Currency is the fundamental economic technology that makes promises credible among actors within and across societies. This has been the defining feature that unifies highly different types of currencies that have emerged through human history. Ranging from shells to various metals, and eventually to today's paper currencies, money has taken a wide variety of physical forms.Footnote 1 Each of these incarnations of money has evolved to meet changing human needs surrounding the core functions of currencies. In this respect, currencies are not only instruments that facilitate economic activity but also currency is a technology of money that makes commitments between actors credible. As the technological capabilities of society evolve, and as social needs regarding the insurance of promises among actors change, the technology of money changes accordingly.

The twenty-first century is witnessing another evolution in the technology of money: digital currencies. While Bitcoin remains the most well-known case of digital currencies disrupting traditional economic and political relations, it is far from the most significant advancement in this area. Indeed, digital currency development dates back over a decade prior to Bitcoin's launch and is premised in the same forces which have shaped the evolution of money over time: economic inefficiencies and political power structures. As I argue in greater length in the following text, whereas much research approaches digital currencies as motivated strictly by inefficiencies, this evolution in the technology of money cannot be wholly understood without concurrent attention to both the preexisting power relations among actors in economic arenas and the implications of digital currency design choices for power relations among traditional and new actors in economies.

While digital currencies constitute a familiar intersection of economics and politics, political economy scholarship has not yet rigorously engaged with the full ecosystem of digital currencies. Although this is due in part to the early focus on economic inefficiencies, I argue that the importance of power relations to digital currency development implicates political economy theory in this area. Further, I argue that political economy can better engage with this space with attention to three key variables of digital currency design that most directly affect power relations among actors they involve: value backing, supply mechanism, and ledger technology. In attending to these three key variables, I argue that political economy can begin to more systematically analyze the importance of digital currencies to power structures in economic relations. In this respect, I explore three key areas of research where digital currency developments most clearly intersect with existing political economy scholarship: corporate governance, banking regulation, and sanctions.

The article proceeds in the following sections. I first offer a brief review of other examples in the evolution of monetary technology to show the importance of both economic inefficiency and power relations in economic arenas as they guide the development of new forms of currencies. Here, inefficiencies refer to the limitations that a given technology of money imposes on that currency's ability to meet the theoretical roles of money, especially at scale. Drawing on this two-factor framework for understanding power in the evolution of money, I explore three crucial points of variation in digital currencies cited in the preceding text, first by exploring the choices available in digital currency design and subsequently by discussing their importance to political economy in particular. I then conclude the article with a proposed research agenda for the digital currencies in political economy, including the three key substantive issues previously mentioned. In each subsection, I discuss how digital currencies stand to affect power in economic relations associated with each topic and identify questions for future research to understand these developments.

Currency, Technology, and Power

Currencies, as the technology of money, have historically evolved to meet the changing needs of human society. In the process, the natural and intentional features of currencies that make promises credible in monetary relations have favored the preferences of some actors in society over others. The history of money shows that these intersecting roles in economic efficiency and political power relations are a salient issue that influences both the design of currency and the social structures in which currencies are embedded. The historical record strongly suggests that currencies are not only instruments designed to make economic relations more efficient but also that the technological design of currencies is a focal point for power struggles within and across economies. Simply, the intersection of money and power cannot be understood without attention to their coevolution with the technology of money, in the form of currencies, over time.

On one hand, we have seen the technology of money evolve to address chronic social issues that make promises either less credible than are demanded among economic actors, or issues that make such credibility more costly. A first and obvious example here is the general consensus among historians that money evolved in the form of currencies to correct the inefficiencies of markets which relied on barter for exchange.Footnote 2 While this common example makes clear the value of money in ensuring credibility of market prices, it fails to capture the ways in which currencies have evolved as technology of money since then to better insure promises among actors in society. As such, we may consider more recent examples of how the technology of money has evolved to address chronic social, political, and economic inefficiencies of previous currencies.

One salient example is early cases of government coins, which were motivated in part to address the inefficiencies of private market currencies that flourished in unconsolidated monetary economies. An especially interesting example can be found in the transition from commodity currencies to precious metals, and eventually to government coins in the early colonial US economy.Footnote 3 Another example is the transition from metal coins to paper “IOU's” among governments and economic actors. These arose in China to address inefficiencies in the greater scarcity of currency metals than the desired scarcity of currency,Footnote 4 and in the West to manage the liquidity squeezes of trans-Atlantic trade as this became the primary business for mercantilists.Footnote 5 In each of these cases, new technologies of money have been either naturally or intentionally designed improvements on the inefficiency of preceding currencies, and have in each case transitioned to a design that better insures promises among actors in and across economies.

On the other hand, the technology of money does not evolve in a vacuum. Rather, as the needs of society evolve to demand different physical forms of money, these decisions around updating the design of currencies have historically been nested in social power structures. In this respect, power asymmetries within and across societies have an undeniable influence over new monetary designs. In this case, we see clear interlinkages through history between power and currency design that suggest a need for attention not only to social, political, and economic inefficiencies that create demand for change but also the various power structures that shape this change in currencies.

