No CrossRef data available.

Published online by Cambridge University Press: 07 April 2017

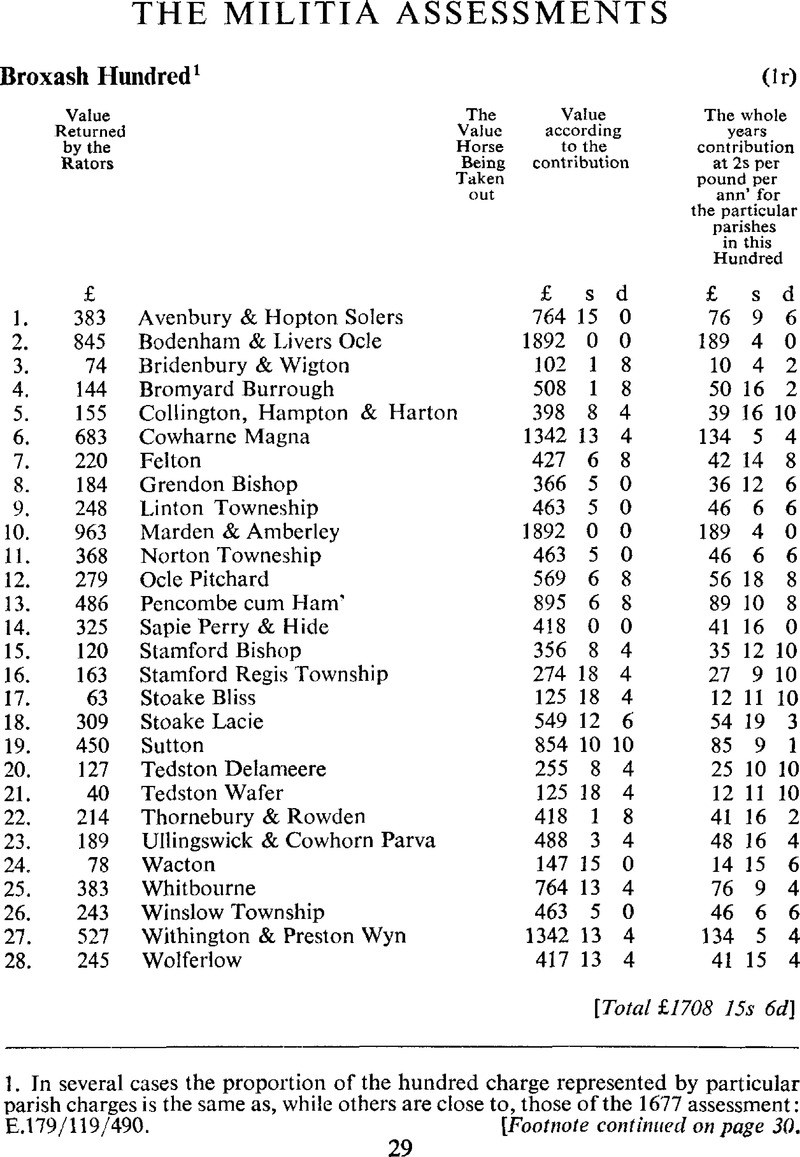

1. In several cases the proportion of the hundred charge represented by particular parish charges is the same as, while others are close to, those of the 1677 assessment: E.179/119/490.

* Actual charges shown in brackets.

2. Sheriff 1668; HT 1664(9).

3. In Bishops Frome.

4. The largest HT charge in 1664 was on Anne Moore (14).

5. George Villiers, 2nd duke of Buckingham, 1628–1687.

6. The largest HT charge in 1664 was on Margery Berington, widow (5).

7. It is likely that Wigton was normally taxed with another place.

8. James Cleark, vicar, is listed as having given £5 to the FP 1661.

9. HT 1664 (12).

10. JP 1660 (C.220/9/4), although not so shown in the Brampton Bryan MS published in TWC, xxxiv (1954), p. 292.Google Scholar

11. Rector, FP 1661 (20s paid).

12. Will proved 18 May 1663 (PCC) by his heir Richard Barrow, who was charged for 4 hearths in 1664.

13. Probably Horton, now in Edvin Ralph parish.

14. In 1660 he paid to the Exchequer a rent of £58 for his own lands in Cowarne; PRO, Various Accounts, E. 101/630/30.

15. HT 1664 (10).

16. Vicar, FP 1661 (20s paid).

17. The largest HT charge in 1664 was on John Badham (5).

18. FP 1661 (£5 paid); HT 1664 (9).

19. HT 1664 (5).

20. HT 1664 (15).

21. The real estate in the county of Thomas Price of Wistaston was valued at £243 a year in 1646 (Loan 29/15, pf. 2); he compounded at ⅙ of his estate, valued at £1200, but settled £50 a year from the tithes of Bartestree and Dormington on their ministers; CCC, iii, p. 1980Google Scholar. In 1646 John Price's estate was put at £30 a year; Loan 29/15, pf. 2. He was appointed JP q in 1660.

22. In 1679 Kings Mills were valued at £30 a year; ‘List of Herefordshire Mills Extracted from Herefordshire Quarter Sessions Papers’, ed. Cooke, C. C. Radcliffe, TWC, xxxii (1947), p. 154.Google Scholar

23. The largest HT charge in 1664 was on William Addams gent. (6).

24. The largest HT charge in 1664 was on Elizabeth Flacket widow (15).

25. JP 1662 (S.P. 29/59); royal aid commissioner.

26. Probably excluding Livers Ocle.

27. The largest HT charge in 1664 was on Thomas Freene (5).

28. Month's tax collector for Radlow and Broxash; Loan 29/49, pf. 4, no. 69.

29. Chief constable of Broxash, 1663; Loan 29/49, pf. 4, no. 69/15.

30. Included Grendon Warren and Marston.

31. The largest HT charge in 1664 was on Ben. Coningsby (8).

32. Thomas Pooter, rector, paid £5 to the FP 1661.

33. The largest HT charge in 1664 was on Thomas Kinge (5).

34. The largest HT charge in 1664 was on Anne Giles widow (7).

35. The largest HT charges in 1664 were on William Weobley and John White (4 each).

36. Vicar, FP 1661 (30s paid).

37. HT 1664 (4).

38. HT 1664 (10).

39. Francis Stedman, junior, rector of Stoke Lacy, is to be distinguished from Francis Stedman, senior, of Yarkhill; FP 1661 (40s paid).

40. Included both Sutton St Nicholas and Sutton St Michael.

41. HT 1664 (15).

42. His estate in the county was valued in 1646 at £243 a year, of which £55 was in Llangarren, £14 in Ganarew, £14 in Whitchurch, £20 in St Weonards, £18 in Thruxton, £5 in Wormbridge, £35 in Wellington and £40 in Sutton; Loan 29/15, pf. 2. In 1660 his estate was rented from the Exchequer by Nathan Rogers for £70; PRO, Various Accounts, E.101/630/30.

43. Rosemaund is now in Felton parish.

44. HT 1664 (5). John Hall and Anne Hall together were also charged for 5 hearths.

45. HT 1664 (3).

46. HT 1664 (9).

47. He may have been rector of Pudleston in 1661; E.179/32/223.

48. Rector, FP 1661 (£3 paid).

49. The largest HT charge in 1664 was on Sim. Jacobb gent. (6).

50. Rector, FP 1661 (£3 paid).

51. HT 1664 (3).

52. HT 1664 (3).

53. HT 1664 (3).

54. HT 1664 (11).

55. Chief constable of Broxash, 1663; Loan 29/49, pf. 4, no. 69/15.

56. HT 1664 (5).

57. HT 1664 (5).

58. HT 1664 (5).

59. HT 1664 (5).

60. HT 1664 (5).

61. HT 1664 (7), probably for Thinghill Court.

62. HT 1664 (8).

1. The charge against Llancillo is an error, but it is not clear when it was made. The month's tax quota would have been very close to one twelfth of £82 rather than of £8, just as for the first three months of the royal aid Llancillo was charged £5 16s 2d a month; Add. 11051, fo. 94.

2. HT 1664 (3).

3. HT 1664 (3).

4. HT 1664 (4).

5. HT 1664 (4) with Watkin Griffith.

6. Included Rowlston, normally taxed with it.

7. Chief constable of Ewias Lacy, 1663; Loan 29/49, pf. 4, no. 69/15.

8. The two blanks in this assessment were queried in error; they precede two lists of tenants.

9. HT 1664 (4).

10. HT 1664 (3).

11. The estates of Lord Hopton, who died in 1652, were inherited by his four sisters; Complete Peerage, ed. Cokayne, G. E. (new edn., London, 1910–1940), vi, p. 577n.Google Scholar

12. HT 1664 (8).

13. ‘&c’ is probably the copyist's abbreviation of the previous narrative descriptions repeated.

14. HT 1664(4).

15. ‘&c’ may refer to Lord Hopton's coheirs.

16. Included St Margaret's.

17. Thomas Prosser of St Margaret's, nephew of Esay Presser of Peterchurch, whose will was proved 1666 (PCC).

18. The largest HT charges in 1664 were on John Miles (3), Thomas Jennings of Newhouse (3) and William James with Katherine Waters (3).

