1 Setting the Stage

Economists have long searched for patterns that relate successful economic development to structure and policy. This comparative approach in development economics was initiated by Simon Kuznets and predicated on ‘the existence of common, transnational factors and a mechanism of interactions among nations that will produce some systematic order in the way modern economic growth can be expected to spread around the world’ (Reference Kuznets and GoldsmithKuznets 1959: 170).Footnote 1 One of the most striking findings of this comparative approach to economic development was the universal inverse association of income and the share of agriculture in income and employment. A key feature of modern economic growth was the movement of workers from agriculture to manufacturing and services (Reference Kuznets and MurphyKuznets and Murphy 1966; Reference Chenery and TaylorChenery and Taylor 1968; Reference TimmerTimmer 2013). As noted by Kuznets, in his Nobel Prize lecture delivered in 1971, modern economic growth had six characteristics, and perhaps the most important of these characteristics was structural transformation, which Kuznets defined as ‘the shift away from agriculture to non-agricultural pursuits, and recently, away from industry to services; a change in the scale of productive units and a related shift from personal enterprise to impersonal organization of economic firms, with a corresponding change in the occupational status of labour’ (Reference KuznetsKuznets 1973: 3).

The comparative approach identified the manufacturing sector as the engine of economic growth for most countries and the rate at which industrialization occurred differentiated successful countries from unsuccessful ones (Reference LewisLewis 1954; Reference KuznetsKuznets 1965, Reference Kuznets1966; Reference McMillan, Rodrik and Verduzco-GalloMcMillan et al. 2014). The movement of workers from agriculture to manufacturing, and then to services is the path of structural transformation that has been witnessed in all countries which comprise the high-income club as well as the successful growth experiences of East Asia. This path of structural transformation has received a great deal of attention among economists, and underpins most of the theoretical understanding of structural transformation all the way from scholars in classical economics – such as Kuznets, Lewis, Chenery, Syrquin – to more modern approaches that are rooted in the neoclassical tradition (see Reference Herrendorf, Rogerson and ValentinyiHerrendorf et al. 2014). Such a view underpins the well-known argument of Kuznets, who argued that structural transformation can lead to higher inequality, at least initially (the so-called ‘Kuznets process’). Indeed, the emblematic view of structural transformation as a process of movement of workers first from agriculture to manufacturing, then on to services remains a powerful unifying vision of the process of economic development among both scholars and policymakers.

How likely is the path of structural transformation – the movement of workers from agriculture to manufacturing, and then on to services – that was identified by economists such as Hollis Chenery, Moses Syrquin, and Simon Kuznets as a characteristic of modern economic growth – for low- and middle-income countries today? What are the patterns of structural transformation that we observe in the developing world? What have been the advances in our theoretical understanding of the process of structural transformation? What do we know about the drivers of structural transformation? What are the consequences of structural transformation, especially for inequality? In this Element, we will assess what we know about the patterns, drivers, and consequences of structural transformation using a recently released high-quality data set on sectoral employment and production for fifty-one low-income and middle-income countries from 1990 to 2018. In our analysis of structural transformation, we will follow the comparative approach to economic development pioneered by Chenery, Kuznets, and Syrquin where ‘intercountry comparisons play an essential part in understanding the processes of economic and social development’ (Reference Chenery and SyrquinChenery and Syrquin 1975: 3). By adopting the comparative approach, we will attempt to identify uniform features of development for groups of countries and examine alternative hypotheses about the causes of structural transformation. A key feature of this approach was to separate ‘universal factors’ from characteristics that are specific to any particular country (Reference Chenery and SyrquinChenery and Syrquin 1975).

A building block of the comparative approach that we will adopt in this Element is the use of a typology to understand the comparative experience of countries through ‘common features and patterns’ (Reference Syrquin, Chenery and SrinivasanSyrquin 1988: 216). We will follow this approach in searching for common features across groups of countries, and not focus on any specific country in the Element.Footnote 2 Similar to the earlier comparative approach, we will not analyse the process of structural transformation by region, as using regions as units of analysis (e.g., sub-Saharan Africa versus Asia) does not allow us to see the common features of structural transformation that cuts across regions. The typology we use will classify countries by stages or paths of structural transformation – and our approach is similar to other typological approaches to economic development such as the stages of economic growth proposed by W.W. Reference RostowRostow (1960) and the agricultural paths of structural transformation by Reference Hayami and RuttanHayami and Ruttan (1985). More description of our typological approach will be provided in Section 3.

While the period of analysis of the patterns of structural transformation by the classical economists was mostly for the 1950s to the 1970s, there have been several attempts by economists to document patterns of structural transformation for both developed and developing countries from the 1980s to the 2000s using data sets such as the ten-sector data set of the Groningen Growth and Development Centre (GGDC) or that produced by the International Labour Organization (ILO) (see, for example, Reference Dabla-Norris, Thomas, Al Garcia-Verdu and ChenDabla-Norris et al. 2013; Reference Herrendorf, Rogerson and ValentinyiHerrendorf et al. 2014; Reference Timmer, de Vries, de Vries, Weiss and TribeTimmer et al. 2015; Reference NayyarNayyar 2019). However, as we will argue in Section 3 of the Element, the analysis of structural transformation in the recent literature is mostly confined to developed and some middle-income countries, and we know very little about the paths of structural transformation followed by low-income countries in Africa and Asia. In addition, past studies have used data sets that do not provide comparable sectoral data for developing countries (such as that provided by ILO), so it is very difficult to assess what we can learn from such intercountry comparisons, with non-comparable data across countries and over time. Furthermore, since the ten-sector GGDC data set (which provides rigorous comparable sectoral data across countries and over time) ends in 2010, we do not know what may have happened to structural transformation since 2010, in a period where many countries in Africa and Asia witnessed rapid economic growth. In this Element, we use the Economic Transformation Database (ETD) produced by the Groningen Growth and UNU-WIDER, which has comparable sectoral data for a range of low- and middle-income countries from 1990 to 2018. We provide more information about ETD in Section 3, discussing its strengths over other similar data sets.

The Role of Manufacturing and Services in Structural Transformation

One of the central tenets in our understanding of economic development is that industrialization lies on the road to economic development (Reference GollinGollin 2018). As labour and other resources move from agriculture to manufacturing, per capita incomes increase, and economic growth is likely to result.Footnote 3 This has been the experience of the advanced market economies and the ‘miracle growth’ economies of East Asia (see Reference KruegerKrueger 1978, Reference Krueger1980; Reference Riedel and HughesRiedel 1988). Therefore, industrializationFootnote 4 is an important driver of employment growth and poverty reduction in developing countries. At the early stage of transition from an agrarian economy to a modern economy, the manufacturing sector in the typical developing economy has greater potential to absorb surplus labour compared to the services sector, which in the typical low-income country is dominated by informal services. While it is feasible to move unskilled workers from agriculture into better-paid jobs in manufacturing activities, it is not feasible to move them into the formal services sector. Formal services sectors such as banking, insurance, finance, communications, and information technology are characterized by relatively low employment elasticity, and also employment in these sectors requires at least upper secondary school–level education. Unskilled workers can find employment only in informal services such as retail trade and distribution, passenger transport, and construction where wages and productivity are often low. By contrast, employment in manufacturing, particularly in traditional labour-intensive industries such as clothing and footwear, requires mostly on-the-job training (Reference Athukorala, Sen, Athukorala, Weiss and TribeAthukorala and Sen 2014).Footnote 5 However, after countries reach a certain level of economic development, the structure of employment and production shifts towards services and away from manufacturing, leading to a hump-shaped nature of manufacturing employment and value-added shares as per capita incomes increase.