One early example here can be found in preindependence India, where cowrie shells served most, if not all, major functions of money in the economy.Footnote 6 The use of these shells as an instrument of credible money dates back to the Neolithic era per archaeological records,Footnote 7 and lasted well into the slave trades of more recent human history.Footnote 8 However, the East India Trading Company began systematically rejecting the use of cowrie currencies for official trade and taxation under direction of the British Crown. This is cited as a major cause of the Patnaik Rebellion in 1817 India, which was the first armed movement in Indian independence.Footnote 9 More recently, we see power structures intersect with changes to the technology of money, as in the case of credit cards, whose role in the United States was not only a hard-won result of lobbying by the financial sectorFootnote 10 but that has also slowly transitioned the authority of money supply from governments and to private actors.Footnote 11

Indeed, history has not yet ended for the coevolution of power and currencies. In line with the preceding examples, the advent of digital currencies stands as a familiar dynamic of evolving monetary technology. In this respect, we cannot understand the politics of today's digital currency revolution without attention to the two factors outlined: technology addressing inefficiency and power structures shaping how these issues are addressed in currency design. However, while I argue that the digital currency revolution can be understood through a similar framework of evolution in the technology of money, digital currencies inhabit a unique context on the global stage that implies a unique set of causal factors driving this process. Specifically, we cannot understand the core technical feature that triggered the digital currency revolution—blockchain—without attention to the chronic economic and political tensions its application in cryptocurrency sought to address. Similarly, we cannot understand the design of digital currencies or their economic implications without attention to the power struggles emerging around different kinds of digital currencies.

There is a rich history of work toward digital currencies in decades before 2008 that serves as necessary antecedent to political economy scholarship on this topic, and that lays bare the longer history of economic inefficiencies that digital currency efforts sought to address in society.Footnote 12 As early as 1983, “blind signature” payments were being developed to address chronic economic issues like limited auditing capabilities among governments.Footnote 13 By 1996, legal scholars had worked to outline the contours of an “anonymous electronic cash,”Footnote 14 and computer scientists worked to find security issues associated with these systems, in efforts to make peer-to-peer and large-scale transactions more efficient than traditional payments.Footnote 15 However, these early technical designs all worked from a common assumption of a central intermediary like a traditional retail or central bank. The technical implications of centrally coordinating and validating electronic transactions at scale posed too large an issue for these proposals to be realized.Footnote 16

The emergence of Bitcoin and other cryptocurrencies is better understood in this historical context. Bitcoin's pointed proposal to build an economic world without intermediaries, especially central banks,Footnote 17 was not only a social reaction to the global financial crisis but was also its key technical promise in overcoming previous obstacles to digital cash. In this way, Bitcoin's white paper served as a proof-of-concept for the potential of decentralized digital currency and leveraged a moment of popular discontent with centralized monetary authority to gain traction. Here we see early support for the two-factor framework around the technology of money applied to digital currency development: the intersection of a breakdown in social structures that triggered a widespread economic crisis, and the application of expert knowledge in the form of blockchain to build a system that would disrupt those prior power structures.

However, in leveraging this political context to gain salience as the first actualized cryptocurrency, Bitcoin functionally created a market space for digital currencies. This space was rapidly populated by hundreds of “altcoins,” or alternative cryptocurrencies, in the years after Bitcoin's launch.Footnote 18 While virtually all these altcoins retained the decentralized approach of Bitcoin, they varied widely in their application of blockchain technology—and in many cases explicitly altered the logic of how this technology ensured the security of the currency network—to achieve different social and economic goals through these digital currency projects. This is due to the fact that blockchain technology is not specific to digital currencies; rather it is a multisectoral application of expert knowledge that can be applied to a wide array of social and economic relations to render those relations more efficient.Footnote 19 Conversely, and as explored in more detail in the text that follows, digital currencies are multitechnological and multiplatformed instruments, implying a dynamic and only partial intersection between these currencies and blockchain technology.Footnote 20

The early research in political science and economics that has explored the cryptocurrency space beyond Bitcoin demonstrates clearly that the design of these alternative digital currencies is directly affected by power structures in how they address specific economic inefficiencies. Across the ecosystem of altcoins, we see clear relationships between technical design and efficiency improvements within the digital currency economy, especially in the different variations on blockchain consensus protocols such as proof of work or stake, or in newer developments like layer 2 protocols to improve the efficiency of existing blockchain networks.Footnote 21 As explored in important early social science research on the cryptocurrency ecosystem, though, there are explicit relationships between power structures and the design of these alternative digital currencies over time. Here, we see linkages with traditional issues in political economy, ranging from the role of digital currencies in international money laundering efforts,Footnote 22 to broadening global financial inclusion.Footnote 23 Importantly, much of this work highlights the ways in which variation along digital currency design produces different intrinsic governance capabilities or regulatory demands.Footnote 24