19. Probably included Bwlch and Fwthwg (Foothog).

20. HT 1664 (8).

21. William Cecil, 2nd earl of Salisbury, 1591–1668; Complete Peerage, ed. Cokayne, , xi, p. 406.Google Scholar

1. The proportions of the hundred total charged here on the respective parishes were exactly the same as those in the 1677 assessment.

* Actual charge in brackets.

2. His real estate in the county in 1646 was valued at £400; Loan 29/15, pf. 2.

3. HT 1664 (4), the rectory.

4. HT 1664 (4).

5. HT 1664 (4).

6. Chief constable of Greytree, 1663; Loan 29/49, pf. 4, no. 69/15.

7. HT 1664 (6).

8. HT 1664 (6).

9. HT 1664 (6).

10. In 1663 a James Collins was chief constable for Greytree; Loan 29/49, pf. 4, no. 69/15.

11. The manor had belonged to the marquis of Hertford (Harl. 6726), who became duke of Somerset in 1660 and died shortly afterwards (see Lyonshall, note 23).

12. FP 1661 (£3 unpaid); HT 1664 (9); will proved 1665 (PCC).

13. HT 1664 (3).

14. HT 1664 (10).

15. Rector, FP 1661 (£3 paid).

16. The largest HT charge in 1664 was on John Barnes gent. (7).

17. John Elmhurst, vicar, paid £6 13s 4d to the FP 1661.

18. The largest HT charge in Lea in 1664 was on Thomas Pitt, gent. (11).

19. FP 1661 (£2); HT 1664 (5).

20. HT 1664 (5).

21. HT 1664 (5).

22. Succeeded 1650, died 1680 (Baronetage, ii, p. 18); JP q 1660; DL 1660; MP for the county 1661; HT 1664 (14).

23. HT 1664 (14).

24. In 1646 Dr Fell's personal estate in the county was valued at £100; Loan 29/15, pf. 2.

25. Rector of Evesbatch, FP 1661 (20s).

26. The largest HT charge in Ross borough in 1664 was on the widow Bodenham (11).

27. He was the son of Christopher Dubberley and was referred to in the latter's will (proved 12 Feb. 1662 (PCC)).

28. Tanner; will proved 1667 (FCC).

29. Dr John Newton, vicar, paid £6 to the FP 1661.

30. HT 1664 (11).

31. The largest HT charges in 1664 were on David Powell and Roger Mathews (4 each).

32. Probably Sir Thomas Grubham Howe of Kempley, Gloucs, who was knighted 15 Dec. 1660; Shaw, , p. 232.Google Scholar

33. Captain of a militia company in the mid-1660s (Loan 29/49, pf. 4, no. 69/15); HT 1664 (7).

34. HT 1664 (15); will proved 1670 (PCC).

35. The largest HT charge in 1664 was on John Bonner (5).

36. John Nourse Esq.

37. JP 1660; HT 1664 (9).

38. FF 1661 (£3 paid).

39. Will proved 8 Aug. 1663 (PCC).

* Actual charge in brackets.

1. The proportions of the hundred charge allocated to the respective parishes are close to, but not the same as, those in 1677.

2. Humphrey Berington's real estate in the county was valued in 1646 at £198 a year (Loan 29/15, pf. 2); he was fined ⅙ of his estate, valued at £632; CCC, iii, p. 2000Google Scholar. The largest HT charge in 1664 was on Thomas Berington (8).

3. Rector, FP 1661 (20s paid).

4. The manor had belonged to the marquis of Hertford; Harl. 6726.

5. HT 1664 (7).

6. Chief constable of Grimsworth, 1663; Loan 29/49, pf. 4, no. 69/15.

7. Rector, 1660–1683.

8. Captain of a militia company in the mid-1660s; Loan 29/49, pf. 4, no. 69/15. HT 1664 (8).

9. He paid to the Exchequer a rent of £10 for his lands in Breinton in 1660; PRO, Various Accounts, E.101/630/30.

10. HT 1664 (10).

11. The annual income from all sources of Roger Dansey of Brinsop Court was put at £800 in 1645; Harl. 911. The estimate was made by a visitor to the county and should be taken only as an indication of Dansey's relative standing. In 1646 William Dansey's real estate in the county was more reliably put at £160 a year and his personal estate at £102; Loan 29/15, pf. 2. Sheriff 1670. HT 1664 (13).

12. George Bannaster, vicar, FP 1661 (20s paid).

13. Instituted 27 Oct. 1664 (Bannister, A. T., Diocese of Hereford Institutions, 1539–1900 (Hereford, 1923), p. 35Google Scholar), but he described himself as rector when certifying the transcripts of his register for 1661 and later years (Hereford CRO, Diocesan Archives), and was similarly described in the return of the FP 1661, to which he gave 40s.

14. Dr William Evans, prebendary of Hereford, and John Scudamore owned the two moieties of the manor; Compston, H. F. B., ‘A Brobury Rent Roll’, TWC, xxiv (1922), p. 120Google Scholar. Silas Taylor, however, states that the manor belonged to Evans and to Lord Scudamore; Harl. 6726.

15. HT 1664 (3 each).

16. The largest HT charge in 1664 was on Thomas Carpenter, gent. (9).

17. His income was put at £300 a year in (?) circa 1677; Loan 29/182, fo. 313. HT 1664 (9).

18. HT 1664 (9).

19. Of Little Pyon; will proved 1668 (PCC).

20. HT 1664 (10).

21. Rector, FP 1661 (40s paid).

22. Included Tupsley. The largest HT charge in 1664 was on Thomas Birch, clerk (6).

23. Included Shelwick.

24. JP q 1660.

25. Anne Herring, HT 1664 (6).

26. Chief constable of Grimsworth, 1663; Loan 29/49, pf. 4, no. 69/15. HT 1664 (6).

27. HT 1664 (6).

28. Richard Parry, gent., HT 1664 (6).

29. In 1646 his estate in the county was put at £80 a year; Loan 29/15, pf. 2.

30. Elizabeth Vaughan together with John Presser, HT 1664 (11).

31. Rector, FP 1661 (20s).

32. In 1646 the Herefordshire real estate of Thomas Rodd of Foxley was valued at £42 a year and his personal estate at £29; Loan 29/15, pf. 2.

33. HT 1664 (5).

34. HT 1664 (5).

35. JP q 1660; MP for Hereford 1660 and 1661, but the latter election was declared void. FP 1661 (£20 paid in Hereford); HT 1664 (9). His income was put at £200 a year in (?) circa 1677; Loan 29/182, fo. 313.

36. HT 1:664 (9).

37. JP 1660; DL 1660; MP for Weobley 1660 and 1661; knighted 2 Jan. 1661/2: Shaw, p. 236. In 1645 the annual income of Mr Tompkins of Monnington was estimated to be £1,200 (Harl. 911); in 1649 he compounded at ⅓ on a value of £2,110; CCC, ii, p. 1035; HT 1664 (20).

38. HT 1664 (10).

39. The 1663 Militia Act imposed a penalty of £5 for not providing a foot-soldier when so charged; it seems that, although the previous Act implied that the smaller estates were liable to charge, there was no penalty for refusal.

40. HT 1664 (6). Thomas Prosser was also charged on 6 hearths.

41. John Addis was punished for his Catholicism in 1684; Add. 36452, fo. 190; HT 1664 (4); he was also charged for 4 hearths at the Court of Lide.

42. Vicar.

43. Clerk of the Peace 1649–52 and 1660–70; Stephens, Sir E., The Clerks of the Counties, 1360–1960 (1961), p. 99Google Scholar. He was also treasurer of the militia funds during the mid-1660s; Loan 29/49, pf. 4, no. 69. FP 1661 (£5 paid in Hereford).

44. Probably included Over Letton township. The manor had belonged to the Tomkins family; Harl. 6726. The largest HT charges in 1664 were on William Carpenter and James Rees (7 each).

45. HT 1664 (13).

46. A Catholic, imprisoned 1682/4; Add. 36452, fo. 190.

47. Included Dinmore.

48. The largest HT charge in 1664 was on the widow Wolrich (14).

49. Knighted 14 Aug. 1660: Shaw, p. 231. JP q 1660; DL 1660; MP for Weobley 1660; sheriff 1661. He owned the Haroldston estate in Pembrokeshire, inherited from Sir James Perrot of that county; Grazebrook, H. S., Heraldry of Worcestershire, ii (1873), p. 426.Google Scholar

50. HT 1664 (8); a farm called The Grange; will of Francis Hall of Ledbury, p. 97 infra.

51. The elder, will proved 1666 (PCC).

52. HT 1664 (9).

53. FP 1661 (20s paid).

1. The parish shares of the hundred total are similar to those of 1677 in proportion to the respective totals.

* Actual charge in brackets.

