No CrossRef data available.

Published online by Cambridge University Press: 25 April 2017

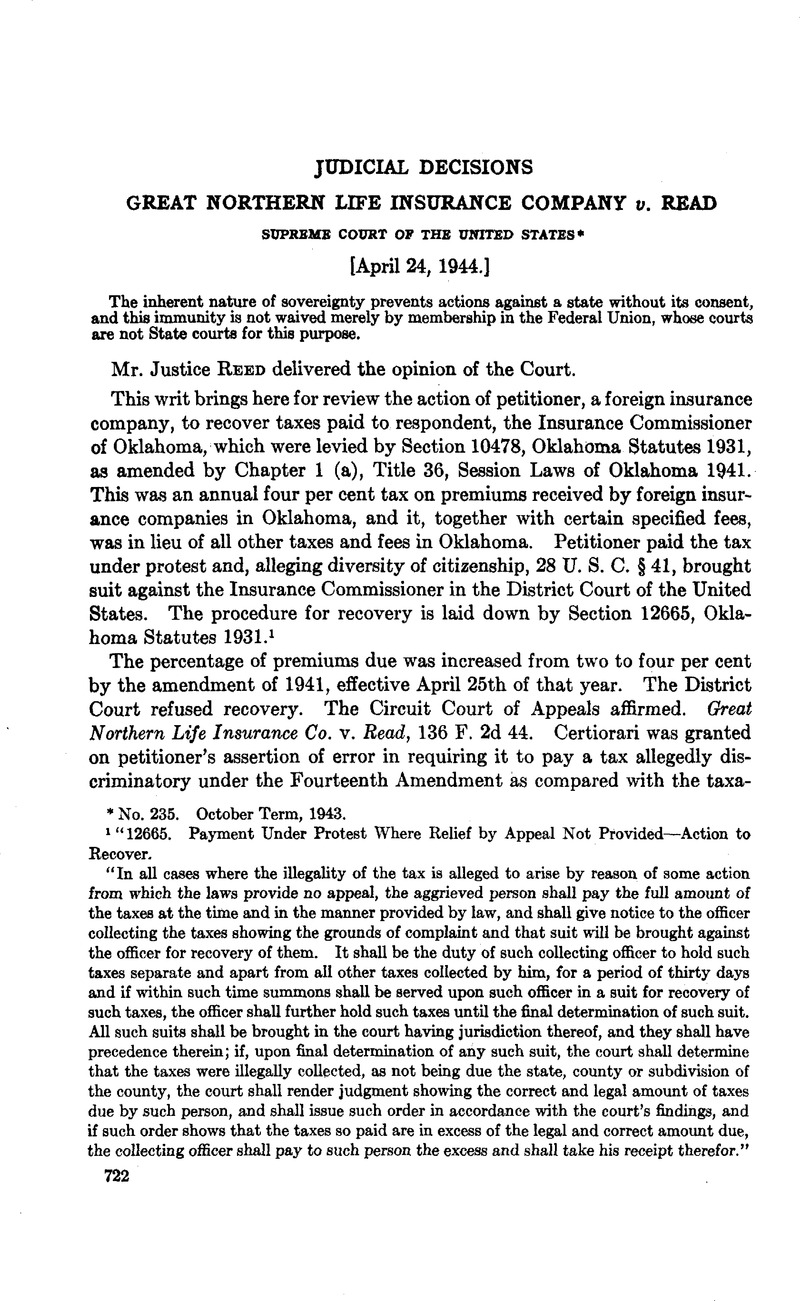

1 “ 12665. Payment Under Protest Where Relief by Appeal Not Provided—Action to Recover.