These developments extend far beyond the case of decentralized digital currencies like Bitcoin. Not long after the rise of early cryptocurrencies, companies across the world began accepting Bitcoin and other cryptocurrencies for transactions,Footnote 25 which raised the profile of these instruments as they became further integrated in the global economy. However, other firms strategically co-opted the technical logic of cryptocurrencies like Bitcoin to build a new type of instrument: initial coin offerings (ICOs). These digital currencies, often built on the blockchain of another cryptocurrency like Ethereum, allow a firm to offer digital coins in lieu of stocks to raise money. Most often, these do not offer ownership in the firm, and rather allow buyers to profit from the firm's success and use those coins for products or services.Footnote 26 Quite often, these ICOs were more centrally managed by an issuing firm, acting more as “tokens” than the designs found among Bitcoin and altcoins. Furthermore, ICOs are designed to be pinned to firm value, unlike the value of Bitcoin and altcoins, which is a function of blockchain consensus. In these features of ICOs—which are technically distinct from cryptocurrencies in a number of ways—we see an efficiency gain in scaling blockchain ledgers for programmable private money, and the effects of prior power structures in the form of firms subverting existing regulations around corporate fundraising.

Importantly, we have also seen efficiency concerns driving demand, and power relationships shaping supply, for digital currency technology in the realm of fiat currencies as well. First, firms in the private digital currency sector produced a new class of instruments called “stablecoins,” which, by design, maintain a stable price relationship to specific targets, like gold or the US dollar.Footnote 27 Unlike Bitcoin, which has an algorithmically limited total supply of digital tokens over time, these instruments maintained value through dynamic supply algorithms, or actual asset holdings by firms.Footnote 28 Building on the stability that stablecoins offered, individuals and firms further began creating a richer market environment for digital currency transactions based on blockchains, known today as “decentralized finance.”Footnote 29 Here, the relationship between efficiency gains and power structures may be most explicit. Stablecoins and decentralized finance respectively serve as efficient substitutes for fiat currency and traditional financial markets. Indeed, there is evidence that governments’ warnings and bans around these instruments have been not only reactions toFootnote 30 but also drivers of innovation in newer implementations of those technologies.Footnote 31

Perhaps most importantly, though, regulators have also played an active role in shaping the digital currency ecosystem beyond their voiced concerns for early versions of this technology. Most saliently, central banks across the world are fielding pilots into sovereign digital currencies, better known as central bank digital currencies (CBDCs). While China's pilot is among the best-known CBDC initiatives, recent surveys by the Bank for International Settlements suggest that well more than 70 percent of responding central banks are actively engaged with research on their own CBDC,Footnote 32 and that this number has grown significantly in the last two years.Footnote 33 This development has raised a litany of theoretical and practical questions, such as how CBDCs would intersect with traditional fiat currency and the infamous monetary policy trilemma;Footnote 34 the impact CBDCs would have on private banks and other financial intermediaries;Footnote 35 and the myriad considerations of CBDC design that would affect these questions.Footnote 36 However, there is again evidence here for the framework of monetary technology identified throughout this section. While governments are reacting to significant inefficiencies like financial exclusion and declining cash usage, they are also actively motivated both by the substitutionary effects of other digital currencies against fiat, and in pursuing opportunities to shape global power by subverting sanctions, for example.Footnote 37 Notably, many of these countries are already relying on cryptocurrency blockchains to subvert sanctions while developing CBDC projects to achieve this goal more effectively.

Broadly, across decentralized, firm-produced, and government-produced digital currencies, we see an important combination of factors linking monetary technology to political economy. Whereas the design of monetary technology in digital currencies can be understood in part as a classic example of technology addressing inefficiencies in economic relations, this approach is alone insufficient to understand the evolution of digital currencies over time. Rather, to understand the emergence of different kinds of digital currencies and why they vary so significantly in designs, we must also observe the power structures that both drive and are affected by changes to this technology of money. With this conceptual framework, it becomes possible to more deeply study the ways in which digital currencies both disrupt and are shaped by phenomena of interest to our field, with examples like corporate governance, banks and payments, and government sanctions. However, to do so, we must first identify and organize features of digital currencies that are most implicated in power relationships in domains where these instruments are designed.

Political Dimensions of Digital Currency Design

Diversity among digital currencies offers analytical leverage for research, but only if this diversity can be meaningfully organized. A proper dissection of digital currencies unveils arguably hundreds of ways in which they may be categorically distinguished, largely along technical features like algorithmic design and related hardware demands. However, I argue that there are three design features of digital currencies that matter most directly for political economists: value backing, supply mechanism, and ledger technology. These each shape how technology of digital currencies makes promises credible among actors by introducing variation in the commodification or centralization of claims that give digital currencies value, the agency or automation behind digital currency supply, and authority structures imbued by ledger systems underlying a digital currency.