2. A William Maddy was a chief constable for Huntington in 1663; Loan 29/49, pf. 4, no. 69/15.

3. HT 1664 (6); will proved 1666 (PCC).

4. Of Voimind.

5. The largest HT charges in 1664 were on John Goode and William Williams (6 each).

6. He owned the manor; Harl. 6726.

7. HT 1664 (6) charged on Margaret Whitney.

8. HT 1664 (6). Albon Willis was also charged on 6 hearths.

9. Vicar, FP 1661 (20s).

10. Sir Humphrey Baskervile of Eardisley was said in 1645 to have suffered a reduction in income from £3,000 to £300 a year; Harl. 911.

11. Sir Samuel Tryan, baronet, of Halstead, Essex, succeeded 1627 (Baronetage, i, p. 140Google Scholar); will proved 1665 (PCC).

12. HT 1664 (8).

13. Jane Coke of Quistmore left lands in Cambridgeshire; will proved 13 Dec. 1664 (PCC).

14. Of Bollinghill.

15. HT 1664 (4).

16. Holman acquired both moieties of the manor. He later enriched himself enough to enable his son to become a baronet in 1663 (Robinson, p. 161); he died in July 1669; Baronetage, iii, p. 277.Google Scholar

17. John Vaughan of Hergest Court; FP 1661 (£10 unpaid); HT 1664 (10); will proved 1670 (PCC); he also owned land in Kent.

18. HT 1664 (5) in Upper Ward of New Kington.

19. Vicar of Lyonshall; FP 1661 (20s paid).

20. In 1646 Thomas Edwards's estate in the county was valued at £10 real and £64 personal (Loan 29/15, pf. 2); HT 1664 (4) in Old Kington.

21. Chief constable of Huntington, 1663; Loan 29/49, pf. 4, no. 69/15.

22. Of Mahollam; uncle of John Vaughan of Hergest; will proved 1670 (PCC).

23. HT 1664 (7) in Chickward.

24. The largest HT charge in 1664 in Bradnor & Rushock was on Robert Mason (4) and in Lower Ward of New Kington on William Goods (8).

25. JP q 1660; listed as DL in 1660, but may not have been chosen; commissioner for the 18 months assessment 1662/3. In 1645 the income of Sir Robert Whitney was put at £4,000 a year; Harl. 911. Dame Anne Whitney, widow of Robert and mother of Thomas, was charged on 15 hearths in 1664.

26. For tax purposes Winforton usually included Willersley, but occasionally the latter was included with Eardisley, which may have occurred here.

27. William Andrews and others bought the manor of Winforton in 1653; it had previously belonged to Lord Craven; CCC, ii, p. 1625Google Scholar. Andrews was charged on 11 hearths in 1664.

28. Rector, FP 1661 (30s).

1. Most of the parish charges bear the same or similar ratios to each other as do those of 1677. The inserted figures have largely been derived by using the 1677 proportions. Others do not permit this kind of interpolation. The Bishops Frome charge seems to have been deliberately understated; were it not so, the total charge for Egleton, Bishops Frome and Haymonds Frome would bear exactly the same relation to the total as does the charge for the whole parish in 1677. There is, however, no agreement in the charges on the various parts of Ledbury parish. The charge for ‘Ledbury Forren’ is puzzling because the Foreign is already wholly covered by the charges on Wallhills etc., Wellington, Muchell and Leadon and Haffield. As the other hundred charges under the 1661 and 1672 quotas and in this document show very similar proportions to the county charge, there must be a presumption that the Radlow charge should be about 12·7% of the county (without Hereford) charge. This requires the deduction of the ‘Ledbury Forren’ charge of £363, leaving the final hundred total of £1,732 13s 4d.

2. The largest HT charge in 1664 was on William George (4).

3. Chief constable of Radlow, 1663; Loan 29/49, pf. 4, no. 69/15.

4. Probably Tuston.

* Actual charge in brackets.

5. John Barston paid 14s to the FP 1661.

6. HT 1664 (5).

7. Vicar, FP 1661 (£4 paid); HT 1664 (5).

8. Chief constable of Radlow (Loan 29/49, pf. 4, no. 69/15); HT 1664 (5).

9. HT 1664 (5).

10. HT 1664 (5).

11. In 1646 the estate of Edward Slaughter of Cheyney's Court was valued at £134; Loan 29/15, pf. 2.

12. HT 1665 (9).

13. Probably Sir Thomas Hanbury, knighted circa 1665; Locke, A. Audrey, The Hanbury Family (London, 1916), i, p. 103.Google Scholar

14. JP 1660; sheriff 1664; FP 1661 (£10 unpaid); HT 1664 (12).

15. Curate of Castle Frome, FP 1661 (30s).

16. Dame Elizabeth Hopton, FP 1661 (£3 unpaid); HT 1664 (11). Sir Edward Hopton, who appears nowhere in these valuations, was JP q 1660 and DL 1660. He was elected MP for Hereford in 1661, but the election was declared void. He commanded a militia company in the mid-1660s; Loan 29/49, pf. 4, no. 69/15.

17. HT 1664 (4).

18. HT 1664 (4).

19. FP 1661 (£3 paid).

20. The largest HT charge in 1664 was on Henry Wright (9).

21. Leicester Devereux, 6th viscount Hereford, succeeded between 1649 and 1658; Complete Peerage, ed. Cokayne, , vi, p. 480.Google Scholar

22. Rector, FP 1661 (£10 paid).

23. Yeoman, will proved 4 July 1663 (PCC).

24. Gent., will proved 1668 (PCC).

25. HT 1664 (7); will proved 1670 (PCC).

26. Yeoman, will proved 1670 (PCC).

27. Yeoman, will proved 31 March 1664 (PCC).

28. The largest HT charge in 1664 was on John Perks (4).

29. William Lawrence paid 14s to the FP 1661.

30. JP 1660; sheriff 1663; FP 1661 (£10 paid); HT 1664 (12).

31. HT 1664 (3).

32. HT 1664 (9).

33. The largest HT charge in 1664 was on Bellingham Slaughter (10).

34. JP q 1655; FP 1661 (£5). clothier; will proved 1668 (PCC). He held land at Wormsley and Ledbury and left over £1,300 in bequests.

35. HT 1664 (9).

36. Glover, will proved 1664 (PCC).

37. HT 1664 (9).

38. HT 1664 (9).

39. Vicar, FP 1661 (£4).

40. Clothier, will proved 1668 (PCC).

41. Clothier, will proved 1667 (PCC).

42. Clothier, will proved 1670 (PCC).

43. Of the Hasell; FP 1661 (£10 paid); HT 1664 (10).

44. (1594–1676); father of Sir Thomas Hanbury; he lost heavily in the service of Charles I; Locke, A. Audrey, The Hanbury Family (London, 1916), i. p. 99et seq.Google Scholar

45. Widow of Anthony Carwardine, yeoman, whose will was proved 16 May 1663 (PCC).

46. Yeoman, brother-in-law of Anthony Carwardine (see previous note); HT 1664 (4).

47. JP q 1660; FP 1661 (£10 unpaid); HT 1664 (9).

48. Will proved 1667 (PCC). He came from a Ledbury family and was related to many merchant families of that town. He owned property in Little Dewchurch, Ballingham, Ledbury, Leadon, Wallhills and Tupsley, and held leases in Hereford shire and Gloucestershire. He left legacies of about £950.

49. Will proved 1666 (PCC). His son Thomas Rodd was charged on 6 hearths in 1664.

50. Rector, FP 1661 (50s).

51. The largest HT charge in 1664 was on Thomas Seycell gent. (5).

52. JP q 1660; HT 1664 (9); will proved 1665 (FCC). He owned the manors of Pixley, Catley and Munsley and lands in Essex and Somerset.

53. Otherwise Parkhold.

54. Dame Alice Lingen was the widow of Sir Henry Lingen, who was buried at Stoke Edith on 22 Jan. 1661/2. He had been the most important royalist commander in the county during the Civil War. In 1646 his Herefordshire estates had been valued at £937 a year; Loan 29/15, pf. 2. HT 1664 (17). The Lingen estates later became the foundation of the Foley interests in the county; Robinson, , p. 257.Google Scholar

55. Robert Scudamore, rector, paid £10 to the FP 1661; instituted 22 Jan. 1662/3; Bannister, A. T., Diocese of Hereford Institutions, 1539–1900 (Hereford, 1923), p. 33.Google Scholar

56. Anthony Frere.

57. The free tenants had bought the manor; Harl. 6726. The largest HT charge in 1664 was on Walter Hopton Esq. (13).

58. HT 1664 (4).

59. Will proved 23 Feb. 1664 (Hereford).

60. Of Tyberton; his son Marshall Bridges was charged on 6 hearths in 1664.

61. The largest HT charge in 1664 was on Edward Withers (16).

62. JP q 1660; captain of a militia company in the mid-1660s; Loan 29/49, pf. 4, no. 69/15. His real estate in the county was valued at £110 a year in 1646; Loan 29/15, pf. 2.

