Introduction

In the early 1930s, the world economy was in the midst of the Great Depression, but in Palestine, the first half of the decade was known at the time as “the age of prosperity.” For Barclays Bank DCO (Dominion, Colonial and Overseas), a subsidiary of Barclays Bank and the bankers of the local British government, 1932 was a low point of trade in countries served by the bank, but “Palestine remained to all appearances immune from the world depression.”Footnote 1 The main reason for the difference between the economic performance of Palestine and other countries was the immigration of European Jews who, faced with deteriorating economic and political conditions, arrived en masse to Palestine.Footnote 2 The tragedy of their emigration from Europe was nonetheless an economic boom for the Yishuv, the Jewish settlements in Palestine.

A corollary of the immigration wave was the vast enlargement of the banking sector, apparent in the establishment of new banks and in the volume and number of deposits.Footnote 3 However, whereas the economic prosperity in Palestine was seen favorably by officials at Barclays DCO, they were much less enthusiastic about the growth of the banking sector. They saw it as a threat to their business in the country and to Palestine’s credit system as a whole, and urged British authorities to take control of the situation.

Barclays advocacy led to a series of committees, memoranda, and legislation during the 1930s, which eventually brought about a sharp reduction in credit and in the number of banking institutions. The new regulation of the banking sector is seen by prior research on Palestine’s banking history as the central cause for the sharp decline in the number of banks in the country, and as a contributor to the banking sector’s oligopolistic nature from that point onward (see Figure 1).Footnote 4

Figure 1. Number of Commercial Banks in Palestine.

In this article, I argue that the regulation of Palestine’s banking sector was instigated by officials from Barclays DCO, who were concerned that the proliferation of banks presented both a systemic threat to the banking sector as a whole, as well as a competitive threat to the bank. I further argue that representatives from Barclays DCO were aided by the Anglo-Palestine Bank—the largest Jewish bank in the country, established and owned by the Zionist Organization—in designing the form of the regulation, one that would benefit the two banks and consolidate their position within the banking sector. This process was carried out in the face of critical opposition by representatives of the smaller banks and credit cooperatives who offered a different view on the dangers of the banking sector and suggested regulatory alternatives. Despite this opposition, the banking ordinances were designed according to Barclays DCO’s and the Anglo-Palestine Bank’s views and interests, and caused a long-lasting consolidation of the banking sector in Palestine, and later Israel.

British economic policy in Palestine is viewed by scholars through the lens of the political and geostrategic objectives of the British Empire. Primarily concerned with securing the imperial routes to India and developing the flow of oil from Iraq, British authorities invested in transportation, communication, and the establishment of a functioning administration. British policy sought to run a balanced governmental budget in Palestine that would not be a burden on British taxpayers, and assisted British firms that wanted to trade and invest in Palestine. Alongside direct government involvement, laws and regulations were enacted by the Mandatory government that were subject to the same political and strategic priorities.Footnote 5

Prior research on Mandatory Palestine’s banking sector views the regulation of the 1930s favorably, as a necessary correction to the potential threat of small banks that lacked the proper means and expertise. A banking crisis in 1935, following the rising tensions between Italy and Ethiopia, proved the need for banking regulation and the curtailment of small banks, along the lines that were enacted by the local government in the following years.Footnote 6 This research presents in essence a story of a banking sector that went out of hand, and was put into place by the actions of a benign government.

Despite the important contributions of this research to our understanding of British economic policy and its consequences, much of it puts political actors at center stage: the British local government, the Colonial Office in London, and Jewish and Arab political organizations. What has so far been largely neglected in the research, both in regard to the banking sector and in Mandatory Palestine’s economy as a whole, is the way local and foreign businesses have advocated for different policies and regulations and were occasionally successful at influencing them.Footnote 7

During the Mandate period, Barclays DCO and the Anglo-Palestine Bank were the largest and most important banks in Palestine, and they played a major role in the regulation of the country’s banking system.Footnote 8 The Anglo-Palestine Bank was a subsidiary of the Jewish Colonial Trust, which was established by the Zionist Organization. Both of these banks were established as the financial arm of the Zionist Organization, carrying the double mandate of a commercial bank with political objectives. The Anglo-Palestine Bank opened its main office in Jaffa in 1903 and in the following decade opened branches in various cities. Although both of these banks’ main offices were in London, the vast majority of the Anglo-Palestine Bank’s business activity was in Palestine, whereas the Jewish Colonial Trust supplied credit to European customers.

Following the British occupation of Palestine during World War I, the Anglo-Egyptian Bank opened its first office in the country. The bank, which later merged into Barclays DCO, initially served the British army forces and later became the government banker and currency agent for the Palestine Currency Board. During the interwar period, its parent bank, Barclays, was managed by “staunch imperialists” who saw the British Empire as a counterweight to Britain’s dependence on American support and to the competitive threat of German banks. As part of this general outlook, Barclays acquired during and after World War I the Colonial Bank (which operated in Barbados and West Africa), the National Bank of South Africa, and the Anglo-Egyptian Bank, which had branches in Malta, Cyprus, and Palestine. In 1925, these three subsidiary banks were amalgamated into Barclays Bank DCO (Dominion, Colonial, and Overseas), which later extended its operations to Uganda and Rhodesia as well. During the interwar period, Barclays DCO’s staff, deposits, and market value grew considerably, and the return on its capital was higher than the parent bank’s return.Footnote 9

Both Barclays DCO and the Anglo-Palestine Bank were, strictly speaking, foreign banks in Palestine. “Foreignness” in the context of banking was defined as banks whose registered offices were abroad.Footnote 10 In contrast to the local banks of Palestine, who were registered in Palestine with their head offices in the country, Barclays DCO and the Anglo-Palestine Bank were registered in London and were subsidiaries of a parent bank. However, despite their similarities, the Anglo-Palestine Bank is different than Barclays DCO (and other foreign banks) in that almost all of its business activity was in Palestine, whereas the other foreign banks had more geographically diverse business.