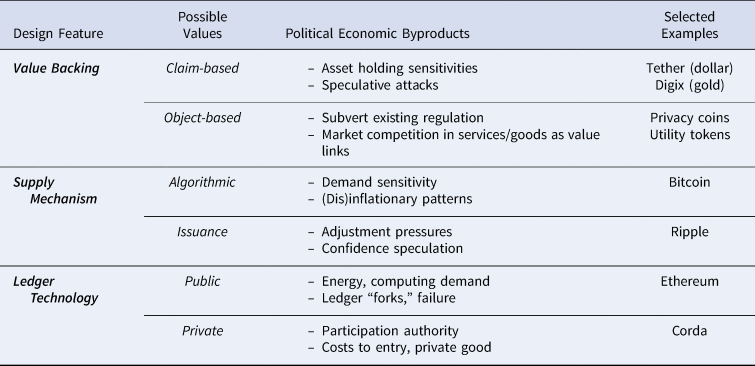

In this section, I briefly detail the observable variation in each of these dimensions of digital currency design with attention to the different instantiations of digital currencies today. I explore not only the different outcomes exhibited digital currency design across each of these dimensions but also discuss how these each intersect meaningfully with power relations that are salient to a political economy. The section concludes with a table summarizing these three dimensions, the variation in possible values across each, implications for political economy, and nonexhaustive lists of select examples of digital currencies that exhibit outcomes across each dimension.

Value Backing

What is the real value in a digital currency? For political economists, this remains a critical dimension in studying the newest incarnation of monetary technology given the roles that digital currencies have taken in economic relations. The answer to this question based on common narratives of digital currencies remains unsatisfying: that market value is in most cases a speculative bubble. However, while this may be true for Bitcoin, observers have noted that this is due more to the idiosyncrasy of its near-certain supply, which has left it to operate more as a commodity than a currency.Footnote 38 Notably, this is not the only model of digital currency value backing.

Functionally, there are two ways in which digital currencies produce value. The first, a more traditional logic of value backing, is claim-based; some digital currencies are backed by specific volumes of assets, fiat currencies, or in some cases, other digital currencies. Stablecoins serve as a helpful example of claim-based digital currencies. These are explicitly designed to maintain a fixed value against another economic object, such as the US dollar with Tether, and achieve this most often by holding the target asset for claims made against the stablecoin.Footnote 39 Other examples include digital currencies backed with gold; Digix, for example, maintains a one-token value pinned to LBMA gold, which is held in a secure vault in Singapore and can be redeemed for the digital currency.Footnote 40 Claim-based digital currencies incur traditional social and legal vulnerabilities of other claim-based instruments; for example, this leaves room for speculative attacks on a claim-based digital currency like those made against currencies with pegged exchange rates.Footnote 41

The second type of value backing among digital currencies is object-based, where the value of a digital currency comes from the value of its use, rather than by a claim to another instrument. Bitcoin proponents argue that it is more durable, secure, and predictable in supply than other stores of value like gold or fiat.Footnote 42 Furthermore, Bitcoin enjoys a unique following that has buoyed its speculative value in traditional and cryptocurrency markets; it is this dimension that typically leads onlookers to label it a market bubble.Footnote 43 However, there are many other cases of object-based digital currency value beyond Bitcoin. Some digital currencies build value on the privacy of their transactions; these are often called “privacy coins” and are known for relying on zero-knowledge proof encryption.Footnote 44 Other object-based digital currencies derive value from services that operate on their blockchains. Golem, for example, facilitates shared rental of computing power across token holders, producing value in the tokens that reflects the value of access to Golem's network.Footnote 45

Currencies’ value mechanisms have direct implications for both economic and political outcomes. Economically, we see familiar relationships between differences in value backing and capacity for market manipulation. On one hand, claim-based digital currencies recreate traditional tensions associated with pegged fiat currencies. Specifically, not unlike George Soros's 1992 attack on the British pound, the peg of a digital currency price to some asset allows for speculative short-selling that can distort digital currency markets and incur losses among issuers and holders. A similar attack occurred as recently as 2018 on a US-dollar-backed stablecoin, Tether, through large-volume sales of the stablecoin for Bitcoin.Footnote 46 Conversely, object-based cryptocurrencies both affect and are affected by regulations and markets around their price links. For example, privacy coins build cryptocurrency value through subversion of regulatory oversight, which challenges financial agencies to broaden enforcement to this domain.Footnote 47 The economic implications of differences in digital currency value backing recreate familiar power struggles in economic activity.