63. Probably Sir Thomas Rich of Sunning, Berks; baronet 20 March 1660/1: Baronetage, iii, p. 180.Google Scholar

64. The largest HT charge in 1664 was on Edward Coucher (7).

65. Yeoman, will proved 1669 (PCC); he owned land in Wellington and Collwall and left legacies of £900.

66. The largest HT charges in Mitchel in 1664 were on Robert Dugmore and William Lewis (6 each).

67. Richard Sackville, 5th earl of Dorset; born 1622, succeeded 1652, died 1677 (DNB). The Herefordshire estates of the 4th earl were valued at £92 a year in 1646; Loan 29/15, pf. 2.

68. The largest HT charge in 1664 was on Edward Porter (5).

69. HT 1664(5).

70. Ursula Andrewes.

71. Francis Stedman senior, vicar of Yarkhill, paid 20s to the FP 1661.

72. HT 1664 (5).

73. Yeoman and blacksmith, will proved 20 September 1665 (Hereford); buried 14 Aug. 1665; his father, also Anthony Cole, died in 1659.

* Actual charge in brackets.

1. Both the order of magnitude and the parish proportions differ from those in 1677.

2. Francis Pember together with Ann Pember bore the largest charge to the HT 1664 (18).

3. Of Upcott; buried 18 Nov. 1663.

4. Samuel Mathews, vicar.

5. The largest HT charge in 1664 was on Richard Walton (6).

6. Rector, FP 1661 (5s paid).

7. Probably excluded Luntley, Little Dilwyn, Sollers Dilwyn and Homme, but included Alton, Hurst, Chadnor and Dilwyn.

8. Martin Johnson, vicar, paid 20s to the FP 1661.

9. HT 1664 (7).

10. For Fawley.

11. Chief constable for Stretford, 1664; Loan 29/49, pf. 4, no. 69/15.

12. The largest HT charge in 1664 was on John Brewster, gent. (7).

13. The manor of Kinnersley was bought for James Pitts in 1652; CCC, in, p. 1714Google Scholar. HT 1664 (9).

14. He bought the manor of Letton in 1652; CCC, in, p. 1714.Google Scholar

15. Rector of Letton, FP 1661 (50s paid).

16. The largest HT charge in 1664 was on Penelope Hereford widow with Richard Kinnersley (8).

17. Herbert Croft, consecrated bishop of Hereford 9 Feb. 1661/2.

18. (1626–1673), brother of Sir Edward and son of Sir Robert (1579–1656); his knighthood is not listed by Shaw, but is referred to in Collins, A., The Peerage of England, ed. SirBrydges, Egerton (London, 1812), iv, p. 55.Google Scholar

19. Rector, FP 1661 (£10 paid).

20. Chief constable of Stretford, 1664; Loan 29/49, pf. 4, no. 69/15.

21. The largest HT charge in 1664 was on George Karver (6).

22. HT 1664(6).

23. Frances Devereux, coheir of the 3rd earl of Essex, was widow of William Seymour, marquis of Hertford and 2nd duke of Somerset, who died in 1660; she died in 1674; Complete Peerage, ed. Cokayne, , xii, part i, p. 73.Google Scholar

24. The valuation may be compared with the distribution of the charges for various rated taxes between 1636 and 1673. The charges for these were upon occupiers rather than owners as such. A comparison shows that the ownership of land was considerably more concentrated than was the occupation of land and that there was apparently a large number of small tenanted holdings.

25. The largest HT charges in 1664 were on James Barnes and Richard Wadeley att le Wallend (5 each).

26. Vicar, FP 1661 (40s paid).

27. Buried 4 Aug. 1664.

28. Of The Byletts; his real estate in the county was valued at £180 a year in 1646; Loan 29/15, pf. 2.

29. HT 1664 (7) in Noke.

30. He was executor of the will of his father Richard Tomkins, proved 16 April 1663 (Hereford); the latter was buried 22 Aug. 1662.

31. Walter Vaughan bore the largest HT charge in Morecott in 1664 (7). He and John James of Trippleton were trustees of the estate of Thomas Stead of Morecott, being respectively the latter's widow's second husband and son-in-law: C.6/19/127; C.6/234/64; C.6/9/147; C.6/18/173. The statement in Robinson (p. 226), that the Morecott estate had been held by John Stead by right of his wife a member of the Vaughan family, is incorrect; the Steads had been at Morecott in the 1570s.

32. Son of Dr William Sherborne; will proved 1695 (PCC).

33. The largest HT charges in 1664 in each township were: Pembridge Borough—John Rogers (10), Bury and Weston—Stead East (5), and Marston—John Crumpe (5).

34. Of Mitcham, Surrey; bought the manor of Shobdon from Lord Herbert: CCC, iii, p. 1713Google Scholar. Sheriff 1662; HT 1664 (10).

35. Vicar, FP 1661 (£3 paid).

36. HT 1664 (4).

37. Will proved 1685 (PCC). He held the manor of Nether or Church Staunton and was believed to have been of Dutch or Flemish origin. His property there descended by marriage to the Sherbornes: Robinson, , pp. 226, 228, 254.Google Scholar

38. The tithes of Church Staunton came into Crown hands when Wigmore Abbey was dissolved; they were sold in 1601 to a group of London speculators who re-sold them five months later to Philip Greenly, a member of a local family. His collectors were forcibly opposed by Richard Wigmore and John Badland (grandfather of John and Richard Badland assessed here); Sta. Cha. 8/154/8.

39. Vicar of Staunton, died 1668.

40. John Badland (died 1689) and Richard Badland of Hatfield (died 1710) were two of the sons of William Badland of Staunton, yeoman. John was father-in-law of Peter Wyke.

41. HT 1664(3).

42. Widow of Roger Fletcher whose will was proved 1661 (Hereford).

43. Yeoman, will proved 1667 (Hereford).

44. Rector, FP 1661 (20s paid).

45. HT 1664 (4).

46. The former parliamentary commander bought Garnston from Roger Vaughan in 1661; Hillaby, J. G., ‘The Parliamentary Borough of Weobley, 1628–1708’, TWC, xxxix (1967), p. 104Google Scholar. JP q 1660; MP for Leominster 1660; FP 1661 (£100); HT 1664 (10).

47. For the Unicorn, HT 1664 (6).

1. The proportions of the parish charges are not the same as those under the 1677 assessment.

* Actual charge in brackets.

2. HT 1664 (6). Elenor Greene widow was also charged on 6 hearths.

3. The largest HT charge in 1664 was on William Garston (? Barston) (8).

4. HT 1664 (9).

5. JP 1660; in 1660 he was considered as a deputy lieutenant but marked as being under age (S.P. 29/11, fo. 162); MP for Hereford 1662; captain of a militia troop in the mid-1660s; Loan 29/49, pf. 4, no. 69/15. He married Ann daughter of Sir Thomas Tomkins.

6. Included Twyford.

7. HT 1664(3).

8. HT 1664(3).

9. In 1646 his estate in the county was valued at £266 a year (Loan 29/15, pf. 2); FP1661 (£10); HT 1664 (13).

10. His estate in the county in 1646 was valued at £53 a year; FP 1661 (£10); JP q 1660.

11. The parish of St Devereux. The largest HT charge in 1664 was on William Westfaling (5).

12. Rector of St Devereux, FP 1661 (£3 paid).

13. Roger Bodenham's estates in Rotheras, Little Marcie, Weston Beggard, Holmer and Pipe were valued at £177 a year in 1646; Add. 19678. The same year his entire real estate in the county was put at £264 a year and his personal estate at £98; Loan 29/15, pf. 2. His whole fortune before the Civil War was estimated in 1684 at near £3,000 a year, but it was said that he had spent his estate on the king and so had to live obscurely; Add. 36452, fo. 190. HT 1664 (14).

14. The largest HT charge in 1664 was on Thomas Jenings (9).

15. JP q 1660; MP for the county 1661; DL 1663 (S.P. 29/87); died 1668.

16. JP 1655; JP q 1660.

17. Rector, FP 1661 (40s).

18. Vicar, FP 1661 (20s paid).

19. Gent., HT 1664 (6).

20. The largest HT charge in 1664 was on David Grundy (8).

21. HT 1664 (4).

22. HT 1664 (4).

23. Chief constable of Webtree, 1663; Loan 29/49, pf. 4, no. 69/15.

24. HT 1664 (4).

25. HT 1664 (6).

26. John Scudamore, Baron Dromore and Viscount Sligo (1601–1671); his income in 1645 was thought to be about £4,000 a year: Harl. 911. More exact evidence suggests that his receipts from his Herefordshire estates in 1641/2 were no more than £3,233; Reade, H., ‘Account Books of the First Lord Scudamore’, TWC, xxv (1925), p. 119Google Scholar. JP, castos rotulorum, 1660Google Scholar. FP 1661 (£100 paid); HT 1664 (48, the largest charge in the county, equalled only by the charge on the college of vicars choral).

27. Vicar, FP 1661 (£5).

28. Considered for appointment as a deputy lieutenant in 1660, but may not have been appointed; S.P. 29/11, fo. 162. HT 1664 (7).

