Introduction

Recent insights from the behavioural sciences have highlighted the importance of contextual rather than personal factors for producing and maintaining financial hardship (Gennetian & Shafir, Reference Gennetian and Shafir2015; Tiemeijer, Reference Tiemeijer2016; Curchin, Reference Curchin2017). For instance, application forms for financial support were found to be unnecessarily complex thereby reducing application rates and limiting opportunities for individuals to improve their situation (Bettinger et al., Reference Bettinger, Long, Oreopoulos and Sanbonmatsu2012). From this perspective, financial hardship is not just the result of individual deficiencies but also caused by social practices (Walker, Reference Walker2012; Walker et al., Reference Walker, Burton, Akhurst and Degirmencioglu2015). This motivated public servants from Rotterdam in the Netherlands to look for improvements in a municipal repayment letter that informed some Rotterdam residents about a debt and asked them to repay.

The letter concerned the repayment of unjustified welfare payments the debtors had received from the municipality, for instance when the municipality was informed too late about additional incomes so that welfare payments had not been reduced or stopped in time. As a consequence of having received welfare payment until shortly before the letter was sent, the debtors were assumed to experience financial scarcity. In fact, pre-experimental data showed that most debtors did not repay debts higher than 100 euro immediately and in full, plausibly because of liquidity constraints. Here, we report the field testing of the improved repayment letter.

Rationale for improving the repayment letter

In assuming that most debtors were bound by liquidity constraints (89% of debts were higher than 100 euro), the repayment letter was improved to increase the proportion of debtors that contacted the municipality after receiving the letter. Contacting was the first step towards agreeing with the municipality to repay the debt in the long run using monthly instalments. Contacting and agreeing on repayment by instalments also enabled debtors with other debt accounts of higher interest rates to prioritise repaying higher interest debts (Greenberg & Hershfield, Reference Greenberg and Hershfield2019), thereby reducing overall expenses. Hence, contacting enabled the municipality to receive the repayment in a socially responsible and non-intrusive way.

Insights from scarcity theory (Shah et al., Reference Shah, Mullainathan and Shafir2012; Mullainathan & Shafir, Reference Mullainathan and Shafir2013) informed improving the repayment letter. Scarcity theory describes the mental consequences of having too little of important resources, in this case financial resources. According to the theory, scarce financial resources lead to greater mental focus on monetary aspects (Shah et al., Reference Shah, Mullainathan and Shafir2012, Reference Shah, Shafir and Mullainathan2019). Having to pay back the debt is then more than just another task to complete; it is inducing complex financial trade-offs that demand extensive thought (Shah et al., Reference Shah, Shafir and Mullainathan2015). As a consequence, fewer cognitive resources are available for other dimensions (Zhao & Tomm, Reference Zhao, Tomm, Schmorrow and Fidopiastis2017), that is, to plan and conduct the repayment. Although there is convincing evidence for scarcity theory (e.g., de Bruijn & Antonides, Reference de Bruijn and Antonides2022), some studies reported difficulties with replicating this evidence (Camerer et al., Reference Camerer, Dreber, Holzmeister, Ho, Huber and Johannesson2018; Shah et al., Reference Shah, Shafir and Mullainathan2019). Nevertheless, we concluded that the cognitive demands originating from financial aspects and financial trade-offs implied in the letter should be minimised.

It can be illustrated that reducing cognitive demands extends beyond using more accessible language: individuals experiencing financial scarcity are more likely to use their financial situation to categorise themselves as poor, drawing an in-group and out-group distinction between themselves and their creditors (Akerlof & Kranton, Reference Akerlof and Kranton2000). This categorisation, in turn, increases cognitive demands to engage and interact with creditors (Vivian & Berkowitz, Reference Vivian and Berkowitz1992; Mewse et al., Reference Mewse, Lea and Wrapson2010) as perceived out-group membership negatively influences the willingness to cooperate (Tajfel & Turner, Reference Tajfel, Turner and Austin1979; Turner et al., Reference Turner, Hogg, Oakes, Reicher and Wetherell1987). Consequently, the letter could be improved by dissolving differences between debtors and creditors.

Adaptations

To minimise in- and out-group thinking, one of the adaptations to the letter was to stress togetherness and collaboration between debtors and creditors for finding a solution. An emphasis on collaboration can also lead to higher perceptions of procedural and interpersonal fairness which both increase motivations to cooperate (De Cremer et al., Reference De Cremer, Ouden and Tyler2005; De Cremer & Tyler, Reference De Cremer and Tyler2007).

Two additional adaptations served to improve opportunities to contact employees of the municipality. First, an email option was added for contact at any time of the day and with more anonymity (McFarland & Ployhart, Reference McFarland and Ployhart2015), and second, the generic telephone number of the municipality was replaced with the direct number of the responsible department. Debtors were assumed to expect better and more immediate help when talking to the departmental experts. In addition, action-related information was added, so that debtors knew when they could call and what information they needed at hand. Action-relevant information can reduce uncertainty and increase confidence in being able to perform the respective action improving the translation into actual behaviour (Armitage & Conner, Reference Armitage and Conner2001).