Under the Ottomans, there was practically no regulation of the banking system except for a prohibition on charging more than 9 percent interest. Following the establishment of a British civil administration in 1920, the Banking Ordinance of 1921 was enacted and defined the meaning of “bank” and “banking business.” It also prohibited banking by any company that was not registered under the provision of the Companies Ordinance. During that same period, additional ordinances concerning cooperatives and mortgage banks were enacted. These early regulations of the banking system were minimal, and rightly described by one historian as an example of the British laissez-faire attitude in economic matters. It was only following the Banking Ordinances of 1936 and 1937—the subject of this article—that stricter rules concerning the banking sector were established.Footnote 11

As a recent historical survey of the subject stresses, banking systems and their regulatory environments are nationally diverse and path dependent.Footnote 12 It is therefore important to briefly mention some of the similarities Palestine had to other places, as well as what makes it unique. In Europe and the United States, the diversity is evident in the different form regulations took. Whereas some countries had very little oversight on the banking sector and low barriers to entry until relatively late in the twentieth century, other countries imposed more strict regulations earlier, which mostly focused on capital requirements and liquidity ratios.Footnote 13

Whereas banking regulations in Europe and the United States were determined by national governments, in British colonies it was the local colonial government who set the policy in place. One of the consequences of this difference is that, in contrast to the diversity mentioned above, the British colonies were usually subject to lax and occasionally nonexistent regulation of the banking sector. Across the British Empire, foreign European banks were considered by the authorities as stable enough for the government to subject them to minimal oversight. When regulations were enacted, it was often following a bank panic that threatened the stability of the financial system. These regulations targeted local banks that were seen as unstable and lacking suitable knowledge and expertise.Footnote 14

Palestine was similar to other British colonies in the laissez-faire policy of the authorities, and the banking sector’s structure of large foreign banks next to smaller local ones. It was also similar to Hong Kong and Cyprus in that, during the 1930s and 1940s, it experienced a rapid growth of its banking sector.Footnote 15 Despite these similarities, there are a number of factors that make the Palestinian case unique, in comparison to other British territories as well as Western countries.

As a result of both the expansion of the banking sector and the role played by the large foreign banks, the regulation of Palestine’s banking sector began in the 1930s. This was similar to trends in Europe and the United States, but different from other British colonies whose regulations often occurred during and after World War II. Conversely, Western countries had sovereign governments that were much less influenced by foreign corporations. Similar to other British overseas territories, Palestine was under the control of a foreign government, and foreign banks had an outsized role in its economy. The Jewish immigration wave to Palestine in the early 1930s, which brought about the rapid growth of the banking sector, was conceived as a potential threat to both the local government and the large foreign banks, and served as the backdrop for the regulation of the banking sector.

Mandatory Palestine’s banking sector was large and significant. Both the ratio between demand deposits to total money, and the ratio of overall claims to national income, were much higher than its surrounding neighbors and in many cases higher than major developed countries. These ratios indicate that Palestine’s economy was highly monetized and that banks financed a large share of its economic activity.Footnote 16 The way British authorities treated and regulated the banking sector was therefore an important element in their economic policy and the regulatory environment they created. As I will show, and contrary to previous accounts of the subject, the banking regulation was to a large extent designed by the large banks in the country. Although the form of regulation did not in any significant way negate the political and geostrategic objectives that stood at the heart of British economic policy, it is clear that it did not stem from these objectives. The forces shaping banking regulation were not public political institutions but private financial ones.

The deliberations and arguments leading up to the regulation of the banking sector were not merely technical matters, limited to the day-to-day business of credit institutions. What was at stake was the form and direction of the Yishuv’s and Palestine’s economic development and its relations with the British metropole. The struggle surrounding the banking regulations pitted the large banks, whose business was largely dependent on their relations with the London money market and the imperial economy, against the smaller banks, whose interests were oriented toward the small lender and the domestic economy.Footnote 17 The contrasting orientations implied a wider argument on the development of the local economy. Will foreign trade and finance be the main driving force, or will local industry and commerce gradually release the local economy from its dependence on imports of manufactured goods and raw materials?

The regulation of Mandatory Palestine’s banking sector exemplifies two distinct but closely related concepts: corporate liberalism and regulatory capture. Corporate liberalism is a stream within American historiography, whose main claim was that the economic regulation during the Progressive Era in the United States was pursued by large corporations in order to gain stability and social legitimacy. This literature began in the 1960s and stemmed mostly from left-wing historians.Footnote 18 Shortly afterward, the conservative economist George Stigler—a major figure in the Chicago school of economics—published his theory of economic regulation. The theory was, in a sense, an economic formalization of the conclusions arrived at by the corporate liberalism school. The main concept in Stigler’s theory was regulatory capture: the process by which economic groups seek to use state power to advance their interests. “Regulation is acquired,” according to Stigler, “by the industry and is designed and operated primarily for its benefit.”Footnote 19

These concepts were developed as an attempt to explain the formation of regulatory environments in sovereign states. As I will show, both of these concepts have deep resonance in the history of Palestine’s banking regulation. However, what distinguishes the Palestinian story is that these dynamics played out in an imperial context, with a foreign power imposing rules according to the interests of a foreign bank, Barclays DCO, and a semi-local one, the Anglo-Palestine Bank. Therefore, the story presented here is an extension of the concepts of corporate liberalism and regulatory capture into the history of the British Empire.

Appointment of the Banking Committee

Like in many of its colonies and overseas possessions, Britain’s economic policy in Palestine was that of balanced budgets, free trade, and strategic investments in projects of importance to its empire. During the 1920s, the local government’s policy toward the banking sector was limited to laying minimal legal requirements by enacting ordinances for commercial banks, mortgage banks, and cooperatives. The Banking Ordinance of 1921 defined the meaning of “banking business” and required registration but had no other limitations on opening banks.Footnote 20 This laissez-faire attitude toward the banking sector carried on until the beginning of the 1930s, when trends in the global and local situation called for a change.

The first impetus for a reform of the banking sector came from Julian Crossley, future general manager and chairman of Barclays DCO. Crossley, who was sent overseas to assess business opportunities in Africa on the bank’s behalf, also arrived in Palestine in 1932.Footnote 21 Following his visit, he met with officials in the Colonial Office in London. Crossley reported that he was surprised by the large number of banks and estimated that there were eighty in Tel Aviv only, although the actual number was significantly smaller.Footnote 22 According to Crossley, these banks had little capital and offered competitive rates of interest. Crossley thought that, as long as the immigration continued, these small banks could probably continue. He feared, however, that once the immigration stopped, many of them were likely to collapse, and such a collapse “would be described as a wholesale banking collapse and would do more damage to Palestine than the facts warranted.” Crossley therefore urged the officials to enact a banking ordinance that would require the banks to hold a minimum amount of capital.Footnote 23

Crossley was frank about his bank’s conflict of interest. “My position was, perhaps, a little difficult in some respects,” he wrote an official at the Colonial Office, “representing as I did the larger bank trying to suggest means of controlling the epidemic of small institutions which is now rampant in the territory.” Although Crossley acknowledged the Colonial Office’s aversion to excessively restrictive legislation, he couched his proposals in the protection of costumers who would be led astray by the misuse of the word “bank.”Footnote 24

While in Palestine, Crossley met with the government treasurer, W. J. Johnson. Following their meeting, Johnson expressed similar views in a note written to his superiors. Johnson wrote that, although the proliferation of banks did not seem to be troublesome at the moment, “the slightest indication of instability on their part may result in hasty withdrawals of deposits and a crisis which would seriously damage Palestine’s credit generally.” According to Johnson, the measures to deal with this possibility were by establishing the banks “financial bona fides” and “prescribing minimum cash reserves” as well as maximum long-term investments in relation to short-term deposits.Footnote 25 The only apparent divergence between Johnson’s and Crossley’s views was the former’s proposal to determine a liquidity ratio, a suggestion that would later become a major point of contention.