29. Probably Denzil Holies, 1599-1680, created Baron Holies, of Ifield, Sussex, 20 April 1661; Complete Peerage, ed. Cokayne, , vi, p. 545.Google Scholar

30. HT 1664 (12); will proved 1670 (FCC).

31. JP 1660: sheriff 1669. HT 1664 (8).

32. Pontrilas Forge.

33. Rector, FP 1661 (40s).

34. HT 1664 (7).

35. Probably vicar of Kingston.

36. George Sawyer, will proved 31 Oct. 1665 (FCC). He also owned land in Berk shire.

37. The largest HT charge in 1664 was on Thomas Rogers, gent. (5).

38. An analysis of a survey of the parish made in 1813 (Morgan, P., ‘An early 19th century survey of Madley’, TWC, xxxiii (1950), p. 118Google Scholar), although based on acreage rather than value, suggests, when compared with this assessment, that between 1663 and 1813 there was a considerable increase in the interest of absentee landowners and a substantial diminution in the total and mean size of the interests of all classes of landowner and occupier except the largest.

39. Herbert Bowton, vicar, FP 1661 (£5 paid).

40. Mary Moore, HT 1664 (11).

41. JP 1660: HT 1664 (7).

42. FP 1661 (£2 15s paid); HT 1664 (8).

43. Tanner, will proved 1666 (PCC).

44. Gent., HT 1664 (6). Walter Probert was also charged on 6 hearths.

45. Chief constable of Webtree, 1663; Loan 29/49, pf. 4, no. 69/15.

46. Of Gwendor. He had been fined £50, at ![]() , for his Herefordshire estates as a delinquent and papist: CCC, iv, p. 3002Google Scholar. HT 1664 (7).

, for his Herefordshire estates as a delinquent and papist: CCC, iv, p. 3002Google Scholar. HT 1664 (7).

47. Will proved 1668 (PCC). He held lands at Madley, Yazor, Weobley, Burton, Lyonshall, Mansell Lacy, Mansell Gamage, Bishops Frome, Preston on Wye, Bosbury, Munsley and Tyberton at the time of his death; HT 1664 (9).

48. HT 1664 (5).

49. Created baronet 1 Feb. 1660/1. A former parliamentary commander, he was prominent in organising the militia after the Restoration; DNB. HT 1664 (9).

50. In 1646 the real estate in the county of Robert Kempe of Chenston was put at £20 a year and his personal estate at £72; Loan 29/15, pf. 2.

51. Vicar, FP 1661 (20s paid).

52. Doctor of Laws, HT 1664 (8).

53. HT 1664 (15).

The royal aid charges eventually levied each quarter on each parish in this hundred were: Atforton, £10 6s 4d; Aston, £2 [10s] 7d; Aymestrey, £6 5s 7d; Buckton &c, £7 17s 4d; Brampton Bryan, £8 5s 7d; Burrington, £8 4s 1d; Combe &c, £12 12s 2d; Downton, £3 2s 10d; Elton, £6 6s; Kinton, £4 10s 10d; Knill &c, £8 19s [9d]; Leinthall Earls, £6 12s 1d; Leinthall Starkes, £10 2s 4d; Leintwardine, £8 4s 10d; Letton &c, £7 0s 7d; Lingen &c, £10 14s 10d; Litton &c, £7 [1s]; Marlow &c, £3 8s 10d; Mowley &c, £1212s 2d; Nether Lye, £3 13s lid; Rodd £12 12s 2d; Stapleton, £9 10s 2d; Pedwardine &c, £7 14s 10d; Titley, £12 12s 2d; Kinsham, £9 10s 2d; Walford, £6 3s 10d; Witton &c, £5 2s 1d; Wigmore, £8 8s; Willey, £9 10s 2d; Yetton, £6 13s 9d; Loan 29/49, pf. 4, no, 69/14. These charges suggest that the figures in the right-hand column of the hundred schedule in Harl. 6766 for Buckton, Letton and Litton are incorrect. Connop was normally taxed with Shobdon in Stretford hundred. While the parish charges as proportions of the hundred charge were mostly the same for the royal aid as for the 1677 assessment, the proportions in Harl. 6766 are not quite the same. A partial explanation of this is the omission of a charge on Marlow, which, if it were the same as the final royal aid charge, would produce a greater similarity. The adjusted hundred total would therefore be about £970.

* Actual charge in brackets.

2. HT 1664 (3).

3. JP 1655; Subs. 1663 (lands £2); HT 1664 (9).

4. HT 1664 (5).

5. In 1646 the real estate in the county of Roger Garnons was put at £20 a year and his personal estate at £5; Loan 29/15, pf. 2. James Garnons was assessed on lands of £2 and as a recusant in the Subs. 1663; he was charged on 6 hearths in 1664.

6. A former parliamentary officer. HT 1664 (8).

7. In 1645 the income of Sir Robert Harley (1579–1656), father of Sir Edward, was estimated to be £1,500 a year; Harl. 911. Sir Edward Harley (1624–1700), K.B. 19 Nov. 1660, governor of Dunkirk, 14 July 1660 to 22 May 1661; DNB. JP q 1660; DL 1660; a man of keen antiquarian interests; the Harley Papers (Loan 29) show him to have been very active in the administration of the county militia. FP 1661 (£50 paid); Subs. 1663 (lands £20 assessed with Thomas Harley); HT 1664 (17)

8. Thomas Cole, rector, FP 1661 (30s).

9. The largest HT charge in 1664 was on Francis Walker (8).

10. Subs. 1663 (goods £5).

11. Bringewood Forge.

12. The hearth tax return for Lady Day, 1664, contains: (chargeable)—James Pirie (4), Thomas Sanimeli (2), Francis Knoke (2), Thomas Fletcher (3), Thomas Griffitts (1), Thomas Penny (2), Thomas Bent (1), John Blackbatch (1), Wm Harvy (1), Edward Sanimeli (1), Elenor Blackbatch (1), Owen Hawes clerke (2), Thomas Woodhouse (5), Richard Weaver (5), James Woodhouse (5), Wm Woodhouse (3), Wm Hill (1), James Woodhouse sen (2), Evan Davies (1), Wm Phillipps (1), Phillip Taylor (1), Wm Woodhouse glover (1), John Man (1), James Evans (1), Henry Willcox (1), Richard Browne (1), Wm Stannage (2); (not chargeable)—Richard Davis (1), Jonas Blayney (1), Richard Dymber (1), Thomas Preece (1), Elenor Phillipps (1), Thomas Morgan (1), David Williams (1), Richard Woodhouse (1), Thomas Griffitts (1), Richard Hinton (1), Thomas Fletcher sen (1); (chargeable hearths 52).

13. Gent., Subs. 1663 (lands £2).

14. Rector, FP 1661 (20s paid).

15. Chief constable of Wigmore, 1663; Loan 29/49, pf. 4, no. 69/15. Subs. 1663 (lands £2).

16. Gent., Subs. 1663 (lands £2).

17. Gent., Subs. 1663 (goods £3).

18. HT 1664 (6).

19. HT 1664 (10).

20. Probably included Patchfield.

21. The largest HT charge in 1664 was on John Mapp (7).

22. Gent., Subs. 1663 (lands £2).

23. Gent., Subs. 1663 (lands £2).

24. HT 1664 (4).

25. Margery Palfrey.

26. Included Lower Harpton; Upper Harpton was in Radnorshire. The hearth tax return for Lady Day, 1664, contains: Knill (chargeable)—John Walsham Esq (5), John Watkins (2), Roger Lide (3), Rowland Stephens (1), Richard Knill (1), Jenkin Knill (2), Francis Stephens (1), Edward Griffiths (1); (not chargeable)—John Thomas (1), Thomas Dayos (1), Roger Lewis (1), Wm Reece (1); (chargeable hearths 16). Herton (chargeable)—Thomas Woodcock (6), Mary Bull widow (3), Elenor Lyde widow (1), Ann Morrice vid (1), John James (1), Hugh Paine (1), James Frees (1), Richard Bull (1), John Pricherd (1); (not chargeable)—Thomas Powell Gough (1), Edward Powell Gough (1), Wm Jones (1), John Gough (1), Richard James (1), Herbert Jorden (1), Elizabeth Williams (1); (chargeable hearths 16).

27. Subs. 1663 (lands £3).

28. Roger Lyde, Subs. 1663 (lands £2).

29. Subs. 1663 (lands £4).

30. In 1646 Sir Sampson Eure's real estate was valued at £60 a year and his personal estate at £10; Loan 29/15, pf. 2. Lady Eure was charged on 11 hearths in 1664. A survey and valuation in 1666 for the additional aid gave these valuations: Lady Ewers £80, Tho. Oakeley £35 10s, James Land £8 15s, Rich. Browne and his tenants £35 10s, The Old Field £28 10s, Mr Rob. Davis £24 10s, Math. Langford for the Lo. Bishop's land £21 10s, Mr Rob. Tayler for the Mynd £2 10s, Mr John Davis and his sonne £21 ICs, Clarkes tithes £17 10s, Tho. Croone £14, Mary Hopkins wid £12 5s, John Beddoes £4 5s, Sheappards lands £4 15s, Edw. Edwards £2 10s, John Elliotts £1 15s, Mr Whittle for tithes £5 5s; total £320; Hereford CRO, Galley Park MSS. The 1677 assessment on half the ‘new’ quota appears at £13 7s 10d to follow the charge in Harl. 6766 rather than the 1666 revaluation: E.179/119/490.

