Introduction

Elected in 2010, Republican Governor Scott Walker quickly set to weakening organized labor in Wisconsin. While his early actions targeted only public-sector unions, in 2015, the governor signed a “right-to-work” (RTW) law that would weaken all labor unions by preventing them from collecting dues from nonmembers. Wisconsin became one of only a handful of states to change RTW status in the last sixty years, a period of remarkably static labor laws in the United States. In July 2017, the same month that Wisconsin's RTW law was upheld by an appeals court, Governor Walker announced that his state had landed the first American factory for Taiwanese manufacturing giant Foxconn, which would bring thousands of jobs to the state.Footnote 1 While the fate of that particular plant has since come into doubt, it illustrates the potential importance of labor laws to foreign firms.

Most research on labor and multinational corporations focuses on firms’ pursuit of low wages, the so-called race to the bottom. Indeed, evidence exists that firms prefer to locate many labor-intensive processes in low-wage countries. But does that same logic apply to their activities within rich countries? It is well documented that foreign multinationals in the American automobile industry produce disproportionately in Southern states, and many industry analysts and scholars alike have highlighted those states’ low propensity to unionize as an important factor.Footnote 2 In this article, we argue that twenty-first-century global value chains divide production in ways that should reduce the importance of labor laws, such as RTW, in rich countries. Production is often segmented across borders, with rich countries hosting innovation and service-intensive processes. MNCs often care more about their search for talent than about the cost of labor. In fact, perhaps the most empirically recognized characteristic of MNCs is that they pay workers more on average than other firms in similar industries (Aitken and Harrison Reference Aitken and Harrison1999). In this article, we investigate how RTW laws change the investments of foreign multinationals in the United States.

Our empirical strategy emanates from the aforementioned recent changes in RTW laws in some states. After a barrage of states implemented RTW in the 1940s and 1950s, only three changed RTW status between 1963 and 2000. Since then, a number of states have followed suit, including Oklahoma (2001), Indiana and Michigan (2012), Wisconsin (2015), West Virginia (2016), and Kentucky (2017). Generally, RTW initiatives emerge from Republican-dominated legislatures, but their adoption is controversial. In August 2018, the voters of Missouri rejected RTW in a statewide referendum that elicited more than $18 million in spending.Footnote 3

Scholarly findings show that RTW reduces union density by increasing the costs of collective action (Moore Reference Moore1998; Peck Reference Peck2015; Vachon and Wallace Reference Vachon and Wallace2013). RTW's other effects are more contested, particularly on the importance of RTW for new investment. While Coughlin, Terza, and Arromdee (Reference Coughlin, Terza and Arromdee1991) find a negative relationship between foreign investment and RTW, Shaver (Reference Shaver1998) surfaces evidence that foreign firms put even more weight on RTW than do domestic firms.Footnote 4 Others, like Head, Ries, and Swenson (Reference Head, Ries and Swenson1999) find no relationship. In part, these mixed findings are driven by methodological limitations. Most previous research on the impact of RTW on foreign direct investment (FDI) examines cross-sectional data owing to limitations in estimating longitudinal effects. Additionally, inward FDI data across US states are surprisingly limited, and existing data suffer from several problems. In this article, we overcome these methodological limitations and investigate the impact of RTW on inward FDI by using only newly created economic activity, or greenfield FDI, into US states. We employ difference-in-differences models to examine the impact of Indiana and Michigan's 2012 changed RTW status.Footnote 5

In the following section, we explore the channels through which RTW laws might affect foreign investment. Next, we explain some of the methodological hurdles that limited previous studies. Our own analysis with new data sources follows, and shows clear evidence of increased foreign investment, but only in Michigan. Because RTW changes clearly cannot explain the different findings across the two states, we then explore other policy changes that had the potential to increase FDI. We then explore RTW's impact only on foreign investment related to manufacturing and find that relaxing labor laws using RTW increases the number of manufacturing projects in both Indiana and Michigan. Overall, then, RTW appears to benefit manufacturing in both states, but only Michigan receives the service-sector investments that we expect to locate in final product markets in industries with global supply chains.

