No CrossRef data available.

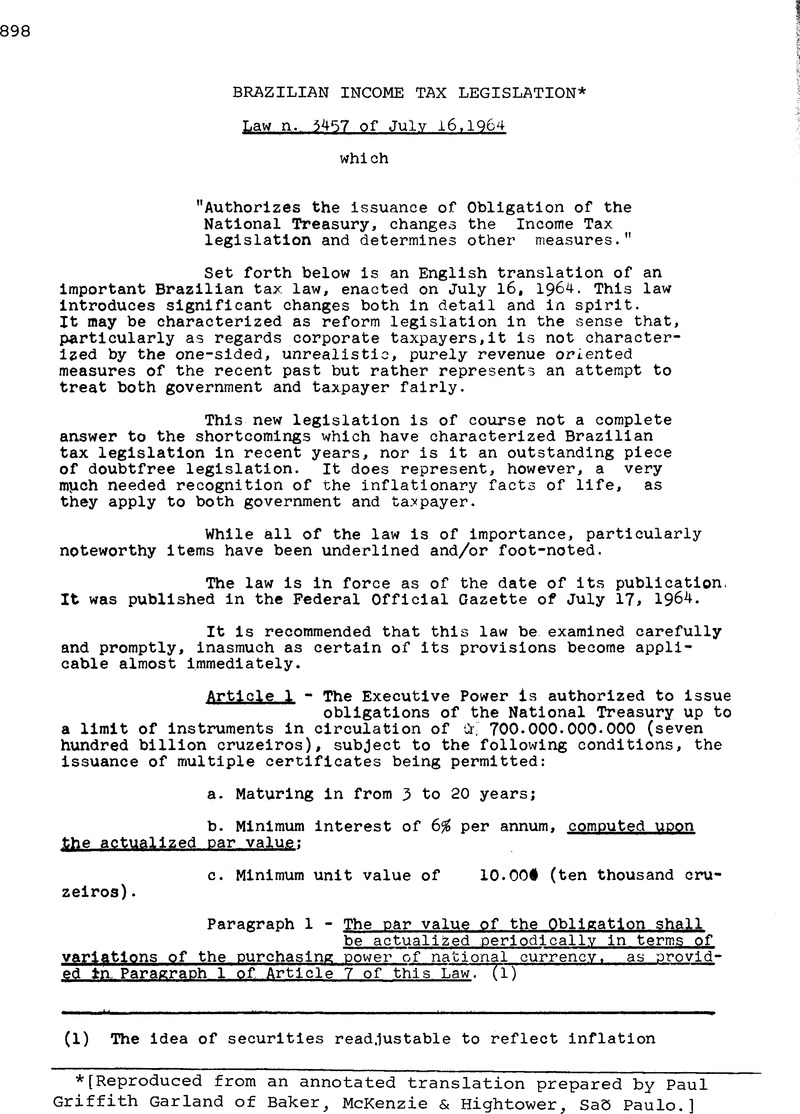

[Reproduced from an annotated translation prepared by Paul Griffith Garland of Baker, McKenzie & Hightower, Saõ Paulo.]

(1) The idea of securities read justable to reflect inflation or, to put it in another way, with built in escalation, is not new to Brazil, having been employed by the State of Guanabara. Escalation does represent an innovation on the Federal level, however.

(2) In the past, government securities have generally been issued at par and accordingly the provision that they may be issued at a discounted market value represents an innovation.

(3) Prior to this time, the law did not require investment of the labor law reserve. Instead, it provided that in order for the reserve to be deductible, the funds involved would have to be invested in government bonds issued for this purpose. Such bonds were not issued, however, and no arrangements were made for their issuance, until 1964, thus making uncertain the deductibility of the reserve. In the 1962 Income Tax Regulations, it was provided that until the bonds were available, tax deductibility could only be obtained by placing the funds in a specific bank account to be used only to satisfy Labor Law obligations. In March of 1964, in one of the final decrees of the Goulart administration, the Federal Government provided for the issuance of bonds for purposes of the funding of the reserve fund. These funds were of the traditional non-escalation type and represented a most unsatisfactory solution. Now not only are escalation clause bonds to be issued and must be acquired in order to obtain a tax deduction but also the investment in the bonds is made compulsory as a general matter.

(4) The reference here is to the Goulart regime’s bonds referred to in footnote 3.

(5) Under prior law, the limit upon labor law reserve in the terms of tax deductibility was 7% of annual payroll. The new Law limits this to 3% but provides for creation of the reserve, and acquisition of the bonds, on a monthly basis.

(6) The apparent intention of this provision is to alleviate somewhat the otherwise existing burden upon the corporation, by giving credit to it, in determining the amount of the required acquisition of bonds, to the revaluation of the bonds already held.

(7) Under prior law revaluation of fixed assets was optional rather than compulsory. In general terms, those electing to revaluate did so in order to have a higher excess profits tax base and/or to keep shareholders relatively happy in a situation in which cash dividends were small.

Under the new law, revaluation becomes compulsory and apparently no exceptions are to be made. Accordingly revaluation is required of those who may derive no benefit from so doing (loss companies not requiring a higher excess profits tax base, for example). Perhaps the feeling was that exceptions would be hard to administer and that it would be unwise to make exceptions in view of the anti-inflationary policies and the need for additional revenues.

One of the less satisfactory aspects of this new law is its cross reference to the 1958 Law. This Law and the Regulations thereunder have not been entirely free from uncertainties. It is to be hoped that the Regulations to follow the new law will serve to clarify the situation.

(8) Under prior law, the tax was 10% also payable in twelve monthly payments.

