No CrossRef data available.

Published online by Cambridge University Press: 24 February 2021

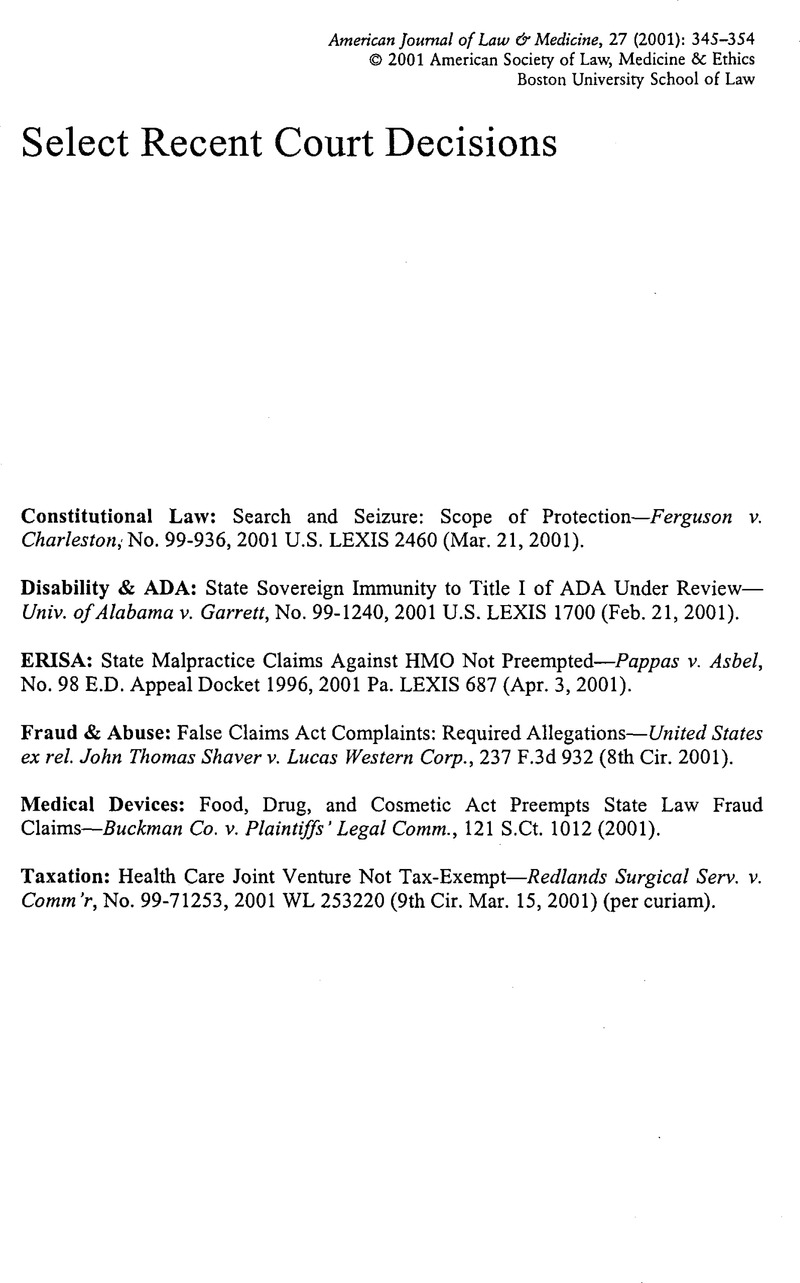

1 No. 99-936, 2001 U.S. Lexis 2460 (Mar. 21, 2001).

2 See id. at *2.

3 See id. * See id. at *1.

5 See id.

6 See id.

7 See id. at *2.

8 See id.

9 See id. at *1.

10 See id. at *18.

11 See id. at *15.

12 See id. at *18,n.9.

13 Id. at *27.

14 See id. at *29.

15 See id. at *30.

16 See id.

17 See id.

1 No. 99-1240, 2001 U.S. Lexis 1700 (Feb. 21, 2001).

2 The Eleventh Amendment states: “The Judicial power of the United States shall not be construed to extend to any suit in law or equity, commenced or prosecuted against one of the United States by Citizens of another State, or by Citizens or Subjects of any Foreign State.” U.S. Const, amend. XI.

3 See Garrett, 2001 U.S. Lexis 1700, at *8-9; see also 42 U.S.C. §§12111-12117 (1998).

4 See Garrett, 2001 U.S. Lexis 1700, at *10-12.

5 See id. at *14-15.

6 Id.

7 See id.

8 521 U.S. 507 (1997).