“In all cases where the illegality of the tax is alleged to arise by reason of some action from which the laws provide no appeal, the aggrieved person shall pay the full amount of the taxes at the time and in the manner provided by law, and shall give notice to the officer collecting the taxes showing the grounds of complaint and that suit will be brought against the officer for recovery of them. It shall be the duty of such collecting officer to hold such taxes separate and apart from all other taxes collected by him, for a period of thirty days and if within such time summons shall be served upon such officer in a suit for recovery of such taxes, the officer shall further hold such taxes until the final determination of such suit. All such suits shall be brought in the court having jurisdiction thereof, and they shall have precedence therein; if, upon final determination of any such suit, the court shall determine that the taxes were illegally collected, as not being due the state, county or subdivision of the county, the court shall render judgment showing the correct and legal amount of taxes due by such person, and shall issue such order in accordance with the court’s findings, and if such order shows that the taxes so paid are in excess of the legal and correct amount due, the collecting officer shall pay to such person the excess and shall take his receipt therefor.”

2 There is here no want of jurisdiction of the parties or subject matter. We are not passing upon a certification of an issue as to jurisdiction such as arose under the Act of March 3, 1891, § 5, 26 Stat. 827, in Illinois Central Railroad Co. v. Adams, 180 U. S. 28, 37. If this is a suit against the state, a failure to show the state’s consent to be sued in the face of this answer would be fatal. Cf. Berryessa Cattle Co. v. Sunset Pacific Oil Co., 87 P. 2d 972, 974.

3 Pennoyer v. McConnaughy, 140 U. S. 1, 10. Compare Louisiana v. Jumel, 107 U. S. 711, 726.

4 Board of Com’rs Love Co. v. Ward, 68 Okla. 287, 288; Broadwell v. Board of Com’rs Carter Co., 71 Okla. 162, 163; cf. Ward v. Love Co., 253 U. S. 17, 22; Broadwell v. Carter Co., 253 U. S, 25; Carpenter v. Shaw, 280 U. S. 363, 369; Railroad Co. v. Commissioners, 98 U. S. 541, 544; Stratton v. St. L. S. W. Ry., 284 U. S. 530, 532.

5 Keifer & Keifer v. R. F. C, 306 U. S. 381, is not to the contrary. When authority to sue is given that authority is liberally construed to accomplish its purpose. United States v. Shaw, 309 U. S. 495, 501.

6 Cf. Matthews v. Rodgers, 284 U. S. 521, 525. The Federal Government’s consent to suit against itself, without more, in a field of federal power does not authorize a suit in a state court. Stanley v. Schwalby, 162 U. S. 255, 270; Minnesota v. United States, 305 U. S. 382, 384, 389.

7 See also session Laws 1913, Ch. 240, Art. 1, sec. 7.

8 The Swartwout scandal led to the Act of March 3, 1839 (§2, 5 Stat. 339, 348), which this Court construed as a withdrawal of the suability of the collector. Cary v. Curtis, 3 How. 236. That decision was rendered on January 21, 1845, and Congress promptly restored the old liability. Act of Feb. 26, 1845, c. XXII, 5 Stat. 727. See Brown, A Dissenting Opinion of Mr. Justice Story (1940) 26 Va. L. Rev. 759. Again, in view of the complicated administrative problems raised by the invalidation of the Agricultural Adjustment Act, Congress devised a special scheme for the recovery of the illegal exactions made under the Act. 49 Stat. 1747, 7 U. S. C. § 644 et. seq.; Anniston Mfg. Co. v. Davis, 301 U. S. 337.

9 “With us every official, from the Prime Minister down to a constable or a collector of taxes, is under the same responsibility for every act done without legal justification as any other citizen.” Doubtless this statement of Dicey’s, Law of the Constitution, 8th Ed. at p. 189, 9th Ed. at p. 193, was an idealization of actuality. But in the perspective of our time its validity as an ideal has gained and not lost.

10 Of course the State can at any time withdraw its consent to be sued. See Beers v State of Arkansas, 20 How. 527. But statutes have steadily enlarged the range of a state’s suability and rarely has there been a recession. See, generally, Borchard, State and Municipal Liability in Tort—Proposed Statutory Reform (1934) 20 A. B. A. J. 747; Borchard, Governmental Responsibility in Tort (1926) 36 Yale L. J. 1, 17, (1927) 36 Yale L. J. 757, 1039, (1928) 28 Col. L. Rev. 577, 735.