An extensive literature has examined the role of industrialization in the structural transformation process (see Reference CheneryChenery 1982 and Reference Syrquin and ChenerySyrquin and Chenery 1989 for the earlier literature, and UNIDO 2013, Reference Felipe, Mehta and RheeFelipe et al. 2015, and IMF 2018 for the more recent literature). In this short monograph, we do not review the entire literature, but highlight two debates that have come up in the recent literature that is relevant for our purpose. A first area of debate has been on whether today’s low- and middle-income countries are following the same path of industrialization in the preliminary stages of economic development as witnessed by the rich countries earlier. Reference RodrikRodrik (2016) documents a significant de-industrialization trend in recent decades that goes beyond the advanced market economies. This phenomenon is particularly noticeable in Africa and Latin America, and less evident in Asia. Rodrik terms this phenomenon ‘pre-mature de-industrialization’ as employment and value added shares in manufacturing are falling in Africa and Latin America at much lower levels of income as compared to the early industrializers (see also Reference TregennaTregenna 2014). Rodrik attributes this phenomenon to globalization and labour-saving technical change. However, Reference Kruse, Mensah, Sen and de VriesKruse et al. (2021) dispute this finding, using data from the ETD. Similarly, Reference Haraguchi, Cheng and SmeetsHaraguchi et al. (2017) argue that there is no evidence to support the argument that manufacturing’s role in economic development has lessened in the recent decades. Reference Felipe and MehtaFelipe and Mehta (2016) also find that manufacturing’s share of global employment did not fall between 1970 and 2010. We return to the issue of whether one can observe a phenomenon of ‘premature de-industrialization’ in today’s low- and middle-income countries in Section 4 of the Element.

A second area of debate is whether services can play the key role in the transformation process instead of manufacturing. With the increasing scepticism of the potential for manufacturing to serve as the driver for economic growth and poverty reduction in the future, there has been interest among scholars and policymakers on whether services can instead play the key role in the structural transformation process in moving a large number of workers out of low productivity jobs in agriculture (Reference Nayyar, Cruz and ZhuNayyar et al. 2018, Reference Nayyar, Hallward-Driemeier and Davies2021). Reference GollinGollin (2018) argues that the modern services sector has some of the features associated with manufacturing, such as knowledge and technology spill-overs and agglomeration economies. As Gollin notes, ‘the service sector has historically taken on many of the beneficial characteristics historically associated with manufacturing’ (Reference Gollin2018: 3). Similarly, Reference Baldwin and ForslidBaldwin and Forslid (2019) argue that with the increasing availability of digital technology which is making remote work possible, many service sectors are becoming more tradable, leading to the possibility that service-led path of economic transformation is a feasible strategy for many low- and middle-income countries. Reference Newfarmer, Page and TarpNewfarmer et al. (2018) argue that ‘industries without smokestacks’ – agro-processing and horticulture, tourism, business, and trading services – can provide a large number of high-productivity jobs, especially in sub-Saharan Africa, where manufacturing has not shown the same dynamism as in East Asia.

It is important to recognize here that services sector in low-income countries is of two types – one, that is highly productive, mostly comprising the business services sector (information and communication technology and finance); and the other, that is relatively low productivity, mostly comprising the non-business services sector (e.g., trade, hotels and restaurants, and the public sector). As we will see later, this distinction is important in our understanding of the process of structural transformation – treating the service sector in a monolithic manner does not take into account the difference in the roles that business and non-business services play in structural transformation – and for the rest of the Element, we will disaggregate the service sector into business services and non-business services, when it makes sense to do so.Footnote 6 We will examine to what extent business services have played a key role in the process of structural transformation for low- and middle-income countries, as compared to non-business services, in this Element.

Drivers of Structural Transformation

What are the determinants of structural transformation? What explains why some countries are better able to move workers out of agriculture to manufacturing than others? Why do we see the hump-shaped nature of manufacturing employment and output share as per capita incomes rise? In recent years, after a long lull, there has been an explosion of research on our theoretical understanding of the drivers of structural transformation, especially in the mainstream tradition. We first review the theoretical approaches to structural transformation in Section 2. Two main drivers have been pointed out in the literature – sectoral productivity growth differentials and demand composition effects. More recent work has highlighted the role of globalization and sectoral input–output linkages. We assess the empirical validity of the postulated drivers of structural transformation using the ETD data in Section 5.

Structural Transformation and Inequality

While structural transformation is an essential feature of rapid and sustained growth, since Kuznets’s seminal (Reference Kuznets1955) piece, it is widely believed that structural transformation can lead to higher inequality, at least initially. Therefore, rapid structural transformation may entail a trade-off between growth and inequality, which may be called the developer’s dilemma (Reference Alisjahbana, Sen, Sumner and YusufAlisjahbana et al. 2022). As Kuznets argued, while inequality may increase at the early stages of structural transformation, beyond a certain level of structural transformation, inequality will decrease, giving rise to the famous inverted U-shaped relationship between income and inequality – the so-called Kuznets curve. In this Element, we evaluate the argument that structural transformation may cause increases in inequality in the early stage of the development process, using data from ETD and the World Income Inequality Data-base (WIID). We do this in Section 6.

Structure of the Element

The rest of the Element has six sections. In Section 2, we review the main theoretical approaches to structural transformation, making a distinction between the classical and neoclassical approaches to structural transformation. We review both the earlier literature and the more recent literature. In Section 3, we introduce the Economic Transformation Database (ETD), discuss its advantages over other available data sets, and propose the typology of structural transformation that we will use in the Element. In Section 4, we set out the patterns of structural transformation, using our typology. In Section 5, we assess the empirical basis for the drivers of structural transformation proposed in the theoretical literature. In Section 6, we examine the relationship between structural transformation, inequality, and poverty. Section 7 concludes with some policy implications that follow from the analysis presented in the Element.

2 Theories of Structural Transformation

Why is the movement of workers from agriculture to manufacturing and services related to economic growth and development? What explains this movement, and why do we see differences in country experiences with structural transformation? A large literature has emerged which attempts to address these core questions in structural transformation through the lens of theory. The two broad theoretical approaches in the literature are the classical and the neoclassical approaches. In this section, we briefly review the classical and neoclassical theoretical approaches to structural transformation.

2.1 The Classical Approach to Structural Transformation

A key feature of the classical approach was the recognition that the overall transformation of demand, trade, production, and employment was the central feature of economic development (Reference Chenery, Chenery and SrinivasanChenery 1988). The emphasis on economic structure and differences that may exist in productivity and other economic characteristics across sectors differentiated the classical from the neoclassical approach of the 1950s, which assumed steady state or balanced growth scenarios (Reference Syrquin, Chenery and SrinivasanSyrquin 1988).

A fundamental assumption of the classical approach was differences in factor returns that one may observe across economic sectors was not temporary, and could be long-lasting. Therefore, ‘in the absence of a continuous equalisation of factor returns across sectors, the reallocation of resources to sectors of higher productivity growth becomes a potential source of growth if it leads to a fuller or better utilization of resources’ (Reference Syrquin, Chenery and SrinivasanSyrquin 1988: 208). Further, ‘the potential gains are likely to be more important for developing countries than developed countries since the former exhibit more pronounced symptoms of disequilibrium and can achieve faster rates of structural change’ (Reference Syrquin, Chenery and SrinivasanSyrquin 1988: 208–209). Thus, the classical approach had at its core a model of the economy which was a dual economy and where economic development was inherently a process of disequilibrium.

