In 1939, H. E. Hemmons, an executive with the Wawanesa Mutual Insurance Company, arrived in Montreal to deliver bad news. He was there to shut down the company’s operation in Quebec. The board of directors for the western Canadian company felt that its experiment in French-speaking Quebec had been an interesting one, but it had failed. It was with this on his mind that Hemmons hailed a taxi to head downtown. It would be a trip that would change the fate of the company in Quebec and, indeed, the direction of the company for decades to come. The conversation with the taxi driver revealed that insurance on taxis in Montreal was difficult to acquire and typically very expensive. Being the insurance man that he was, he asked about accident rates and existing premiums. Hemmons would have understood that taxis were commercial vehicles and exposed to high risk, but he also knew that it was possible to create a viable rating system for these vehicles based on a decade of experience in automobile insurance in Canada. Rather than exiting Quebec, the company altered its organizational structure in a single province to accommodate the regional environment. Unbeknownst to the company at the time, the experiment in Quebec freed the company from the constraints of a more traditional method of selling insurance that they used in the rest of the country and allowed for unprecedented growth in a market that they had all but given up on.

Recreating Wawanesa in Quebec required recognition of the unique nature of the province.Footnote 1 Business in Quebec did not function as it did elsewhere in Canada.Footnote 2 The company attributed its early failures in Quebec to a lack of committed agents and poor results in rural Quebec. In response to its failure, the company decided to salvage its business in Quebec by targeting a niche market, automobile insurance on taxis in the Montreal market, thus retrenching the company in the province. The company then took a bold step and terminated contracts with agents, as it no longer sold property or automobile insurance to individuals in the province, and shrunk its market to a single area (Montreal)—a radical move for a company built on its agent-based structure in the rest of Canada. Over the next twenty years, Wawanesa adopted an aggressive strategy that included advertising campaigns to support the direct-writing nature of the new structure and slowly expanded back into private automobiles, geographically into the rest of the province, and more importantly, into suburban environments with their new shopping malls.Footnote 3 In the 1940s and 1950s, when the number of individuals purchasing automobiles accelerated rapidly, Wawanesa offered a policy tailored to the province. Instead of adopting a new structure for the whole company, Wawanesa recognized the importance of region when it decentralized the operation to allow for greater flexibility across the country, particularly in Quebec. As a result, Wawanesa had two successful structures in one country: one built around a network of agents, the other around brick-and-mortar service offices staffed with local employees.Footnote 4 In exploring how Wawanesa adapted its approach to business in Quebec, it becomes clear that the notion of “region” should be carefully considered when developing an understanding of corporate structure and business practices.Footnote 5

Wawanesa’s shift in strategy tells us more than the story of a single company in one province in Canada. Instead, it points to the importance of being attuned to regional differences. While business historians are keenly aware of the differences affecting businesses between nations, regional differences within nations are more easily overlooked.Footnote 6 The overall success or failure of a company nationally can easily mask issues lurking elsewhere. Alternatively, the triumphs or disappointments of a single-region enterprise can be explained by regional anomalies such as geography or market.Footnote 7 Treating nations, or even regions, as unified static entities is problematic, because business tends to be more dynamic in its approach to its strategy and its structure. In insurance history, Robin Pearson assumed that many of the problems encountered by foreign insurance companies could be attributed to a lack of understanding of the market and problems with government regulators. Pearson was correct in his assumption, but he did not go far enough.Footnote 8 Problems within the North American market were not unique to the foreign companies. Instead, insurance companies attempting to enter new markets were susceptible to problems of regional differences and legislative complications. Because the insurance industry in Canada was affected by laws and regulatory frameworks developed by individual provinces as well as by the federal government, companies needed to approach the underwriting and business practices more broadly and with flexibility. The initial inability to adapt nearly ended Wawanesa’s tenure in Quebec. The shift to a decentralized structure that gave autonomy to branch offices that were aware of the local nuances changed the fate of the company in Quebec. It also forced companies like Wawanesa to limit risk by reducing the territory covered and the number of lines written.

While automobile insurance is an important consideration in the lives of many North American consumers, historians often overlook its significance in the dramatic growth in the insurance markets and the change in our perception of the role of insurance in our lives.Footnote 9 Instead the focus has been more on automobile insurance’s connection to highway and automobile safety. While property and casualty insurance grew increasingly important at the end of the nineteenth century, it remained a relatively small field when compared with others.Footnote 10 To provide a point of reference, Wawanesa’s automobile line accounted for just 8.6 percent of total business in 1931, with the remaining business focused on property insurance more generally. By 1961, automobile insurance constituted 76 percent of all insurance sold by Wawanesa in Canada.Footnote 11 Although this is one example, it is representative of the shift that the insurance industry underwent.Footnote 12 The history recounted here tells historians something about the development of automobile insurance and the importance of the introduction of financial responsibility law (precursor to compulsory insurance). The introduction of financial responsibility law across North America changed the way the North American insurance industry functioned by making automobile insurance the only viable way to meet the requirements set up by the laws. Self-insuring was out of reach for most drivers, and driving without insurance under the laws came with costly consequences in the event of an accident. Quebec was one of the last markets on the continent to adopt financial responsibility law, and the reluctance of insurance companies to do business in the province is telling. Most companies feared the high cost of claims and the general absence of insured drivers before 1961. Wawanesa’s decision to remain in the market allowed them to accumulate years of experience, visibility through ongoing advertising, a strong understanding of the regional differences within the province, and traction in a market that was difficult to penetrate for most companies coming from outside the province.