Although Johnson thought it would be preferable to close thirty-six banks (about half of the commercial banks in the countryFootnote 26) whose paid-up capital was lower than £P20,000, it would bring about “unnecessary hardship.” The first steps for the control of banking should be, according to Johnson, a requirement from the banks to register and be approved by the high commissioner. The high commission would be granted the discretion to refuse and cancel past and future registration if the bank had lower than £P5,000 of paid-up capital. Additionally, a banking committee should be appointed that would consider fixing a minimum of paid-up capital, fixing a minimum cash reserve as percentage of deposits, limiting short-dated deposits to short-dated investments, and revising the Banking Ordinance of 1921–1922 and the Credit Banks Ordinance of 1920–1922. According to Johnson, the suggested banking committee should consist of himself as chairman; A.P.S. Clark, manager of the local Barclays DCO who would represent the foreign banks in the country; and five other representatives of the banking and business community.Footnote 27

Johnson’s views were reiterated in a letter sent by the high commissioner, Arthur Wauchope, to the secretary of state for the colonies, Philip Cunliffe-Lister. Wauchope added that he felt “it is most urgent to bring the Ordinance into force during the present period of economic prosperity, before there is any appearance of a slump.”Footnote 28 In October of 1933, the government of Palestine appointed a banking committee assigned with the same objectives mentioned above by Johnson:

-

(a) fixing a minimum capital to be paid up within a year from the date of registration or to recommend some other suitable way of establishing the financial bona fides of a Bank;

-

(b) fixing a minimum cash reserve as a percentage of deposits;

-

(c) limiting the use of short-dated deposits or current accounts to short-dated investments;

-

(d) giving retroactive effect to any recommendations.

To consider the necessity for and to make recommendations regarding the revision of:

-

(a) the provisions of the Banking Ordinances, 1921–1922; and

-

(b) the Credit Banks Ordinances, 1920–1922.Footnote 29

The Banking Committee’s Deliberations and Recommendations

The committee discussed two methods for regulating the banking sector, stipulating a minimum capital requirement and requiring a liquidity ratio between assets and liabilities. The discussants were not detached government officials, but bankers and businessmen who had a lot at stake. The different forms of regulation could have dire consequences on the credit institutions of the country and therefore influencing the committee’s recommendations was of the utmost importance.

During the Banking Committee’s first meeting it was decided that there was a need for a smaller, “technical subcommittee” that would supply the main committee with information and expert advice, but soon became the main arena in which the regulations would be formulated.Footnote 30 The subcommittee had fewer members and included Johnson, the treasurer; Clark, Barclays local manager; Eliezer (Sigfried) Hoofien, manager of the Anglo-Palestine Bank, the largest Jewish bank in the country that was owned by the Zionist Organization; Moshe Smoira, an advocate representing some of the small Jewish banks; and Haj Taher Bey Karaman, a Haifa businessman who represented the Standing Committee for Commerce and Industry but was absent from many of the subcommittee’s meetings. The technical subcommittee was assigned the role of formulating the recommendations for the first part of the terms of reference, namely those concerning the methods of regulation. Later on, it would also discuss the second part of the terms of reference, those concerned with amendments to the Banking Ordinance and the Credit Banks Ordinance.Footnote 31 Whereas the parent committee held its first meeting in November 1933 and the next one not until April 1934, the subcommittee met eight time during that same period. In other words, the smaller subcommittee was not simply a conveyor of factual information and expert advice to the parent committee, but the main arena for the discussion and formulation of banking regulation. The size and composition of the subcommittee gave the managers of the large banks, namely Hoofien of the Anglo-Palestine Bank and Clark of Barclays, a much larger say in the discussions.

During the subcommittee’s meetings, two methods of regulating the banking sector were discussed. The first was requiring a minimum amount of capital for the establishment and operation of credit institutions. The second method considered was stipulating a certain ratio between assets and liabilities. The two methods had different consequences for the institutions involved. The dividing lines in the discussions of these methods were drawn between the large and small banks, and between the representatives of the banks and Johnson, the government treasurer.

Fixing a minimum amount of capital raised two questions: What will the minimum amount be, and will the capital requirements be applied retroactively, to existing banks and credit institutions? These questions had obvious repercussions on the booming banking sector and on its future development.

Hoofien and Clark, managers of the larger banks, advocated for high capital requirement, standing at £P25,000, for new and existing banks.Footnote 32 For frame of reference, out of the forty-three local banks, only seven had paid-up capital of £P20,000 or over, whereas twenty-one of them had no paid-up capital at all.Footnote 33

Clark articulated clearly what was at stake. In a note written before one of the subcommittee’s meetings, he wrote that “the Committee’s attention should be directed towards affording some protection to the public from the menace of the small Banks, while avoiding any action likely to hamper or obstruct the business of the large Banks.” He regarded the stipulation of a minimum paid-up capital as the main measure to deal with the “menace” and explicitly mentions that over 80 percent of the small banks will be under a £P25,000 minimum requirement. “What we have, in reality, been desirous of being able to do,” he wrote, “is to bring to an end the existence of so many small Banks. This can only be achieved by making a minimum capital stipulation retroactive.”Footnote 34

Although less straightforward, Hoofien expressed similar views. He argued that low capital requirements would allow for “the danger of the multiplication of small and possibly unsound banks.” Neglecting to apply the capital requirements on existing banks “would stultify the whole purpose.”Footnote 35

Smoira, who advocated on behalf of the smaller banks, thought that capital requirements of £P25,000 were too high, and if applied retroactively, it “would be interpreted as an act by the big Banks to suppress small banks.”Footnote 36 As a lawyer, Smoira’s arguments were mostly legal. He claimed the existing banks that would fall under the minimum capital requirement were already incorporated in compliance with the law and therefore obliging them to conform to the new law would be a transgression of their acquired rights. Smoira suggested a minimum capital requirement of £P5,000–£P10,000 that would apply only to new banks. He also suggested establishing a certain ratio between the banks’ capital and their assets.Footnote 37

