No CrossRef data available.

Published online by Cambridge University Press: 27 February 2017

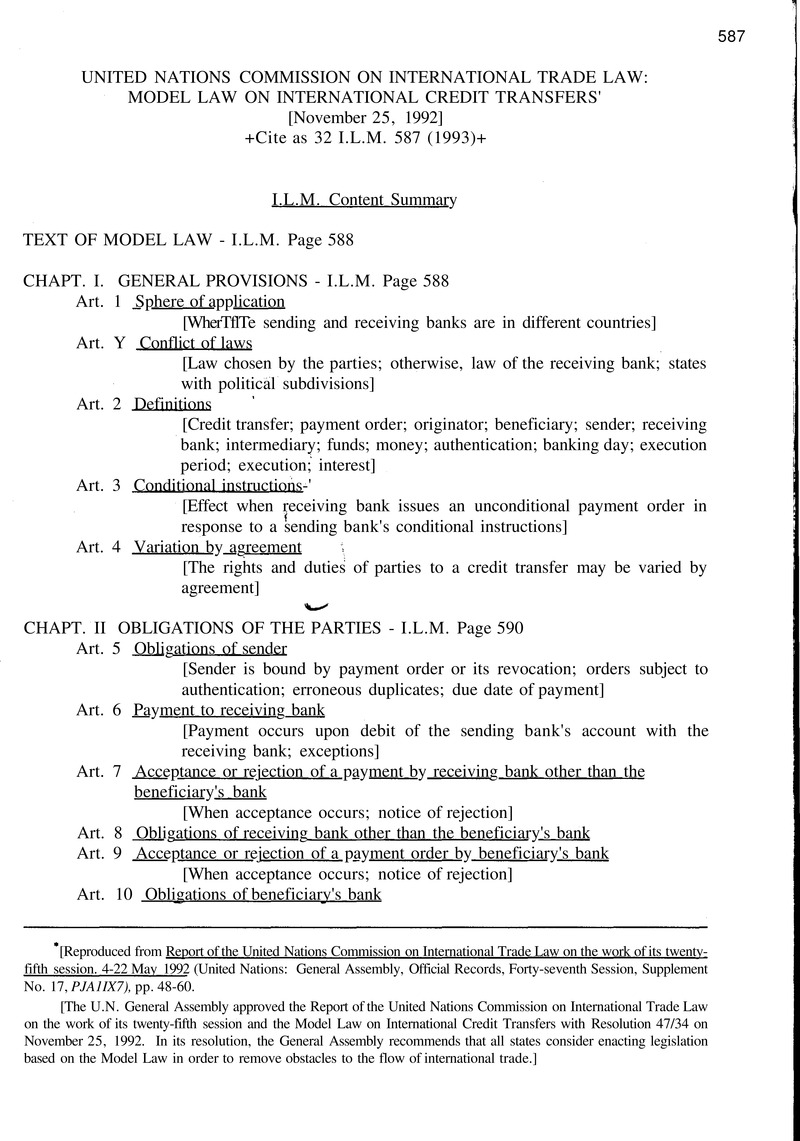

* [Reproduced from Report of the United Nations Commission on International Trade Law on the work of its twenty-fifth session. 4-22 May 1992 (United Nations: General Assembly, Official Records, Forty-seventh Session, Supplement No. 17, PJA1IX7), pp. 48-60.

[The U.N. General Assembly approved the Report of the United Nations Commission on International Trade Law on the work of its twenty-fifth session and the Model Law on International Credit Transfers with Resolution 47/34 on November 25, 1992. In its resolution, the General Assembly recommends that all states consider enacting legislation based on the Model Law in order to remove obstacles to the flow of international trade.]

* The Commission suggests the following text for States that might wish to adopt it: [See Article Y at 32 I.L.M. 589 (1993)]

** This law does not deal with issues related to the protection of consumers.

*** The Commission suggests the following text for States that might wish to adopt it: If a credit transfer was for the purpose of discharging an obligation of the originator to the beneficiary that can be discharged by credit transfer to the account indicated by the originator, the obligation is discharged when the beneficiary's bank accepts the payment order and to the extent that it would be discharged by payment of the same amount in cash.