No CrossRef data available.

Published online by Cambridge University Press: 12 April 2017

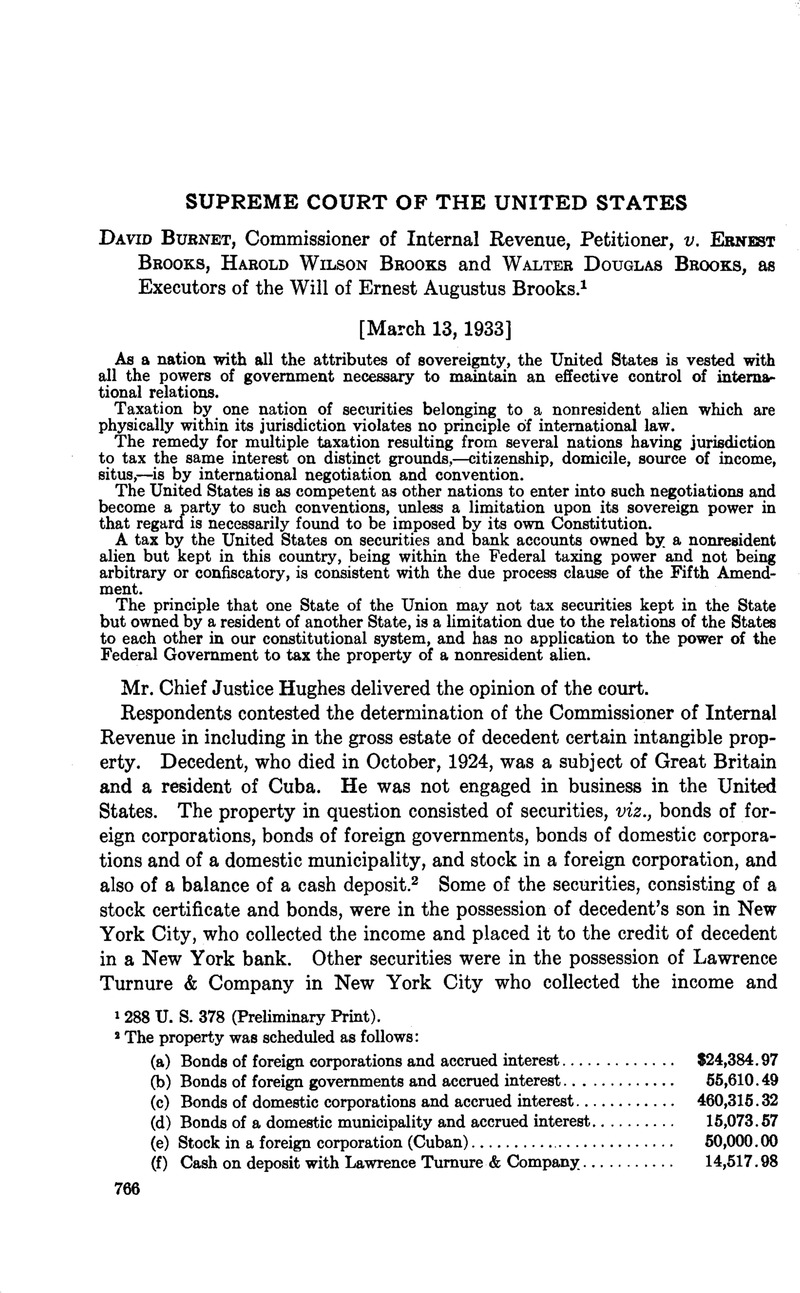

288 U. S. 378 (Preliminary Print).

2 The property was scheduled as follows:

(a) Bonds of foreign corporations and accrued interest........................ $24,384.97

(b) Bonds of foreign governments and accrued interest........................ 55,610.49

(c) Bonds of domestic corporations and accrued interest..................... 460,315.32

(d) Bonds of a domestic municipality and accrued interest.................. 15,073.57

(e) Stock in a foreign corporation (Cuban)............................................ 50,000.00

(f) Cash on deposit with Lawrence Turnure & Company................... 14,517.98

3 Sec. 301. (a) In lieu of the tax imposed by Title IV of the Revenue Act of 1921, a tax equal to the sum of the following percentages of the value of the netestate (determined as provided in section 303) is hereby imposed upon the transfer of the net estate of every decedent dying after the enactment of this Act, whether a resident or nonresident of the United States: (rates follow) . . .

Sec. 302. The value of the gross estate of the decedent shall be determined by including the value at the time of his death of all property, real or personal, tangible or intangible, wherever situated—

(a) To the extent of the interest therein of the decedent at the time of his death which after his death is subject to the payment of the charges against his estate and the expenses of its administration and is subject to distribution as part of his estate; . . .

Sec. 303. For the purpose of the tax the value of the net estate shall be determined—

(a) In the case of a resident, by deducting from the value of the gross estate— . . .

(b) In the case of a nonresident, by deducting from the value of that part of his gross estate which at the time of his death is situated in the United States—

(1) That proportion of the deductions specified in paragraph (1) of subdivision (a) of this section which the value of such part bears to the value of his entire gross estate, wherever situated, but in no case shall the amount so deducted exceed 10 per centum of the value of that part of his gross estate which at the time of his death is situated in the United States; . . .

(c) No deduction shall be allowed in the case of a nonresident unless the executor includes in the return required to be filed under section 304 the value at the time of his death of that part of the gross estate of the nonresident not situated in the United States.

(d) For the purpose of Part I of this title, stock in a domestic corporation owned and held by a nonresident decedent shall be deemed property within the United States, . . .

(e) The amount receivable as insurance upon the life of a nonresident decedent, and any moneys deposited with any person carrying on the banking business, by or for a nonresident decedent who was not engaged in business in the United States at the time of his death, shall not, for the purpose of Part I of this title, be deemed property within the United States. . . .

Sec. 304. (a) . . . The executor shall also, at such times and in such manner as may be required by regulations made pursuant to law, file with the collector a return under oath in duplicate, setting forth (1) the value of the gross estate of the decedent at the time of his death, or, in case of a nonresident, of that part of his gross estate situated in the United States; . . .

4 The case of Blackstone v. Miller, 188 U. S. 189, was not overruled until 1930. See Fanners' Loan & Trust Co. v. Minnesota, 280 U. S. 204, 209.

5 See House Rep. No. 767, 65th Cong., 2d Sess., p. 22; Sen. Rep. No. 275, 67th Cong., 1st Sess., p. 25; House Rep. No. 350, 67th Cong., 1st Sess., p. 15.

6 See Sen. Rep. No. 275, 67th Cong., 1st Sess., p. 25.

7 See, also, as to taxation in Italy, U. S. Department of Commerce's pamphlet entitled Taxation of Business in Italy, Trade Promotion Series—No. 82 (1929); sub tit. Tax on Successions, p. 105; as to taxation in France, see French Fiscal Legislation, Neurrisse and Bezoz (1928), pp. 151-153.

8 Publication entitled Double Taxation Relief, Bureau of Foreign and Domestic Commerce, Department of Commerce (January, 1928), pp. 20, 21; Double Taxation and Tax Evasion, Report of the General Meeting of Government Experts to League of Nations, Document C. 562, M. 178, 1928, II, 49, pp. 22-24; Fifth General Congress, International Chamber of Commerce, Amsterdam, 1929, Resolution No. 1, Annex, p. 11; Washington Congress, 1931, International Chamber of Commerce, Resolution No. 10, pp. 20-22. See also, Taxation of Foreign and National Enterprises (League of Nations, Geneva, 1932).