Three final adaptations aimed to improve readability of the letter. First, choice options were presented as bulleted lists rather than as running text to improve memorising (Jansen, Reference Jansen2015). Second, pictograms were added to improve comprehension of the letter (Levie & Lentz, Reference Levie and Lentz1982; Anglin et al., Reference Anglin, Vaez, Cunningham and Jonassen2004) and understanding of the letter's topic structure (Lorch, Reference Lorch1989; Lorch et al., Reference Lorch, Lorch and Inman1993). Third, a concrete deadline (e.g., ‘10 June’) was added to the relative deadline (‘in six weeks’) to free debtors from the need to pause reading for calculating the deadline or memorising to calculate it later, thereby allowing a more fluent reading experience. Task instructions that read more fluently were found to be associated with higher levels of estimated task easiness (Song & Schwarz, Reference Song and Schwarz2008), while lower levels of reading fluency have been associated with choice deferral (Novemsky et al., Reference Novemsky, Dhar, Schwarz and Simonson2007).

These adaptations rely on nudging techniques: small and seemingly irrelevant changes in how choices are presented to exploit behavioural automatisms such as biases, habits, and heuristics to programme behaviour (Thaler & Sunstein, Reference Thaler and Sunstein2008). Similar nudging techniques have been used before to improve tax payments (e.g., Hallsworth et al., Reference Hallsworth, List, Metcalfe and Vlaev2017) and reminders for debt repayment (Janssen et al., Reference Janssen, Bergsma and Cooper2017; Jensen et al., Reference Jensen, Reuss and Rasmussen2018; Kondratjeva et al., Reference Kondratjeva, Roll, Bufe and Grinstein-Weiss2021).

Relevance

The improved repayment letter was assumed to help some Rotterdam residents to better deal with indebtedness. Indebtedness is often perceived as stressful (Brown et al., Reference Brown, Taylor and Price2005). Moreover, high levels of indebtedness can have negative effects on life satisfaction (Ruberton et al., Reference Ruberton, Gladstone and Lyubomirsky2016), well-being (Tay et al., Reference Tay, Batz, Parrigon and Kuykendall2017), and mental as well as physical health (Fitch et al., Reference Fitch, Hamilton, Bassett and Davey2011; Sweet et al., Reference Sweet, Nandi, Adam and McDade2013; Clayton et al., Reference Clayton, Liñares-Zegarra and Wilson2015). For the Netherlands, the percentage of households with low income, and consequently at risk of problematic indebtedness, was highest in Rotterdam (15%; Statistics Netherlands, 2018). Adaptations in the letter promised to be cost-effective and easily scalable (Benartzi et al., Reference Benartzi, Beshears, Milkman, Sunstein, Thaler, Shankar, Tucker-Ray, Congdon and Galing2017). Contacting behaviour of debtors has rarely been studied (for, an exception, see Mewse et al., Reference Mewse, Lea and Wrapson2010) and to the best of our knowledge this is the first study that stimulated contacting to ultimately improve debt repayment.

Hypotheses

We hypothesised that an improved repayment letter would stimulate more debtors to agree on a repayment plan. To investigate possible compensatory effects where more individuals agree on a repayment plan, but fewer individuals immediately repay the full debt, we analysed overall response rates as a secondary outcome measure. We hypothesised that overall response rates would increase with the nudging letter. In addition, we hypothesised that debtors agreeing on a repayment plan would adhere to the plan. Put differently, we assumed an indirect effect where more debtors agree on a repayment plan leading to an increase in repayments.

Methods

Design

Given the municipal technical infrastructure, it was not possible to randomise the type of repayment letter at the individual level. Therefore, a quasi-experimental design was employed for this field research where the type of letter was dependent on the year it was sent. Specifically, we compared the data from a period where the standard letter was sent (June 19, 2017 till November 8, 2017) with data from the same period one year later where the nudging letter was used.