In each of these cases, the economic byproducts of differences in digital currency value backing open unique vectors of constraint and opportunity to economic actors, whose engagement with digital currencies pressures regulators to oversee and manage those byproducts. These distinct sets of political and economic byproducts help to explain the trajectory of governance around claim- and object-based digital currencies. Whereas the clear fit for claim-based digital currencies have found a natural home in the banking sector, and thus fallen in bank regulators’ domain,Footnote 48 object-based digital currencies have naturally proliferated in corporate fundraising, subject to securities law.Footnote 49 Perhaps most importantly, we see the edge of sovereignty already creating issues in value-backing decisions among states. While all central bank digital currency projects involve some logic of claim-based currency, even here we see initial tensions regarding the nature of claims—specifically with regard to the design of architectures that facilitate either familiar two-tiered structures of claims against retail and central banks, as compared to more radical hybrid and direct claim architectures that would substantially disrupt the intermediary power of retail banks.Footnote 50

Supply Mechanism

A second dimension of digital currency design that is important to political economy is the mechanism by which supply is managed. Fiat currency has functionally one supply mechanism; sovereign governments issue or destroy money in an economy through adjustment, which affects both confidence and liquidity of the currency. Some digital currencies exhibit this supply logic as well, as with many tokens or ICOs. In these cases, new units of digital currencies are “issued,” often through a smart contract on a blockchain network.Footnote 51 In other cases, units of digital currencies are considered “premined,” as with Ripple (XRP); issuance in these cases is a function of supply control, wherein the firm behind the cryptocurrency either buys or sells units to manage supply in circulation.Footnote 52 These issuance process mimic the traditional logic of fiat monetary issuance and adjustment and introduce similar governance issues. This design feature often yields digital currencies with stable pricing, but notably introduce vulnerabilities associated with centralized supply authority. Ripple (XRP), for example, is explicitly designed to offer rapid and low-cost cross-border transfers; it is for this reason important that the company that manages the cryptocurrency can strategically adjust the supply of this token in circulation to maintain parity for transfers.

Other digital currencies have algorithmic supply mechanisms. Unlike issuance, which relies on a central actor to oversee digital currency issuance, algorithmic supply is often a feature the protocol by which a digital currency's blockchain is maintained. In some cases, the algorithm underlying a digital currency's blockchain has a predictable rate of supply for the digital currency over time; Bitcoin, for example, has a total fixed supply of 21 million coins to be reached by approximately the year 2140.Footnote 53 Digital currencies with an algorithmically managed supply exhibit different patterns of use than those with manually managed supply. For example, these kinds of digital currencies do not have the advantage of supply adjustment to target prices; this means that their market value is significantly more sensitive to speculation. This helps to explain why some digital currencies with this feature are subject to volatile price swings and do not function well as a store of value. However, this also means that these digital currencies become useful instruments for trades in other digital currencies, as their supply against counterpart currencies is easily predicted.

Political economists are very familiar with the wide variety of power struggles that arise over supply issues in currencies. Indeed, the infamous trilemma of monetary policy implicates supply of fiat currency in other salient issues around exchange rate volatility and capital flows,Footnote 54 a policy issue that continues to plague political economic decisions today,Footnote 55 and remains a central focus of scholarship on the politics of currencies. Here, we see a clear credibility issue associated with supply issuance that is reminiscent of concerns that have survived decades, from hyperinflation of the post–World War II eraFootnote 56 to new critiques of modern monetary theory.Footnote 57 More specifically, the tradeoff between issuance and algorithmic supply mechanisms in digital currencies can be understood as a traditional concern around the credibility of currency supply and the choice between flexibility in price management, versus the credibility of tying one's hands. While we need look no further than scholarship around the Bretton Woods system to understand how this design choice was managed in fiat currency,Footnote 58 today's digital currencies involve much more diverse actors and instruments.

Digital currencies’ supply mechanisms directly affect their function as economic instruments, by constraining or empowering different strategies among actors with power over circulation. This has implications both for the inflationary or disinflationary tendencies of a digital currency, as a function of whether adjustment can occur and, if so, whether that can be centrally coordinated or emerges from patterns of exchange. In the classic case of Bitcoin's algorithmic supply, we see the digital currency creating strong competition with traditional assets that share this feature, like gold.Footnote 59 Conversely, we see supply issuance creating significant issues for organizations that create digital currencies, like the Ripple corporation XRP. As the organization is able to manage the supply of these tokens and operates as a legally registered company, the choices around issuing and destroying those tokens creates important intersections with securities laws, a tension that recently brough Ripple into a legal dispute with the US Securities and Exchange Commission.Footnote 60 As such, the credibility effects of supply mechanisms directly implicate digital currencies in traditional political economy issues around asset classes, intermediaries, and regulations.

Ledger Technology

Digital currencies rely on a virtual ledger of all transactions to verify the number of units in circulation and validate transitions of ownership. This is sometimes a particular class of digital ledger, a blockchain, that encrypts transaction data in a decentralized manner. While not all digital currencies operate on blockchain, many decentralized versions of those instruments rely on this mode of ledger encryption to remove trust from the equation of economic transactions; this was one of Bitcoin's central technical promises cited earlier.Footnote 61 Here, one key difference among digital currencies’ digital ledgers is whether they are publicly or privately accessed.