Foreign investment and RTW laws

When multinationals create subsidiaries in the United States, they do so deliberately. Locating some part of the production process on American soil must offer advantages over exporting or contracting with American firms for the same services. The classic case is tariff-jumping, such as when Japanese automobile manufacturers chose to build American factories to evade restrictive trade policies. The rise of global value chains adds more reasons for FDI in rich countries (Gereffi, Humphrey, and Sturgeon Reference Gereffi, Humphrey and Sturgeon2005). While low value-added processes may take advantage of low wage labor in poorer countries, final assembly will more likely happen near destination markets. Additionally, more developed countries typically house innovation processes and many of the service components of production, such as marketing and accounting.Footnote 6

RTW laws might have an impact through at least two channels. First, they may decrease overall costs of labor by decreasing union strength and thereby muting wage demands. Second, they may operate as costly signals to foreign firms that they are now welcome or that states are focused on improving the overall operating environment for business.

The wage-reducing effect seems unlikely in the short term if for no other reason than RTW laws tend not to affect existing labor contracts. But when locating new production, some multinational firms may prioritize minimizing labor costs even as others prefer higher wages for more productive workers. Scholars who emphasize the former story expect MNCs to pursue a “race to the bottom” in wages and, as a result, generally poor treatment of workers (Davies and Vadlamannati Reference Davies and Vadlamannati2013). Many industry reports support the negative impact of economic integration on labor (see Distelhorst et al. Reference Distelhorst, Locke, Pal and Samel2015 for a list). Some recent scholarship shows evidence along these lines. Adolph, Quince, and Prakash (Reference Adolph, Quince and Prakash2017) focus on African workers and their economic ties to China, and they find that labor rights tend to deteriorate.

However, even with the rise of global value chains and automation, labor can still be an important component of production. Quite a few scholars emphasize the more optimistic account, in which human capital remains an important source of productivity or a firm-specific asset for firms. If so, firms that compete internationally may tend toward better treatment of workers. Blanton and Blanton (Reference Blanton and Blanton2007), Greenhill, Mosley, and Prakash (Reference Greenhill, Mosley and Prakash2009), and Malesky and Mosley (Reference Malesky and Mosley2018) argue instead that economic integration is positively associated with labor conditions.

Importantly, the focus of virtually all this research is on the impact of integration on poorer countries in supply chains, with very little attention to the impact of integration on workers in richer countries. How might working conditions in rich countries affect multinational enterprises and their decisions about where to locate production? Rich countries still compete as sites of production, and different stages of production are often located in different countries based on the need for high-skilled labor and the desire to produce close to markets for final products. We specifically ask where MNCs locate production within an important rich country market, based on differences in labor rights.

While RTW may generate lower labor costs, scholars have more often assumed that the policy was more important as a signal to businesses (Holmes Reference Holmes1998; Rao, Yue, and Ingram Reference Rao, Yue and Ingram2011). It is unclear whether RTW alone is a costly enough signal to help sort states that are business friendly from those that are labor friendly. Rao, Yue, and Ingram (Reference Rao, Yue and Ingram2011) examine Walmart's location of new stores, and they find that the company will locate just across the border in a RTW state where two states differ in RTW status. The logic for Walmart is that RTW laws undermine activists and prevent political demands, not just economic ones. In other words, RTW signals lower political risks overall.

As a signaling device, RTW may be a welcome tool in the aggressive competition among American state and local governments for new jobs and see in MNCs an opportunity to boost and diversify their economies (Jensen and Malesky Reference Jensen and Malesky2018). While states are known to recruit existing businesses from one another, the fiercest competition often takes place when foreign firms announce new endeavors, or greenfield investments. Voters seem to reward recruitment of new firms (Jensen et al. Reference Jensen, Malesky, Medina and Ozdemir2014), even though investment promotion activities may have little impact on where investment happens. In practice, RTW states often tout their labor laws in recruitment efforts.Footnote 7

Measuring FDI

Foreign investment into American states reflects differences in input costs, such as the price of land and the extent of transportation infrastructure, as well as labor skills and availability. Unemployment rates and education levels are usually included to proxy for skill sets. Unionization or a state's right to work status is sometimes included as a determinant of FDI as well (Head, Ries, and Swenson Reference Head, Ries and Swenson1999). Most studies have examined the impact of these variables on FDI, but some scholars have reversed the causal story to argue that foreign investment reduces unionization (Vachon and Wallace Reference Vachon and Wallace2013). Overall, then, little agreement exists regarding the relationship between state attributes and the investment location decisions of foreign firms.