Johnson, the treasurer, initially sided with Hoofien and Clark on the issue, but decided that the opinions of other local bankers should be heard before a decision was made.Footnote 38 Hoofien and Clark were assigned the role of writing a questionnaire, interviewing local bankers, and submitting a summary of the results. The answers the two received from the interviewees were conclusive: The representatives of the local banks thought a minimum paid-up capital of £P25,000 was excessive and that there was a place for banks holding a much smaller amount. In light of the evidence, Johnson changed his view and thought it would be hard to persuade the government to force the small banks to raise the amount or liquidate.Footnote 39

Following Hoofien’s suggestion, a compromise between Johnson and the large banks, was reached, despite Smoira’s objections. The committee recommended that existing banks be granted a year to acquire £P10,000 as capital, and three more to reach £P25,000. New banks would be required to present the larger sum within six months of their incorporation. These, in essence, were the recommendations of the committee’s final report.Footnote 40

The second major issue in discussion was that of fixing a ratio between assets and liabilities. The subcommittee quickly arrived at the conclusion that two points of the terms of reference—fixing a minimum cash reserve as a percentage of deposits and limiting the use of short-dated deposits or current accounts to short-dated investments—were to be treated as one. It was in essence an issue of liquidity.

Within the subcommittee, Johnson was the main advocate for stipulating a liquidity ratio. He thought “such measures should be made compulsory by legislation and not be left entirely to the discretion of the Banks themselves.” These measures were common in other countries and, according to Johnson, the local government “attached great importance to them as a solution of the present problem.” Local bankers would have to make “a very strong case” for him to be “convinced of their impracticality.”Footnote 41

On the other hand, Clark and Hoofien opposed legislation: They thought liquidity should be required by the Registrar of Companies or be left to the banks’ policies.Footnote 42 According to Hoofien, liquidity was a hard concept to legally define because it meant different things for different banks. For instance, British government securities were liquid for the Anglo-Palestine Bank because they could easily convert them to cash, but they would not be considered liquid for the Big Five banks in England because if they would all convert them to cash it would adversely affect the entire market. Conversely, “high grade discounts in London” were liquid for the Big Five but discounts of Jaffa or Jerusalem were not for local Palestinian banks. Hoofien “was sure that any of the foreign banks operating in Palestine would fall considerably below the standard reserves set out in the Treasurer’s memorandum in this respect.”Footnote 43

Clark was mainly preoccupied with the applicability of the proposed liquidity ratio on the foreign banks, such as his own. Whereas the treasurer claimed it would be difficult to exclude them from statutory requirements, Clark said he did not think Barclays would agree to such control because the bank’s Palestinian assets are used by the headquarters and in other countries. He claimed there should be a differentiation between the large foreign banks and smaller local ones. Whereas the former should be exempted from legislation, for the latter “it was quite essential to control the relation between liquid assets and deposits.” Hoofien agreed there was no way to control the foreign banks’ ratio between reserves and deposits and therefore the discussion and legislation should be focused on the small banks.Footnote 44

Once again, a compromise was reached, this time following the suggestion of Clark. It was agreed that “the High Commissioner should have power to enforce, if and when the occasion demanded it, the minimum reserve which, after seeking the advice of a Banking Advisory Committee, it was found necessary for Banks to maintain.”Footnote 45 Although the composition of the proposed advisory committee was initially contested by Johnson and other members of the committee, the final report stipulated that it would include the managers of the large foreign banks (Barclays DCO, the Anglo-Palestine Bank, and the Ottoman Bank) as well as two representatives, one of urban industries and one of agricultural interests.Footnote 46 In other words, Clark and Hoofien were able to limit the regulation of liquidity to exceptional circumstances that would be decided by an advisory committee in which they would have a built-in majority.

Opposition to the Banking Committee’s Recommendations

Enacting the banking regulations went through the routine processes of legislation in Mandatory Palestine. Once the legislation was drafted by the legal department of the local government, informal consultations were conducted with Jewish and Arab stakeholders. The legislative authority was in the hands of the high commissioner, who would then send the legislation for approval of the Colonial Office in London.Footnote 47

As we have seen, a number of objections were raised during the Banking Committee’s discussion to the form of regulations that Hoofien and Clark were pursuing. When the committee’s recommendations were sent for approval by the high commissioner, Arthur Wauchope, and the secretary of state for the colonies, Philip Cunliffe-Lister, most of these objections were disregarded.Footnote 48

The failure of the opposition from within the committee did not deter criticisms of its recommendations once they became widely known. A group of small commercial banks came together to form a wholesale opposition to the way the committee was constituted, its recommendations, and the impending legislation. These fifteen banks were spread out across the country, with an aggregate of about twelve thousand customers and paid-up capital of between £P1,000 and £P8,000 each. They were represented by the S. Horowitz & Co. law firm, headed by Salomon (Shalom) Horowitz, one of the most prominent lawyers in Palestine during the British Mandate and after the establishment of the State of Israel. Horowitz’s firm sent on behalf of these banks a detailed memorandum, which portrayed a different picture of the banking situation and suggested alternative measures to deal with its problems.

The bankers’ criticism of the committee was laid out right from the start: “The Committee sat in secret, its Report has never been published, nor—as far as we are aware—is it likely to be published, no invitation was given to the public or to the parties more directly interested to appear before the Committee and to give evidence.”