Public ledgers are permissionless; anyone can join the network, making it both more transparent and less private. In turn, the computational demands of a public ledger are high, given the number of participants and decentralized responsibility for ledger management.Footnote 62 Bitcoin is an example of a digital currency with a public ledger, as is Ethereum, which is one explanation for their rapid adoption uptake as there are no barriers to entry. However, this design comes with a number of costs and byproducts. A primary effect is the increased likelihood of technical failure, known as “forks” in the ledger, wherein a single blockchain ledger splits into several distinct branches.Footnote 63 This has happened on the Bitcoin ledger due to miners’ incentives to break the consensus structure of mining protocols.Footnote 64 Because public ledgers rely on many end-users to validate transactions, their vulnerabilities are also decentralized. While this affords a number of instrumental benefits, such as scaling a digital currency across borders without centralized coordination, it creates large-scale collective action problems among actors on the ledger that can be difficult to centrally address.

Private ledgers restrict access to a set of preapproved participants. Where consensus is achieved on public ledgers through decentralized transaction validation, private ledgers rely more often on “leader-based consensus,” where network leader has authority to approve edits on the blockchain.Footnote 65 As a result, private ledgers require trust among network users and serve distinct purposes to public ledgers. Though private ledgers are more immune to collective action problems associated with public ledgers, these private alternatives imbue a greater hierarchy of authority on a blockchain and, by extension, create risk asymmetries. In these cases, blockchain vulnerabilities are more centralized in a specific node or set of nodes on the network, creating a clear target for attacks on a digital currency. Furthermore, because of the centralized computing demands of private ledgers, these digital currencies are more frequently operated by organizations or firms, as in the case of ZCash, a privacy coin that pitches itself as a “privacy-protecting” alternative to Bitcoin.

The design of ledger technology implicates digital currencies again in familiar issues of political economy; in this case, ledger technology raises concerns around whether a digital currency's network is a public or private good. The issue of governing public and private goods has a long history in political economy scholarship,Footnote 66 and differences in this feature of currencies matters significantly for digital currencies’ disruptive potential and related regulatory outcomes. Whether a digital currency ledger is public or private has clear implications for its role in economic relations and reception by regulators. The public or private design of a digital currency dictates the location of collective action problems associated with technical management and regulatory oversight. In public ledgers, responsibility for technical management is dispersed among a large number of end users, producing unique emergent governance processes.Footnote 67 Conversely, private ledgers have a more centralized responsibility structure, typically housed by an organization; this skews the cost of technical management and centers it disproportionately on one organization or set of actors.

This difference helps to explain distinct patterns of regulatory response to digital currencies. Public ledgers have a larger number of actors to oversee, yielding blunt bans and warnings given the absence of a centralized target of regulatory response, whereas private ledgers can see specific governance responses given responsibility centralization. The difference in ledger technology can also be understood as a strategic decision based in power structures, rather than only as a mediator in the expression of power over digital currencies. Here we see the infamous choice of public ledgers for Bitcoin as part and parcel of the initiative to disintermediate money and finance,Footnote 68 where we see traditional actors in the financial sector leveraging private ledger technologies to facilitate their own technological improvements as a counterforce against these rising challenges.Footnote 69 Again, we see evidence that the choices in digital currency ledger technology are both byproducts of power structures and causes of change in power structures around these currencies.

Summary of Political Design Features

In this section, I have argued that three design features of digital currencies create salient points of political tension: value backing, supply mechanisms, and ledger technology. In each case, I argue that while the technical dimensions of their variation in digital currencies may be substantively new, the political struggles surrounding those design features are familiar to political economists.

By extension, I argue that these features of digital currencies will be a central focus in future scholarship that addresses the political economy of digital currencies across different sectors and countries. In table 1, I briefly summarize these three design features of digital currencies, including the possible values realized in each design feature, the byproducts associated with design features, and selected examples of digital currencies that exhibit that design feature. While the byproducts and digital currencies are here illustrative examples for each design feature, they are by no means exhaustive lists, nor the only points of difference among digital currencies that exist today.

Table 1: Summary of Political Design Features in Digital Currencies.

Research Agenda: Political Economy and Digital Currencies

In the preceding sections, I have argued that currency, as a technology of money, has a long history of technical evolution that is driven both by economic and political considerations. In line with earlier examples like shells, metals, and paper money, today's transition to digital currencies at decentralized, private, and government levels constitutes a new iteration in how the technology of money has evolved. While the framework for understanding today's evolution of money can be drawn from earlier examples, I argue that we cannot understand the politics of digital currencies today without attention to three unique features of digital currencies that are imbued in power relations: value backing, supply mechanisms, and ledger technology. I have argued that choices in these features of digital currencies are not only made to improve economic efficiency but are also influenced by prior power structures and have implications for power in the future digital economy.