Some of these disagreements may arise from previous attempts to measure FDI. Many FDI transactions take the form of mergers and acquisitions (M&A), whose effects on the economy are less clear than their greenfield counterparts. Most mergers, for example, include as a core justification the reduction of overlapping workforces. If an American firm is acquired by a foreign firm, overall employment in the United States could increase or decrease, depending on where the merged firm chooses to keep employees. Aggregate FDI statistics, including those searching for the determinants of inbound investment into the United States, are composed of both M&A and greenfield investment, thereby complicating both the theoretical expectations for and causal inferences from empirical research.

The activities of multinational corporations have historically been analyzed using FDI flow or stock data, but these data typically emanate from balance-of-payments calculations, or from surveys of firms. Scholars have grown increasingly skeptical that such highly aggregated measures accurately convey the behavior of MNCs, given their aggregation of equity investments, debt flows, and repatriated income (Kerner Reference Kerner2014; Kerner and Lawrence Reference Kerner and Lawrence2014). In trying to ascertain where foreign firms locate inside the US market, most empirical work uses data from the Bureau of Economic Analysis (BEA; see Shannon, Zeile, and Johnson [Reference Shannon, Zeile and Johnson1999]), particularly the value of property, plant, and equipment (PPE) of foreign companies in the United States. The companies report the FDI data according to a single standard, but these widely used data are bound by confidentiality, and are excluded when small numbers might allow identifying the firms. Particularly at the state level, the data are plagued with missingness. BEA has another FDI measure (number of jobs in foreign companies per year) that suffers less due to confidentiality, but it is equally affected by mergers and acquisitions and therefore complicates inferences.

To overcome data limitations related to analyzing a state's attractiveness to FDI, an acceptable measure would have to find a way to circumvent the confidentiality issue and provide a reliable picture of greenfield projects coming into states and countries. The Financial Times’ (FT) fDi Markets database tracks cross-border greenfield investment since 2003 across all sectors and countries worldwide, with real-time monitoring of investment projects, capital investment, and job creation. Unlike the BEA data, it does not track mergers and acquisitions and other equity investments, and joint ventures are only included when they lead to a new physical operation.

Using fDi Markets, we build a state-level fixed-capital FDI dataset ranging from 2003 to 2017. Individual investment projects are aggregated to the state level for three measures of fixed-capital FDI: the capital expenditure of all projects for a given year, the number of jobs created by all FDI projects each year, and an annual count of greenfield investment projects. Our data are more comprehensive and reliable than previous measures of FDI, and number of projects is probably the single best estimate of greenfield FDI.Footnote 8 Yet even in greenfield investment projects there are times where companies will not release information on investment amount or job creation. These measures involve some uncertainty due to discrepancies between projected and actual capital expenditure and job creation. To this end, FT analysts developed a proprietary econometric model that estimates the jobs and investment amount where the actual value is not known. These analysts search daily not only through FT's sources but also thousands of other media sources and receive project data from more than 2,000 industry organizations and investment agencies. Each project identified in the database is then cross-referenced against multiple sources allowing a reliable analysis of cross-border investment by source, destination, sector, and activity at not only country but also state, county, and city level. Others have used the data in published workFootnote 9 and we also find it useful for our purposes.

Most states—forty-four of the forty-eight continental states in our sample—retain the same RTW status throughout the sample period, creating the methodological difficulty highlighted earlier. However, the fact that some states change policies offers a new opportunity to identify the effects of the change in RTW status. We focus on Indiana and Michigan, which both adopt RTW in 2012, allowing just enough observations before and after the policy change to analyze its effects.

Figure 1 shows all three of our measures: projects, capital investment, and jobs. The bottom line in each figure shows the mean of all states that have not passed RTW laws throughout the sample period. The top line shows the mean of Indiana and Michigan, and the vertical line in each graph highlights the year 2012, when each of those states passed RTW. In the first two graphs the two lines display similar trends. The third graph shows more volatility in jobs due to greenfield investment in Indiana and Michigan both before and after the year RTW passed. Our difference-in-differences estimator requires that these trends be parallel prior to the policy change, so we focus disproportionately on projects and capital investment.

Figure 1. Investigating the Parallel Trend Assumption

The impact of RTW changes

We identify the real impact of RTW on FDI by using difference-in-differences (DID) estimation. It creates a statistical counterfactual based on common trends in the data, which in turns isolates the effect of a given policy shift. DID estimation is similar to fixed effects in a panel model, but supplements fixed unit effects with an interaction between the period of treatment and the treated units. We consider the two recent RTW states to be treated, and we compare their post-RTW FDI with those of states that kept their non-RTW status.