The small banks began by criticizing the composition of the committee, which had prominent representatives from the large banks but none on behalf of the smaller ones. The consequence was a proposed regulation that disregarded the interests of the small banks in Palestine and their customers.Footnote 49 The memorandum emphasized that the small banks were not in imminent danger, and filled an important function for the Palestinian economy as a whole. The banks served twelve thousand shopkeepers, tradesmen, artisans, and employees who required small, short-term credit that the large and medium banks were not interested in supplying. Closing these smaller banks would push their customers “into hands of usurers.”Footnote 50

According to the memorandum, the fixing of a minimum paid-up capital—the measure advocated by the large banks and adopted by the Banking Committee—was not only ineffective “for the real or presumed dangers,” it was also “indefensible” because it would “force out of existence existing institutions lawfully founded and lawfully conducted … [T]here can be no serious doubt but that the proposed new requirements are nothing less than a death warrant.”Footnote 51 Considering the limited stock market in Palestine, the small banks would have trouble raising enough capital, and amalgamation could not be forced by “a threat of extinction.” The higher amount would require the banks to either increase their rate of interest, engage in more dangerous and speculative loans, or concentrate on larger loans at the expense of the smaller ones.Footnote 52 Additionally, the banks claimed that the recent banking crises in Europe were caused by larger banks, and that though there were some developed countries that had minimum capital requirements, they were usually quite low, and should be lower still in a country as small as Palestine.Footnote 53

The memorandum suggested an alternative: regulating the banks’ assets and liabilities. As will be recalled, this form of regulation appeared in the committee’s terms of reference, was initially adopted by the treasurer, only later to be abandoned due to Hoofien and Clark’s objections. From the small banks’ point of view, the advantage of this kind of regulation was that it did not differentiate between banks according to their size, but according to their business practices. According to the memorandum, there were large banks in Palestine with liabilities that were disproportionate to their paid-up capital. In contrast, the smaller banks had an adequate ratio between paid-up capital and liabilities that was similar or better than those present in a number of developed countries. The memorandum concludes by welcoming stricter controls on banking than the ones proposed by the committee, namely fixing a proportion between paid-up capital to liabilities and/or turnover, inspecting the banks’ accounts, and restricting “hazardous forms of investment.”Footnote 54

An important difference between the two kinds of regulation should be noted. Fixing a minimum amount of paid-up capital erects an entry barrier to new players and eliminates the smaller ones, if applied retroactively, as the large banks suggested. Once legislated, it requires minimal intervention by governmental authorities. On the other hand, fixing a ratio between assets and liabilities is a more invasive regulation that requires the perpetual monitoring and, if needed, also intervention by the government.

It seems this line of reasoning had caused Wauchope, the high commissioner of Palestine, to wholly reject the small banks’ objections. In a letter to Cunliffe-Lister, the secretary of state for the colonies, he rejected all of the objections raised by the smaller banks, asserting that “it is clearly undesirable” that institutions with as little as £P1,000 would carry the title “Bank.” Establishing a ratio between the capital of the bank to its deposits would require a constant monitoring of deposits, and banks would be obliged to stop receiving deposits once a certain ratio was reached. It would also reinforce the opinion that as long as the ratio was maintained, the government would not question the bank’s stability. Wauchope was therefore unwilling to adopt such measures. “As to control by means of inspection of accounts by Government and of restrictions on certain forms of investment,” he wrote, “I regard such measures as undue interference with the internal management of banks, the burden of which should not be assumed by Government.” Despite the various objections raised by forces within and without the committee, the high commissioner endorsed the committee’s recommendations.Footnote 55

However, the enactment of the regulation suggested by the committee was postponed, and a few months later, a crisis would put to the test the different opinions regarding Palestine’s banking sector and its proper regulation.

The Abyssinia Crisis

During the summer of 1935, rising tensions between Italy and Ethiopia brought the two countries to the brink of a war. Mussolini laid claims to the country and demanded the League of Nations remove its custodianship of the country. Supported by Great Britain, the league declined, and Mussolini threatened to invade the country. During that summer, diplomatic efforts were made to avoid the outbreak of the war. The negotiations eventually failed, and in the beginning of October, the Italian army invaded Ethiopia, starting the second Italo-Ethiopian War.Footnote 56

The buildup to the war sparked fear that a new world war was imminent, a fear that was pronounced in adjacent countries in the eastern Mediterranean. During the summer months, Banco di Roma, an Italian bank that operated in the area, experienced an increase of withdrawals and was restricting advances. By the beginning of October, the bank had lost most of its deposits in Malta, Alexandria, and Beirut.Footnote 57 It had lost many of its deposits in Palestine as well, and there was a growing fear that these withdrawals would not be limited to the Italian bank. Although Palestine’s treasurer was assured by the foreign banks that there were no widespread withdrawals of deposits, he expressed concerns about the position of some of the smaller Jewish cooperative banks, especially the Ashrai Bank and the Halvaa Vehisachon [Savings and Loans] Co-Operative Society of Tel Aviv.Footnote 58

The panic did, indeed, spread to other banks in Palestine. The arrival at Haifa of the British Mediterranean Fleet in the beginning of September further exacerbated the local population’s fear of an upcoming war and withdrawals increased. During the first days of the crisis, it was mainly the local Arab population that withdrew deposits, surely influenced by the relatively recent memories of the monetary havoc during World War I. The panic quickly spread to the Jewish population as well, and moved from Haifa to Tel Aviv. The small Jewish banks withdrew deposits from the larger ones, mainly the Anglo-Palestine Bank and Barclays. Large amounts of currency were withdrawn from the currency officer, who requested from the Currency Board sitting in London to send more currency. According to the treasurer, if the help that the large banks granted to the smaller ones would not stop the run, some of them would have to close down.Footnote 59

The treasurer’s report expressed worries about the smaller banks, and some were no doubt in danger. However, as the crisis unfolded it became apparent that the main bank in danger was the Ashrai [Credit] Co-Operative Bank, the second largest Jewish bank in the country and the Anglo-Palestine Bank’s main competitor. The Ashrai Bank was a middle-class commercial bank based in Tel Aviv with a comparatively large amount of its business dedicated to land purchases and construction.Footnote 60

Toward the end of September, Ashrai Bank had lost £P400,000 worth of deposits out of a total of £1.5 million, second only to the Banco di Roma’s local branch, which lost £P600,000. Ashrai’s manager, Yehiel Rabinovic, claimed the withdrawals from his bank were due to “propaganda” spread by the Anglo-Palestine Bank. Clark, Barclays DCO’s local manager who was Ashrai’s main correspondent bank, wrote to his general managers that he was unable to verify the claim but “that there may possibly some truth in the suggestion.” Ashrai’s managers were initially reluctant to receive support from the Anglo-Palestine Bank, claiming they would rather close down than be saved by their adversaries.Footnote 61

The absence of central banks to act as a lender of last resort made it harder to cope with the crisis, and put much of the burden on the large banks who had more reserves. A number of them reached an agreement to provide the smaller banks assistance against securities. The largest sum was provided by Barclays (£200,000), followed by the Anglo-Palestine Bank (£100,000) and the Ottoman Bank (£20,000).Footnote 62 This was in addition to over £P300,000 worth of emergency limits that Barclays granted the Ashrai Bank and several smaller banks a number of weeks earlier.Footnote 63