Letters

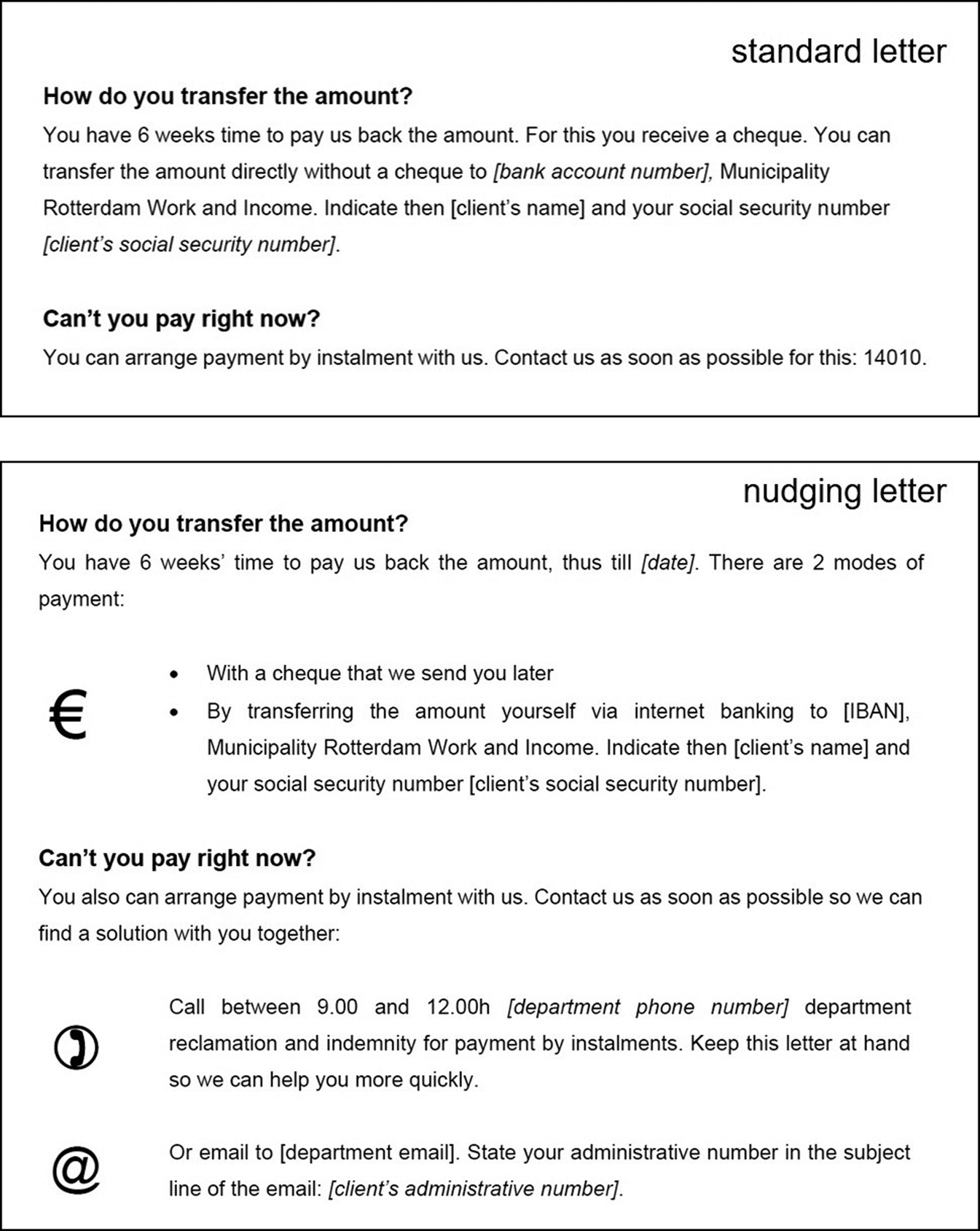

The standard letter and the nudging letter differed concerning the instructions for repayment. The remainder of the letter was the same in both letters and included information on why the debt was accrued and its amount. The two differing paragraphs are shown in Figure 1 and typically appeared in the centre of the first page of the letter. Normally the letter was between one and a half and two pages long. The adaptations made in the nudging letter where the result of an internal brainstorm of the Behavioural Insights Group Rotterdam (www.bigrotterdam.nl) and a pilot test.

Figure 1. Translated excerpts from the standard and the nudging letter

Procedure

The municipality of Rotterdam worked with a standard collection procedure for all debts resulting from work and income related services. Sending out the repayment letter marked the beginning of this procedure. After that, debtors were given 1.5 months (i.e., six weeks) to respond, either by paying back the whole debt or by contacting the municipality for negotiating a repayment plan. During that period, reminder letters were sent to some debtors initiated by the employees in charge of debt collection.

Whenever an agreement on a repayment plan had been reached, the municipality sent a letter of confirmation immediately and a money transfer form within one month, because those forms were only sent on one specific date for each month. The transfer form granted individuals one month's time for their first instalment. If debtors agreed on monthly instalments, they were thus expected to transfer the first instalment within a maximum of 1.5 months plus two months after having received the repayment letter (Figure 2). If debtors had not responded after the response deadline, they were automatically sent multiple overdue notices and ultimately their wages could be garnished.

Figure 2. Schematic overview of the repayment procedure for repayment via instalments

Data on all debtors and correspondence was registered and stored as part of the standard collection procedure of the municipality. The municipality of Rotterdam agreed to share datasets relevant for the evaluation of the nudging letter with the authors. Specifically, we received three datasets: one containing information on all debtors receiving the repayment letter, one containing metadata on correspondence other than the repayment letter, and one containing information on repayments. The data was cross validated by the first author for 50 randomly chosen debtors with the individual dossiers of the debtors at the municipality, in which all personal information and correspondence were stored. This validation revealed only two inconsistencies: one case where a reminder letter was wrongly used to confirm contact that had been made before and one case where a repayment plan was confirmed using a wrong letter type, meaning that this agreement was overlooked. The municipality had no role in the analysis and interpretation of data, in the writing of the article, and in the decision to submit it for publication. Approval to conduct this research was granted by the local ethics committee.

Measures

Agreeing on a repayment plan

To measure whether or not debtors had agreed on a repayment plan, we constructed a variable that indicated whether debtors had received the letter confirming a repayment plan letter no later than 45 days after the repayment letter. The 45 days limit was chosen because it corresponded to the response deadline (i.e., 1.5 months) upon which debtors who could not pay were expected to contact the municipality plus an additional three days processing period before sending the confirmation letter.

Response

The debtors who neither agreed on a repayment plan nor had made any repayment within 45 days after the repayment letter had been sent were assumed to not have shown any response to the letter. We therefore constructed a response variable, which we set to one in case debtors had either agreed on a repayment plan or made any payment within 45 days after the repayment letter.

Repayment

We constructed a repayment variable to reflect repayment of (part of) the debt before the instalment deadline (see Figure 2). For each debtor, it was checked if they had made at least one repayment not later than 105 days after the repayment letter had been sent. This repayment could reflect full repayment of the debt or instalments. The number of days corresponded with the maximum of 45 days for agreeing on a repayment plan plus maximum one month (i.e., approximately 30 days) for receiving the transfer form and one month before the payment deadline mentioned on the transfer form.

