No CrossRef data available.

Published online by Cambridge University Press: 20 March 2017

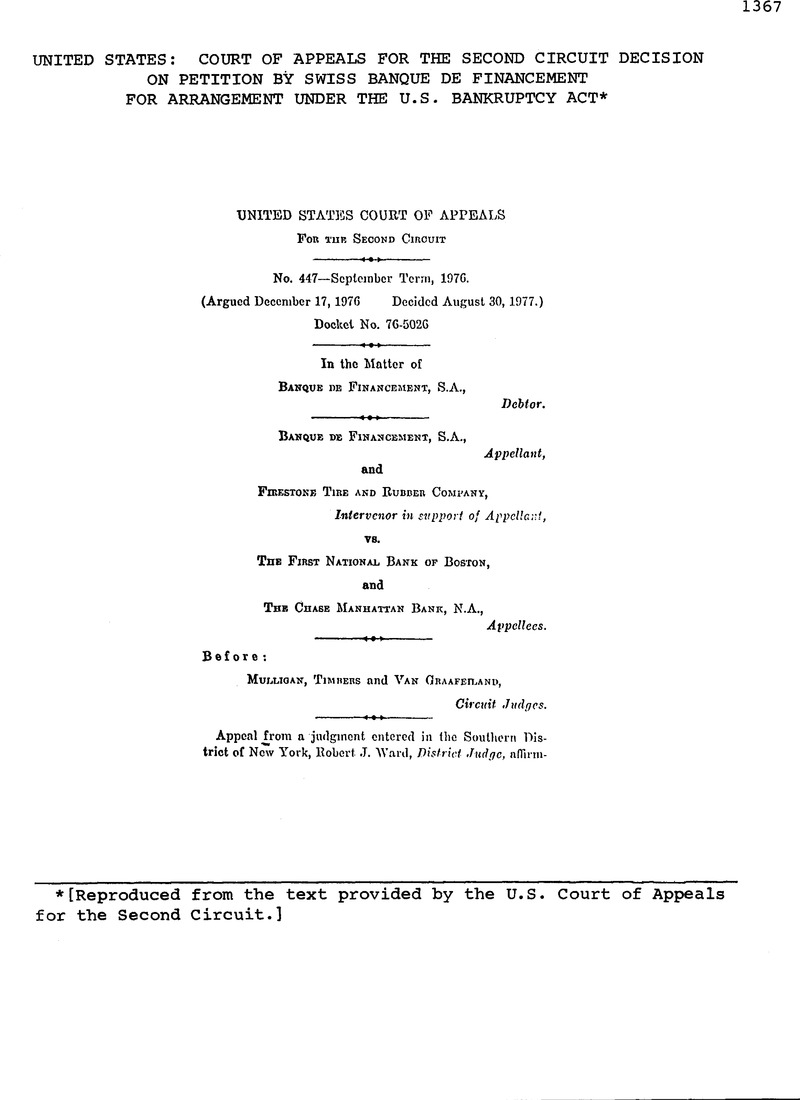

[Reproduced from the text provided by the U.S. Court of Appeals for the Second Circuit.]

page 1368 note 1 The rehabilitation contemplated by this procedure tinder Swiss law occurs out of court and entails the payment of all debts in full.

page 1368 note 2 As of May 31, 1975, Finabank had liabilities of Swiss Fr. 188,021,614.82 and assets of Swiss Fr. 98,361,001. According to the July 14 opinion of the Court of Justice, “the unprotected amount of about Swiss Fr. 90 million shown by tho balance-sheet . . . is indisputably due to the nonfulfillment by Edilcentro . . . of its engagements . . . . “ The court concluded that “nil things considered . . . a liquidation by a proceeding of arrangement with creditors is likely to produce results which are more advantageous to creditors than a liquidation through bankruptcy.

page 1369 note 3 On January 21, CBI commenced an interpleader action to obtain adjudication of the rights of various claimants to certificates of deposit and other funds which CBI was holding for the account of Finabank. Continental Bank International v. Banque de Financement S.A., 75 Civ. 299 (S.D.N.Y.). The contract actions by FNBB and Chase against Finabank were consolidated with two interpleader action on September 19, 1975.

In the consolidated action FNBB and Chase claim priority based on their attachments. Two other American parties have filed claims totalling $29S,803. Several foreign corporations and individuals have filed claims totalling several million dollars. Finabank as a party to the interpleader action claims that $11,000,000 of its account with CBI “represents trust assets held by Finabank as custodian” which are not “a potential pool asset for Finabank’n general creditors.”

page 1369 note 4 FNBB’ motion of June 26, 1976 to dismiss the Chapter XI petition claimed that the petition was deficient in the following additional respects: (1) the schedules of debts, property and executory contracts and the statement of affairs failed to satisfy the requirements of Rule ll - ll (a) and Bankruptcy Forms C, and 8; (2) the allegations-required by Bankruptcy Act (323, 11 U.S.C. §723 (1970), wcie lacking; (3) Exhibit A under Bankruptcy Form 11-F1 was lacking; and (4) FIDES had no authority to file the petition.