The challenges for English companies coming into Quebec highlight the larger social, political, legal, and cultural differences between Quebec and the rest of Canada. Canada is a federal state with a division of power between provinces and the federal government that was defined by the British North America Act in 1867. Both the federal and provincial governments claimed authority over the insurance field until the early 1930s, but ultimately the federal government agreed to supervise the financial security of federally licensed companies, while the provincial governments would regulate local matters. Interestingly, automobile insurance was considered to be a provincial rather than a national concern, making it the domain of Quebec’s government.Footnote 13 Because the insurance industry in Canada was affected by laws developed by individual provinces, companies needed to approach the underwriting of insurance with a degree of flexibility.

The differences between the province of Quebec and the rest of Canada are also significant. As a former French colony, Quebec has always been distinct in terms of its language (French), religion (Catholic), and cultural identity. Quebec’s economy, however, was largely dominated in the first half of the twentieth century by English-speaking minorities, with these minorities earning more than francophones through this period.Footnote 14 English was the language of business, although historians argue that this was shifting in this period and would see an ever more profound change as governments in Quebec introduced French language laws after 1960. It also meant that some of the norms within Quebec society were missed by English Canadian companies entering the market. Between 1935 and 1960, Quebec remained politically conservative, but significant changes were on the horizon within the province. Vincent Geloso recently called this period the “great catch-up,” because Quebec’s economy, which lagged when compared with the rest of Canada, rebounded during this time.Footnote 15 Backlash against the English domination of the economy spurred the creation of the caisse populaire movement—a French Quebec initiative intended to keep money in the province and invest in development. This, alongside a sea of similar challenges to traditional practices, would lay the groundwork for secessionist movements in the province in the years following 1960.Footnote 16 Increasingly, people from Quebec rejected the English domination of the economy, and English companies in particular needed to adapt.

The beginning of the 1960s marked a period of profound transformation—both in the province and for Canada. The great catch-up of the 1940s and 1950s was followed by the Quiet Revolution in the 1960s, a period of rapid social, political, and cultural change as francophone intellectuals acceded to power and eschewed “traditional Catholic values in favour of secularism and statism.” Footnote 17 Change also brought with it a growth in Quebec nationalist sentiment and a defense of the French language that would be at the center of debates for decades to come. This shift in Quebec society was one that Wawanesa would take advantage of with a change in structure that allowed the company to distance itself from its English head office and employ increasing numbers of French-speaking employees. Other key decisions, such as the use of French in advertising, attracted a population that was increasingly attuned to language as providing the substantive and distinguishing grammar of Quebec’s existential distance from the rest of Canada, carving the province out as a “distinct society.”

Unfamiliar Territory

Before examining the Quebec operation in depth, it is necessary to understand Wawanesa’s development. In 1896 a group of Manitoba farmers founded the Wawanesa Mutual Insurance Company to provide affordable insurance against threshing machine fires. This fulfilled a need for inexpensive insurance in a market dominated by expensive offerings from foreign and eastern Canadian insurance companies. To attract the volume of business necessary to ensure survival of the nascent enterprise, the company constructed an agency system, which allowed for quick and efficient expansion outside the immediate township without compromising quality. This meant Wawanesa contracted individuals in communities across western Canada to sell insurance on behalf of the company. Wawanesa depended on small, successful businessmen to sell insurance to their neighbors and respectable members of the community; agents accepted applications, evaluated the moral and social standing of the applicant and his or her property, and sold insurance to those the company deemed acceptable. This agency system relied heavily on consumer and agent loyalty and also demanded that agents follow rigid guidelines. Cultivating this loyalty and strict adherence to Wawanesa’s rules resulted in a client portfolio of the best possible consumers in the market and achieved a lower loss ratio. The business success of the agents in western Canada led Wawanesa to rely on the agents to do all of the corporate advertising.Footnote 18 By 1921, the company sold insurance in Manitoba, Saskatchewan, Alberta, and British Columbia; had hundreds of agents across western Canada; and was the largest mutual insurance company in Canada.Footnote 19 While a strategy of centrally controlling operations from the Wawanesa Manitoba head office while employing agents had proved successful, as well as cost effective, independent agents allowed the company to move into new regions with minimal commitment to brick-and-mortar offices as well as staff.Footnote 20 The company modeled its new operations in Ontario in 1930 and Quebec in 1931 on this agency system, and early results from the two provinces suggested the system would again prove successful in eastern Canada.Footnote 21

The success of this business structure in Quebec and Ontario, however, was limited. The board of directors viewed Wawanesa as a farmer’s mutual, specializing in the sale of policies to individuals in rural areas. Upon entering the Ontario and Quebec markets, the company sold insurance primarily on homes, farms, and landed properties. Its decision to underwrite the automobile line nationally in 1930 accompanied its regional expansion and at the same time presented new challenges, because writing cars proved to be different from writing houses. As historian Oliver Westall points out, automobile insurance customers, unlike Wawanesa’s existing client base, worried about price, not long-term loyalty to a single company.Footnote 22 Wawanesa did not believe its future lay in writing automobiles in eastern Canada, as the board of directors continued to view Wawanesa as a mutual dedicated to selling quality property insurance to western Canadians. Wawanesa entered the eastern Canadian market to manage risk through expansion, and added the new automobile insurance offering across Canada to better service its existing customer base.Footnote 23 Although the head office viewed Wawanesa’s entry into Ontario as a move to capture the property market, much to the chagrin of the head office, the Ontario branch wrote a significant number of automobile policies.Footnote 24 By 1942, the company acknowledged it had become one of the top automobile writers, while only minimally increasing property business.Footnote 25 This dominance of automobile underwriting in Ontario threatened the stability the company had taken for granted in the property market. Rates in automobile insurance tended to fluctuate, consumers shopped on price, and governments adjusted the laws for both cars and drivers, making the automobile insurance market a volatile business risk. In eastern Canada, this move toward automobile insurance also challenged a corporate structure constructed around the stability and seeming predictability of property insurance.

