its employees Sumitomo suggests might fall in this category. In context, moreover, it seems clear that the term “specialists” in Article VIII (1) refers to persons with a particular professional or equivalent training such that their unique expertise is essential to the effective operation of the company. Mere supervisory, lower-level management, and sales personnel, for example, would not appear to fall in this category, as Sumitomo perhaps intends to argue in this case.

19 There is, for example, little basis under the Treaty for distinguishing a U.S.-incorporated subsidiary established at the outset by and integrated with a parent trading company in Japan, such as Sumitomo, from an on-going, wholly U.S.-owned corporation serving the domestic U.S. market that is purchased by a Japanese company.

1 DENMARK. The Convention of 1826 does not apply to the Faroe Islands or Greenland.

2 GERMANY. The Treaty which entered into force in 1956 now applies to Berlin, as defined in Article XXVI thereof.

3 JAPAN. The Treaty which entered into force in 1953 does not apply to trade with the Ryukyu Islands (south of 29 degrees north latitude), or to certain lesser island groups specified in Protocol paragraph 13 thereof.