In other words, we can effectively estimate how much investment Indiana and Michigan would have gotten had they NOT changed RTW status, based on common FDI trends among other states that did not change policies. To investigate the impact of passing RTW laws in both Michigan and Indiana, we first eliminate all states with RTW throughout the sample, which leaves 29 states in the untreated control group. We then estimate the difference between the estimate and the actual values of FDI for the two treated states as follows. We initially create two dummy variables identifying the treated units and a dummy variable identifying the treatment, meaning a value of zero prior to 2012 and of one after that. This dummy variable identifies whether the state in question had RTW in any given year, so we call it RTW. We next create an interaction between treatment and treated units, which we label DID. It is this interaction that estimates the coefficient of interest, how much FDI the treated state received relative to how much it would have received given trends in all non-RTW states.

For controls, we emulate Keller and Levinson's (Reference Keller and Levinson2002) influential work on environmental regulation and FDI in American states. Like Keller and Levinson (Reference Keller and Levinson2002), we include state economic size, population, proximity to other markets, transportation infrastructure measured in total road mileage, corporate taxes, and the costs of energy, land, and labor. In addition we add college-educated population and unemployment rates. Unlike Keller and Levinson (Reference Keller and Levinson2002) we omit unionization rates in our initial analyses, owing to its close relationship to RTW.

We convert all monetary values into real 2009 values.Footnote 10 We use the natural log of state GDP, which we obtain from the BEA's Regional Data, and the natural log of population, obtained from the US Census Bureau. College education data come from US Census and measure the percentage of the state's population between eighteen and twenty-four years with some college education. Our measure of market proximity is a distance-weighted measure of the (real) gross state product to capture how near each state is to potential markets in other states. Road mileage is the sum of a state's urban and rural highway mileage, acquired from the US Department of Transportation. The corporate tax measure comes from BEA's Regional Data and reflects a state's corporate tax rate (highest marginal).

The energy cost variable used in this study is from the US Department of Energy and reflects the average retail price of industrial electricity, measured in cents per kilowatt/hour. The land prices measure is the cropland asset value obtained from the National Agricultural Statistics Services and measured in dollars/acre. The unemployment rate variable is the total unemployed as a percentage of civilian labor in the state, and it came from the US Bureau of Labor Statistics. We expect GDP, population, proximity, mileage, unemployment, and college education to be positive covariates of FDI, and corporate tax, electricity prices, and agricultural land prices to be negatively correlated.Footnote 11