31. Widow of Sir Sampson Eure, former attorney in Wales, who bought Gatley Park from the Crofts in circa 1634 and who died in 1659. Subs. 1663 (lands £3). She died in 1673; Robinson, , p. 172.Google Scholar

32. Subs. 1663 (lands here and in Cowarne £2).

33. HT 1664 (6).

34. In 1646 his real estate in the county was put at £40 a year and personal estate at £19; Loan 29/15, pf. 2.

35. Probably Sir Walter Long of Whaddon, Wilts, created baronet 26 March 1661, died 1672; Baronetage, iii, p. 181.Google Scholar

36. In 1664 an assessment on Leintwardine parish for church repairs charged the constituent townships: Walford £6 9s; Adforton £6 2s 10d; Peyto £4 5s; Letton and Newton £7 15s 3d; Witton and Trippleton £5 18s 9d; Kinton £4 9s; Marlow and the Wood £3 8s 6½d; Leintwardine £9 6s 9d; Broxop and Brakes £2 5s 5d; Jay and Heath £3 17s 10d. Even if the last two townships are assumed to be included in the Leintwardine militia return, this church lewn was distributed differently from the militia valuations. Church assessments may well have been conventionally based on township allocations rather than rated equally across the parish; Hereford CRO, Diocesan Archives, Court Papers, I. and O.P., Box 485.

37. William, Earl Craven, 1606–1697 (DNB); his manor of Leintwardine had been bought by Robert Thorpe (CCC, ii, p. 1625Google Scholar), but he had apparently recovered it.

38. The largest HT charge in 1664 was on the widow Harper (6).

39. Subs. 1663 (lands £2); HT 1664 (4).

40. The largest HT charges in 1664 were on William Rodd, gent., and John Cocke (4 each).

41. Will proved 19 June 1664 (PCC).

42. Subs. 1663 (goods £3).

43. The hearth tax return for Lady Day, 1664, contains: (chargeable)—John Williams (1), Reese Davis (2), John Davis (1), Elenor Pugh (3), Henry Hurston (1), Meredith Davis (1), Thomas Howld (4), Johan Howld (2), James Meredith (1), Edward Powell Gough (3), Edward Howld clerke (2), Elenor Morris widow (2), Hugh Pugh (2), Peter Pugh (1), Lewis Jones (1), Marga: Thomas (1), Evan Jenkin (1); (not chargeable)—Thomas Meredith (1), Phillip Morris (1), Howell Frees (1), Hugh ap Thomas (1), David Morgan (1), John Prichard (1), Thomas Sherman (1), Miles Evans (1); (chargeable hearths 29).

44. HT 1664 (3).

45. The hearth tax return for Lady Day, 1664, contains: (chargeable)—Andrew Greenly (5), Phillip Greenly (5), John Fletcher (1), Edward Hudson (2), Francis Ricards (1), Symon Griffitts (1), James Astley (5), John Hunt (6), Phillipp Bleeke(1), Robert Woodhouse (4), Walter Frizer (3), John Greenly (1), Thomas Fletcher (1), Elenor Steade (1), Thomas Lewis (1), Wm Fletcher (1), Wm Frizer (2), Wm Sevan jun (1), David Lochard (1), John Badland (4), Henry Williams (4), Mary Stead (1), Beniamin Bryan (2), James Sevan (1), John Stinson (1), Peter Kinge (1), John Phillipps (1); (not chargeable)—James Thomas (1), Wm Bevan (1), Elizabeth Higgins (1), Thomas Greenly (1), Richard Powell (1), Wm Glover (1), Sibili Greenley (1), Thomas Davis (1), Edward Greenly (1), Thomas Godwyn (1), Richard Phillipps—, Wm Tuder (1), John Bevan (1), Robert Morris (1), Thomas Parker (1); (charge able hearths 58).

46. Anne Hunt was assessed to the Subs. 1663 on lands of £3 (on 1 May).

47. Of Ashley and of Bircher; will proved 1671 (PCC).

48. This estate was the subject of a marriage settlement in 1656; Hereford City Lib., Local Collection. Subs. 1663 (lands £2).

49. Of Stansbach; will proved 1672 (Hereford).

50. Subs. 1663 (lands £2); HT 1664 (4).

51. Subs. 1663 (lands £2).

52. The hearth tax return for Lady Day, 1664, contains: Rodd (chargeable)—Richard Rodd Esq (10), James Rodd (3), Walter Evans (2), John Lyde (1); Nash, (chargeable)—Henry Pyvinch (5), John Lyde (3), Wm Connopp (4), Roger Badland (2), Richard Stead (1), Evan Watkins (2); Brampton, (chargeable)—Francis Owen (5), John Browne (3), Henry Pyvinch (3), Richard Lyde (1), Tamberlaine Passey (1), Thomas Scudamore (2), Peter Lewis (1), Mr Owens mill (1); Rodd, Nash & Brampton, (not chargeable)—Evan Powell (1), John Rees (1), Richard Lewis (1), Ann Thomas (1), Elenor Powell (1), Sibili Powell (1), Margaret Meredith ap John (1), Wm Thomas (1), Edward Woodhouse (1), Wm Trooper (1), Joan Ashley (1), John Clerke (1), David Steephens (1); (chargeable hearths 49 struck through becoming 50).

53. His real estate in 1646 was valued at £80; Loan 29/15, pf. 2. Subs. 1663 (lands £3).

53. For Heads land.

54. For Passey's estate.

56. Possibly Baugh.

57. Subs. 1663 (lands £2).

58. (1610–1694), brother of John Badland of Staunton.

59. Subs. 1663 (lands £2).

60. Subs. 1663 (for Massey's land £2).

61. Vicar of Presteigne from 1660. He gave £20 to the FP 1661 and is there described as rector, although it is likely that he did not recover the rectory until 1664; Lord Rennell of Rodd, Valley on the March (London, 1958), p. 246.Google Scholar

62. The hearth tax return for Lady Day, 1664, contains: (chargeable)—Thomas Cornewall Esq (8), Wm Jones gent (7), John Price gent (7), Thomas Wheeler (3), Richard Gronows (2), Robert Younge (3), Wm Ruston (1), John Hill (2), John Younge (1), Robert Clerke (2), Richard Rodd gent (1), James Ruffe (1), Thomas Younge (2), Wm Pyvynch (1), Edward Hill (2), Richard Hill (1), Thomas Vaughan (1), John Fox (1), Thomas Davis (1), Peter Younge (1); (not chargeable)—none; (chargeable hearths 48).

63. Baron of Burford, lord of the manor of Stapleton; JP q 1660. Subs. 1663 (lands £6). A manorial rentroll of 1681 shows that his rents from Stapleton and Frogstreet were lesst han £13 a year; Shrewsbury Borough Library Deeds 2603.

64. Subs. 1663 (lands £2).

65. Will proved 1669 (Hereford).

66. Yeoman, will proved 1682 (Hereford), inventory £118.

67. Yeoman, brother of Edward, will proved 1669 (Hereford).

68. Will proved 1666 (PCC).

69. HT 1664 (3).

70. HT 1664(3).

71. The hearth tax return for Lady Day, 1664, contains: (chargeable)—Thomas Traunter gent. (7), Andrew Greenley gent. (5), John Knight jun (6), Wm Passey (5), Wm Scandrett (4), John Greyms (3), Edward Greenous (3), Richard Hill (3), Wm Wolfe (1), John Watkins (3), Wm Rodd (2), Anne Passy (1), John Davis (2), Walter Higgins (1), Wm Griffitts (1), Mary Byrd (1), Mary Godwyn (1), Evan Powell (1), Symon Higgins (1), Phillipp Davies (1), John Deykes (1), Wm Greenly (2), John Williams (1), Thomas Foxall (1), George Llewellyn (2), Rice Evans (1), Jenkin Lewis (1), Richard Greenley (1), John Angell (l); (not chargeable)—none; (chargeable hearths 63).

72. Subs. 1663 (lands £2).

73. Subs. 1663 (lands £2).

74. Subs. 1663 (lands £2).

75. Buried 20 Aug. 1665.

76. Thomas Parris alias Pace, administration granted 19 Oct. 1665 (Hereford).

77. Buried 18 May 1665.

78. Titley manor extended over the eastern part of the parish; it had belonged to Winchester College since the early 15th century; Winchester College MSS.

79. The hearth tax return for Lady Day, 1664, contains: (chargeable)—Thomas Blayney Esq (8), Richard Greenhouse (6), Wm Price (1), James Woodhouse (3), Ralph Tippins (2), Roger Derand (1), — Hunt widow (1), Wm Davis (1), Phillipp Hew (1), Henry Brians (I), James Price (1), Anthony Harris jun (1), Bridget Tyler widow (1), John Smith (1), John Duppa (1), Wm Sims (1), Anthony Harris sen (1), James Starr (2), Anthony Tippins (1), Richard Mason (1), Robert Yabins (1), Luke Hanford (1), Thomas Wheeler (4), John Derand (2), Richard Derand (1); (not chargeable)—Johan Jenkins (1), Sibili Walton (1), Stephen Meredith (1), Elenor Edwards (1), Richard Price (1), Margaret Harris (1), John Phillipps (1), Joshuah Davis (1); (chargeable hearths 45).