Another line of action was the assurance of the business community and the public in general that credit was forthcoming. Hoofien and Clark agreed to announce in the meetings of the Tel Aviv and Jerusalem Chambers of Commerce that they are willing to supply credit to sound borrowers. In their public addresses, the two managers assured the audience that the banking system was stable, that they were supporting the smaller banks, and that the monetary system, linked as it was to the British one, was willing and able to withstand the temporary crisis.Footnote 64

In later accounts of the crisis, it was the large banks, mainly Barclays and the Anglo-Palestine Bank, who came to the rescue.Footnote 65 Although the two banks were no doubt central in handling the crisis, the role of the local government has often gone unnoticed. Behind the scenes, Sir John Caulcutt, deputy chairman of Barclays DCO, pushed for a government guarantee to further advances from the large banks. In a meeting held at the Colonial Office in London, he claimed the best option was a government guarantee of advances up to £P500,000. Caulcutt’s suggestion was accepted and in the following weeks a memorandum of a government guarantee to Barclays’s advances was given.Footnote 66 In late October, less than a week after the guarantee was granted, the withdrawals from Ashrai had subsided and the guarantee was annulled.Footnote 67

Clark, the local manager of Barclays, thought the crisis proved he was right about the need to control the Palestinian banking sector. While the crisis was unfolding, Clark reported to his superiors that in his view the banking legislation should be amended in light of the recent events. He suggested appointing a banking inspector for the country, but thought that the most effective measure would be to restrict the rate of interest given by the small banks on short-term deposits.Footnote 68 Clark’s suggestions are telling. Whereas formerly he was one of the most forceful advocates of the need for a minimum capital requirement, now, in the midst of the crisis and in an internal correspondence, he thought inspection and supervision of banking practice was needed. In this, his suggestions were similar in principle to those of the smaller banks, but differed in their specifics. The new suggestions of Clark reconciled the obvious need for oversight on the way banks did business, with his own bank’s need to subdue the competition presented by the smaller banks that offered better rates.

In general, the banking crisis seemed to have vindicated the stance taken by the smaller banks, during and after the Banking Committee’s discussions. It is worth recalling that the small banks claimed the size of the banks was irrelevant to their safety, and that large banks were just as prone to instability and mismanagement. In fact, whereas some small banks were in danger during the crisis, it was two of the larger banks, Banco di Roma and Ashrai Bank, that suffered most from the crisis and required the most assistance.

Once the crisis subsided, it was clear to all that enacting regulation was needed in order to avert a similar crisis. Although the Banking Committee’s recommendations served as a reference point, the exact form of the regulation was reopened for discussion, and a familiar dynamic ensued.

The Horwill Report and Its Critics

Although the deliberations on stablizing the banking sector had begun in previous years, it was only following the crisis that new regulations were imposed. The first regulatory action taken after the crisis was the enactment of the Banking (Amendment and Further Provisions) Ordinance in March 1936. The amendment required a license from the high commissioner to open a bank and demanded from all companies engaged in banking to submit monthly statements of their assets and liabilities and biannual analysis of advances and bills discounted. It also provided for the appointment of an examiner of banks.Footnote 69 The ordinance was a first step that provided the local authorities some oversight of the banking sector. It was clear, however, that these measures would not be enough, and that stricter regulation would be needed.

F. G. Horwill, a Westminster Bank official, was appointed to the newly established position of examiner of banks. Shortly after his arrival in the country, he submitted a wide-ranging report, titled “On the Banking Situation in Palestine.” The bulk of the report is dedicated to comments on the draft Banking Ordinance, written along the lines of the Banking Committee’s recommendations.Footnote 70

Horwill’s report took a stance similar to that of the larger banks. According to Horwill, most of the small banks were ill managed and lacked suitable knowledge. They were overlent and did not have sufficient collateral in case they would need help by the large banks. According to Horwill, a gradual contraction of credit was needed.Footnote 71

In order to curtail the “mushrooming” of banks, which was ascribed to the large influx of money by immigrants, Horwill adopted the Banking Committee’s recommendations, both in regard to capital requirements and to liquidity. Horwill recommended that new banks would be required to have £P25,000 of paid-up capital and £P50,000 of subscribed capital. According to the report, this would have the desirable effect of preventing new banks from opening up. Concerning existing banks that would not be able to comply with the minimum requirements, Horwill recommended they should refrain from calling themselves banks and from accepting deposits withdrawable by check or order. This would remove any feelings of injustice done to them and minimize the possibility of a run. Possibly, it would also induce some of them to amalgamate.Footnote 72

Horwill also adopted the large banks’ views regarding liquidity, and thought its form and extent should not be stipulated by the regulation. He recommended to delete the whole clause dealing with liquidity—limited as it was—from the draft of the Banking Ordinance.Footnote 73 Interestingly, although Horwill opposed liquidity requirements, he regarded them as a central indication of the banks’ stability. While researching for his report, he asked for two graphs on each bank: one with the ratio between liquid assets to overall deposits and another with the ratio of credit (advances and discounts) to deposits. While interviewing the banks’ managers, he presented the graphs as an indication of their stability.Footnote 74

Although Horwill adopted Barclays and the Anglo-Palestine Bank’s views regarding liquidity and capital requirements for the banks, he diverged from them on one important issue. According to Horwill, credit cooperatives were more secure than banks, and therefore required different regulation. The credit cooperatives’ share capital was fluid and the members assumed joint liability much larger than the size of their share. In contrast to the Banking Committee’s recommendations, their “own funds” should not be compared to the small banks’ capital, and Horwill therefore recommended to cancel the clauses in the draft of the Banking Ordinance that fixed a minimum capital for the credit societies.Footnote 75 This exemption of the credit cooperatives allowed them to survive and prosper for the following decades, until regulations enacted by the Israeli state had forced many of them to close down or amalgamate.Footnote 76

Horwill’s recommendations regarding fixing a minimum amount of capital for banks and against intervening with their liquidity were accepted by the local government.Footnote 77 Shortly after, a familiar dynamic began: The small banks unsuccessfully tried to object and change the oncoming legislation. This time the small banks were represented by Dr. Bernard Joseph, a prominent lawyer who served as a legal advisor of the Jewish Agency and held various ministries in the Israeli governments during the 1950s.

Joseph wrote to the chief secretary of government offices on behalf of sixteen small banks, four of which were also part of the earlier protests to the authorities.Footnote 78 In a similar vein, and occasionally with almost identical wordings, Joseph raised familiar objections. “The large banks,” he wrote, “in their anxiety to rid themselves of competitors and to centralize control of the financial structure of the country in their hands,” would bring about the collapse of the small banks, harming the small lender who was neglected or ignored by the big banks.