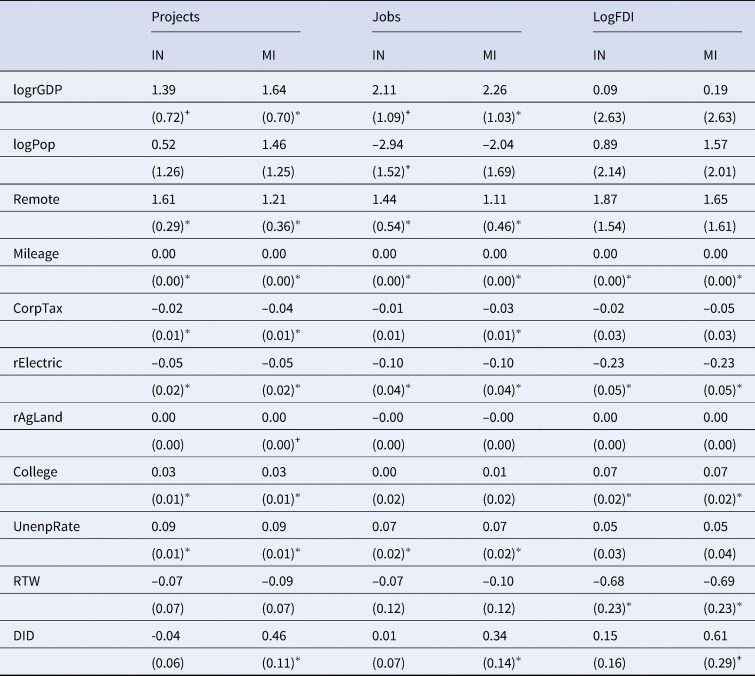

Table 1 compares the results of six DID models, two using each of our FDI measures. For each measure, we estimate the impact of RTW laws using a DID model first for Indiana and then for Michigan. We use the same control group for each—the twenty-nine states that did not adopt RTW. The estimator varies across each pair of models due to the nature of our dependent variables. Models 1 and 2 examine the correlates of our Projects variable and Models 3 and 4 our Jobs variable, respectively. All four estimations use fixed-effects Poisson count models with robust standard errors due to issues with heteroskedasticity. Models 5 and 6 report the results of OLS fixed effects regression with Driscoll–Kraay standard errors due to the presence of cross-sectional dependence in the data. Our primary estimations find no statistically significant change due to RTW in Indiana but positive changes across all three variables for Michigan. Those changes are potentially large, too. The count models in table 1 show an increase of 46 percent in projects, a 30 percent boost in FDI-related jobs, and a 61 percent increase in greenfield FDI, but these marginal effects are quite model dependent. The increase in Michigan is more than 2,600 jobs if we use an OLS model rather than a count model, and that is about the same as the mean annual job creation across states, so closer to a 100 percent increase.

Table 1. DID Results

Standard errors in parentheses. Estimates of constant omitted. N = 406.

+p < 0.10; *p < 0.05.

Results on control variables vary according to the dependent variable. The only controls that are consistent across the three models are mileage (positive) and electricity prices (negative). As expected, bigger economies and those that are proximate to larger markets draw more projects and more jobs. We do not find a positive effect of market size on FDI flows. Controlling for economic size, population has no effect. Agricultural land prices are also not statistically significant. Corporate tax rates are negatively signed as expected, but are statistically significant only for Projects. A higher number of college graduates is correlated with more greenfield projects and more FDI, but not necessarily more jobs. State-level unemployment rates are positively correlated with projects and jobs, but not FDI. On the whole, statistically significant covariates are signed as expected, but results vary depending on the measure of our dependent variable.

Based on our earlier examination of the parallel trends assumption in figure 1, we believe that the DID results for projects and for (log of) FDI meet the criteria necessary for DID to provide unbiased inferences. Even in these two cases, we find strikingly divergent results across the two states that adopt RTW in 2012. Indiana shows no evidence of increases in FDI; Michigan shows a statistically significant gain in projects, and a borderline statistically significant gain in FDI. Both of Michigan's gains appear important in magnitude, more than 30 percent, but RTW alone cannot explain the difference across the two states.

To examine the robustness of our results, we estimate several additional models, which are not shown here.Footnote 12 First, we include a lagged dependent variable (LDV), which is theoretically appropriate given FDI's historic tendency to concentrate in some areas more than others. Unfortunately, including LDVs in difference-in-differences estimators can be somewhat problematic.Footnote 13 Estimating the model without fixed effects, however, makes comparisons to our previous results harder. We therefore estimate a model with both LDV and fixed effects. The lagged dependent variable is statistically significant in both Projects models, but it is also quite small in magnitude, close to zero when rounding to the second decimal place. The LDV is not statistically significant in either of the models with capital expenditures as the dependent variable. Our key result from the initial regressions, that Michigan experiences an increase in projects and in FDI while Indiana does not, still holds for the estimations on number of Projects. Additionally, the coefficient remains unchanged and it appears even more precisely estimated. However, including a lagged dependent variable pushes the Michigan results on (log of) FDI out of range of statistical significance. The coefficient declines from 0.59 to 0.50 and the standard error increases from 0.33 to 0.41, at least in part due to the smaller sample size that results from the LDV.

As a second robustness test, we consider our dependent variables as shares of total greenfield projects or of capital investments in the United States. If RTW shows an impact here, it may reveal the diversion of FDI from other areas of the country to Indiana and/or Michigan. Despite a very different dependent variable, our result for Projects in Michigan withstands the transformation of the dependent variable. No other DID results are statistically significant.

Beyond RTW

Like those who have studied this issue before us, our results do not reveal a clear, systematic relationship between the adoption of RTW laws and a state's ability to attract foreign investment. Our empirical model improves on previous models, though, by directly identifying the impact of RTW changes in two states relative to their peers. Our results suggest that circa 2012 Michigan began receiving substantially more foreign direct investment than it would have otherwise. Why might the same policy change have different effects in the two states?

The fixed unit effects in our models control for time-invariant differences between the states, so one remaining possibility is that the implementation of RTW differed in our two treated states. For example, perhaps other changes to industrial recruitment strategies made in concert with or around the same time as the RTW change made Michigan's RTW signal more credible. Hanley and Douglass (Reference Hanley and Douglass2014) suggest that the development strategies of state and local governments can be separated into two ideal types. The first is a “low road” to industrial recruitment, which focuses on property tax abatements and other programs that lower overall costs of production for firms. The second focuses more on providing an entrepreneurial environment with higher skilled workers, technology transfer, and other programs that generally increase advantages in the overall business environment. Hanley and Douglass (Reference Hanley and Douglass2014) find evidence that each strategy is associated with a specific mix of policies, and we can examine Indiana and Michigan from this perspective.