80. Lord of Kinsham manor; in 1681 his rents therefrom totalled £1; Shrewsbury Borough Library Deeds 2603.

81. JP 1660; FP 1661 (£6 13s 4d paid); Subs. 1663 (lands £2). Buried 10 Jan. 1666/7.

82. Buried 6 Dec. 1663; will proved 11 Mar. 1663/4 (PCC); he owned land in Kinsham, Mowley and in Worcestershire and Warwickshire.

83. Subs. 1663 (goods £3).

84. Subs. 1663 (lands £2).

85. clerk.

86. Subs. 1663 (lands £2).

87. HT 1664 (6).

88. Sheriff 1649; custos rotulorum 1655; S.P. 18/95/72 (ii). FP 1661 (£10 unpaid); Subs. 1663 (lands £4); HT 1664 (8).

89. HT 1664 (7).

90. HT 1664 (7).

91. With Richard Hopkins he was charged to the Subs. 1663 on lands of £3.

92. The hearth tax return for Lady Day, 1664, contains: (chargeable)—Charles Vaughan (3), John Vaughan (4), Roger Presser (3), Thomas Childe (3), Edward Legge (2), Richard Millichopp (5), Edmund Hacklett (3), John Powell (2), Wm Paine (1), Wm Gittins (2), Owen Powell (3), John Woodhouse (1), Peter Hill (3), Thomas Davis (2), Walter Powell (2); (not chargeable)—David Prees (1), Henry Kedward (1), Lucy Davies widow (1), Alice Griffiths (1), John Higgs (1); (chargeable hearths 39).

93. Elizabeth Vaughan of Stocking, Subs. 1663 (lands £1).

94. Subs. 1663 (lands £2).

95. Subs. 1663 (goods £3).

96. Anne Weaver, Subs. 1663 (lands £3). Robert Weaver Esq bore the largest charge to the HT 1664 (8).

97. Chief constable of Wigmore, 1663; Loan 29/49, pf. 4, no. 69/15.

1. The proportions of the hundred charge allotted to the individual parishes are not the same as those of 1677.

* Actual charges in brackets.

2. The largest HT charge in 1664 was on John Holland gent. (8).

3. Included Hennor and Stratford.

4. The largest HT charge in 1664 was on Edmund Gittoes (13).

5. In 1645 his estates were valued at£ 1,000 a year(Harl.911);a more reliable estimate in 1646 put his Herefordshire estate at £303 a year; Loan 29/15, pf. 2. JP q 1660. DL 1660 (listed): S.P. 29/11, fo. 162.

6. Rector, 1662-7; FP 1661 (£6).

7. HT 1664 (4).

8. JP 1660; DL 1660 et seq. In the niid-1660s he was a major in command of a company of the county militia; Loan 29/49, pf. 4, no. 69/15. MP for Leominster 1661. HT 1664 (7). His income was estimated to be £200 a year in ? circa 1677: Loan 29/182, fo. 313.

9. Will proved 1670 (PCC).

10. Vicar, FP 1661 (40s paid).

11. The largest HT charge in Moreton in 1664 was on John Walter (8).

12. The largest HT charge in Luston in 1664 was on Peter Young (8).

13. Of Kinlet, a Master in Chancery, knighted 12 May 1661: Shaw, p. 234.

14. Probably included Brockmanton and Westwood.

15. JP q 1660. In 1646 his real estate in the county was valued at £72 a year; Loan 29/15, pf. 2. HT 1664 (13). Will proved 1670 (PCC).

16. Of Bilfield; will proved 1668 (Hereford).

17. Yeoman, will proved 1669 (Hereford).

18. Yeoman, will proved 1710 (Hereford); he owned the St Mary House in Staunton on Arrow.

19. Included Hampton Wafer.

20. HT 1664 (6).

21. Sampson Wise of Clerkenwell, Middlesex; will proved 30 Oct. 1663 (PCC); in it he resigned his interests in the estates of his father-in-law, Fitzwilliam Coningsby, and of Humphrey Coningsby to them respectively; he also left a legacy to his servant for his years of service at Hampton Court.

22. Of Winsley; alleged to have suffered plunder during the Interregnum; Add. 36452, fo. 190. FP 1661 (£3).

23. Fitzwilliam Coningsby and his sons compounded at ⅓ of their estates, valued in all at £4,243; these probably included property outside the county as his Hereford shire estates were put at £950 in 1650; CCC, iii, p. 2064Google Scholar. In 1645 his income was by repute £4,000 a year; Harl. 911. Another, more exact, valuation put his real estate in the county at £558 a year and his personal estate at £270 in 1646; Loan 29/15, pf. 2. According to Robinson (p. 146), he had been reduced to absolute want in the Civil War and its aftermath. In his will, proved in 1666 (PCC) he left lands in Bodenham and in Worcestershire, Leicestershire, Salop and Radnorshire. JP q 1660; DL 1660. In 1664 he was charged on 35 hearths in Hampton; probably his estate at Hampton Court is represented here by the charge on Sampson Wise.

24. In the MS this comment is an annotation in the margin opposite the names Rogers to Farrington.

25. The largest HT charge in 1664 was on John Carter (7).

26. Included Risbury and Prittleton.

27. Chief constable of Wolphey, 1663; Loan 29/49, pf. 4, no. 69/15.

28. The largest HT charge in 1664 was on Henry Browne (4).

29. HT 1664 (10).

30. The largest HT charge in 1664 was on Sibili Goode (6). The churchwardens of this parish who appear in this schedule were: 1662, Williarn Bilwyn and Thomas Vernall; 1663, William Coleman, Humphrey Wall and Richard Browne; 1664, Walter Wancklen, Humphrey Smith and William Yeomans; 1665, John Bach; 1665/6, Alexander Jauncey; 1667, William Gittoes; 1668, Edmund Powell; 1669, John Wancklen; 1670, John Carpenter; 1671, John Coleman and Thomas Jay; 1673, William Yeomans and Ethelbert Jay.

31. Often taxed with While, although the implication here is that they were separate; Susana Clarke was charged to hearth tax in 1664 in While, but John Pateshall of Pudleston, also charged to hearth tax in While, does not appear in this schedule.

32. Of Brockmanton; his real estate in the county in 1646 was put at £58 a year and personal estate at £25; Loan 29/15, pf. 2. JP 1660.

33. The largest HT charge in 1664 was on John Cornewall (5).

34. The 1678 assessment (E. 179/237/46) for which the half year's charge under the ‘half quota was £24 16s 11d, the same as the 1677 charge, suggests that the town's proportionate quota within the hundred was unchanged after 1664. In 1678 the charge respectively laid on the wards was very different from that in this schedule, High Street ward being much higher and Cross and Pinsley much lower in 1678. In the latter year the number of individuals charged was, at 302, almost double the number in 1663, 78 of them being charged 6½d or less, the equivalent of a £1 valuation.

35. HT 1664 (14).

36. Gent.; month's tax collector for Stretford, 1664; Loan 29/49, pf. 4, no. 69/16.

37. Bailiff 1663, town clerk 1660–88; Townsend, G. F., The Town and Borough of Leominster (Leominster, circa 1861), pp. 293, 295.Google Scholar

38. Collector of the month's tax for Wolphey, Wigmore and Stretford.

39. Month's tax collector for Wigmore, 1664.

40. HT 1664 (13).

41. See Dilwyn (p. 108) for constituent townships.

42. HT 1664 (13).

43. In 1659 the manor had belonged to Mr Dansey and Mr Archer; Harl. 6726.

44. HT 1664 (5).

45. HT 1664 (5).

46. HT 1664 (5).

47. John Comby, FP 1661 (clerical) (5s).

48. Lucton manor belonged to the Wigmores; Harl. 6726. In 1646 Wigmore's real estate in the county was put at £62 a year and his personal estate at £15; Loan 29/15, pf. 2. HT 1664 (12).

49. Of Stoke, Suffolk; created baronet 22 June 1660; died 1705; Baronetage, iii, p. 51.Google Scholar

50. JP q 1660. He owned the manor: Harl. 6726. FP 1661 (£50); HT 1664 (17). His income was put at £1,000 a year in ? circa 1677; Loan 29/182, fo. 313.

51. Major in command of a militia company in the mid-1660s; Loan 29/49, pf. 4, no. 69/15.

52. Buried 8 Mar. 1664.

53. HT 1664(5).

54. Buried 14 Mar. 1667.

55. Buried 21 Sept. 1666.

56. Buried 7 Aug. 1669.

57. HT 1664 (7).

58. Died 27 Nov. 1663; Robinson, , p. 223Google Scholar. Will proved 18 Aug. 1664 (PCC). He had a 99-year lease, from 1640, of lands in Orleton, Yarpole, Bircher and Eye, and also held land in Warwickshire. In 1660 he rented from the Exchequer his lands in Orleton and Eye for £19; PRO, Various Accounts, E.101/630/30. In the HT 1664 his widow was charged for 7 hearths.