The small banks urged to eliminate or reduce the clauses fixing a minimum paid-up capital, and claimed the danger to the banking system came from each bank’s policy, not its size. Joseph alluded to a large bank—most certainly Ashrai Bank—which was a major part of the Abyssinia Crisis, despite its comparatively large size. Joseph claimed that the control of the banking sector should be done by stipulating a ratio between paid-up capital and liabilities as well as inspection of banking accounts by a supervisory board.

The two sides of the argument also disagreed about the likely consequences of the regulation. Whereas Joseph, on behalf of the small banks, claimed the ordinance would bring about the closure of the small banks and severely limit the amount of credit offered to the “small man,” Horwill claimed credit would be forthcoming from the larger banks.

Although unknown to him, Joseph’s argument was corroborated by an unlikely source: Barclays DCO. In an internal letter from F. Rigby, the bank’s general manager, to the directors of the Palestine office, he wrote that the local banks served customers that the large banks did not accept. “The small banks,” Rigby wrote, “would have a legitimate grievance if a rigid system were applied, and incidentally it would place them at a disadvantage compared with co-operatives, to whom the rule does not apply and who, as you are aware, are in many respects also competitors in banking business.”Footnote 79

The 1937 Banking Ordinance and Its Aftermath

As was true in the earlier rounds of discussions, the small banks’ objections carried little weight. In October 1937, the Banking (Amendment and Further Provisions) Ordinance was enacted. It set a minimum subscribed capital of £P50,000 of which at least half had to be paid up in cash. Existing companies were given two years to comply with the regulations.Footnote 80

The mission of halting and contracting the booming banking sector, first initiated by Crossley of Barclays DCO and later taken up by the large banks and the local government, was successful. From 1936 until the outbreak of World War II, the seventy-five local banks declined by about half. By the end of 1944 there were twenty-five. The main cause was the new capital requirements.Footnote 81

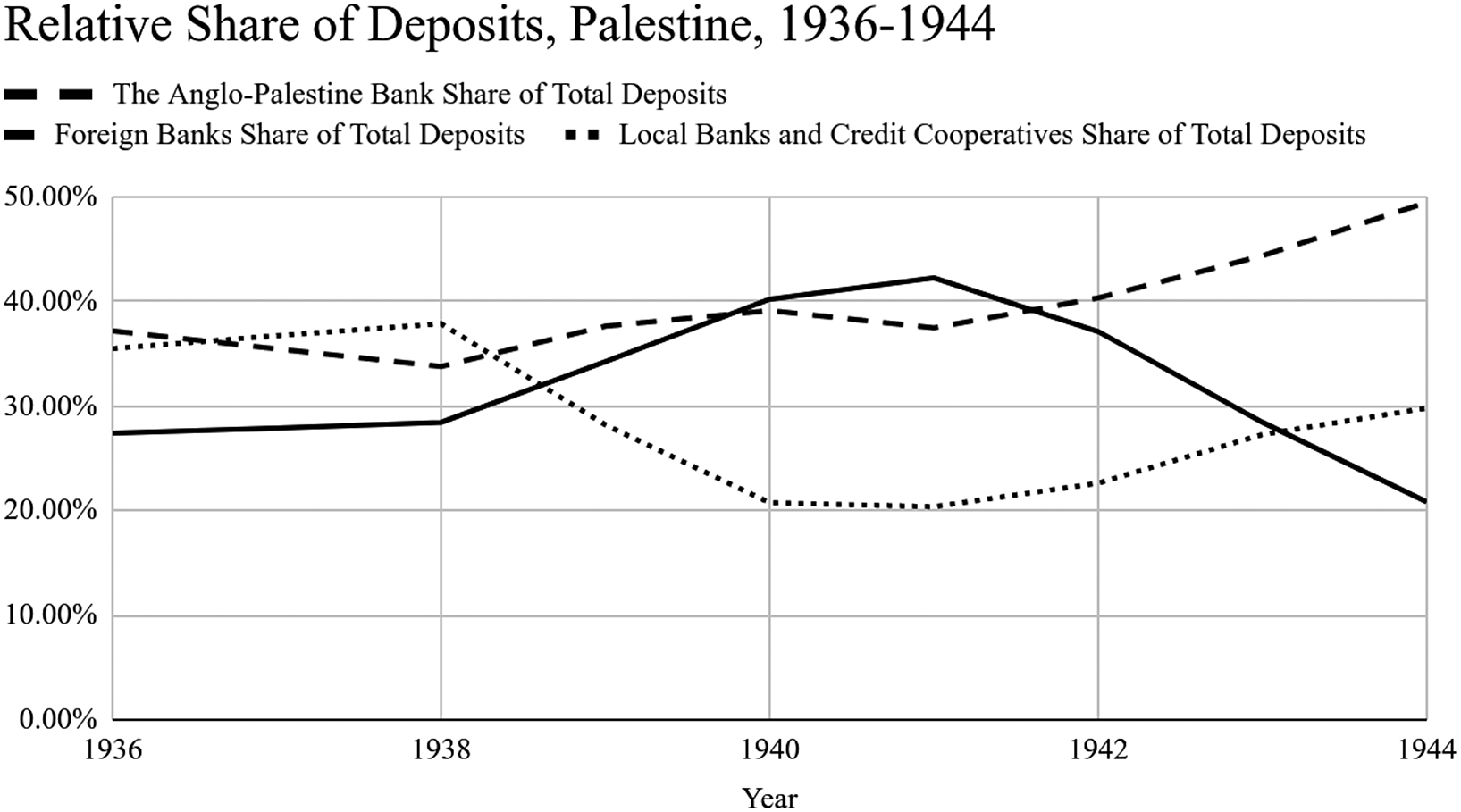

Although not attributable solely to the new legislation, the concentration of the banking sector is also evident from the relative share of the foreign banks and the Anglo-Palestine Bank in deposits and credit (see Figures 2 and 3). The local banks and credit societies’ share of deposits declined from its peak in 1938 to its lowest point in 1941. Conversely, during the same period, the Anglo-Palestine Bank’s and the foreign banks’ share of deposits rose from a little over 60 percent to almost 80 percent. The local banks and credit societies’ share of deposits rose again toward the end of the war, but mainly at the expense of the foreign banks, some of which were of enemy countries and had to close during the war. By 1946, the Anglo-Palestine Bank held 47 percent of all deposits.Footnote 82

Figure 2. Timeline of Banking Regulation in Palestine.

Figure 3. Relative Share of Deposits in Palestine.