Indiana uses primarily tax incentives as a tool for economic development, which would put it in the “low road” camp. According to Council for Community and Economic Research (2015a, 3), the state spends substantially less than average ($449 per business annually when the median state spends $972), so the state is not greatly subsidizing the cost of doing business. In aggregate, Michigan spends substantially more on a wider variety of tools for economic development, including “business assistance, technology transfer and workforce preparation and development” (Council for Community and Economic Research, 2015b, 5). Most importantly, Michigan began a dramatic reordering of these tools in 2011, including “simplification and reduction in corporate income tax … and the net elimination of over 1,500 regulatory requirements” (1). Similarly, Jansa and Gray (Reference Jansa and Gray2017) show that between 2006 and 2014, Michigan dramatically increased spending on economic development, much more than did Indiana. That period predates RTW legislation, but perhaps a combination of both elements has led to greater success.Footnote 14 Michigan thus appears closer to the “high road” strategy but with more fiscal effort on subsidizing the costs of doing business than in Indiana. Greater budgetary effort could also interact with the signaling effect of RTW to convince foreign investors of an improving business environment. The timing of Michigan's changes, and perhaps the higher aggregate spending are almost certainly reflected in our measure of the RTW “treatment” and may be the more likely determinant of any increase in foreign investment during the posttreatment period.

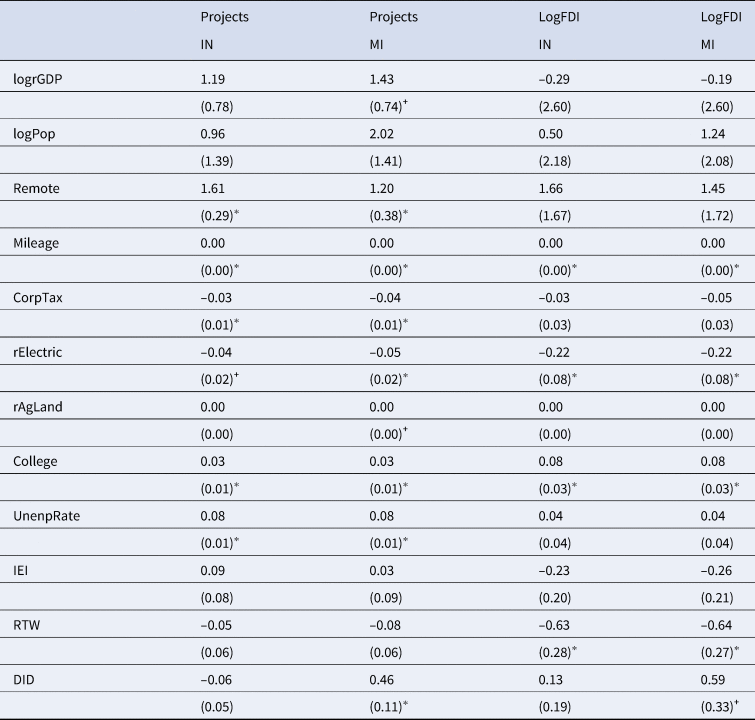

We examine that possibility in two ways. First, we estimate our previous models with a new variable the Incentives Environment Index (IEI) from Patrick (Reference Patrick2016). IEI examines the (state) constitutional limits on local governments to offer assistance to private firms. To the extent that Michigan reduced constitutional barriers to local incentives, the measure would explain the FDI increase in Michigan (and potentially eliminate RTW's statistical significance). However, as our results in table 2 demonstrate, including the IEI measure in our models produces few changes to our earlier results. IEI is not statistically significant, and including it barely affects RTW's correlation with our FDI measures. For Projects, the coefficient for Michigan's DID estimate remains the same (0.46), as does the statistical significance. For FDI, the coefficient declines slightly from 0.61 to 0.59, but the standard error increases from 0.29 to 0.33. The latter measure is no longer statistically significant. Given the consistency in the estimates and the insignificance of IEI, formal constraints on incentives do not appear to be causing the difference in projects, although they may be affecting the overall size of capital expenditures. Of course, IEI is a slow-changing measure, and while it is the best available indicator for cross-state differences in spending on incentives, it may not reflect important differences in RTW across the two states. We therefore investigated the origin of RTW in the two states, with the idea that RTW might have been a costlier signal in one state than the other.