Analytic strategy

All analyses were carried out within the R statistical computing environment (version 4.0.2). The effect of the nudging letter on response was examined by a logistic regression. Specifically, we separately regressed the binary agreement on a repayment variable and the response variable on the letter variable. To evaluate the model, we compared it against the null model using likelihood ratio testing and inspected Nagelkerke's R 2 (Nagelkerke, Reference Nagelkerke1991). Moreover, we conducted sensitivity analyses using age and gender as covariates. Multicollinearity for these sensitivity analyses was assessed by inspecting the correlation matrix of the predictors and the variance inflation factors (VIF). We assumed multicollinearity to be a concern if correlations between predictors exceeded 0.80 and the VIF exceeded 2.5 (Midi et al., Reference Midi, Sarkar and Rana2010). In another sensitivity analyses that was suggested by a reviewer, we investigated abrupt increases in the proportion of debtors agreeing on a repayment plan or responding to the letter around the date that the letter was changed (December 21, 2017) using a regression discontinuity design and different datasets.

Some debtors received a reminder from the municipality before the deadline to respond. We did not include this reminder as a covariate as it was more likely to be the result of the unresponsive behaviour of debtors rather than a determinant of a response. Moreover, compared to the debtors who received the nudging letter, more debtors receiving the standard letter received a reminder (see Table 1). Thus, any positive effect of the nudging letter when compared to the standard letter could not be attributed to the effectiveness of reminder letters. Not including those letters as a covariate was therefore assumed to lead to a conservative estimate of the effect of the nudging letter.

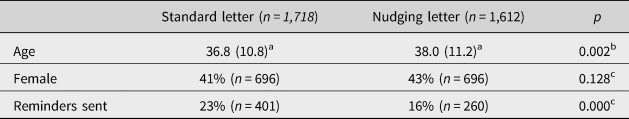

Table 1. Descriptive statistics for the total sample by the letter received

Note. aM and (SD).

b According to Welch's test.

c According to the chi-squared test.

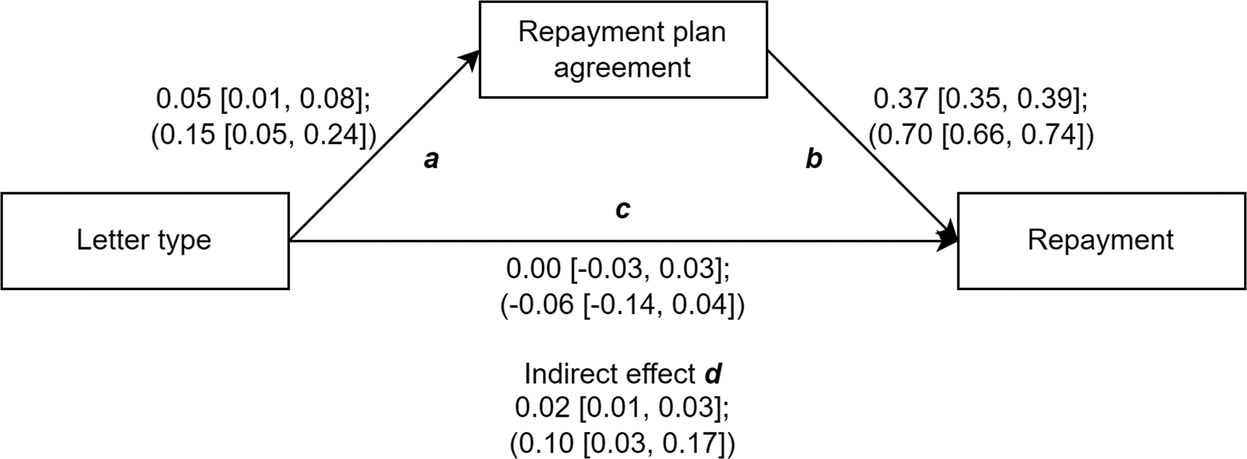

To test the mediation effect of the nudging letter on repayment via contacting, we followed the procedure suggested by Zhao et al. (Reference Zhao, Lynch and Chen2010). They argued that to conclude mediation, only the indirect effect d = a × b (see Figure 5) needs to be significant and that a significant direct effect c of the predictor on the outcome is not necessary. For this analysis, we employed the lavaan package (version 0.6-5; Rosseel, Reference Rosseel2012). Specifically, we used bootstrap testing drawing 2000 samples in combination with structural equation modelling to test for the indirect effect. In this modelling structure, we conducted again a sensitivity analysis with the same covariates as with the logistic regressions.

In addition, we conducted an exploratory analysis in which we analysed whether debtors who had received the nudging letter had agreed earlier on a repayment plan than debtors who had received the standard letter.

Sample

The required sample size was estimated prior to receiving the data using G*Power (version 3.1.9.7; Faul et al., Reference Faul, Erdfelder, Buchner and Lang2009) for one-tailed logistic regressions with a binary predictor. We used conventional alpha and beta values (0.05 and 0.80, respectively) and assumed that the same number of debtors would receive the nudging and the standard repayment letter. The estimated effect size was based on pre-experimental data for the primary outcome (agreeing on a repayment plan), showing that a baseline of 19% of the debtors reached an agreement on an individual repayment plan and an estimated increase of four percentage points (i.e., 23%). This increase was found as a lower threshold in similar experiments by the Behavioural Insights Team (BIT, 2012, 2014; Haynes et al., Reference Haynes, Service, Goldacre and Torgerson2012). This yielded an estimated effect size of OR = 1.27 and a required sample size of N = 2,566.