The two key components of the classical approach was capital accumulation in the modern sector and sectoral composition of output and employment. The former necessitated an aggregative approach, while the latter is, by its nature, at a disaggregated level but in an economy-wide framework. As Reference Syrquin, Chenery and SrinivasanSyrquin (1988: 211) states, ‘accelerating and sustaining growth required increasing the rates of accumulation and maintaining sectoral balance to prevent disequilibrium in product markets, or to overcome disequilibrium prevailing in factor markets’. Therefore, in the classical approach, increases in the investment rate was seen as fundamental in increasing economic growth. As Reference LewisLewis (1954: 155) notes, ‘the central problem in the theory of economic development is to understand the process by which a community which was previously saving and investing 4 or 5 per cent of its national income or less, converts itself into an economy where voluntary saving is running at about 12 or 15 per cent of national income or more’.

In addition to capital formation, classical theories of structural transformation stressed sectoral differences and the dualistic nature of the economies of developing countries. The sectoral differences took different forms in the works of the classical economists. For example, Colin Reference ClarkClark (1940) took the sectors as primary-secondary-tertiary. The Nobel Laureate W. Arthur Lewis took the sectors as traditional-modern, where the traditional-modern did not correspond entirely to the agriculture-manufacturing/services dichotomy which has now become standard in the modern literature on structural transformation (Reference GollinGollin 2014) since commercial agriculture could be considered as part of the ‘modern’ sector, and that there may be parts of the services sector such as petty retail trading which could be considered as ‘traditional’.

Among the classical economists, the clearest theoretical exposition of how structural transformation occurs, and how this may be related to economic growth, is provided by Lewis. For Lewis, the difference between the traditional and modern sectors is that in the former sector, there is a large mass of underemployed workers, with low productivity, while in the modern sector, productivity is high and capitalist methods of production are used. As Reference LewisLewis (1954: 147) notes, productivity is high in this sector as it is ‘fructified by capital’. Economic growth will occur with the expansion of the modern sector as workers move out of the low-productivity traditional sector to the modern sector. The expansion required an increase in savings which can only come from the capitalist sector or from external sources (Reference GollinGollin 2014). With capital accumulation, jobs are created in the modern sector, which are filled by workers from the traditional sector. As these workers move, the savings rate of the economy rises, leading to a virtuous circle that steadily raises the level of income per worker in the economy.

How does structural transformation occur in the Lewis model? We now provide a simple exposition of the Lewis model.Footnote 7 In the standard Lewisian framework, the increase in employment in the modern/ capitalist sector occurs due to a rightward shift in the demand for labour curve in that sector (Reference LewisLewis 1954). Though Lewis defined the modern/capitalist sector broadly to include any activity characterized by modern production techniques or with high levels of capital intensity (such as mining, utilities, and plantation agriculture),Footnote 8 we will focus our analysis on the manufacturing sector, which is the sector most capable of all Lewis characterized as being in the capitalist sector of generating jobs of a sufficient scale (Reference FieldsFields 2004). Due to a wage gap between the manufacturing and the agricultural sectors (the subsistence sector, in Lewis’s original framework), where the manufacturing wage rate is higher than the subsistence wage in the agricultural sector, surplus labour moves from the agricultural sector to the manufacturing sector (Reference BasuBasu 1989). In Lewis’s model, the wage rate in the manufacturing sector is institutionally set (Reference FieldsFields 2004). The wage rate in the agricultural sector, on the other hand, is set in relation to the average productivity in that sector. As long as the real wage differential between the manufacturing and agricultural sectors is sufficiently large, firms in the manufacturing sector will face an unlimited supply of labour from the agricultural sector – that is, they can hire as many workers as they want without increasing the manufacturing wage rate. As the demand for labour in the manufacturing sector shifts rightwards, the labour force in the agricultural sector diminishes, increasing the agricultural wage rate. This movement of labour from the agricultural to the manufacturing sector at the institutionally set fixed manufacturing wage rate will come to an end when the agricultural wage rises to the level of the manufacturing wage rate.

We next provide a simple graphical depiction of the Lewis model. We depict the movement of labour from the agricultural to the manufacturing sector in Figure 1. The demand for labour curve is denoted by D, and employment is denoted by L. The wage rate in the manufacturing sector is set at

![]() . With a shift rightwards of the demand for labour curve from D0 to D1, employment in the manufacturing sector increases from L0 to L1. Agricultural wages increase from w0 to w1 as labour exits from the agricultural sector, leading to a fall in employment in the agricultural sector from L-L0 to L-L1.

. With a shift rightwards of the demand for labour curve from D0 to D1, employment in the manufacturing sector increases from L0 to L1. Agricultural wages increase from w0 to w1 as labour exits from the agricultural sector, leading to a fall in employment in the agricultural sector from L-L0 to L-L1.

Figure 1 The Lewis model

What explains the rightward shift in the demand for labour curve? Implicitly, in the Lewisian framework, this is because of an increase in manufacturing output. This could occur through investment and accumulation as capitalists re-invest their profits (Reference LewisLewis 1954). We depict this possibility in Figure 2. To see how output would affect the demand for labour, we draw a line that gives the different levels of labour demanded at different levels of output in the upper panel of the figure. As output increases from Q0 to Q1, labour demand increases from D0 to D1, leading to higher employment in the manufacturing sector (L0 to L1) at a given real wage (shown in the lower panel of Figure 2). Therefore, as long as there was surplus labour in the agricultural sector, structural transformation (i.e., the movement of workers from agriculture to manufacturing) would be associated with economic growth and higher average productivity in the economy.Footnote 9

Figure 2 Structural transformation in the Lewis model

Lewis did not provide a clear theoretical answer on why we may see different rates of structural transformation across countries. While Reference ClarkClark (1940)’s approach is mostly empirical, he did relate the observed shifts in employment and production structures to differential productivity growth across sectors and shifts in demand over time. As Reference ClarkClark (1940, p. 204) argues, sectoral re-allocation of resources can be

fully explained in terms of two causes, and in terms of them alone. The first is the relative changes in demand on the part of consumers for different types of goods and services … The second cause is quite different and independent. Over a time when consumers’ demands are not changing at all, it is possible that output for worker may be increasing more rapidly in some forms of production than in others; under these circumstances, there will be a transfer of labour away from those industries where output for worker is increasing more rapidly (or decreasing less rapidly).

Clark’s explanation of the twin causes of structural transformation – relative sectoral productivity growth differences and Engel effects related to changes in demand – became the mainstay of the neoclassical approach to structural transformation, which we turn to next.

2.2 The Neoclassical Approach to Structural Transformation

The workhorse model of economic growth in the neoclassical tradition is the Solow–Swan model. This model was proposed independently by Robert Solow and Trevor Swan in 1956. The model economy had one sector, where a single good was produced using two factors of production – capital and labour. Capital was subject to diminishing returns, and the rate of technological progress was taken as exogenous. The model predicts that in the long run, economies converge to their steady state equilibrium and that permanent growth is achievable only through technological progress. Thus, by its very nature, the Solow–Swan model abstracted from sectoral allocation issues in the process of economic development, focusing on the role of capital accumulation and technological change in the aggregate. As Herrendorf, Rogerson, and Valentinyi (henceforth, HRV 2014) note:

The one–sector growth model has become the workhorse of modern macroeconomics. The popularity of the one–sector growth model is at least partly due to the fact that it captures in a minimalist fashion the essence of modern economic growth, which Reference KuznetsKuznets (1973) in his Nobel prize lecture described as the sustained increase in productivity and living standards. By virtue of being a minimalist structure, the one–sector growth model necessarily abstracts from several features of the process of economic growth. One of these is the process of structural transformation, that is, the reallocation of economic activity across the broad sectors agriculture, manufacturing and services.