While the Ontario branch was coping with the large quantity of automobile insurance sold, agents in Quebec wrote very few policies, period. The quality of the customers was also problematic, because Quebec agents typically sent the poor-quality business to the “new” company. Wawanesa suffered high loss ratios on this new business, which frequently translated into an underwriting loss. The success of the business in Ontario also meant few members of the Toronto staff paid any attention to the less robust business prospects of its eastern neighbor. To compound the problem, the Toronto staff was deaf to the complaints of the office manager in Quebec, who constantly pointed out the unique situation in the province. In discussing promotional pamphlets, for instance, he asserted the literature would “have to be done in French as practically all my members are French and quite a number of them do not understand English at all well.”Footnote 26 The problem was painfully clear to the manager from Quebec, but not to the prairie-centric decision makers who viewed the Toronto management of Quebec business as a logical financial and geographic decision. The inability of the company to appreciate regional differences hampered its potential success in the Quebec market before 1940.

The otherwise successful agent-based structure quickly became unworkable in Quebec. In Ontario, Wawanesa absorbed a number of established companies that provided a ready-made network of existing agents and policyholders. In Quebec, the successful company assumed it would be attractive to independent agents, but this proved incorrect. Wawanesa found it difficult to convince agents that it offered a good product. Jonathan Fournier, in his article on the professionalization of life insurance agents in Quebec, also notes that turnover among agents in the province was high, with an estimated 19.9 percent not renewing their licenses from year to year between 1943 and 1959.Footnote 27 This no doubt made building lasting relationships difficult for companies attempting to enter the market. The reliance on sales and advertising through agents also meant Wawanesa continued to be a little-known name. While other mutual organizations like the caisse populaires flourished in financially stable rural areas, Wawanesa suffered the opposite fate.Footnote 28 Early attempts to penetrate the rural market failed. The premiums written on property insurance in Quebec were pitiful. In 1937, agents in Quebec sold a total of $39,346 worth of property insurance. By comparison, Ontario posted premiums worth $397,840, while Manitoba listed $152,901. The Quebec operation managed only $52,460 in 1942, a full eleven years after the company entered the market.Footnote 29 The difficulties involved in selling insurance in rural Quebec contributed to the decision to move out of the property insurance market in 1942, and out of rural Quebec until the 1950s.Footnote 30 Never before had the company shied away from business on such a scale. This move out of property insurance in Quebec, however, proved even more complex and had its roots in the success of the Montreal automobile line.

The English-speaking insurance industry as a whole approached Quebec with caution.Footnote 31 The absence of financial responsibility laws, which made drivers liable for costs incurred as a result of an accident, made Quebec less appealing for insurers.Footnote 32 Poor enforcement of traffic rules also made Quebec a hazardous place, at least in terms of risk management, for all insurance companies. By the 1940s, all other provinces adopted some form of financial responsibility law, which improved access to compensation for traffic accident victims by instituting legislated minimums and maximums in case of injury and death.Footnote 33 Becoming financially liable for accidents made insurance appealing to consumers across the country, without making insurance compulsory. By not having this law in place in Quebec, insurance companies had (1) a smaller consumer base; (2) higher legal costs, because most cases continued to be fought in court; and (3) trouble recovering costs in the event of an accident, because fewer people had insurance. The resulting automobile insurance market proved unpredictable and typically expensive for insurance companies, because most companies found setting rates to meet expenses difficult. Many insurance companies experienced years of high losses, making the Quebec market unappealing.

While the laws applying to insurance varied across Canada, the legal problems in Quebec appeared more acute than elsewhere. Only 25 percent of the passenger vehicles on the road in Quebec had insurance in 1946 compared with almost 94 percent in Manitoba in 1947.Footnote 34 The insurance industry feared the absence of legislation and increasing rates for insurance would force companies to withdraw from Quebec, compounding an already difficult situation, making the push for legislation “imperative.”Footnote 35 In 1940, Wawanesa’s managing director commented, “They have no financial responsibility law, and when I consulted with a lawyer in Montreal about this matter I found that the owner of the car was not responsible for perhaps 75 percent of the cases of accidents. They still operate under the old Napoleonic law … I doubt if any rate that we gave in Quebec would be anywhere near adequate.”Footnote 36 An article in the Montreal Gazette pointed out that over a ten-year period, the province’s lowest rate of property damage was 50 cars per thousand higher than the national average.Footnote 37 The article cited “legislative apathy” and asserted the introduction of financial responsibility laws reduced the cost of insurance significantly by making it near compulsory.Footnote 38 Premier Maurice Duplessis announced his government’s intention to study the introduction of financial responsibility laws in 1948, stating: “It is a delicate problem and we will study it with care and endeavour to bring about an equitable arrangement.”Footnote 39 Financial responsibility legislation in 1940s Quebec, however, did not resemble laws enacted across the rest of the country, as it focused on driver safety and keeping higher-risk drivers off of the road, rather than improving access to compensation following an accident. Unlike other parts of the country, where coverage for liability was near compulsory by the end of the 1940s, there was no such mandate in Quebec, which also lacked an indemnity fund for victims and a mechanism for assigning poor risks to insurance companies (known as an “assigned risk plan”).Footnote 40 This meant that higher-risk drivers had no motivation to acquire insurance and no means to obtain insurance if their applications were denied.