Based on the number of repayment letters sent each month, we were confident to reach the required sample size given the researched periods. In fact, the data we received contained 3,568 cases in which a repayment letter had been sent. We excluded cases where a repayment letter had been sent to the same individual before (n = 188), assuring that every individual appeared only once in our dataset. Further, we excluded cases in which the person had died before the outcome variables were measured (n = 37), in which the debtor was reported younger than 18 years or older than 66 years (n = 9), and in which the first payment was made on the same day the repayment letter had been sent (n = 4), since in these cases payment could not be attributed to receiving that letter. This yielded a total sample size of 3,330 for the logistic regression. For the mediation analysis, we excluded cases where a payment took place before the letter confirming a repayment plan was sent (n = 81) because agreeing was no meaningful mediator if it took place after repayment. It is plausible, however, that these cases resulted from debtors who transferred their first instalment immediately after agreeing on a repayment plan before the confirmation letter had been processed. Note that excluding these cases leads to a more conservative estimate of the indirect effect.

In Table 1, descriptive statistics and randomisation checks are depicted. Differences between the total sample and the subsample used to test the indirect effect were negligible. Compared to individuals receiving the standard letter, individuals receiving the nudging letter were slightly older according to Welch's test, t(3,294.3) = −3.15, p = 0.002, and received fewer reminders according to chi-squared testing, χ² (1, n = 3,330) = 26.74, p = 0.000.

For the regression discontinuity design, we used a sample of debtors who had received the repayment letter not longer than one month before (n = 405) or after the letter type had been changed (n = 278).

Results

Agreement on a repayment plan

Overall, 18% (n = 588) of all debtors reached an agreement on a repayment plan within 45 days after the repayment letter was sent. For individuals who had received the nudging letter, this percentage was higher (19%, n = 313) than for individuals who had received the standard letter (16%, n = 275). Compared to the null model, the model that included the letter type as a predictor provided better fit according to likelihood ratio testing, χ² (1) = 6.65, p = 0.001. However, predictive power of the model was low with Nagelkerke R 2 = 0.00.

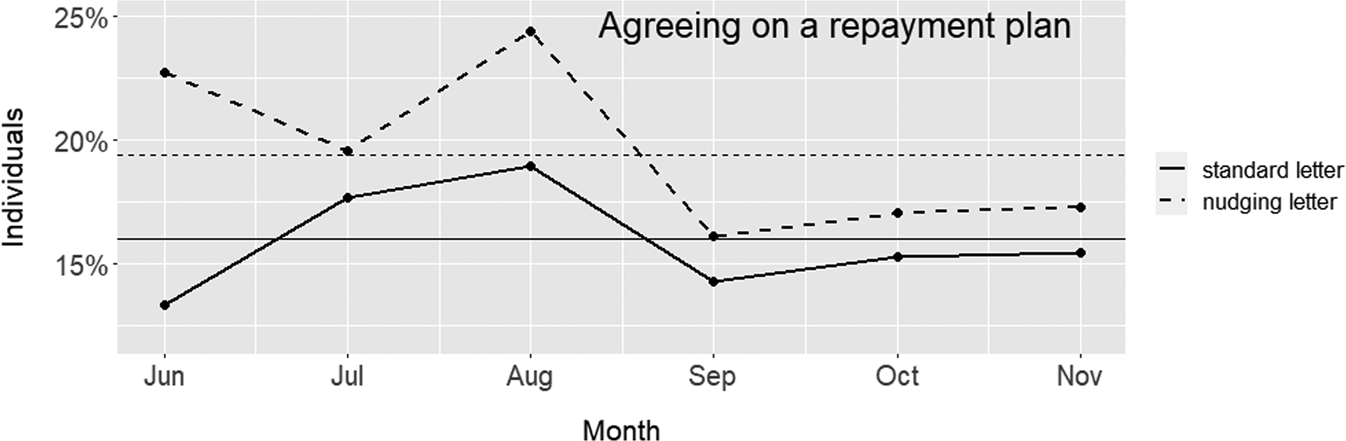

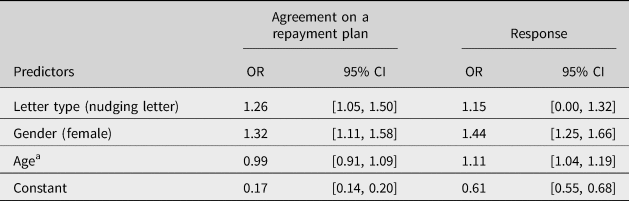

In line with our theorising, we found a significant effect with debtors who received the nudging letter being 1.26 times more likely to reach an agreement on a repayment plan than debtors who received the standard letter, F(1, 3,328) = 6.63, p = 0.010. As a sensitivity analysis, we added gender and age to the regression model. There was no evidence for multicollinearity. Without affecting the size and significance of the coefficient for the letter type, we found gender to be a significant predictor with women having agreed on a repayment plan more often (Table 2). In another sensitivity analysis, we inspected the proportion of debtors agreeing on a repayment plan each month (Figure 3). This proportion was consistently higher for the nudging letter when compared to the standard letter, implying a systematic increase due to the nudging letter rather than random variation between the two quasi-experimental periods. The predicted probabilities to have reached an agreement on a repayment plan for a ‘normal’ debtor (i.e., male, 37 years) were 0.14 with the standard letter and 0.18 with the nudging letter.

Figure 3. Proportions of debtors agreeing on a repayment plan per month and letter type – The horizontal lines indicate the means per letter type.

Table 2. Logistic regression results

Note. OR, odds ratio; CI, confidence interval.

a Standardised predictor.