9 Garrett, 2001 U.S. Lexis 1700, at *16.

10 Id. at *21, quoting Cleburne v. Cleburne Living Ctr., Inc., 473 U.S. 432 (1985).

11 See id. at *22.

12 W. at*17.

13 See id. at *22, 32.

14 Id. at *33 n.9.

15 See id., at *8 n.l; see also 42 U.S.C. § 12132 (1990) (dealing with “services, programs, or activities of a public entity.”).

1 No. 98 E.D. Appeal Docket 1996, 2001 Pa. Lexis 687 (Apr. 3, 2001) [hereinafter Pappas //].

2 See Pappas v. Asbel, 724 A.2d 889 (Pa. 1998) [hereinafter Pappas /].

3 See Pappas II, 2001 Pa. Lexis 681, at *1; see also Employee Retirement Income Security Act of 1974, 29 U.S.C. § 1001 er seq. (2000).

4 530 U.S. 211 (2000) [hereinafter Pegram]. In Pegram, a patient brought suit against her treating physician and her health maintenance organization (“HMO”) for medical malpractice and fraud in state court. The employer of the patient's husband contracted with the HMO to provide pre-paid medical services to the employer's employees and their families. The HMO sought successfully to have the case moved to federal court on the premise that the fraud claim was preempted by ERISA. The Supreme Court held that treatment decisions made an HMO, while acting on behalf of its contracting physicians, are fiduciary acts under the terms of ERISA. See id. at 214.

5 See Pappas I, 724 A.2d at 889.

6 See Pegram, 530 U.S. at 226-29.

7 “Pure 'eligibility decisions' turn or the plan's coverage of a particular condition or medical procedure for its treatment. 'Treatment decisions' are choices about how to go about diagnosing and treating a patient's condition. 'Mixed eligibility and treatment decisions' are just what their name implies- decisions in which coverage and medical judgment are intertwined.” Id. at 228-30.

8 See id. at 229-31. The Court noted that since ERISA's fiduciary duties arise from common law trust principles, which include fiduciary responsibilities that attach to financial decisions concerning management of assets and property, Congress could not have intended mixed decisions to be fiduciary in nature. See id. at 229-33.

9 Pappas II, 2001 Pa Lexis 687, at *18.

10 See id. at *19.

1 237 F.3d 932 (8th Cir. 2001).

2 31 U.S.C. §3729(2000).

3 See Lucas Western, 237 F.3d at 933.

4 See id.

5 See id.

6 See id.

7 See id.

8 See id.

9 31 U.S.C. § 3729(a)(1).

10 Lucas Western, 237 F.3d at 933.

11 See id. at 934.

12 31 U.S.C. § 3730(b)(1). A qui tarn relator is one who brings an action on behalf of himself as well as the state. See Black'S Law Dictionary 1251 (6th ed. 1990).

13 See Lucas Western, 237 F.3d at 934.

14 See id.

1 121 S.Ct. 1012(2001).

2 See id. 1 See id. at 1015.

4 See id.

5 See id.

6 See id.

7 See id.

8 See id. at 1016.

9 See id.

10 See id.

11 See id. at 1017.

12 See id. at 1018.

13 See id.

14 See id.

15 See id.

16 See id.

17 See id. at 1019.

18 464 U.S. 238(1984).

19 See Buckman Co., 121 S.Ct. at 1019.

20 See id.

21 518 U.S. 470(1996).

22 See Ruling Limits Medical Product Suits: Decision is a Boon to Medtronic Unit, Star-Trib. (Minneapolis-St. Paul), Feb. 22, 2001, at 2D.

23 See id.

24 See id.

1 No. 99-71253, 2001 W L 253220 (9th Cir. Mar. 15, 2001) (per curiam).

2 See id.

3 I.R.C. § 501(c)(3) (1986).

4 See Redlands, 2001 Wl 253220, at *1.

5 Redlands Surgical Services v. Commissioner of Internal Revenue, 113 T.C. 47 (1999).

6 See id. at 78.

7 See id.

8 See Redlands, 2001 Wl 253220, at *1.

9 Redlands, 113 T.C, at 94.

10 Id. at 97.

11 See An Irs Win, Ninth Circuit Affirms Hospital-Subsidiary Partner Not Tax-Exempt, Health Care Daily Rep. (BNA) (Mar. 19, 2001), available at http://www.healthlawyer.org/bna010319.htm.

12 See id.