In this legal environment, selling automobile insurance did not appeal. Wawanesa initially wrote insurance on private automobiles in Quebec, but by 1938 the quantity of claims prompted an attempt to eliminate three-quarters of the line.Footnote 41 The company achieved this reduction by ceasing underwriting on certain lines. This did not mean the company terminated existing policies; instead policies lapsed as the renewals came up. Automobile premiums written dropped from $50,215 in 1937 to $9,207 in 1938, indicating the company achieved its goal. In 1938, the total premiums written on Quebec property and automobile insurance amounted to a paltry $60,994 compared with Ontario’s $545,566.Footnote 42 Considering business in the two provinces started almost simultaneously, Wawanesa’s head office considered the Quebec experience a disaster.

New Opportunities

Quebec would have been written off, had it not been for a new business strategy. As mentioned at the beginning of the article, Wawanesa folklore recounts the story of a company executive en route to the Montreal office to recommend the Quebec operation be closed.Footnote 43 During the taxi ride, the cabdriver complained how he and his colleagues found it impossible to acquire any insurance on their vehicles.Footnote 44 Agents in the province refused to write taxi companies, viewing them as too high a risk. A radical idea thus emerged. Following some scrutiny of the market, the company entered an agreement with taxi companies and drive-yourself fleet owners. As the government more carefully scrutinized professional drivers than they did the general population, these drivers were better trained and more likely to be taken off of the road in the case of high-risk driving behavior. Most taxi drivers willingly paid rates commensurate with their risk, making the line appealing for the company. Taxi companies were so desperate to maintain their insurance, they offered, in a preemptive strike, to pay significantly higher rates for the insurance to insure their vehicles with Wawanesa. Shocked, the company refused to accept the terms and insisted on continuing their coverage at previously agreed upon rates.Footnote 45

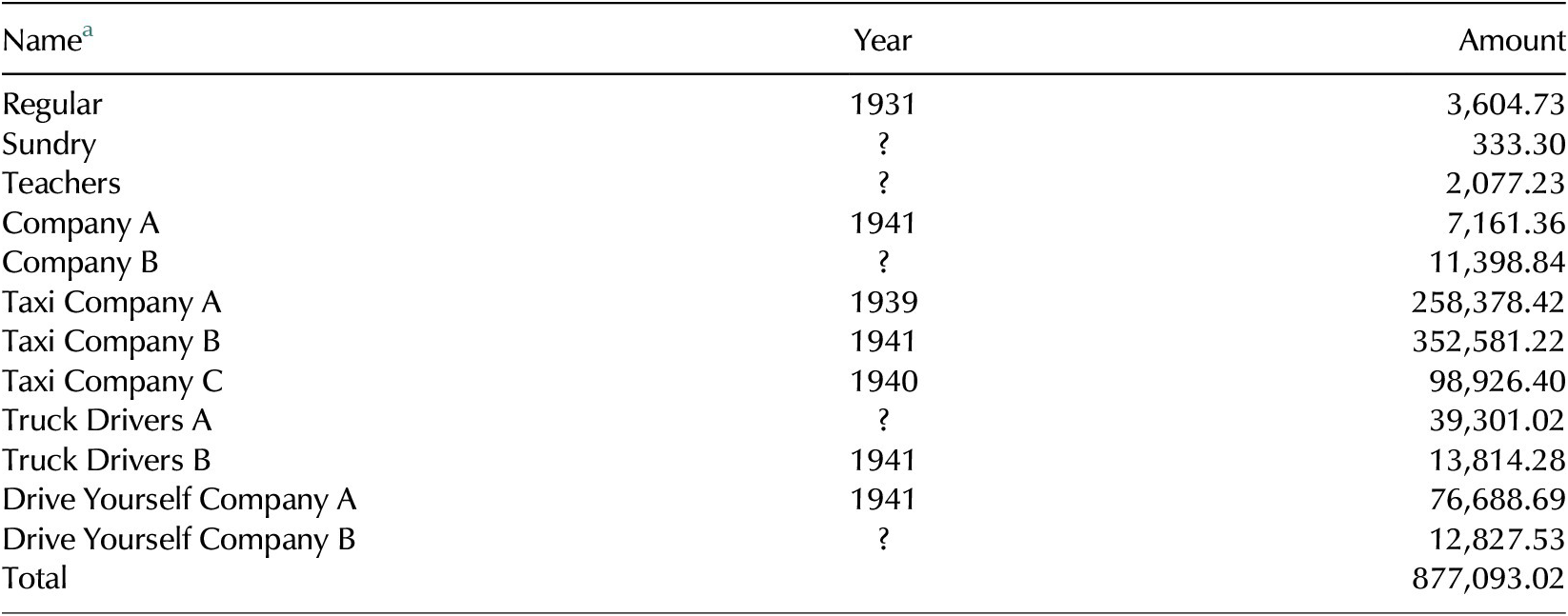

Insuring taxis and drive-yourself vehicles proved a monumental business opportunity. In 1939, the company entered an agreement with “Taxi Company A” for $85,000, representing almost all of the growth experienced in Quebec in 1940.Footnote 46 In 1941, Wawanesa entered an agreement with “Driver Yourself Association A,” and followed this up in the next year with a lucrative agreement with “Taxi Company C.”Footnote 47 These three agreements allowed Wawanesa to make a radical change in the way it operated. The company now relied on a few select groups for the majority of its premium income; it no longer made sense to maintain a relationship with agents, partly because agents refused to write taxi companies. Wawanesa did not immediately terminate the agent–company relationship, but instead started eliminating the individual automobile and property lines.Footnote 48 By 1947, the company insured a variety of fleets, including taxis, drive-yourself associations, teachers associations, and other large private companies. The detailed breakdown of premiums is provided in Table 1. In 1947, premium income from individual vehicle owners amounted to just $3,605 out of the $877,093 Wawanesa had in the Quebec underwriting account.Footnote 49 In 1948, the six-year success in the large fleet lines allowed the company to officially terminate remaining relationships with agents in the province.Footnote 50 Wawanesa developed its direct-writing model by employing and training a staff in Montreal. These individuals dealt strictly with fleets in Montreal, limiting both staff and travel requirements. This shift to a direct-writing and direct-selling model proved the single largest structural shift in the company’s history.Footnote 51 The new direct-writing method also represented the beginning of a new era of general operations in Quebec and Canada.