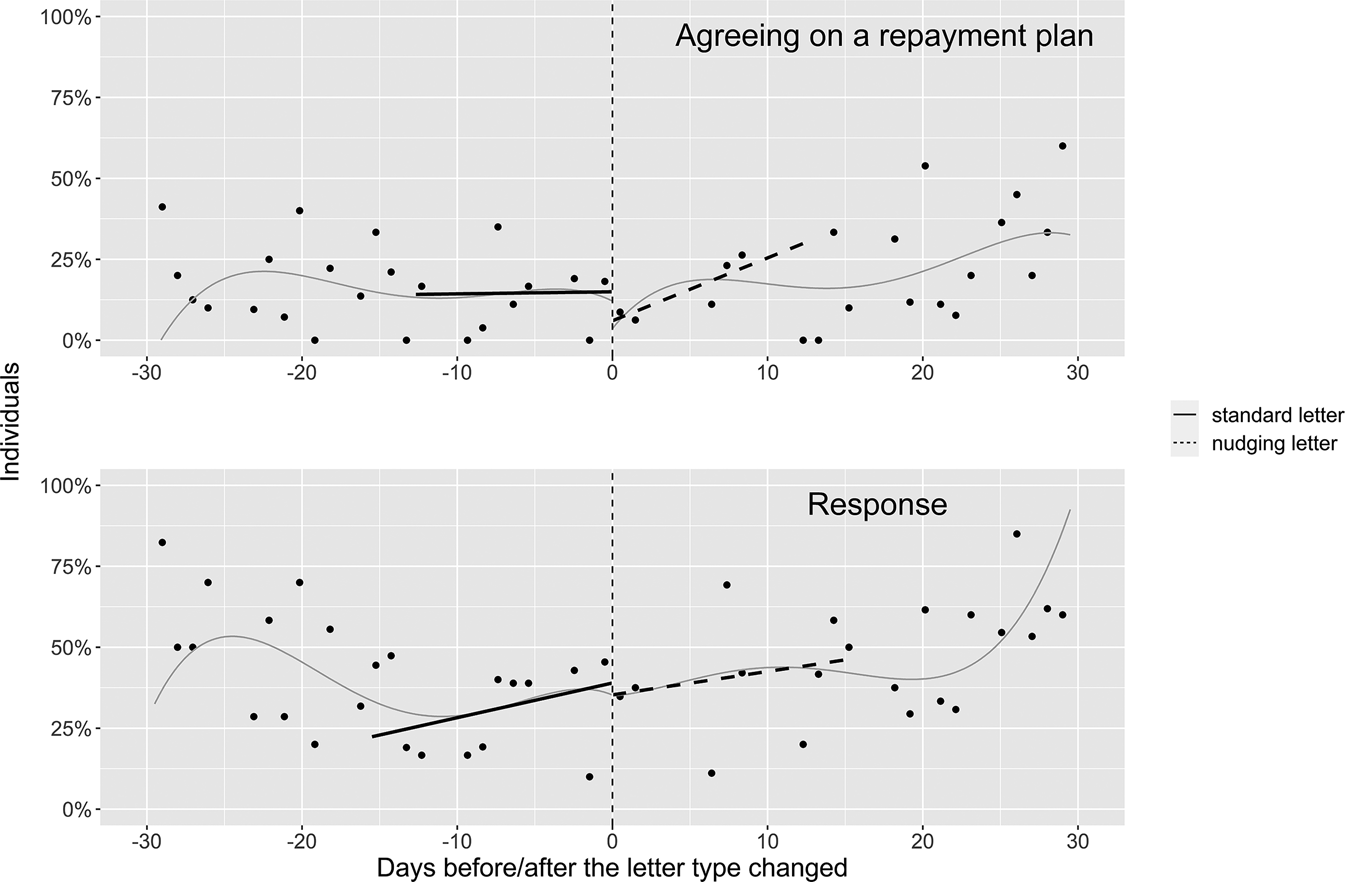

According to the regression discontinuity analyses, there was no significant local increase in debtors agreeing on a repayment plan when the letter changed, z = −0.93, p = 0.354. However, the smoothed line in Figure 4 suggests an increase in early January, and it is plausible that letters sent briefly before or during the holiday season led to irregular responses. Results did not change when covariates were included in the analysis.

Figure 4. Local change in outcomes around the day the letter type changed – The dashed vertical line indicates the day when the letter type was changed. The grey curved lines indicate smoothed proportions of debtors. Lines with slope indicate local regression lines.

Concerning the number of days that had passed between the repayment letter and the confirmations of a repayment plan, Figure 5 reveals that most debtors who agreed on a repayment plan did so two or three weeks after the repayment letter had been sent. Different from the nudging letter, there was a peak for the standard letter after the deadline for a response to the repayment letter, possibly after having received an overdue notice. In general, debtors who agreed on a repayment plan did so earlier with the nudging letter (Mdn = 23 days) than with the standard letter (Mdn = 28 days), according to the Wilcoxon signed-rank test, Z = −3.60, p = 0.000.

Figure 5. Delay between the repayment letter and the confirmation of a repayment plan - The dashed vertical line indicates the deadline for agreeing on a repayment plan that was stated in the repayment letter.

Response

In total, 43% (n = 1,443) of all debtors responded to the repayment letter before the six weeks’ deadline either by agreeing on a repayment plan or by repayment. For individuals who had received the nudging letter, this percentage was higher (45%, n = 731) than for individuals who had received the standard letter (41%, n = 712). Model evaluation indicated better fit for the full model according to likelihood ratio testing, χ² (1) = 5.16, p = 0.023. However, predictive power of the model was again low with Nagelkerke R 2 = 0.00.