Judge Babitt noted but did not pass on these claims.

page 1370 note 5 We do not hold that the inherent power of the bankruptcy court never may be relied upon for a dismissal based on facts which arise after the filing of the petition. Normally, of course, such a situation would be covered by Rule 11-42. After a good faith filing, a rehabilitation that subsequently becomes hopeless would manifest itself in grounds for dismissal—such as failure to propose a plan or withdrawal or abandonment of a plan—which would fall squarely within Rule 11-42.

page 1370 note 6 Bankruptcy Act § 376, 11 U.S.C. § 776 (1970), in relevant part provides:

“If the statement of the executory contracts and the schedules and statement of affairs, as provided by paragraph(1) of section 724 of this title, are not duly filed, or if an arrangement is not proposed in the manner and within the time fixed by court, or if an arrangement is withdrawn or abandoned prior to its acceptance, or is not accepted at the meeting of creditors or within such further time as the court may fix, or if the money or other consideration required to be deposited is not deposited or the application for the confirmation is not filled within the time fixed by the court, or if confirmation of the arrangement is refused, the court shall—

. . .

(2) where the petition was filled under section 723 of this title, enter an order, upon hearing after notice to the debtor, the creditors, and such other persons as the court may direct, either adjudging the debtor a bankrupt and directing the bankruptcy be proceeded with pursuant to the provisions of this title or dismissing the proceeding under this chapter, whichever in the opinion of court may be in the interest of the creditors: Provided, however, That an order adjudging the debtor a bankrupt may be entered without such hearing upon the debtor’ consent.”

page 1370 note 7 Bankruptcy Rule 11-42 (b) in relevant part provides:

(b) Dismissal or Conversion to Bankruptcy for want of Prosecution, Denial or Revocation of Confirmation, Default or Termination of Plan. The court shall enter an order, after hearing such notice as it may direct dismissing the case, or adjudicating the debtor a bankrupt if he has not been previously adjudged, or directing that the bankruptcy can proceed, whichever may be in the best interest of the estate—

(1) for want of prosecution; or

(2) for failure to comply with an order under Rule 11-20(d) for indemnification; or

(3) if confirmation of a plan is denied; or

(4) if confirmation is revoked for fraud and a modified plan is not confirmed pursuant to Rule 11-41; or

(5) where the court has retained jurisdiction after confirmation of a plan;

page 1371 note 9 Bankruptcy Act §324(1), 11 U.S.C. 724(1) (1970), in relevant part provides:

“Statements and fees accompanying petition. The petition shall be accompanied by—

(1) a statement of the executory contracts of the debtor, and the schedules and statement of affairs, if not previously filed: Provided, however, That if the debtor files with the petition a list of his creditors and their addresses and a summary of his assets and liabilities, the court may, on application by the debtor, grant for cause shown further time, not exceeding ten days, for filing the statement of the executory contracts and the schedules and statements of affairs, and such time shall not further be extended except for cause shown and on such notice and to such persons as the court may direct. . . . ”

page 1371 note 10 Bankruptcy Rule 11-11 in relevant part provides:

“Schedules, Statements of Affairs, and Statement of Executory Contracts

(a) Schedules and Statements Required. The debtor shall file with the court schedules of all his debts and all his property, a statement of his affairs, and a statement of his executory contracts, prepared by him in the manner prescribed by Official Forms No. 11-F5 and either No. 11-F6 or No. 11-F7, whichever is appropriate. The number of copies of the schedules and statements shall correspond to the number of copies of the petition required by theses rules.

(b) Time Limits. Except as otherwise provided herein, the schedules and statements, if not previously filed in a pending bankruptcy or Chapter XII case, shall be filed with the petition. A petition shall nevertheless be accepted by the clerk if accompanied by a list of all the debtor’ creditors and their addresses, and the schedules and statements may be filed within 15 days thereafter in such case. On application, the court may grant up to 30 additional days for the filing of schedules and the statements; any further extension may be granted only for cause shown and on such notice as the court may direct.”

page 1371 note 11 Bankruptcy Act § 7a(8), 11 U.S.C. §25(a)(8) (1970), provides:

“Duties of bankrupts.