Table 1. Statement of underwriting account for automobiles: Quebec, 1947

a The company names have been removed and replaced with aliases.

Source: Financial statements as of December 31, 1947, box 1, file 7, 1947 Fin. State., WMICA.

Insuring fleets had decided appeal. Insurance companies liked insuring fleets, because it proved extremely profitable. One article in the Canadian Underwriter suggested that “while the private passenger cars are the bread and butter of the automobile insurance business, it is the big commercial fleets lines that really produce the big premium incomes.” The fleets also proved easier to rate, because insurance companies developed long-term relationships with relatively small groups of people whose driving behavior could be easily monitored. Insurance companies could also intervene with regular safety inspections, safety devices, monitoring of driving schedules, vehicle loading, and related matters.Footnote 52 While such a close relationship would result in a lawsuit against Wawanesa following its attempt to too closely monitor and control taxi drivers in Montreal, the fleet still held appeal, because insurance companies could intervene in ways not possible in the private automobile line.

Contributing to the company’s changing attitude toward Quebec was the appointment of M. C. Holden as the new managing director for the company in 1948.Footnote 53 Holden had a distinct vision of where the company should direct its attention and how to achieve his goals. Informed by his time as a branch manager, one of his first goals was the decentralization of the company, giving each branch more power to write policies and adapt guidelines to meet regional needs. He also separated Quebec from the Toronto office. These two changes allowed for greater flexibility in Quebec and freed the office to act in its best interests. Introducing a decentralized corporate structure allowed the company to manage unique regional business practices.Footnote 54 For most branch managers, this liberation proved a welcome relief from the day-to-day drudgery of trying to implement ill-suited policies. For example, H. E. Hemmons, managing director between 1943 and 1948, decided advertising and entertainment should be “reduced considerably.” Both of these activities merely pointed out the obvious, he claimed, and “our Company does not need very much boosting now.”Footnote 55 Advertising and entertaining, however, allowed the branches to establish and maintain good relations with agents and potential policyholders. The ability to produce their own budgets gave the branches the kind of autonomy that had been lacking before 1948. Decentralization allowed John Fisher, Quebec branch manager, who now reported directly to the managing director and the board, the opportunity to implement ideas long shunned by Toronto and the head office. For example, the Quebec branch introduced its first service office in 1949, terminated the remaining contracts with agents, and commenced with wide-scale advertising.

Following the decision to sell insurance policies directly to the consumer, without agents, operations in Quebec underwent structural change. The Montreal office became the center of operations for Quebec following its designation as a branch in 1948. Montreal proved a logical location for operations in Quebec, because all of the fleet policies sold between 1942 and 1948 came from Montreal and surrounding areas. In 1949, as part of the desire to sell more policies outside Montreal and expand a direct-selling framework, the company established its first service office in Chicoutimi in order to sell policies to the Lac St-Jean district. The company targeted regions with populations of between 30,000 and 50,000 for service offices. In areas like Chicoutimi, the company eventually established resident agents in nearby towns, thereby expanding its operations. The Chicoutimi office turned out to be the first in a network of service offices.