A similar trend, although less pronounced, was evident in the relative share of credit (see Figure 4). The local banks and credit societies share of credit (advances and discounted bills) declined from 55.6 percent in 1936 to 49.2 percent in 1941. During that same period, the Anglo-Palestine Bank’s share of credit rose from 25.3 percent to 38.5 percent. By 1946, the local banks and credit societies slightly recuperated their share of credit to 54.9 percent in comparison with the Anglo-Palestine Bank’s 34 percent. The larger share of the local banks and credit societies was due to the decline of the foreign banks (whose share of credit declined by 8 percent between 1938 and 1946), to their general orientation toward the local economy, and to the fact that the credit societies were exempted from the new legislation.Footnote 83

Figure 4. Relative Share of Credit in Palestine.

The concentration of Palestine’s banking sector during the late 1930s is often portrayed as the welcome, although belated, response of the British authorities to the supposed “unstable structure” of the sector.Footnote 84 As I have shown, this narrative was first enunciated by the large banks and was one bitterly opposed by the small banks, who presented an alternative to it.

The claim that the size of the bank was the main danger to the stability of the banking sector was, according to the advocates of the small banks, largely refuted by the Abyssinia banking crisis. It was Banco di Roma and Ashrai Bank, two large banks, that were in danger. Indeed, at the outbreak of World War II, Ashrai Bank was once again hurt by a run and was eventually dissolved during the war. As the small banks claimed, fixing a high capital requirement harmed them and forced many of them to close down. Their advocates’ suggestion of stipulating a liquidity ratio was declined mainly due to the objections of the managers of the large banks, Hoofien and Clark. The barriers set on who would be allowed to allocate credit, and therefore, to a large extent, who would receive credit, were determined according to their interests.

Due to the importance of credit in a market economy, the tussle over banking regulation was not simply of narrow sectoral significance. It reflected a larger question on the character of economic development and the relationship between the local Palestinian economy and the British imperial one. As we have seen, the Anglo-Palestine Bank teamed up with Barclays DCO to curb small-scale credit institutions who served shop owners, artisans, and individuals. Those sectors of the local economy that were tied to the imperial commercial economy, and to which these two banks were oriented, were not harmed from the new regulation and plausibly benefited from it.

In George Stigler’s original conception of regulatory capture, he proposed a general hypothesis: “Every industry or occupation that has enough political power to utilize the state will seek to control entry.”Footnote 85 In his formulation, the group that demands regulation is usually large, and has large stakes in the regulation. As we have seen, this general framework applied to the regulation of the banking system in Palestine: The large banks of the country, when faced with competition by smaller banks, urged the British local government to regulate the industry. They pushed for a certain form of regulation—raising the minimum paid-up capital—that would control entry to the sector in a much more effective way than the alternative of stipulating a liquidity ratio.

Whereas from the demand side, Stigler’s theory bodes well, the supply side complicates the picture. In Stigler’s articulation, the process of regulation involves political parties seeking votes and resources. This clearly does not apply to the imperial context of Palestine: There were no political parties involved in the process, and the political authorities had little to gain from either form of regulation. A more fitting theory of regulation in this aspect seems to be the public interest view of regulation, which portrays regulation as an earnest attempt by the government to protect and advance the public good. If indeed the local British authorities were primarily concerned with ensuring the banking sector’s stability and the general public’s interests, why did they tend to support the proposals of the larger banks, which were motivated by self-interest?

There are a number of reasons for this, which overlap with one another. Most generally, the complex nature of the banking system and the need for expert knowledge increases the potential for regulatory capture.Footnote 86 From the relatively small cadre of banking professionals in Palestine, it is understandable that the opinions of the managers of the larger banks carried more weight in the eyes of government authorities. Alongside their size, the role of Barclays DCO and the Anglo-Palestine Bank surely made their impact as well. Barclays DCO was a British overseas bank with branches in many other places, and was also the issuer of the local currency. This allowed the bank’s managers voice to be heard more clearly both in the Colonial Office in London, and in the governmental halls of Palestine. For its part, the Anglo-Palestine bank was by far the largest Jewish bank in Palestine, and served as a quasi-central bank for the Jewish economy. Owned by the Zionist Organization, it was plausibly viewed by the local officials as representative of the Jewish Yishuv as a whole.

Other views were either sidelined or not heard. The small and medium-sized Jewish banks were not part of the Banking Committee and had no say in its deliberations. Their objections to the committee’s recommendations and the final regulation of the banking system were heard by the local government, but not loud enough to change anything. The Arabs of Palestine—the vast majority of the population—were for all intents and purposes absent from the whole process. It is no wonder that Arab businessmen resented the banking ordinances. As Sreemati Mitter has written, they “felt that [the Ordinances] were deliberately intended to make it harder for Arabs to own and run businesses in Palestine as the minimum capital and other formal requirements stipulated in them were so complicated, and set the bar so high, as to make it impossible for all but the wealthiest entrepreneurs to be able to meet them.”Footnote 87

As mentioned in the introduction, corporate liberal scholarship developed in the context of American historiography, and showed how class-conscious elites used the state for their own needs, thereby thwarting and co-opting the demands of the less powerful.Footnote 88 The power differentials in Palestine—stemming from class, ethnicity, and empire—created a similar trajectory. As far as Palestine’s banking sector is concerned, the early Mandate years were classical laissez-faire liberalism, presenting practically no obstacles to establishing and running a bank. Following the banking ordinances, this classical liberal order morphed into a corporate liberal one, whereby private corporations pushed for the establishment of a regulatory state that would stabilize the banking sector and prevent competition.

How general was this transition to a corporate liberal order calls for further research, but it is worth mentioning in closing some of the later development of the banking system. As mentioned earlier, the credit cooperatives were exempted from the regulation and thereby saved from the fate faced by the smaller banks. Arie Krampf’s research on the financial system of Israel during the 1950s shows how the credit cooperatives were seen—once again—as a competitive threat to the large banks of the country: the Anglo-Palestine Bank (which changed its name to Bank Leumi) and Bank HaPoalim (the Workers Bank). The representatives of these large banks, aided by the recently established Bank of Israel, advanced policies that favored themselves and brought about a sharp reduction in the number of credit cooperatives.Footnote 89

In conclusion, the process of regulating Palestine’s banking sector closely parallels the theory of regulatory capture. Although the imperial context and the local conditions of Palestine provide some unique characteristics, it is clear from the above that the design and implementation of banking regulations were heavily influenced by the large banks of the country. This process can be seen as the origin of a corporate liberal order in Israel’s political economy.