In line with our theorising, we found a significant effect with debtors who received the nudging letter being 1.17 times more likely to have responded to the repayment letter than debtors who received the standard letter, F(1, 3,328) = 5.16, p = 0.023. The sensitivity analysis did not affect the effect of the repayment letter but revealed that female and older debtors responded more often (Table 2). The predicted probabilities to have responded for a ‘normal’ debtor were 0.38 with the standard letter and 0.41 with the nudging letter.

According to the regression discontinuity analyses, there was no significant local increase in debtors responding when the letter changed, z = −0.53, p = 0.597, but again the smoothed line in Figure 4 suggests an increase in early January plausibly related to the holiday season. Results did not change when covariates were included in the analysis.

Indirect effect

We found a significant indirect effect d (Figure 6) of the letter type on repayment via reaching an agreement on a repayment plan, with its 95% percentile interval for the standardised coefficient excluding zero [0.01, 0.03]. Individuals who received the nudging letter were thus more likely to have reached an agreement on a repayment plan and consequently have started repayment of the debt. The respective individual coefficients a and b were both significant with more individuals with the nudging letter agreeing on a repayment plan [0.01, 0.08] and more individuals with a repayment plan starting repayment [0.35, 0.39]. We found no evidence of a significant direct effect c of the letter type on repayment [−0.03, 0.03], indicating an indirect-only mediation (Zhao et al., Reference Zhao, Lynch and Chen2010). This means that the letter type affected repayment only via agreements on a repayment plan. The findings remained the same when the mediation analysis was conducted with the covariates. Note that for some debtors, wage garnishment might have led to repayment by force rather than behaviour. However, this is implausible to have affected the effects a, b, and d because garnishment only took place after the response deadline and was delayed if debtors had agreed on a repayment plan. Nearly all debtors (92%) who agreed on a repayment plan had started repayment. All standardised and unstandardised effects are displayed in Figure 6.

Figure 6. Standardised (unstandardised) coefficients and 95% percentile intervals for investigating the indirect effect.

Discussion

In comparing the standard repayment letter of the municipality against the nudging letter, we found, in line with our hypothesising, more debtors agreeing on a repayment plan after having received the nudging letter. In addition, overall response rates increased with the nudging letter, meaning that the increase in debtors who agreed on a repayment plan was not driven by debtors avoiding immediate repayment and agreeing on a repayment plan instead. Taking a long-term perspective, we found that agreeing on a repayment plan served as a mediator for repayment. However, the effects of the nudging letter were of small magnitude, increasing agreeing on a repayment plan by not more than three percentage points. Comparing these effects to other studies is complicated because of the unique setting and nudging techniques of this study. In fact, recent reviews have highlighted the context dependency of nudges and the heterogeneity of observed effects (Hummel & Maedche, Reference Hummel and Maedche2019; DellaVigna & Linos, Reference DellaVigna and Linos2020). Yet, the effect sizes found here are twice those obtained by other behavioural insights teams, but lower than those found in academic studies (DellaVigna & Linos, Reference DellaVigna and Linos2020). When compared to nudges aiming to increase tax compliance, the nudging letter achieved slightly higher effect sizes (Antinyan & Asatryan, Reference Antinyan and Asatryan2020).

A lesson learned is that to achieve repayment in the context of financial scarcity, creditors should not focus on repayment but on contacting behaviour and agreeing on a repayment plan. In other contexts, contact might, however, not be necessary nor desirable since debtors with fewer liquidity constraints are more likely to be able to repay their full debts immediately without contact and agreeing on a repayment plan first. In addition, we show that compared to earlier studies that adapted reminder letters for debt repayment (Janssen et al., Reference Janssen, Bergsma and Cooper2017; Jensen et al., Reference Jensen, Reuss and Rasmussen2018), debt collection can be improved at low-cost earlier on by adapting debt repayment letters. Some studies suggest that larger and more robust effects sizes may have been obtained by including deterrence information in the nudging letter (e.g., specifying penalties for late payments; Hallsworth, Reference Hallsworth2014; Antinyan & Asatryan, Reference Antinyan and Asatryan2020; De Neve et al., Reference De Neve, Imbert, Spinnewijn, Tsankova and Luts2021). However, such information (and real costs incurred by debtors) would represent an additional stressor and burden for individuals experiencing financial scarcity potentially creating or reinforcing chronic indebtedness (Heidhues & Kőszegi, Reference Heidhues and Kőszegi2010; Lea, Reference Lea2020).

The effects cannot be attributed to specific adaptations in the nudging letter because all adaptions were integrated in a single letter at once. For instance, we do not know if the longer text of the nudging letter increased cognitive demands thereby offsetting overall effectiveness of the letter. For future research, it is hence of interest to test different adaptations and combinations thereof separately to specify their effects (Ludwig et al., Reference Ludwig, Kling and Mullainathan2011) or use non-experimental methods like surveys or interviews to help identify effective adaptations (Marchionni & Reijula, Reference Marchionni and Reijula2019). Combining multiple adaptations in single letters is common in applied settings, however (Janssen et al., Reference Janssen, Bergsma and Cooper2017; Jensen et al., Reference Jensen, Reuss and Rasmussen2018).