A concluding byproduct of this framework and typology of political design features in digital currencies is the need for a research agenda in the political economy of these instruments. In this section, I briefly explore three areas of research that matter to political economists in the domain of digital currencies. These include firms and corporate governance, banks and financial markets, and governments and international sanctions. In each of these concluding subsections, I detail existing areas of political economy scholarship whose theoretical explanations of power relations in each of these economic arenas is affected by design features of new digital currencies. I lay out the ways in which these existing approaches are challenged by the advent of new digital currency designs, and the avenues of future research necessary to improve political economy scholarship in these areas with explicit attention to the efficiency and power dynamics of digital currency design.

Firms, Corporate Governance, and Supply Mechanisms

Firms vary in the logic behind their profit maximization efforts and, by extension, firms allocate resources differently in accordance with these priorities. The power relations that produce and accompany these incentive structures are a key component of a rich line of scholarship on the issue of corporate governance in political economy. This line of research, initially preoccupied with comparative assessments of cross-national patterns in corporate governance, has more recently turned to study the varying ways in which firms produce value for their respective share- and stakeholders in the economy.Footnote 70 Importantly, we see attention to the dynamics of decision making within firms that creates variation in profit-seeking behavior, investment, and both market and nonmarket strategies.Footnote 71 In these primary issue areas of corporate governance research, advances in digital currencies have direct implications for political economy scholarship on this topic.

Specifically, we see digital currency technology shifting dynamics of capital allocation among traditional firms. While salient news stories might direct attention on this issue to the question of specific companies, like Tesla, buying Bitcoin with their reserves,Footnote 72 this dynamic raises a broader question about corporate finance, investment, and shareholder value. Namely: How does the advent of private digital currencies that operate as assets change investment decisions among traditional firms? Here, we see the supply mechanisms of some decentralized digital technologies, like Bitcoin, guiding decisions as a function of deflationary price effects from algorithmically limited supply. Furthermore, this is not a strictly instrumental consideration of how algorithmic supply mechanisms shift firm incentives; we also see digital currencies with issued supply, like Ethereum and Ripple, attracting investment attention from traditional firms for the applications that this supply mechanism produces alongside differences in value backing and ledger technology.Footnote 73

This disruption through change to value backing has created an important shift in how firms raise capital. Beyond the immediate topic of regulatory challenges associated with firm investments in private and decentralized digital currencies, there remain a wide array of questions for scholars of corporate governance. What are the firm- and market-level dynamics shaping the choice to invest in digital currencies—and how firms select different digital currencies to invest in—and what regulatory landscapes favor or disadvantage either strategy in this new context? How do traditional drivers of corporate financial decisions—such as board composition—affect dynamics around investing in different digital currencies? Broadly, the advent of new corporate financing opportunities that leverage a change in supply mechanisms among digital currencies pose interesting new questions for political economy research on corporate governance and finance.

Banks, Financial Payments, and Value Backing

Banks have preferences for stable currencies and both economic and regulatory infrastructure that permits near-real-time payments, limiting pairwise value fluctuations in transactions. In a political economy, there is a long line of scholarship on how banks have not only worked to secure these conditions through their own private governance initiatives but also extensive evidence on the myriad ways in which banks leverage social connections,Footnote 74 market clout,Footnote 75 and their international positioningFootnote 76 to extract regulatory outcomes suiting their interests. Today's transition to digital currencies raises important regulatory issues for banks, and private advocacy has already begun.

Here, we see stablecoins playing a growing role among banks and financial markets. As discussed earlier, stablecoins provide an important change in banking relations due largely to their role in real-time payment settlement, a critical component of financial markets. Indeed, there is already a burgeoning literature on the economic mechanics that make these instruments technological improvements upon private versions of fiat money.Footnote 77 However, there is not yet research on banks’ preferences for stablecoin design and regulation. This stands in stark contrast with the already unfolding regulatory infrastructure for stablecoins, with salient news events like the US Office of the Comptroller of the Currency allowing banks to use stablecoins in payment activities.Footnote 78 Perhaps more important are the current deliberations at the International Monetary Fund's Financial Stability Board regarding an international regime for stablecoin definitions and rules, which are open for comment by private actors; a large majority of comments have come in from private banks already.Footnote 79

In this respect, the political economy faces a rich diversity of regulatory issues around stablecoins. Here, we again see political design features of these digital currencies playing an important role in the unfolding political conflict and still unresolved regulatory responses. In this case, stablecoins leverage a combination of new value backing—often in the form of algorithmically balanced prices—and ledger technology to improve on the previous technology of payment instruments. These design features are not only means to improve efficiency of payment technology but also stand a potential challenges to the privileges enjoyed by banking intermediaries. Why do some banks support stablecoin legalization while others do not, and what explains differences in preferences for more or less controlling stablecoin regulation? How do new financial actors achieve their own interests in the regulation of stablecoins, and how does technical expertise in digital currencies affect—if at all—traditional processes of bank lobbying and private governance? In what ways are stablecoins liable to change structural patterns in domestic and global financial power, and how are these outcomes mediated by regulatory responses within and across states? These questions fall squarely in the purview of political economy and stand as important lines of future research.

