No CrossRef data available.

Published online by Cambridge University Press: 20 March 2017

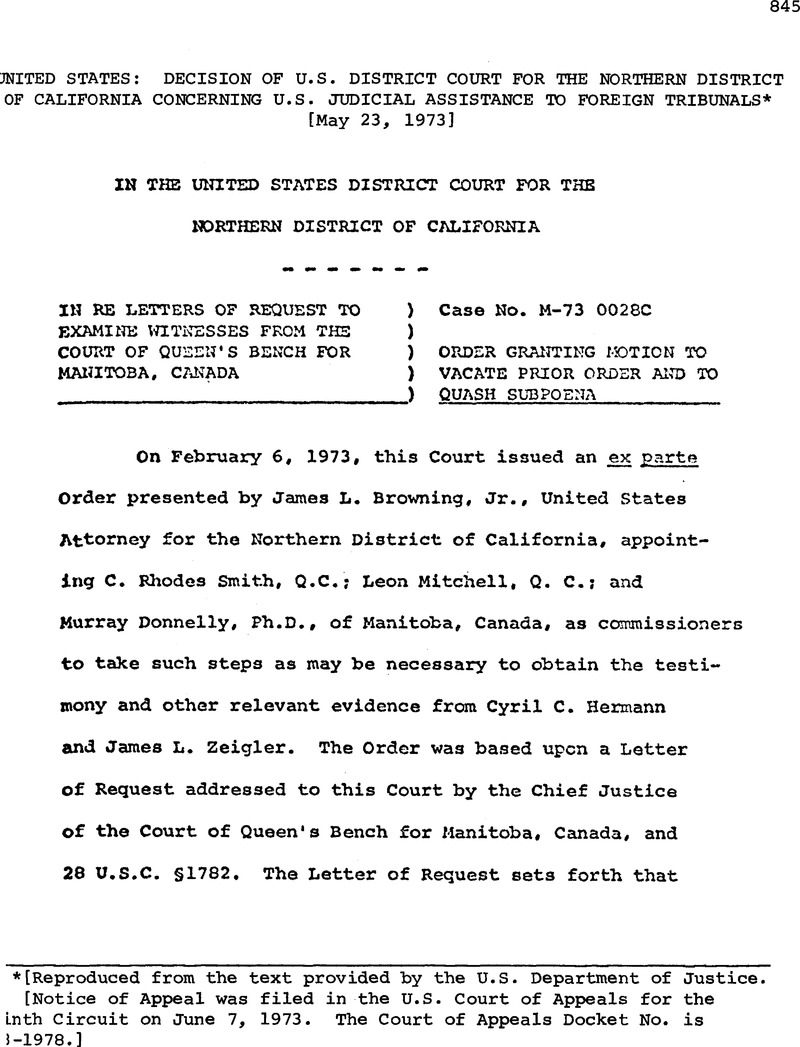

[Reproduced from the text provided by the U.S. Department of Justice.

[Notice of Appeal was filed in the U.S. Court of Appeals for the Ninth Circuit on June 7, 1973. The Court of Appeals Docket No. is 8-1978.]

1/ Letter of Oscar Cox, January 28, 1963, reproduced in the FOURTH ANNUAL REPORT OF THE COMMISSION ON INTERNATIONAL RULES OF JUDICIAL PROCEDURE, H.R. Doc. No. 88, 88th Cong., 1st Sess. 19 (1963).

2/ JUDICIAL PROCEDURES IN LITIGATION WITH INTERNATIONAL ASPECTS, Report of the Committee on the Judiciary, H.R. Rep. No. 1052, 88th Cong., 1st Sess. 4 (1963); S.Rep. No. 1580, 88th Cong., 2d Sess. 2 (1964); Cf., 1964 U.S. Code Cong. & Adm. News p. 3782, 3783.

3/ Reproduced in H.R. Rep. No. 1052, 88th Cong., 1st Sess. at 3. (1963).

4/ House Doc. No. 88, 88th Cong. 1st Sess. 45 (1963); H.R. Rep. No. 1052, 88th Cong., 1st Sess. 9 (1963); S. Rep. No. 1580, 88th Cong., 2d Sess. 7-8 (1964).