Table 2. Adding a Control for Incentives

SEs in parentheses; constant estimate omitted; N = 392.

+p < 0.10; ∗ p < 0.05.

Surprisingly, the circumstances surrounding passage of RTW in the two states are similar. Neither Indiana nor Michigan passed RTW laws in a careful, deliberative manner that indicated a rethinking of industrial recruitment strategies. In both cases, the governors had declined the opportunity to make RTW a priority. When Republican majorities in each state took up the issue anyway, each governor acquiesced and signed the bill into law. In Indiana, the RTW bill received much attention when it was originally introduced in 2011, but Democrats prevented the Republican majority from passing it by fleeing the state to deny quorum. In a compromise, the bill was tabled but resurfaced in 2012, when it passed after being designated as emergency legislation. Governor Mitch Daniels signed the legislation despite “not being a strong supporter” (Varga, Reference Varga2014, 27). In Michigan, RTW passed quickly, without much public debate, during a lame duck session of the legislature in December 2012. According to Kaminski (Reference Kaminski2015), Michigan's adoption of RTW can be traced not to a united coalition of business owners but instead to Republican control of the state government, specific advocacy of the policy by one large donor, and labor's own political missteps. Neither Indiana nor Michigan passed RTW as part of a coherent strategy for economic development, but Michigan had previously made several changes that may be conflated with RTW based on their timing.

RTW effects in manufacturing

We examine the possibility that Michigan's more comprehensive economic development strategy plays a role by investigating only the impact of RTW on manufacturing, which a vital part of the economy in both states. Organized labor has historically been more important in manufacturing, and RTW may disproportionately impact the location of manufacturing plants owing to the importance of labor costs. At the same time, manufacturers can increasingly turn to automation to replace high labor costs, and they are particularly likely to do so where labor costs are high. On balance, then, it is an open question whether relaxing labor laws is enough to persuade manufacturing firms to invest.

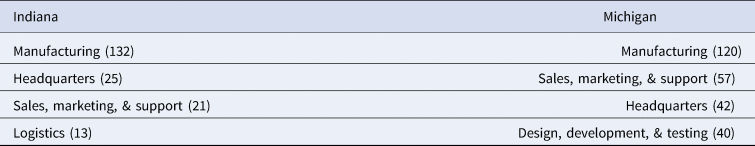

Interestingly, the composition of greenfield projects differs somewhat across the two states. Indiana's greenfield investment is much more concentrated in manufacturing, exceeding 60 percent of the projects after RTW was enacted. Michigan has a significant amount of manufacturing as well, but only 40 percent of its projects are focused on manufacturing in that same period. Table 3 shows most frequent activities by the number of projects in each state after the implementation of RTW.

Table 3. Greenfield Projects by Top Activity (# Projects)