The limitation of the neoclassical approach (until recently) to explain structural transformation was noted as early as 1988 by Moses Syrquin. As Reference Syrquin, Chenery and SrinivasanSyrquin (1988: 211) notes, ‘in the aggregative version (of the neoclassical approach), there is no surplus labour and long-run growth is independent of the savings rate. In multisectoral models of the von-Neumann type, growth, still independent of the savings rate, proceeds in a balanced fashion and no disequilibrium is allowed’.

The emphasis on balanced growth has been a cornerstone of neoclassical growth for a long time. Balanced growth models could reproduce the so-called Kaldor stylized facts of growth: the relative constancy of the growth rate, the capital-output ratio, the capital share of income, and the real interest rate (Reference Acemoglu and GuerrieriAcemoglu and Guerrieri 2008). However, as HRV (p. 4) note, ‘the conditions under which one can simultaneously generate balanced growth and structural transformation are rather limited and that under these conditions, the multi-sectoral model is not able to account for the broad set of empirical regularities that characterize structural transformation’. HRV argue that ‘progress in building better models of structural transformation will come from focusing on the forces behind structural transformation without insisting on exact balanced growth’ (Reference Acemoglu and GuerrieriAcemoglu and Guerrieri 2008, p. 4).

One of the earliest attempts to move away from balanced growth assumptions in the neoclassical framework was that by William Reference BaumolBaumol (1967). Baumol emphasized the unbalanced nature of growth due to differential productivity growth across sectors, leading to the famous Baumol thesis: that the relative price of services increases with economic development. Reference Acemoglu and GuerrieriAcemoglu and Guerrieri (2008) provide an extension of Baumol’s model by allowing for differences in factor proportions across sectors. By doing so, they show that these differences combined with capital deepening leads to non-balanced growth because an increase in the capital output ratio increases output more in sectors with greater capital intensity. Their model can deliver non-balanced growth at the sectoral level but, at the same time, remain consistent with the Kaldor facts in the long run. The Baumol and Acemoglu–Guerrieri models can be seen as the first credible attempts to incorporate sectoral allocation of resources in neoclassical models of economic growth.

Since the early 2000s, a series of path-breaking papers were developed of multisector models of growth in the neoclassical tradition that were consistent with the stylized facts of structural transformation, such as Reference Ngai and PissaridesNgai and Pissarides (2007), Reference RogersonRogerson (2007), Reference Duarte and RestucciaDuarte and Restuccia (2010), and Reference Herrendorf, Rogerson and ValentinyiHerrendorf, Rogerson, and Valentinyi (2014). Consistent with the neoclassical approach, the models assumed utility maximization by households and profit maximization by producers in the different sectors. Initially, two classes of models were developed: (i) one where the causal explanation was technological or supply-side in nature and which attributed structural transformation to different rates of sectoral total factor productivity growth, and (ii) the second, which was a utility-based or demand-side explanation that required different income elasticities for different goods and could yield structural transformation even with equal total factor productivity growth across all sectors. However, these models assumed a closed economy and also paid less attention to input–output linkages. More recently, there has been attempts to incorporate open economy considerations and construct models which explicitly bring in input–output linkages in the economy. We will first describe the supply-side and demand-side classes of neoclassical models, then briefly discuss the recent theoretical developments in the neoclassical approach to structural transformation.

Supply-Side Models of Structural Transformation

A pioneering paper by Reference Ngai and PissaridesNgai and Pissarides (2007) derived the implications of differential sectoral total factor productivity (TFP) growth rates for structural transformation. Using a benchmark model of many consumption goods and one capital good and with identical production functions across sectors, Ngai-Pissarides show that with low elasticity of substitution across final goods, differences in sectoral TFP growth rates lead to shifts of employment to sectors with low TFP growth through changes in relative prices. Therefore, if TFP growth is higher in agriculture than in services (with TFP growth in manufacturing somewhere in between), relative prices fall in agriculture as compared to services, leading to a re-allocation of workers from agriculture to services. Ngai-Pissarides show that manufacturing’s employment share will be either monotonically decreasing or hump-shaped.

More recent supply-side models of structural transformation have been proposed by Reference Fujiwara and MatsuyamaFujiwara and Matsuyama (2020), Reference Huneeus and RogersonHuneeus and Rogerson (2020), and Reference Sposi, Yi and ZhangSposi et al. (2021) to capture an important stylized fact of structural transformation that we have noted in Section 1 – the phenomenon of premature deindustrialization. Huneeus and Rogerson show that productivity growth in agriculture leads to an increase in the manufacturing employment share, and productivity growth in the non-agricultural sector leads to a flow of workers out of manufacturing under empirically reasonable specifications. At low levels of development, the first force dominates, and at higher levels of development, the second force dominates. This generates the inverse U-shaped nature of manufacturing employment share as income increases. The reason why some countries see manufacturing employment share peaking earlier than others is that sectoral productivity growth rates differ across countries. For countries with slower agricultural productivity growth relative to the rest of the world, manufacturing employment share will peak at a lower level and at an earlier point in the development process. Huneeus and Rogerson argue that differences in agricultural productivity rates across countries can account for the majority of the variation in peak employment shares. The fact that agricultural productivity differs greatly across countries and is particularly low in sub-Saharan Africa has been observed by several scholars, including by Reference Gollin, Lagakos and WaughGollin et al. (2014), and may explain the possibility that sub-Saharan African countries are witnessing the phenomenon of premature deindustrialization. However, as we will argue in Section 5, when we look at the drivers of structural transformation, it is not clear whether sectoral productivity growth differences can explain the patterns of structural transformation that we see in the data, especially for low-income countries.

The models proposed by Reference Fujiwara and MatsuyamaFujiwara and Matsuyama (2020), and Reference Sposi, Yi and ZhangSposi et al. (2021), also look at differences in sectoral productivity growth to explain the phenomenon of deindustrialization. In Fujiwara-Matsuyama, countries differ in their ability to adopt ‘frontier technology’, and premature deindustrialization occurs if adoption takes longer in the service sector than in the manufacturing and agricultural sectors, and poorer countries with larger technology gaps reach the peak manufacturing employment share later and at a lower level of income than richer countries with smaller technology gaps. Sposi et al. bring in sectoral trade integration along with sector-biased productivity growth and show that this leads to a twin phenomenon of deindustrialization and increasing industry polarization.

Demand-Side Models of Structural Transformation

Demand-side models of structural transformation highlight the role of differences in sectoral income elasticities in explaining sectoral re-allocation of labour. If relative sectoral demand shows a strong and stable dependence on income, changes in income will lead to a re-allocation of resources towards sectors with higher income elasticities. For example, if there is a falling demand for agricultural goods and an increasing demand for services with increases in income this would give rise to sizeable shifts of workers from agriculture to services when both sectors are compared to manufacturing. An earlier class of demand-side models (such as Reference Kongsamut, Rebelo and XieKongsamut et al. 2001) relied on specific classes of utility functions with non-homothetic preferences such as generalized Stone-Geary preferences to generate Engel effects on sectoral demand and consequently, changes in sectoral employment and production.

However, a limitation of such models is that they imply that the slopes of relative Engel curves flatten out rapidly over time. Consequently, these models have limited explanatory power in explaining structural transformation in the long run. Reference Comin, Lashkari and MestieriComin et al. (2021) provide a model which assumes non-homothetic Constant of Elasticity (CES) preferences. The advantage of using such a class of utility functions is that they can generate non-homothetic sectoral demand for all levels of incomes, and sectoral Engel curves do not level off with increases in income. Using such a class of utility functions, Comin et al. show that demand-side factors can play a larger role in explaining structural transformation than has been accounted for by previous studies.