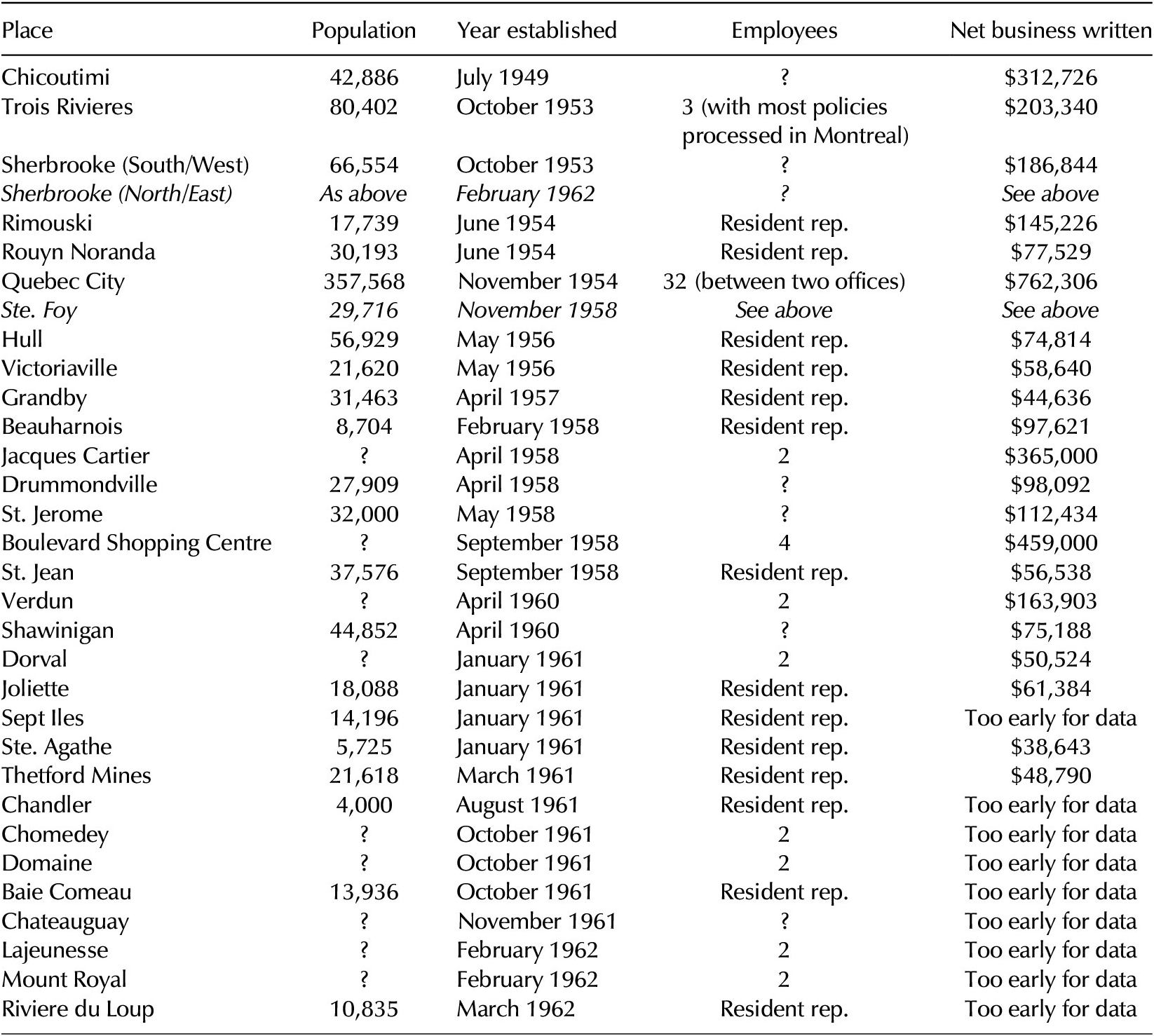

Wawanesa approached the new service office network with caution. It waited for the Chicoutimi office to prove it could effectively sell and service its region before seriously considering other areas. Wawanesa in Quebec developed an effective strategy to explore markets. First, it appointed what it referred to as resident representatives. These individuals worked to sell insurance in their communities and also worked as claims adjusters. Appointing these individuals required the company to pay salaries to the representatives, but did not require an investment in office space, because these men typically worked from home. If the region demonstrated it could support a larger investment, the company established a service office, which involved renting and maintaining office space and typically hiring another individual to assist the representative turned service office manager. By the early 1960s, the company had mastered the art of opening these offices; and by 1962, Wawanesa maintained a total of twenty-one service offices and twelve resident agents in the province. A partial listing of these offices and representatives (Table 2) reveals that the company opened the majority of these offices between 1958 and 1962, after the model had proven itself in a few select regions.

Table 2. Service offices and representatives as of 1962

Source: Information on service offices, box 4, file 10, Holden–Branch Managers Presentation 1962, WMICA.

The creation of the service office did not mean autonomy for the resident agent in his new capacity as the loftily named “service office manager.” All of the service offices and resident agents forwarded all material directly to the central office in Montreal, where bookkeeping, collections, and clerical work were conducted. The two exceptions were the Quebec and Chicoutimi offices.Footnote 56 These offices acquired enough business to justify training and keeping a significant staff in the office. Unfortunately, a breakdown of staff is not available for all of the offices. If Quebec City is any indication, however, an income of $762,306 between the Quebec City and Ste. Foy offices justified a combine staff of thirty-two.Footnote 57 By 1962, the Montreal office had a total of 191 employees working in the central office and the surrounding service offices.Footnote 58