(a) The bankrupt shall . . . (8) prepare, make oath to, and file in court within five days after adjudication, if an involuntary bankrupt, and with his petition, if a voluntary bankrupt, a schedule of his property showing the amount and kind of property, the location thereof and its money value, in detail; and a list of all his creditors, including all persons asserting contingent, unliquidated, or disputed claims, showing their residences or places of business, if known, or if unknown that fact to be stated, the amount due to or claimed by each of them, the consideration thereof, the security held by them, if any, and what claims, if any, are contingent, unliquidated or disputed; and a claim for such exemptions as he may be entitled to ; nil in triplicate, one copy for the clerk, one for the referee, and one for the trustee. . . . ”

page 1372 note 12 Under Bankruptcy Act §17a(3), 11 U.S.C. §35(a)(3) (1970), debts not duly scheduled are not discharged unless the creditor had notice or actual knowledge of the proceedings.

page 1372 note 13 Bankruptcy Act §§2a(l) and (22), 11 U.S.C. §§11(a)(1) and (22) (1970), provides:

“Creation of courts of bankruptcy and their jurisdiction

(a) The courts of the United States hereinbefore defined as courts of bankruptcy are created courts of bankruptcy and are invested, within their respective territorial limits as now estab-**TextMiss** at law and in equity as will enable them to exercise original jurisdiction in proceedings under this title, in vacation, in chambers, and during their respective terms, as they are now or may be hereafter held, to—

(1) Adjudge persons bankrupt who have had their principal place of business, resided or had their domicile within their respective territorial jurisdictions for the preceding six months, or for a longer portion of the preceding six months than in any other jurisdiction, or who do not have their principal place of business, reside, or have their domicile within the United States, but have property within their jurisdiction, or in any cases transferred to them pursuant to this title;” (emphasis added).

. . .

“(22) Exercise, withhold, or suspend the exercise of jurisdiction, having regard to the rights or convenience of local creditors and to all other relevant circumstances, where a bankrupt has been adjudged bankrupt by a court of competent jurisdiction without the United States.”

page 1372 note 14 Sec note 13 supra.

page 1372 note 15 Bankruptcy Rule 119 provides:

“Bankrupt Involved in Foreign Proceeding

When a proceeding for the purpose of the liquidation or rehabilitation of his estate has been commenced by or against a bankrupt in a court of competent jurisdiction without the United States, the court of bankruptcy may, after hearing on notice to the petitioner or petitioners and such other persons as it may direct, having regard to the rights and convenience of local creditors and other relevant circumstances, dismiss a case or suspend the proceedings therein under such terms as may be appropriate.”

Rule 119 applies to Chapter XI proceedings by the terms of Bankruptcy Rule 11-17.

page 1372 note 16 See Nadclmann, “The National Bankruptcy Act and The Conflict of**TextMiss**

page 1373 note 17 The debtor in In re Everich Art Corp., supra, 39 F.2d at ——, merely sought to exclude from participation those creditors whose claims it disputed. In In re Semel, supra, 411 F.2d at ——, the debtor was a practicing attorney who sought to avoid listing unpaid fees by claiming an attorney-client privilege; while the Third Circuit rejected the excuse, it appeared to hold open the possibility that the referee could determine any particular claim of privilege after the debtor had completed his list. 411 F.2d at 107. A debtor whose records were in chaotic condition was held to full compliance with the official forms in In re Frce, 38 F.Supp. 316 (D. Conn. 1941). See also Carolina Motor Express Lines, Inc. v. Blue & White Service, Inc., 192 F.2d at 92; but cf. In re DeSato Crude Oil Purchasing Corp., 35 F.Supp. 1, 6-7 (W.D. La. 1940) (late filing excused where list of creditors was “unavailable” at time voluntary petition was filed).

page 1373 note 18 We recognize that there are difficulties in connection with both of Finabank’ alternative procedures. While we note some of those difficulties, we draw no conclusions regarding them but leave them for further inquiry by the bankruptcy court.

Undoubted power to effect the first alternative stems from §2a(22) and Rule 119. FNBB however contends that, if the assets in this country were to be remitted to the Swiss court for administration, the individual depositors would be able to extract payment in full to the extent of $11,000,000. This contention is based on Finabank’ claim in the interpleader action that this $11,000,000 does not belong to it but to its depositors. If this were found in fact to be the result, a suspension under Rule 119 might be improper. Rule 119 must be applied with “regard to the rights . . . of local creditors,” and priority treatment of the depositors in the Swiss court would derogate those rights. See Nadelmann, , “The National Bankruptcy Act and The Conflict of Laws* ,” 59 Harv. L. Rev. 1025, 1015 (1946)CrossRefGoogle Scholar.

At first blush, the second alternative might be said to lack explicit support in the Act. Section 2a(22) and Rule 119 authorize only “dismissal” or “suspension” of proceedings. See p. 5635, infra.

If the procedure suggested is found to lack explicit support in the Act or the Rule, the bankruptcy court should determine whether it might be permissible in the exercise of the bankruptcy court’ equitable powers. Cf. SEC v. United States Realty & Improvement Co., supra.

page 1374 note 19 We would not be inclined to accept FNBB’ construction even if a contrary Congressional intent were less clear than, it is. A construction so contrary to the principle of equality in the Act would require a very clear expression of Congressional intent. See In re Israel-British Bank (London) Ltd., supra, 530 F.2d at 515.

page 1374 note 20 We do not suggest that §2a(22) and Rule 319, as construed herein.