In Annexe A1, we propose a simple formal neoclassical model of structural transformation that combines demand- and supply-side explanations, and then assess whether the model is able to replicate the patterns of structural transformation that we observe in the ETD data.

Recent Developments in the Neoclassical Approach to Structural Transformation

Two recent classes of neoclassical models have been developed to take into account key limitations of the earlier models of structural transformation. One limitation is that these models are mostly of the closed economy and do not incorporate the fact that in the current economic environment, most economies are well integrated with the rest of the world (Reference RodrikRodrik 2016). A second limitation is that the earlier models assume away cross-sectoral input–output relationships, when both recent theoretical and empirical research suggest that input–output relationships matter for aggregate total factor productivity and output (Reference ValentinyiValentinyi 2021). We briefly discuss these recent developments in the neoclassical approach to structural transformation.

We first discuss the extensions of the closed economy neoclassical models of structural transformation to the open economy. As Reference MatsuyamaMatsuyama (2009: 478) notes,

we live in the global economy where economies are interdependent with one another. Most empirical studies of structural change, however, write down a closed economy model, apply it to each country, and use the cross-country data to test the model. Effectively, they treat each country as an autarky as if these countries were still isolated fiefdoms in the Middle Ages or were located on different planets.

Matysuyama further argues that assuming that economies are closed would imply that with productivity growth in manufacturing, say in a country like South Korea, the supply-side approach to structural transformation would predict that the number of workers in manufacturing in South Korea would fall. However, since South Korea has significant trade in manufacturing with the rest of the world, the displacement of workers in manufacturing may not occur in South Korea, but in countries that South Korea trades with such as the United States or the UK.

Matsuyama proposes a simple two-economy Ricardian model of trade and structural change, and shows that with trade, productivity growth in manufacturing in the home economy can lead to two countervailing effects – first, an income effect, where manufacturing employment falls at home; and the second, a trade effect, where manufacturing employment increases at home. This suggests that closed economy supply-side models of structural transformation may yield incorrect predictions which are not consistent with empirical facts (since countries with high productivity growth in manufacturing as in East Asia have witnessed increases in manufacturing employment share).Footnote 10

In a similar vein, Reference RodrikRodrik (2016) proposes a model of structural change with international trade and labour-saving technological progress, and uses the model to characterize scenarios where the home country is an advanced economy, a developing economy with comparative advantage in manufacturing, and a developing economy without such a comparative advantage. The model predicts that (a) for the advanced economy, manufacturing employment will sharply decline with the impact on manufacturing output depending on the net effect of technology (positive) and trade (negative), (b) for the developing economy with comparative advantage in manufacturing, there will be an increase in manufacturing output (and possibly employment), and (c) for the developing economy without comparative advantage in manufacturing, there will be a decrease in manufacturing output and employment.Footnote 11

A limitation of the earlier neoclassical models of structural transformation was that they did not pay sufficient attention to the increasing importance of global value chains (GVCs) or global production networks in world trade, where firms in a sector of one country ship intermediate inputs to firms in other sectors based in another country for production (World Bank 2020; Reference ValentinyiValentinyi 2021).Footnote 12 This is also known as vertical specialization in the literature. As the World Bank (2020: 3) points out, ‘GVCs are associated with structural transformation in developing countries, drawing people out of less productive activities and into more productive manufacturing and services activities.’ Typically, analysis of structural transformation is based on the use of value-added production functions which assume away cross-sectoral input–output relations (Reference ValentinyiValentinyi 2021). More recently, models of structural transformation have been developed which incorporate cross-country differences in sectoral linkages or intermediate input intensities across countries. One such model is the one proposed by Reference SposiSposi (2019) which builds a multi-country general equilibrium model of structural change and calibrate the model to forty-one countries using data from the World Input-Output Database. The model captures the two mechanisms by which sectoral linkages matter for structural transformation. Firstly, differences in sectoral linkages result in asymmetric responses in the composition of value added to otherwise identical changes in the composition of final demand. Secondly, cross-country differences in sectoral linkages result in asymmetric responses of relative prices to otherwise identical changes in productivity. Reference SposiSposi (2019) show that inter-sectoral linkages operating through these two mechanisms are able to explain the hump-shaped nature of manufacturing output share with increases in per capita income.Footnote 13

What is the empirical evidence of greater vertical specialization on productivity and employment growth in developing countries? Using an unbalanced panel of ninety-one countries over 1970–2013, and measuring vertical specialization using the import content of exports, Reference Pahl and TimmerPahl and Timmer (2019) find that greater GVC participation has a positive effect on productivity growth but not on manufacturing employment growth. This is consistent with the argument of Reference RodrikRodrik (2018) that the spread of GVCs has had the effect of homogenizing new labour-saving technologies around the world. These new technologies are biased towards skill and other capabilities and away from unskilled labour, making it difficult for low-income countries (who have an abundant supply of unskilled labour) to compete in world markets. However, the Pahl-Timmer study does not directly study the effect of GVC trade or vertical specialization on structural transformation, and this is an area of research that remains to be explored.Footnote 14

2.3 Concluding Remarks

The classical approach to economic development was built on the premise that economic growth was deeply interrelated with processes of structural transformation. The classical approach took as its starting point that economic growth was a disequilibrium process and involved the movement of workers and economic activity from low-productivity traditional sectors such as agriculture to high-productivity modern sectors such as manufacturing, and that this movement was driven in large part by capital accumulation in the modern sector. From the 1950s onwards, with the dominance of the one-sector neoclassical model of economic growth in the literature, there was a long period of time when mainstream economists lost interest in issues around structural transformation (though this interest remained strong among the heterodox economists).

More recently, there has been a resurgence of interest among neoclassical economists on what explains the patterns of structural transformation and the different experiences of industrialization that we observe around the world. Interesting and innovative models of structural transformation have been proposed in the theoretical literature. These models in large part formalize the insights of a classical economist, Colin Clark, on the role that demand and supply-side factors play in determining the pace of structural transformation. While the earlier models were mostly of the closed economy variety and did not incorporate important recent trends in the global economy such as the increasing importance of global production networks, more recent developments in the literature bring in open economy considerations and inter-sectoral linkages in production. It could be argued that these models do not fully capture a characteristic of low-income economies, which is the presence of surplus labour in agriculture. More theoretical work needs to be done to develop models that are more in line with the empirical features of low-income countries. Nevertheless, given the impressive work that has occurred in the literature on the modelling of structural transformation, one can be optimistic that this will be the next stage in the theoretical literature of structural transformation in the neoclassical tradition.

3 A Typology of Stages of Structural Transformation

In this section, we first describe the data that we use in the empirical analysis. We then introduce the typology that we will use to study the paths of structural transformation across countries.