5/ The Commissioners’ contention that the Commission of Inquiry is such a body is discussed in connection with the argument that the Commission is a tribunal.

6/ This, interpretation of “tribunal” is based upon the opinion of Professor Hans Smit, Reporter to the Commission and Advisory Committee on International Rules of Judicial Procedure, as reflected in Smit, “International Litigation Under the United States Code,” 65 Colum. L. Rev. 1015 at 1021 n. 36, 1023 n. 53, and 1026 n. 71 (1964). It is in accord with standard definitions, such as BLACK’S LAW DICTIONARY (4th Ed. 1951): “. . .a judicial court; the jurisdiction which the judges exercise.” and WEBSTER’S NEW INTERACTIONAL DICTIONARY (2d ed. 1950): “a tribune who administered justice; . . .

2. Hence, a court or forum of justice; a person or body of persons having authority to hear and decide disputes so as to bind the disputants . . . .” Smit indicates that the term “was chosen deliberatedly as being both neutral and encompassing. Any person or body exercising adjudicatory power is included.” 65 Colum. L_. Rev. at 1021 n. 36.

7/ The Commissioners point to language in the House and Senate reports to the effect that: “If the court fails to prescribe the procedure, the appropriate provisions of the Federal Rules of Civil Procedure are to be followed, irrespective of whether the foreign or international proceeding or investigation is of a criminal, civil, administrative, or other nature.” S. Rep. No. 1580, 88th Cong., 2d Sess. 9 (1964) H.R. Rep. Ho. 1052, 88th Cong., 1st Sess. 10 (1963). This language is directed towards the procedures to be followed once a valid request has been honored. Use of the terms “investigation” and “or other nature” recognize that an adjudicative tribunal may be a body which conducts investigations. But it doe3 not appear to indicate that a body whose sole function is to conduct investigations on behalf of a legislative or executive agency is a tribunal within the meaning of the statute.

9/ Moreover, reliance upon these definitions to find that the Commission is a tribunal proves too much, for if the definitions be accepted, then the Commission would have qualified as a court under the 1948 version of §1782. Yet the Concision has not cited the Court to a single instance where any Canadian or other foreign commission of inquiry has been aided by a United States court.

10/ The only federal case construing §1782 since the 1964 amendment is consistent with this holding. In In re Letters Rogatory Issued by the Director of Inspection of the Government of India, 272 F.Supp. 758 (S.D. N.Y.), rev’d, 385 F.2d 101 (2d Cir. 1967), the District Court, after reviewing the legislative history of .the 1964 amendment, came to the conclusion that an Indian tax inspector, who had powers of comparable magnitude to those exercised by the Commission of Inquiry, as well as the power to assess tax liabilities, was a tribunal as contemplated by §1782. The Court of Appeals reversed on the grounds that there was no separation between the prosecutorial and adjudicative functions exercised by the inspector, and that:

“Congressmen, who have doubtless had their income tax returns audited and somtimes questioned like the rest of us, would hardly have considered that the procedures of the Internal Revenue Service leading to a determination of deficiency or an assessment were proceedings in a ‘tribunal.’” 385 F.2d at 1021.

In dictum, the Court suggested that the concept of a “tribunal” “is not so broad as to include all the plethora of administrators whose decisions affect private parties and who are not entitled to act arbitrarily . . . .” Id. The problem of whether the Commission would qualify under the implied limitation of this language does not arise since we hold that it is not a tribunal. C.f., Kenoff, “Note - Discovery, 10 Harv. Int. L.J. 172 (1969).

11/ The Court’s ruling on the meaning of “tribunal” in §1782 obviates the necessity of a detailed consideration of Ziegler’s alternative basis for quashing the subpoena-that the Court should exercise its discretion on the fact3 of this particular case to find that granting aid to a foreign tribunal would be inappropriate. Suffice it to say that if this Court had the power under §1782 to grant such aid, the Court would, in the exercise of its discretion, permit the Order and subpoena to stand on condition that Ziegler be given reasonable compensation for the period during which necessary preparation for the deposition was made, and during the deposition itself.