59. The Salways owned the manor; Harl. 6726. FP 1661 (£20 paid); HT 1664 (10).

60. Chief constable of Wolphey, 1663: Loan 29/49, pf. 4, no. 69/15.

61. HT 1664 (4).

62. The manor belonged circa 1659 to Sir Gilbert Cornewall and Mr Morris; Harl. 6726.

63. In 1646 her real estate was valued at £102 and her personal estate at £130: Loan 29/15, pf. 2. In 1660 ⅔ of her estate in Sarnsfield and Almeley was valued at £135; PRO, Various Accounts, E.101/630/30. HT 1664 (11).

64. The largest HT charge in 1664 was on John Ballard (3).

65. The duke of Buckingham's estates in Ivington and Stagbach were let in 1648 to John Wanklen, ironmonger, of Leominster, at a rent of £32 a year; Add. 19678.

66. HT 1664 (3).

67. Gent., HT 1664 (3).

68. HT 1664 (3).

69. Normally included Risbury.

70. The largest HT charges in 1664 in Stoke Prior were on John Higgason and Richard Pennell (8 each).

71. HT 1664 (6); gent.

72. Sheriff 1654; JP 1655; JP q 1660. HT 1664 (9).

73. JP q 1660; DL 1660; MP for the county 1661. His income was put at £400 a year in? circa 1677; Loan 29/182, fo. 313.

74. HT 1664 (12).

75. Rector of Croft and treasurer of Hereford cathedral; will proved 1669 (PCC).

76. HT 1664 (12).

77. The symbol Wp28 has been allocated to While rather than Wp27 in order that the symbols shall parallel the original numbering of the schedules in the MS. It will be noted that the latter has at this point become a little disordered.

78. Included Bircher.

79. HT 1664 (4).

80. HT 1664 (4).

81. Curate of Yarpole, FP 1661 (2s 6d paid).

82. The chief property owner appears to have been Bishop Croft on whom the entire HT 1664 charge (18) fell.

1. The charge on Much Dewchurch bears the same proportion to the hundred charge (assuming a £120 charge on Llangarren) as the charge in the 1677 assessment. It does not seem possible that the valuation has been miscopied. A deliberate doubling of the charge apparently due must therefore be assumed. The other charges are equal to or close to the proportions in the 1677 tax.

* Actual charges in brackets.

2. Created baronet 1644; succeeded by his son Sir John; Baronetage, ii, p. 227Google Scholar. JP q 1660. Subs. 1663 (lands £10); HT 1664 (14).

3. The largest HT charge in Bolstone in 1664 was on Philip Taylor (6).

4. Gent., Subs. 1663 (lands £1).

5. Subs. 1663 (lands £1).

6. Succeeded to baronetcy 1652; inherited barony of Chandos 1676; Baronetage, ii, p. 15. JP q 1660; DL 1660; sheriff 1667. FP 1661 (£30 paid).

7. Sir William Powell alias Hinson of Pengethley, created baronet 23 Jan. 1660/1, died 1680/1; Baronetage, ii, p. 1903Google Scholar. Sheriff 1657; JP q 1660; DL 1660. FP 1661 (£30 paid).

8. HT 1664 (6).

9. Subs. 1663 (lands £1).

10. Subs. 1663 (lands £1).

11. Vicar, FP 1661 (£2 paid).

12. The largest HT charge in 1664 was on Edward Hitchman, gent. (7).

13. The largest HT charge in 1664 was on Richard Barry, gent. (9).

14. Subs. 1663 (lands £1).

15. Of Cummadog (Cwm Madoc); it was alleged that he had been plundered and sequestered by parliament before 1660; Add. 36452, fo. 190. Subs. 1663 (lands £1).

16. Subs. 1663 (lands £1).

17. John White, Subs. 1663 (lands £1).

18. Gent., Subs. 1663 (lands £1).

19. Gent., Subs. 1663 (lands £1).

20. Subs. 1663 (lands £1).

21. Subs. 1663 (with Elizabeth Swift, lands £1); HT 1664 (7).

22. Subs. 1663 (lands £1).

23. Subs. 1663 (lands £1, with Roger Howells).

24. Normally taxed with Dewsall.

25. Gent., Subs. 1663 (lands £1).

26. Yeoman, Subs. 1663 (lands £1). Will proved 18 Oct. 1664 (PCC).

27. HT 1664 (15).

28. Anne Eavons, widow. Subs. 1663 (with William Roberts, lands £1).

29. Subs. 1663 (lands £1). HT 1664 (5).

30. Subs. 1663 (lands £1).

31. Subs. 1663 (lands £1).

32. Gent, Subs. 1663 (lands £1).

33. Spinster, Subs. 1663 (lands £1).

34. Gent., Subs. 1663 (lands £1).

35. Widow of Sir Walter Pye who died 1 Dec. 1659; Robinson, p. 88.

36. HT 1664 (4).

37. HT 1664 (4).

38. Probably included Harewood.

39. Subs. 1663 (lands £8).

40. Subs. 1663 (lands £2). Elinor Andrews was charged on 3 hearths in 1664.

41. Subs. 1663 (with his son Thomas and the widow Edwards of Lancran, lands £1).

42. FP 1661 (£13 6s 8d paid); Subs. 1663 (lands £3).

43. HT 1664 (9).

44. FP 1661 (£5).

45. Walter Hall, FP 1661 (£3 paid).

46. The largest HT charges in 1664 were on Henry Milbourne Esq and William Morton (11 each).

47. JP q 1660. In 1646 his real estate in the county was put at £25 a year and his personal estate at £93: Loan 29/15, pf. 2. Subs. 1663 (lands £4); HT 1664 (9).

48. Subs. 1663 (lands £1).

49. The largest HT charge in Aconbury in 1664 was on Giles Wilton (9).

50. In 1646 the personal estate in the county of Sir John Bridges of Aconbury was valued at £289; Loan 29/15, pf. 2.

51. Probably Richard Gething, gent., Subs. 1663 (lands £1).

52. Probably of Trebandy, Subs. 1663 (lands £2); HT 1664 (5).

53. Gent., Subs. 1663 (lands £1).

54. Gent., Subs. 1663 (lands £1); HT 1664 (4).

55. HT 1664 (4). Morgan Thomas was also charged for 4 hearths.

56. HT 1664 (23).

57. In 1646 the real estate of Jane Bodenham of Bringwen, a papist, was valued at £60 a year; Loan 29/15, pf. 2. In 1660 her estate was rented from the Exchequer by herself for £25; PRO, Various Accounts, E.101/630/30. Subs. 1663 (lands £2).

58. The largest HT charge in 1664 was on Thomas Bodenham, gent. (3).

59. Yeoman, will proved 14 Feb. 1665/6 (PCC).

60. Subs. 1663 (lands £1); HT 1664 (5).

61. Subs. 1663 (lands £1).

62. Subs. 1663 (lands £1).

63. Subs. 1663 (lands £1).

64. Rector, FP 1661 (£1).

65. Subs. 1663 (lands £1).

66. Gent., Subs. 1663 (lands £1).

67. Gent., Subs. 1663 (lands £1).

68. Subs. 1663 (with Roger Davies, lands £1).

69. Subs. 1663 (lands £J).

70. HT 1664 (5).

71. Subs. 1663 (lands £2); HT 1664 (11).

72. Yeoman, Subs. 1663 (lands £1).

73. FP 1661 (£100 paid); Subs. 1663 (lands £10); commissioner for this subsidy.

74. Subs. 1663 (lands £10); commissioner for the subsidy.

75. HT 1664 (9).

76. Vicar of Sellack, FP 1661 (£3).

77. Vicar of Foy, FP 1661 (£5).

78. Chief constable of Wormilow; Loan 29/49, pf. 4, no. 69/15.

79. Rector of Tretire, FP 1661 (£1 paid); HT 1664 (4).

80. Subs. 1663 (lands £1); HT 1664 (4).

81. Subs. 1663 (lands £1).

82. HT 1664 (4).

83. Subs. 1663 (lands £1); HT 1664 (11).

84. In 1646 his real estate in the county was valued at £36 a year; Loan 29/15, pf. 2. Subs. 1663 (lands £1).

85. Subs. 1663 (lands £1).

86. Chief constable of Wormilow; 1663; Loan 29/49, pf. 4, no. 69/15. Gent., Subs. 1663 (lands £1).

87. JP q 1655 and 1660; captain of a militia company 1664; Loan 29/49, pf. 4, no. 69/15. FP 1661 (£10 unpaid); Subs. 1663 (lands £3); HT 1664 (7).

88. Probably Sir Thomas Darrell of Lillingstone Dayrell, Bucks; Shaw, p. 202.

89. Gent., Subs. 1663 (lands £1).

90. Rector of Whitchurch, FP 1661 (50s).

1. This is a list of parishes for which no nominal schedules are included in the MS, although totals are included for all but two. There are other nominal schedules apparently missing, but only those for Kilpeck and Llanhithog are unlikely to be represented under other parish schedules.