3.1 Data

A key challenge that researchers faced in examining patterns of structural transformation in the developing world was the lack of reliable data on sectoral employment and value-added that is comparable across countries and over time. Much of the previous research on structural transformation used the GGDC ten-sector database (e.g., Reference Timmer and de VriesTimmer and de Vries 2009; Reference Duarte and RestucciaDuarte and Restuccia 2010; Reference Herrendorf, Rogerson and ValentinyiHerrendorf et al. 2014; Reference Diao, McMillan and RodrikDiao et al. 2017). The ten-sector database consists of sectoral and aggregate employment and real value-added statistics for thirty developing countries and nine high-income countries covering the period up to 2010 and, for some countries, to 2011 or 2012. A strength of the database was that the sectoral employment is obtained from the population censuses which have a more complete coverage of informal employment as compared to the labour force surveys. Therefore, employment data in the ten-sector database can be taken to broadly coincide with actual employment levels, regardless of formality status (Reference Diao, McMillan and RodrikDiao et al. 2017). Furthermore, GGDC has specialized in providing harmonized and consistent data on sectoral real-value added, which provides a significant amount of credibility to the data. However, an important limitation of the ten-sector database is that it has only two low-income countries – Ethiopia and Malawi.Footnote 15 In addition, the data end in 2010 for most countries, when the period following 2010 has seen quite remarkable shifts in sectoral patterns in employment and value added, especially in sub-Saharan Africa (see Reference Kruse, Mensah, Sen and de VriesKruse et al. 2021).

In the analysis of structural transformation in this monograph, we use the newly launched GGDC/UNU-WIDER Economic Transformation Database (ETD). The ETD provides time-series of employment and real and nominal value added by twelve sectors in fifty-one countries for the period 1990–2018. It includes twenty Asian, nine Latin American, four Middle East and North African (MENA), and eighteen sub-Saharan African countries/economies at varying levels of economic development. The ETD is constructed from an in-depth investigation of the availability and usability of statistical sources on a country-by-country basis. The ETD is a new data set; it is not an update of time series in an existing sectoral data set. In comparison to the GGDC ten-sector database (Reference Timmer and de VriesTimmer and de Vries 2009), the ETD has better coverage of low-income developing countries, distinguishes twelve sectors in the ISIC revision 4 classification, and has time-series data that run until 2018.

Table 1 gives an overview of the content of the ETD. The data set consists of fifty-one countries at varying levels of economic development. It includes twenty Asian, nine Latin American, four Middle-Eastern and North African (MENA), and eighteen sub-Saharan African countries/economies.Footnote 16 According to data for 2018, they account for a major part of the output of each region, namely 98 per cent, 82 per cent, 36 per cent, and 73 per cent of GDP in Asia, Latin America, MENA, and sub-Saharan Africa, respectively. The ETD countries account for 55 per cent of global real manufacturing VA and 42 per cent of global GDP. The database is constructed by an in-depth investigation of the availability and usability of statistical sources on a country-by-country basis. See Reference De Vries, Arfelt and Dreesde Vries et al. (2021) for a detailed documentation of the sources and methods.

Table 1 Content of GGDC/UNU-WIDER Economic Transformation Database

| Countries included: | |

| Developing Asia (14) | Bangladesh, Cambodia, China, India, Indonesia, Lao People’s Democratic Republic, Malaysia, Myanmar, Nepal, Pakistan, Philippines, Sri Lanka, Thailand, Viet Nam |

| Advanced Asia (6) | Hong Kong (China), Israel, Japan, Korea (Rep. of), Singapore, Chinese Taipei |

| Latin America (9) | Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Ecuador, Mexico, Peru |

| Middle East and North Africa (4) | Egypt, Morocco, Tunisia, Turkey |

| Sub-Saharan Africa (18) | Botswana, Burkina Faso, Cameroon, Ethiopia, Ghana, Kenya, Lesotho, Malawi, Mauritius, Mozambique, Namibia, Nigeria, Rwanda, Senegal, South Africa, Tanzania, Uganda, Zambia |

| # of sectors | Brief description (ISIC rev. 4) |

| 1. | Agriculture (A) |

| 2. | Mining (B) |

| 3. | Manufacturing (C) |

| 4. | Utilities (D+E) |

| 5. | Construction (F) |

| 6. | Trade services (G + I) |

| 7. | Transport services (H) |

| 8. | Business services (J + M + N) |

| 9. | Financial services (K) |

| 10. | Real estate (L) |

| 11. | Government services (O + P + Q) |

| 12. | Other services (R + S + T + U) |

| Time period (annual) | 1990 – 2018 |

| Variables |

|

| Principal sources | National accounts; population censuses; labour force surveys; business surveys |

| Available at: | GGDC and UNU-WIDER, public release 17 February 2021 |

The ETD includes annual data on gross value added at both real and nominal prices for the period 1990–2018. Data on persons employed are also included such that labour productivity (value added per worker) trends can be derived. The database covers the twelve main sectors of the economy as defined in the International Standard Industrial Classification, revision 4 (ISIC rev. 4). Together these twelve sectors cover the total economy.

The data on gross value added in real and nominal prices are from the National Accounts published by the National Statistical Institutes, which accounts for income from formal and informal activities.Footnote 17 Employment in the ETD is defined as ‘all persons engaged’, thus including all paid employees, but also self-employed and family workers, with an age boundary of fifteen years and older. Hence, it aims to include formal and informal workers. Ideally, labour input is measured in hours worked, as differences in hours worked across sectors affect sectoral productivity gaps (Reference Gollin, Lagakos and WaughGollin et al. 2014). However, the data, insofar available, are irregular, and information on hours worked typically only covers the formal sector (see Reference Kruse, Mensah, Sen and de VriesKruse et al. 2021).Footnote 18

The ETD is not the only database that provides sectoral data on value added and employment. For example, the World Bank’s World Development Indicators (WDI) provide value-added database on national accounts data and are, therefore, comparable. For employment, the ILO provides sectoral data. However, the ETD is superior to the ILO’s employment data in several ways. Firstly, while the ETD prefers population censuses, the ILO model prioritizes labour force surveys. Sometimes LFS are not nationally representative and cover urban agglomerations only. As a result, sectoral employment shares can be unreliable.Footnote 19 Another major difference is the reliance on econometric imputation methods to fill up blanks in the ILO model (see Reference Kruse, Mensah, Sen and de VriesKruse et al. 2021 for further details).

Secondly, and most importantly, at the 19th International Conference of Labour Statisticians (ICLS) in 2013 it was decided to narrow the definition of employment to work for pay or profit only. That definition induces a downward effect on the level of agricultural employment, because farmers who mainly or exclusively produce for own use are no longer included in employment by the ILO (Reference Gaddis, Oseni, Palacios-Lopez and PietersGaddis et al. 2020). Production of agricultural goods for own use falls within the boundaries of the system of national accounts and is therefore included in agricultural value added.Footnote 20 Hence, the implementation of the 19th ICLS standards creates an inconsistency between value added in the national accounts and ILO model-based employment estimates for agriculture. This implies that that is difficult to obtain accurate and consistent time series of employment in developing countries using the ICLS definition where subsistence production is common (Reference KlasenKlasen 2019) as well as providing misleading information on the sectoral distribution of employment (Reference Gaddis, Oseni, Palacios-Lopez and PietersGaddis et al. 2020). Currently it is not clear whether, how or for which countries and time periods the 19th ICLS standards have been implemented. The ETD avoids these issues, as it uses the old definition and includes subsistence production workers (Reference Kruse, Mensah, Sen and de VriesKruse et al. 2021).

The ETD does not contain data on high-income countries (except Japan and South Korea). While in principle, we could merge the GGDC 10 sector database with the ETD to have an unified database on structural transformation for high-income, middle-income, and low-income countries, we do not do this in our empirical analysis for three reasons. The first reason has to do with our conceptual understanding of structural transformation. The second and third reasons have to with constraints of data. On the first reason: high-income countries such as the United Kingdom and the United States have reached an advanced stage of structural transformation, where the movement of workers from agriculture to other sectors is largely complete, with very low shares of employment in agriculture. The focus of our Element is on countries which are yet to reach this advanced stage of structural transformation. For this reason, it would be preferable to exclude the mature high-income countries in our analysis of the patterns of structural transformation (we retain Japan and South Korea in our set of countries as they reached high-income status at a later date). Secondly, the GGDC 10 sector database stops in 2010, and we are keen to analyse the period after 2010, as the 2010s were a period of rapid economic growth, especially in sub-Saharan Africa and South Asia, possibly accompanied by significant shifts in sectoral shares of employment and value added. Finally, the ETD uses a twelve-sector classification in contrast to the ten-sector classification used in the original GGDC database which makes sectoral data not strictly comparable. However, in order to check the robustness of our findings, especially in the econometric analysis, we supplement our analysis of the ETD data with the original GGDC data. At the same time, we exclude the real estate sector from our analysis of structural transformation as this sector generates very few jobs and contributes little to GDP.