Governments, International Sanctions, and Ledger Technology

Governments derive extraordinary levels of nonviolent power through their fiat currencies.Footnote 80 The primary mechanism by which governments exercise economic power to achieve geopolitical goals today is through sanctions. While the public-facing mechanism of sanctions is the simple declaration that a country, or group of people within a country, may no longer engage in the same economic activity as they previously could, the underlying mechanism of sanctions is directly related to the design of government money. Specifically, especially in the case of today's targeted financial sanctions,Footnote 81 these exercises of power operate through a large global network called the Society for Worldwide Interbank Financial Telecommunications (SWIFT). This network operates as a functional “blacklist” in sanctions by denying sanctioned actors participation in financial networks, and because SWIFT oversees a majority of global financial flows, this is an extremely effective instrument for countries seeking to achieve political goals through economic sanctions.Footnote 82

The effectiveness of sanctions is directly challenged by central bank digital currencies. This is not a strict challenge resulting explicitly from the transition to digital fiat currency, but rather a conditional challenge resulting from the possible design choices available in CBDC projects. Specifically, because CBDCs can be designed with either built-in or accompanying cross-border clearance mechanisms, those mechanisms can be designed in ways which render SWIFT obsolete.Footnote 83 This is primarily due to the ways in which CBDCs vary from traditional government currencies, namely in programmable interoperability through permissioned digital ledger systems. Whereas today's digital ledger for global financial flows, SWIFT, privileges some countries over others as a function of asymmetrical control over a static ledger technology, new CBDC ledgers stand to decentralize this authority and undermine a critical tool for nonviolent interstate power.

Why do some countries leverage this technological opportunity to challenge the sanctions status quo, whereas other countries with a history of being sanctioned are not? What are the implications of states’ choices in pursuing more or less radical technical designs for CBDC ledgers and payment mechanisms for interstate alliances and economic relationships, and how do states’ early choices affect the longer-term struggle over consensual global norms for technical interoperability? How might governments begin to coordinate to produce consensual standards for CBDCs and sanctions, and what form might this coordination take in a multilateral, regional, or bilateral manner? These, and other related questions in the domain of government money and sanctions power, stand as possibly the most significant disruption to traditional interstate relations resulting from digital currencies, and in this respect will be a central focus for scholars of sanctions enforcement as the population of countries pursuing these projects increases over time.

Conclusion: Toward a Political Economy of Digital Currencies

Digital currencies are part and parcel of the long history in money's evolution over time, and as such are subject to the same driving forces of efficiency demands and power mediation as earlier currency revolutions. In this way, the design of digital currencies is both an important outcome associated with variation in today's economic inefficiencies and power asymmetries, and as a causal factor for understanding changes to economic governance in increasingly digital sectors. Three particular design characteristics of digital currencies matter especially to scholars of political economy, including the value backing, supply mechanism, and ledger technology across these new instruments. Specifically, these three features help to both organize variation in digital currency designs across a wide variety of decentralized, private, and government-issued instruments and serve as a starting point for situating digital currencies in traditional topics of political economy.

Although digital currencies constitute a wide-ranging variety of technologies, this article seeks to organize these new instruments for sake of scholarship in political economy. In this respect, neither the technical features explored in the typology nor the specific locations of economic activity identified in the proposed research agenda are exhaustive lists. Rather, this organizational effort is among the first installations in a political economy of digital currencies, a line of work that will necessarily proliferate as the tensions associated with money's evolution continue to expand into public and international arenas. As such, future research must explore the ways in which new technical features, or existing features omitted from this typology, imbue power asymmetries into economic activity associated with digital currencies. Furthermore, there is naturally a need for much more detailed, substantively focused research on the specific mechanics by which each design feature (or all these design features) situates in existing, well-studied areas of political economy research.

Beyond the opportunities for expanded scholarship, this typology and research agenda for digital currencies in political economy open new important avenues of policy-focused work. Namely, because this nascent issue area remains predominantly guided by developments in the private sector and among individuals contributing to decentralized projects, the regulatory landscape around digital currencies remains largely sparse. The findings of political economy research on digital currencies in different areas of economic activity will offer important policy implications to decision makers who badly need expert-informed information on how to most effectively oversee the digital currency economy. The effect of today's power asymmetries on digital currency designs, and the implications of those designs for collective action problems among traditional and new actors in the economy, all stand as critical lines of inquiry with important policy implications.

As the world proceeds toward an increasingly digital economy, money will continue to evolve in response to changing social needs. Political economy specializes in assessing power relations among actors engaged in economic activity, and by extension offers a unique perspective to the study of digital currencies more broadly. To effectively incorporate this technology into the purview of our field, I have argued that we must understand digital currencies as an evolution in the technology of money, and that we can better study its role in society with attention to especially political design features of these instruments. No matter how the digital currency ecosystem and work in political economy proceeds, we can remain confident that the implications of this broader transition are profound and potentially highly disruptive to the world as we know it. In this way, we must see digital currencies for what they are: a much bigger issue than Bitcoin.