Nevertheless, we can speculate about the effectiveness of different adaptations and underlying mechanisms. Many adaptations in the nudging letter can be categorised as simplifications (Münscher et al., Reference Münscher, Vetter and Scheuerle2016) reducing the cognitive effort necessary to process the information in the letter, namely presenting choice options as bulleted lists, adding pictograms, and including also the concrete response deadline. Simplification has been identified as relatively powerful when compared to other nudging techniques (Hummel & Maedche, Reference Hummel and Maedche2019; DellaVigna & Linos, Reference DellaVigna and Linos2020). However, given the short and already simple paragraph on contacting in the standard letter, it is plausible that not simplification, but the other adaptations were responsible for most of the observed effects, namely stressing togetherness and collaboration between debtors and creditors, improved opportunities for contacting and adding action-relevant information. These adaptations reduced the administrative burden loaded on debtors receiving the standard letter (Moynihan et al., Reference Moynihan, Herd and Harvey2015). For instance, the social consequences of contacting were plausibly less threatening with the nudging letter because it freed debtors calling the municipality from the need to first explain their potentially stigmatising situation in sufficient detail to ensure being put through correctly by the general call centre staff. Instead, with the nudging letter, debtors could call the responsible staff directly. Reducing administrative burden was theorised to be especially effective for individuals experiencing (financial) scarcity (Sunstein, Reference Sunsteinforthcoming), further supporting this reasoning.

Debtors who received the nudging letter seem to have agreed on a repayment plan earlier than debtors who received the standard letter. This is in line with similar nudge interventions used to increase tax compliance (De Neve et al., Reference De Neve, Imbert, Spinnewijn, Tsankova and Luts2021). Shorter delays between the repayment letter and debtors’ responses are practically relevant because they might lead to fewer reminders and overdue notices being sent, meaning that creditors can save costs and that debtors receive fewer potentially stressful communication. However, this finding still needs confirmatory testing to be able to draw valid conclusions.

Future research can innovate repayment letters further: most adaptations in the nudging letter aimed to increase motivation or to make the target behaviour easier. Individuals, however, often fail to follow-up on their intentions even if they have the opportunity and if it is easy (Sheeran & Webb, Reference Sheeran and Webb2016). Therefore, interventions aiming to improve the translation of intentions into behaviour, for instance implementation intentions (Gollwitzer, Reference Gollwitzer1999) or enhanced active choice formats (Keller et al., Reference Keller, Harlam, Loewenstein and Volpp2011), may be added to future repayment letters. In addition, changing the envelope of letters may increase opening rates, further improving effectiveness. This may be done by printing importance appeals (e.g., ‘important information’) on envelopes (Amos & Paswan, Reference Amos and Paswan2009). Further improving the letter is necessary because our results showed that the majority of debtors did not respond to it in time. However, a recent study showed that such avoidance behaviour is common when experiencing financial scarcity (Hilbert et al., Reference Hilbert, Noordewier and van Dijk2022).

Like all research, this study is subject to limitations. As a practical limitation, instead of fixing the problem of unjustified welfare payments, it may have been better to develop and test measures avoiding those payments in the first place, for instance by stimulating welfare receivers to inform the municipality about additional incomes on time (e.g., Zhang et al., Reference Zhang, Hemmeter, Kessler, Metcalfe and Weathers2020). As a methodological limitation, the quasi-experimental design of this study means that our findings may be confounded by unobserved contextual factors (e.g., economic changes that affected incomes and how much individuals could repay) rather than the letter type. This seems to be the case for the regression discontinuity analyses which plausibly were affected by the holiday season, highlighting the importance of choosing an adequate day for changing the letter with that type of analysis. Similarly, the differences might be attributed to random variance over time or regression to the mean. For future research, it is of interest to fully randomise the letter to allow stronger conclusions.

As a final limitation, the data used for the analysis was not able to fully represent reality of the debt collection procedure because several relevant aspects were not registered as a standard. Plausibly the most relevant aspect was that municipality employees in rare cases proactively contacted debtors before the response deadline to suggest agreeing on a repayment plan. If more debtors receiving the nudging letter had been reached this way than debtors receiving the standard letter, the increase in debtors agreeing on a repayment plan might be the result of these contact attempts rather than the nudging letter. However, the public servants involved in debt collection had no reason to contact debtors more with the nudging letter and they themselves found it unlikely that this had been the case. Another important aspect of reality that we could not account for in the analysis is that not from all debtors a response was needed to repay the debt. This is because welfare receivers built up holiday allowance (i.e., money paid out once a year supposedly for going on holidays) and sometimes this allowance was used to fully repay the debt. This was booked internally by municipality employees, meaning that no action was required from the debtors. Based on pre-experimental data, this applies to approximately 7% of all debtors receiving the repayment letter.

As evidenced by these limitations, conducting field experiments is often difficult (Hansen & Tummers, Reference Hansen and Tummers2020). Yet they are of high practical and scientific relevance because of their ecological validity. By accounting for the main positive outcomes of the debt collection procedure, we believe that our results are useful for practitioners and scientists alike.

Acknowledgments

We thank the municipality of Rotterdam for sharing the data. We thank Gertrude Slag, Mireille Wolfers, and Ashleigh Woodend for their efforts in drafting the nudging letter. In addition, we thank Gertrude Slag for providing insights in the debt collection procedure and her help for understanding the data. Finally, we thank Hans van Kippersluis for his help with the analysis.

Financial support

This research received no specific grant from any funding agency in the public, commercial, or not-for-profit sectors.

Conflict of interest

There are no conflicts of interests.