3.2 A Typology of Stages of Structural Transformation

An important question that is raised right at the outset when we embark on an analysis of the patterns of structural transformation is the following: Should we treat all countries symmetrically? Are there not country differences in the stages of structural transformation or specific features of countries that should be taken into account? The classical approach to structural transformation recognized this possibility when they categorized countries by size (small versus large countries), trade orientation (export-oriented versus import substitution) and so on (see Reference Syrquin, Chenery and SrinivasanSyrquin 1988). For example, in their classic book on the paths of development, Reference Chenery and SyrquinChenery and Syrquin (1975) classify countries using the following criteria: (a) whether the country specializes in primary products or industrial goods, (b) whether the country has balanced trade and production, and (c) whether the country’s trade regime can be classified as export oriented or characterized by import substitution. While this classification made sense at the time of writing of the 1975 book by Chenery and Syrquin, when a large number of developing countries followed import substituting industrialization and many countries were mainly primary producers with little semblance of non-primary production, such a classification is less relevant in contemporary times when most countries have dismantled their import substitution regime and many developing countries have a large part of their workforce in non-primary activities such as manufacturing and services.

In this study, we propose a simple and intuitive way of classifying countries that takes into account the different stages of structural transformation that they are in. A first set of countries are those where agriculture is still the largest sector in terms of the share of employment in the most recent time period available. In our sample, these countries are Burkina Faso, Bangladesh, Cambodia, Cameroon, Ethiopia, India, Kenya, Lao PDR, Malawi, Mozambique, Myanmar, Nepal, Nigeria, Pakistan, Rwanda, Tanzania, Uganda, Vietnam, and Zambia. These countries are in Asia and sub-Saharan Africa. We call these countries structurally underdeveloped. The next set of countries are where more people are employed in the services sector than agriculture, with agriculture being the second largest sector. These countries are Bolivia, Botswana, China, Colombia, Costa Rica, Ecuador, Egypt, Ghana, Indonesia, Lesotho, Morocco, Namibia, the Philippines, Peru, Senegal, Sri Lanka, Thailand, Turkey, and South Africa. We call them structurally developing countries. These countries span all three continents – Africa, Asia, and Latin America.Footnote 21 The final set of countries has more people employed in manufacturing sector than agriculture. These countries in the sample are Argentina, Brazil, Chile, Hong Kong, Israel, Japan, Malaysia, Mauritius, Mexico, Singapore, South Korea, Taiwan, and Tunisia. These countries are either in East Asia or in Latin America (with the exception of Mauritius, which is in Africa). We call these countries structurally developed.Footnote 22 We provide the list of countries by stage of structural transformation in Table 2.Footnote 23

Table 2 Structural transformation country groups

| Structural Transformation Group | |

| Underdeveloped (19) | Burkina Faso, Bangladesh, Cambodia, Cameroon, Ethiopia, India, Kenya, Laos, Malawi, Myanmar, Mozambique, Nigeria, Nepal, Pakistan, Rwanda, Tanzania, Uganda, Vietnam, Zambia |

| Developing (19) | Bolivia, Botswana, China, Colombia, Costa Rica, Ecuador, Egypt, Ghana, Indonesia, Sri Lanka, Lesotho, Morocco, Namibia, Peru, Philippines, Senegal, Thailand, Turkey, South Africa |

| Developed (13) | Argentina, Brazil, Chile, Hong Kong, Israel, Japan, Mauritius, Malaysia, Mexico, Singapore, South Korea Taiwan, Tunisia |

A natural question that arises is whether the classification of countries by stages of structural transformation (ST) maps perfectly to the levels of per capita incomes of these countries. In other words, is it the case that all countries which are structurally underdeveloped poorer than countries which are structurally developing? And are all countries which are structurally developing poorer than countries which are structurally developed? To see if this is the case, we provide a box plot of countries in the three different ST groups by their level of per capita income in Figure 3. We observe that as expected, on average, structurally underdeveloped countries are poorer than structurally developing countries, and structurally developing countries are poorer than structurally developed countries. However, we also note that there are countries in the top quartile of incomes in the structurally underdeveloped group which are richer than the bottom two quartiles for the structurally developing group. Similarly, there are countries in the top quartile of the structurally developing group which are richer than the bottom quartile of the structurally developed group. This suggests that per capita income per se is not a reliable marker of a country’s progress in structural transformation. That is to say, while high levels of per capita income are a necessary condition to reach higher stages of structural transformation, they are not a sufficient condition.

Figure 3 Structural transformation country groups by level of per capita income

Note: ln GDPpc is log of GDP per capita (in constant USD PPP dollars).

In Table 3, we provide selected characteristics of the countries in the three structural transformation groups. These characteristics were seen as the ‘empirical regularities’ accompanying development by Reference Chenery and SyrquinChenery and Syrquin (1975) and Reference Syrquin, Chenery and SrinivasanSyrquin (1988). Firstly, we note that there is a clear positive relationship between trade structure and stage of structural transformation. Structurally underdeveloped countries have the lowest ratios of exports and manufactured exports as percentages of GDP, followed by structurally developing countries, with structurally developed countries having the most export oriented economies. As already noted, structurally underdeveloped countries are the poorest set of countries, followed by structurally developing countries, with structurally developed countries being the richest. Average GDP per capita in structurally underdeveloped countries is roughly one third of that of structurally developing countries, and average GDP per capita in structurally developing countries are roughly one third that of structurally developed. Interestingly, we do not see a clear positive relationship between investment rates and stage of structural transformation. In fact, structurally developed countries have the lowest investment rates among the three groups of countries. Finally, we note that the structurally underdeveloped and developing countries are much larger in terms of population size than structurally developed countries.

Table 3 Selected characteristics by stage of structural transformation (ST), country groups (means)

| ST Groups | Exports (% of GDP) | Manufacturing Exports (% of GDP) | Gross Capital Formation (% of GDP) | GDP per capita (PPP, 2017 US$) | Population (millions) |

|---|---|---|---|---|---|

| Underdeveloped |

|

|

|

|

|

| Developing |

|

|

|

|

|

| Developed |

|

|

|

|

|

Note: standard deviations in parentheses.

In the next section, we examine the differences in patterns of structural transformation across the three country groups.

4 Patterns of Structural Transformation

In this section, we provide a comprehensive description of the patterns of structural transformation for the fifty-one low- and middle-income countries in Africa, Asia, and Latin America in the ETD database for the period 1990–2018, using the typology introduced in the previous section. In our analysis of the patterns of structural transformation, we focus on employment, value added, and labour productivity.