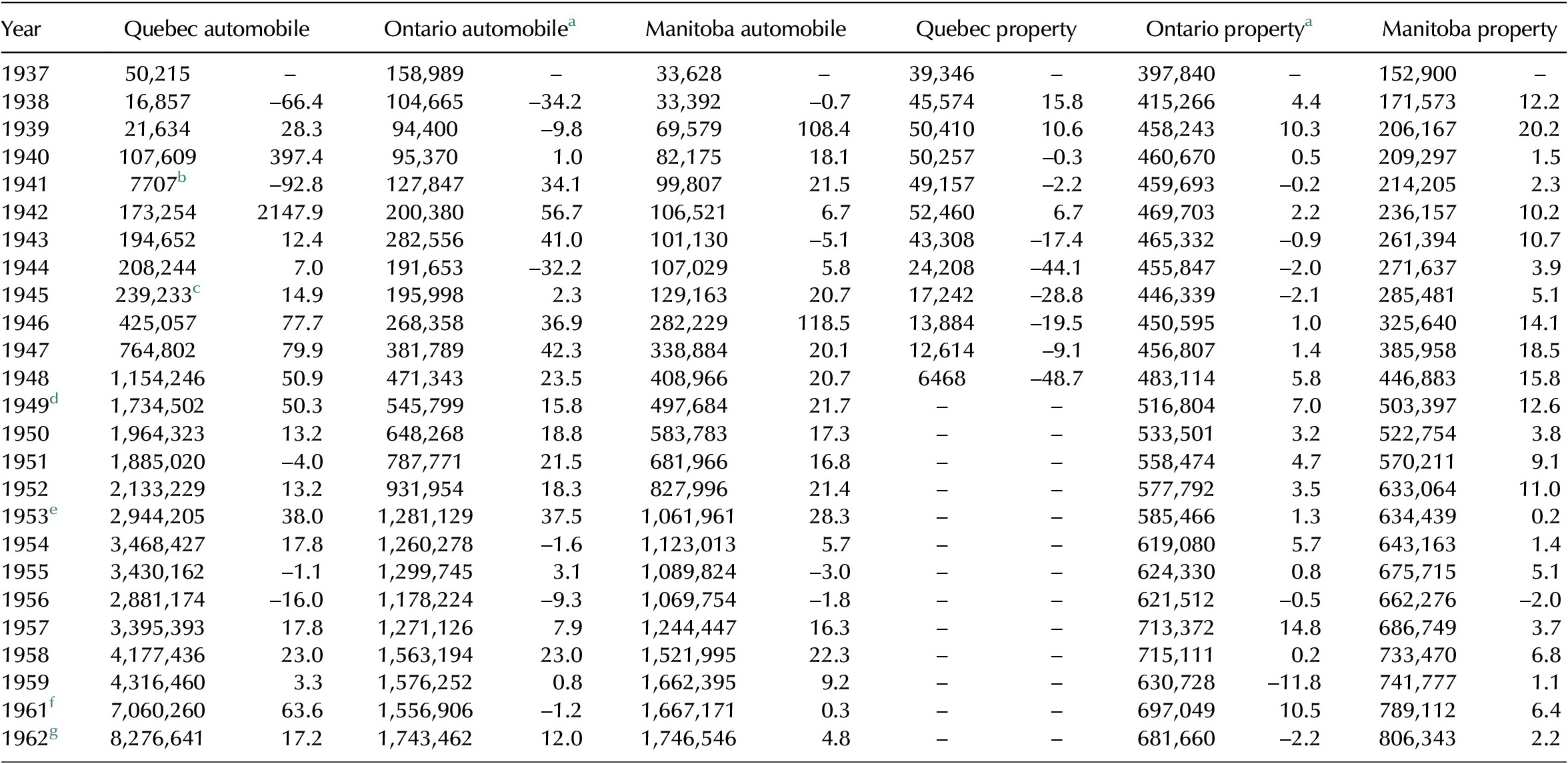

The service offices and resident agents became the backbone of the success of the Quebec operation. Wawanesa also continued to find its strength in insuring fleets of vehicles. One senior manager recalled his early days at the Sherbrooke office. He explained that the company insured seventy-four of the seventy-five taxis in the area. The seventy-fifth cabdriver, he added, “did not believe in insurance” and self-insured.Footnote 59 Although the company experienced some difficulties with the fleets insured in Montreal, the success of these smaller offices offset any other competitive threats. The company lost two of its largest fleets in 1956 and 1958 following the establishment of the Belair Insurance Company by a group of taxi companies. This represented a notable loss for Wawanesa, but by no means prevented ongoing success in the province, as Table 3 indicates.Footnote 60 In part, the expansion into private automobiles also helped balance any ebbs and flows experienced in the fleet business. Managing these inconsistencies turned out to be one of the major strengths of the new Quebec structure, although the decision to specialize in automobile insurance also aided in Quebec’s stability.

Table 3. Premium growth (Can$) with year to year growth (%)

a The totals for both Ontario automobile and property exclude amounts from western Ontario (everything west of Thunder Bay). It should be noted the Winnipeg branch office controlled the western Ontario business but calculated western Ontario numbers separately. No totals for western Ontario are included here.

b This number is correct but there is no explanation provided in the financial statements for the dramatic drop in business.

c The auditor’s note reads: “Montreal Branch: The books here were devised to take care of [Taxi Company A]. The addition of the other risks such as [Taxi Company B], [Drive Yourself Company A] and more especially the Independent Taxis from outside as well as the inside of the City of Montreal have rendered the present system inadequate.”

d In 1948, the board of directors appointed M. C. Holden as managing director for the company. Holden viewed the corporate operations as a whole, instead of divided by east and west. At the same time, he worked to decentralize the company to give the branches more autonomy in recognition of regional differences in business.

e In 1953, the financial statements stopped showing the gross premiums written. Instead, these numbers are the net premiums written.

f The year-end financial statement for 1960 is missing.

g In 1962, Price Waterhouse & Co. became the auditor for the company.

By the 1950s, Quebec reemerged as an appealing place for automobile insurers to work. Improved driver safety records through the 1950s resulted in lower rates for consumers, because accident rates per vehicles owned dropped, making insurance easier to sell and more manageable due to the lower incidence of claims. The Canadian Underwriters Association noted the more positive Quebec market, calling “the 1956 automobile insurance picture … the brightest since immediately after the Second World War.”Footnote 61 Improvements in highway safety justified Wawanesa’s reentrance into the private automobile market in 1952, but brought it once again into competition with many of the other companies that had also reentered the Quebec market.Footnote 62 Wawanesa’s continued presence in the Quebec market throughout the 1940s and 1950s in combination with its increased visibility and Quebec-specific practices all allowed the company to realize Quebec as one of its strongest automobile insurance markets by 1960. This would be important, because it offset losses in Saskatchewan, where the government had introduced public compulsory insurance through a crown corporation that dominated the province’s automobile insurance market after 1946. The introduction of financial responsibility laws in 1961, which made drivers liable for $10,000 for bodily injury and up to $5000 for damage to property, further improved Wawanesa’s standing in the Quebec market, because its experience allowed for more effective underwriting following passage of the law. The government in Quebec also introduced an Assigned Risk Plan in 1961, which required insurance companies to take on poor or unknown risks, allowing access to automobile insurance for all drivers. These assigned risks were rated according to the driver’s risk level. New drivers could expect a policy at a similar cost to that of a regular policy, while the high-risk driver with convictions could expect to pay considerably more.Footnote 63 The new financial responsibility law resulted in a $1.7 million increase in business, which Wawanesa attributed to people seeking insurance to “avoid incurring penalties under the new insurance legislation.”Footnote 64 While the law helped all insurance companies sell policies, Wawanesa had long since established itself as the company best capable of assuming responsibility for drivers and their claims.