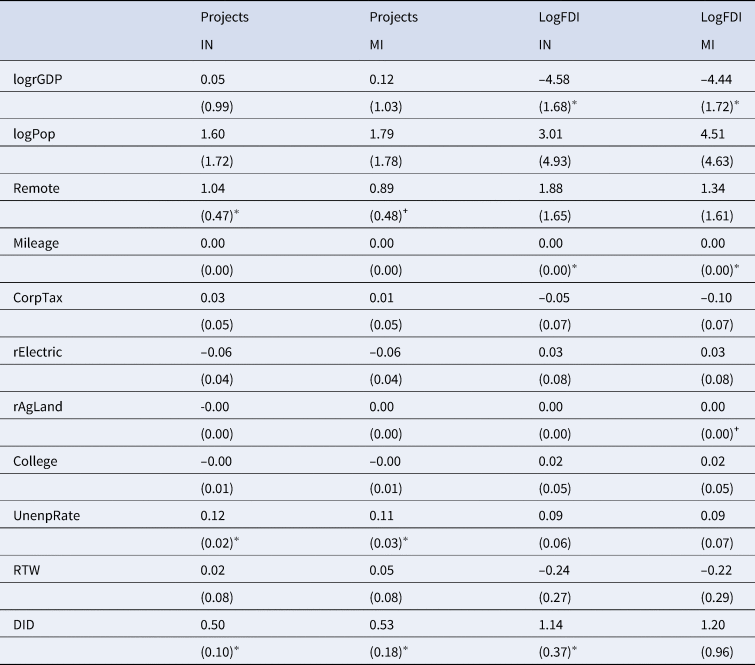

To investigate the subsample of only manufacturing projects, we recompile our data from fDi markets and reestimate our results.Footnote 15 The new estimates appear in table 4, and they differ in interesting ways from our initial results. Michigan again appears to attract more Projects, but not more capital expenditure (FDI). Importantly, Indiana now appears to gain both Projects and FDI after RTW. In other words, even as Indiana did not gain new investments relative to all greenfield projects, it does appear to gain manufacturing projects relative to its non-RTW peers. This set of estimations provides our strongest result showing that Indiana did generate some gains with their adoption of RTW. Michigan's failure to register gains in manufacturing investment flows is a bit surprising, but it provides insight into the overall pattern of investment across the two states. These results provide important qualifications of our earlier results, suggesting that even in a rich economy where labor is relatively expensive, foreign manufacturers are more sensitive to labor conditions than nonmanufacturing firms.

Table 4. Using Only Manufacturing

SEs in parentheses; constant estimate omitted; N = 406.

+p < 0.10; ∗ p < 0.05.

Relative to their non-RTW peers, both Indiana and Michigan appear to gain manufacturing projects in the years after RTW. But Indiana's gains from RTW stop there, while Michigan's are broader. Table 3 shows that Michigan's greenfield investments focused not just on manufacturing but also on the service-sector activities that we would expect to locate in more advanced economies during this period. Those include sales, marketing, and support, as well as design, development, and testing. Indiana received some projects focused on sales, marketing, and support services as well, but only about one-third as many as Michigan. Indiana received only one-fourth the number of projects (10) focused on design, development, and testing. On the whole, then, Michigan's ability to attract a broader array of projects distinguishes it from Indiana and is responsible for our initial results showing the broader gains from Michigan's implementation of RTW, and possibly the other policy changes that it enacted around the same time.

Overall, our results, particularly the positive effect of RTW on Projects in Michigan, prove relatively stable across different model specifications. Michigan gets more projects overall with or without a lagged dependent variable, and even when we standardize the projects variable as share of overall American greenfield projects. Michigan gets more manufacturing projects after RTW as well.

In contrast, RTW provides Indiana with increased projects and investment when we focus only on manufacturing firms. That result necessarily qualifies our initial findings that RTW brought no economic gains to Indiana, but most of our estimations show no additional investments in Indiana beyond what was expected given trends in other non-RTW states. We infer that RTW seems to increase manufacturing employment as expected, but that it is not enough to invigorate nonmanufacturing FDI.

Conclusion

Does reducing protection for organized labor attract more foreign investment? We contribute to this literature with new data and methods that investigate the impact of changes in labor laws in Indiana and Michigan. Overall, our results show that RTW status is no silver bullet for attracting new investments across many sectors. Relative to FDI trends in non-RTW states, Indiana saw no improvement in overall FDI, whether measured in terms of projects or capital expenditure. In contrast, Michigan's received a higher number of projects started by foreign investors, and in some models, more capital expenditure as well.Footnote 16 We explore differences in economic development programs and in the origination of the RTW laws in each state but find no definitive explanations for the different impacts of RTW in two states.

When examining only new investments in manufacturing, however, we find evidence that both states received a higher than expected number of projects, and that Indiana also received an unexpectedly high amount of capital expenditure. We thus infer that foreign manufacturers seem particularly focused on RTW relative to foreign investors in other activities. Those gains also appear to be relatively important in magnitude—often between 30 percent and 50 percent more projects than would have been expected. We are surprised at these results due to the segmenting of supply chains, increasing competition for labor internationally, and the rise of automation. To the extent that states want solely to boost manufacturing projects, RTW may help. Of course, many states are now more interested in attracting high-tech and service jobs rather than manufacturing. Michigan has clearly done better in attracting foreign investors outside manufacturing, including in service-sector activities that we would expect to locate in markets for final products.

Our research cannot address why Indiana's gains appear limited to manufacturing, or why Michigan's gains appear to be more broad-based. Our estimations control for time-invariant characteristics and for common time trends, so time-varying differences across the two states must be driving the results. As our article shows, RTW laws impacted two comparable states in different ways. Future research should investigate the role of spending on economic development initiatives and perhaps broader philosophical differences in economic development as the most promising alternative explanations. Other policy changes that Michigan implemented around the same time as RTW may also explain why foreign firms of all stripes chose to locate there in increasing numbers.