(9) No such option existed under prior law. In view of the escalation nature of the Government bonds, it is not unlikely that may taxpayers may elect to acquire them. On the other hand, most successful enterprises may well assume that they can obtain a better return from the additional 5% in their own business than the 6% interest on the bonds.

(10) In both cases such capital increases were subject to a 0.8% Federal Stamp Tax.

(11) As a result, and representing another innovation, the revaluation of assets is made a depreciable asset. Under the prior law, revaluation was non-depreciable.

As regards depreciation, it should be kept in mind that land and buildings are not tax depreciable assets in Brazil and there is no indication that the new law is intended to change this result. Accordingly, it should be assumed that only “movable” fixed assets revaluation will be eligible for depreciation. This is in effect confirmed by Paragraph 14.

(12) As a result the seller of real estate is given the opportunity of paying the tax at a lower rate than would be the case if he simply paid the ordinary tax on real estate profits.

(13) Accordingly, instead of paying the 5% tax, the taxpayer may invest 10% in the new Bonds.

(14) In the past no such provision has existed. Accordingly, in view of the rapid depreciation of the cruzeiro, there has been a temptation not to pay taxes when due, inasmuch as the interest and fines generally speaking have been less than the rate of inflation. In other words, self-financing at government expense has been a fairly common practice, and one which the new law is intended to eliminate.

(15) The purpose of this article is to put an end to another common practice, namely of engaging in litigation (perhaps initiating same with a request for ruling) and thus postponing the day of payment, which could then be made in depreciated cruzeiros.

(16) Thus the Government obligations are also subject to actualization.

(17) In the past the Government has been notoriously slow in making restitution to taxpayers, a circumstance obviously not such as to encourage taxpayers to err on the side of overpayment or often not even to approach the amount actually due. Perhaps this new provision, providing fairer treatment to taxpayers, will result in their giving fairer treatment to the Government.

(18) As a result, taxpayers in arrears are encouraged to settle their existing obligations, at a discount, lest they suffer the effect of escalation.

(19) Failure to make the employer contributions and failure to apply over the employee contributions withheld by the employer to the Social Security Institutes has been a fairly common means of obtaining financing at Government expense, and a perhaps understandable one as in view of the way in which the Institutes have been operated. With a new government in the picture and with escalation introduced, the prior picture should change appreciably.

(20) Here again the picture has been that monetary penalties expressed in flat sums have become comparatively insignificant as the cruzeiro has depreciated, encouraging a disregarding of the law. The new Law is intended to correct this situation and put teeth into the fines. It should be noted that the provision for actualization of fines is not limited to the tax areas.

(21) The Panal Code provides for imprisonment of from one to four years and (not or) fines. In the past vidations of the legislation have not been subject to imprisonment but rather only to interest and fines.

(22) Accordingly the taxpayer is in effect given the right to an offset against the Government at least for purposes of defence in a criminal tax proceeding.

(23) The result of this change is to broaden the coverage of the withholding tax upon wages and salaries and to include virtual ly everyone, and at higher rates than previously applicable.

(24) This is necessary by reason of the modification in the treatment given to deductions in the new law.

(25) This is the withholding tax on dividends to holders of bearer shares who elect to remain unidentified, formerly 45%.

(26) Two reductions in the tax obligations of individuals to ameliorate the somewhat higher tax burdens provided in the new law.

(27) This article, obviously intended to encourage the disclosure of previously undisclosed assets, is not very well drafted. It is not clear, for example, what happens in the event that the assets do not result from taxable income, nor whether tax is due as well as the fine when the assets did result from taxable income.

(28) The apparent intention of this Article is to change the present situation, in which tax audits generally refer only to prior years and often to periods dating back four or five years. In other words, tax examination is to be carried out on a more current basis.

(29) This provision establishes a fine of from one to five times the fiscal minimum wage.

(30) The provision thus revoked has provided, in effect, that there would be a postponement of the tax upon amounts result. ing from revaluation or from the sale of fixed assets if a balance reserve were mentioned for four years.

(31) This provision is unquestionably a mixed blessing. On the negative side, as seen from the taxpayers’ point of view, it clearly indicates an intention to extend the Excess Profits Tax. On the positive side, however, the provision for actualization of working capital is certainly desirable. In the past with out such a provision, it has become increasingly difficult to avoid Excess Profits Tax by reason of the fact that the tax base was in historic cruzeiros and current earnings in inflationary cruzeiros. As a result, taxpayers often found themselves required to pay high Excess Profits Taxes, even though from the economic point of view they had only maintained working capital or even lost ground.

(32) The latter reference is to the 30% tax upon reserves in excess of paid in capital to which sociedades anonimas are subject.

(33) The result of the amendment is to give civil servants the same treatment given to others in this respect.

(34) The distinction made is between industries establishing themselves in the North East and accordingly entitled to income tax reductions and other companies which may make investments in the North East in lieu of paying income tax. This law makes it clear that the same entity is not entitled to both benefits.

(35) Article 29 of Law no 4.131, which is the so-called “Remittance of Profits Law”, provides:

“Art. 29 - Whenever it becomes advisable to save in the utilization of exchange reserves, the Execut five Power is hereby authorized to demand, temporarily, by a SUMOC instruction, a finantial charge of a strictly monetary nature, on importation of merchandises and on finantial transfers, up to a maximum of 10% of the value of the imported products and up to 50% of the value of any finantial transfer, including expenses with “International Travel .

Sole Paragraph - The maximum period of time mentioned in this Article is of 150 days, consecutive or not, during the year.”