Playing to its strengths, Wawanesa developed services most appropriate for a company specializing in automobiles. The service offices, while also used for sales, primarily served as space for efficient claims service. The company trained and employed its own claims adjusters and installed many of them in the service offices across the province. These offices offered on-the-spot claims checks to cover damages and twenty-four-hour access to claims adjusters. The Quebec branch also vowed to insure all lines of automobile insurance, referring to this as its “open market attitude.” This attitude applied “regardless of race, creed or colour and the type of occupation, even those of a very hazardous nature.”Footnote 65 This represented a decided break from the more conservative underwriting practices employed by insurance companies in the rest of the country.

The decision to move exclusively into the automobile market also resulted in a few interesting marketing and advertising decisions in the ensuing years, permitted by the advent of decentralization. With the poorly supported and marginally interested agents removed from the equation, the company focused on selling itself to consumers. Initially, this involved direct contact and negotiating with companies that had fleets, but following its decision to move into private automobiles in 1952, the company worked to strategically sell itself to the individual motorist. Wawanesa wanted to be a brand and have its name synonymous with automobile insurance in Quebec.Footnote 66 The company dedicated, on average, 2 percent of the net written premiums of the previous year to advertising. By 1962, Wawanesa in Quebec boasted an advertising budget of approximately $225,000 compared with the $115,038 spent in the rest of Canada. In 1962, the Quebec branch spent 66 percent of the advertising budget for Canada, while maintaining 41 percent of the net written premiums.Footnote 67 It achieved this success through comprehensive and pervasive campaigns in English and French in newspapers, on the radio, and even on the backs of buses. While the back of the bus campaign may seem an odd choice, this directly targeted those most likely to buy its product, other motorists. The strategic placement of service offices also reflected this new vehicle-centered model. Starting in the mid-1950s, most service offices were primarily accessible by automobile. In a bold move, Wawanesa rented storefront space in shopping malls, starting in 1958 in Ste. Foy. By 1962, five of Montreal’s eight offices were located in shopping centers.Footnote 68 Wawanesa correctly determined shopping centers increasingly attracted the new suburban driver, the consumer it wished to attract to the company. Geloso notes, for example, the dramatic increase in automobile ownership in Quebec, which jumps from 19 percent in 1941 to 57 percent in 1961 (see Table 4).Footnote 69 Wawanesa in Quebec had adapted its structure to match the realities of dealing in an area with limited customer loyalty.Footnote 70

Table 4. Motor vehicle registrations for 1930 to 1961, with % year to year growth

Source: Historical Statistics of Canada, Series T147-194, motor vehicle registrations.

By 1962, Wawanesa’s sales in Quebec placed it second only to Lloyd’s of London, a fact the company, and more importantly the branch manager in Quebec, eagerly announced to those willing to listen.Footnote 71 The success of the new structure in Quebec attracted the attention of other branch managers across the country who admired the effectiveness of the Quebec system. The board of directors also noticed how efficiently Quebec managed growth and creatively targeted its desired market. In the early 1970s, when Wawanesa entered the American market, the company demonstrated that it had learned from its experience in Quebec. While the traditional agent-based model held some appeal, the efficiency and control of the Quebec business model of direct writing resulted in San Diego adopting the model. Wawanesa chose to target definable markets and sell specific lines, starting with a narrowly defined group at first and moving to carefully chosen markets as the company expanded throughout California.Footnote 72

Conclusion

When the Wawanesa Mutual Insurance Company moved into Quebec, it tried to replicate the skills and methods learned from thirty-five years in the insurance industry in western Canada. Relying on agents, the company unsuccessfully tackled the Quebec market starting in 1931. Agent and consumer loyalty quickly became a problem for the company, as it was perceived as an English-Canadian company attempting to work its way into Quebec’s rural areas. Trying to replicate the English-Canadian business model failed. Change was needed, and the answer lay in limiting the company to a narrowly defined market—writing automobile fleet insurance in Montreal. To accommodate this reality, the company decentralized, allowing the Quebec branch to fully develop a unique service offering within its own business structure. Over the next fifteen years, Quebec acquired its own branch office and worked to develop its own network of service offices and resident representatives. By 1962, with 41 percent of the net written premiums for the country, Quebec had truly become the cornerstone of Wawanesa’s operations in Canada. The company paid further tribute to the efficiency of the Quebec operation when it decided to utilize the Quebec model in creating the new branch in San Diego, its first foreign business venture. Unlike native financial institutions, which relied primarily on language to attract consumers to their branches, Wawanesa evolved a strategy that relied on targeted marketing and a business structure more attuned to its intended market.Footnote 73 Wawanesa’s involvement in the Quebec market was complicated by automobile legislation, which made the market particularly volatile, but also opened the door to new markets. Wawanesa chose to rebuild its operations in Quebec by limiting its market to the heavily regulated taxi market and, in doing so, created a new market. Only after it understood the regional market did it expand back into private automobiles and, later, into other property lines.

In exploring the history of twentieth-century insurance in North America, historians should carefully consider the importance of region in the development of underwriting strategy and corporate structure. Historians interested in understanding the modern insurance industry will also need to carefully consider the ramifications of legislation and regulation on corporate decision making. In the case of Quebec, the absence of financial responsibility laws (the precursor to compulsory insurance) drove most insurers out of the market. This underinsured and poorly regulated market created a unique opportunity for a company like Wawanesa to dominate the market. As a change in government and an increased willingness to insure occurred, the market boomed, and the insurance market exploded in the province. The underlying shift in social and political culture also played an important role here. As the quality of life for the people of Quebec improved, so too did the business prospects of a company attuned to these changes.

Acknowledgments

The author thanks Ken Cruikshank, Tabussom Qureshi, Karim Dharamsi, Alejandro Rojas, and William Nelson. She is also grateful to the three anonymous reviewers for their helpful comments. The Wawanesa Mutual Insurance Company, in particular Gregg Hanson and John Bjornson, granted unrestricted access to the private archives making this article possible. Any errors that appear here are hers alone.