4.1 Patterns in Sectoral Employment

We begin our descriptive analysis of patterns in sectoral employment by looking at employment shares by disaggregated sectors in all countries in our sample over time (Table 4). The share of agriculture in total employment fell from 47.1 per cent in 1990–94 to 32.0 per cent in 2015–18. There was almost no change in manufacturing employment share, which was 12 per cent in 1990–94 and 11.2 per cent in 2015–18. There was a small increase in employment share in non-manufacturing industry from 6 per cent in 1990–94 to 8 per cent in 2015–18, due to an increase in employment share in construction. We observe a large increase in the share of employment in services from 34.9 per cent in 1990–94 to 48.8 per cent in 2015–18. This increase in the share of workers in services is also evident in each of the disaggregated sectors, with the largest absolute increase occurring in the trade sub-sector.

Table 4 Share of employment by stages of structural transformation over time, disaggregated sectors, all countries

| Period | Agriculture | Manufacturing Ind. | Non-manufacturing Ind. | Mining | Utilities | Construction | Services | Trade | Transport | Business | Financial | Govt. & Other |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1990−94 | 47.1% | 12.0% | 6.0% | 0.8% | 0.6% | 4.6% | 34.9% | 12.7% | 3.1% | 2.5% | 0.9% | 15.6% |

| 1995−99 | 44.6% | 11.5% | 6.3% | 0.7% | 0.6% | 5.1% | 37.6% | 14.1% | 3.4% | 3.1% | 1.1% | 16.0% |

| 2000−04 | 41.8% | 11.2% | 6.2% | 0.6% | 0.5% | 5.1% | 40.8% | 15.6% | 3.6% | 3.6% | 1.2% | 16.7% |

| 2005−09 | 38.7% | 11.1% | 6.7% | 0.6% | 0.5% | 5.5% | 43.5% | 16.8% | 4.0% | 4.3% | 1.3% | 17.1% |

| 2010−15 | 35.3% | 11.0% | 7.5% | 0.8% | 0.6% | 6.2% | 46.3% | 17.8% | 4.1% | 5.0% | 1.5% | 17.8% |

| 2015−18 | 32.0% | 11.2% | 8.0% | 0.8% | 0.6% | 6.7% | 48.8% | 18.9% | 4.3% | 5.5% | 1.6% | 18.4% |

Notes: (a) Ind. Is Industry, Serv. Is Services, (b) Non-manufacturing industry is mining, utilities and construction; (c) Services is Trade, Transport, Business, Financial and Govt. and Other.

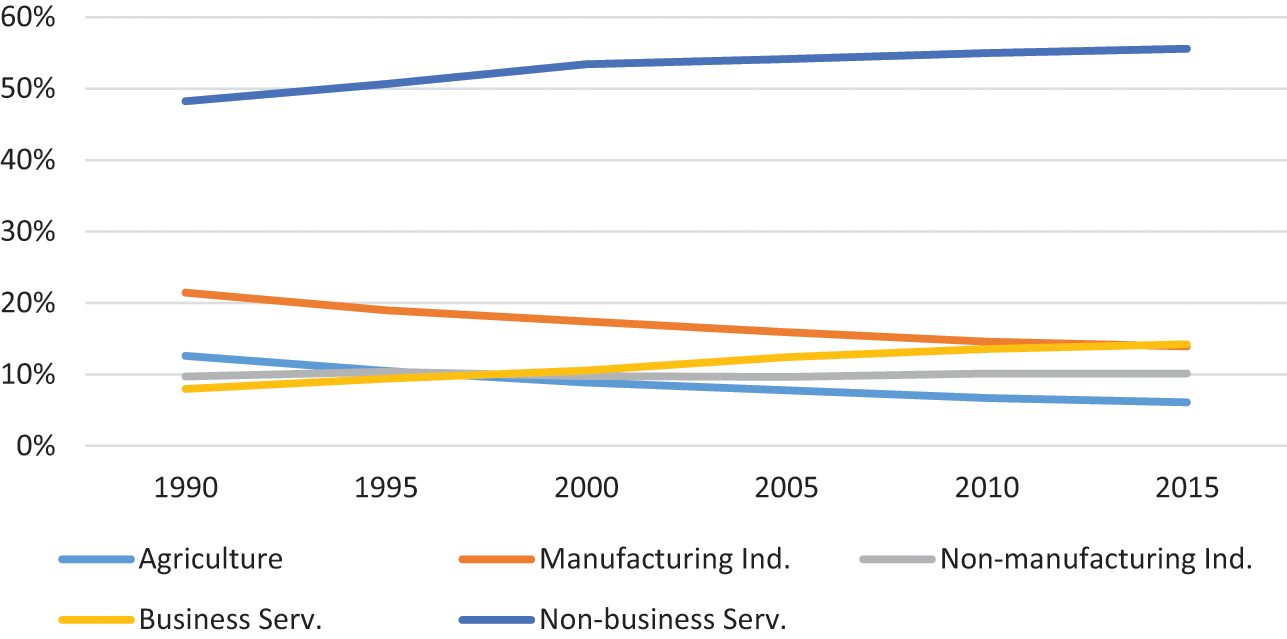

In Figure 4, we provide the allocation of workers by stage of structural transformation, averaged over the entire period, 1990–2018. The broad sectors we look at are agriculture, manufacturing industry, non-manufacturing industry (mining, utilities, and construction), business services (including financial services), and non-business services (trade, transport, government, and others). While it is customary to look at sectoral employment by broad categories – agriculture, manufacturing industry, non-manufacturing industry, and services, in our case, we split services into business and non-business services. There are three reasons why we do so. Firstly, as we will show later in this section, the productivity of the business services sector far exceeds that of the non-business services sector, and is comparable to the productivity of the manufacturing sector. Secondly, the business services sector includes the more tradable parts of the services sector (e.g., information technology), while the non-business sector broadly corresponds to the non-tradable services sector. Thirdly, most of the activity that occurs in the business services sector is in enterprises that are in the formal sector (e.g., information technology firms and banks), while a large part of the activity in the non-business services sector is in the informal sector – including self-employed or household enterprises in trade, hotels and restaurants, and personal services (e.g., fruit and vegetable street vendors).Footnote 24

Figure 4 Share of employment by stages of structural transformation

Note: (a) Ind. Is Industry, and Serv. Is Services.

Agriculture provides under 68 per cent of the employment for structurally underdeveloped countries, 34.6 per cent in structurally developing countries, and 8.9 per cent in structurally developed countries. Manufacturing provided an average of 6.6 per cent of employment in structurally underdeveloped countries, 12.1 per cent of employment in structurally developing countries, and 17.2 per cent of employment in structurally developed countries. Non-manufacturing industry (comprising mining, utilities, and construction) provided an average of 3.4 per cent of employment in structurally underdeveloped countries, 7.9 per cent of employment in structurally developing countries, and 10 per cent of employment in structurally developed countries. Business services (including financial services) provided an average of 1.5 per cent of employment in structurally underdeveloped countries, 4.5 per cent of employment in structurally developing countries, and 11.2 per cent of employment in structurally developed countries. Finally, non-business services provided an average of 20.5 per cent of employment in structurally underdeveloped countries, 40.7 per cent of employment in structurally developing countries, and 52.7 per cent of employment in structurally developed countries.

In Table 5, we provide the same information as in Figure 4, except now we do it by sub-decadal sub-periods. We see the very slow movement of workers in agriculture in structurally underdeveloped countries, from 75.5 per cent in 1990–99 to 58.8 per cent in 2010–18. These countries have also seen a slow increase in the share of employment in manufacturing from 5.5 per cent in 1990–99 to around 8.1 per cent in 2010–2018. In the case of structurally developing countries, the average share of employment in services overtakes employment in agriculture only in the 2000s. For these countries, the share of workers in manufacturing actually fell from the period between 1990 and 2018. Nevertheless, these countries have seen rapid decline in the share of employment in agriculture from 42 per cent in 1990–94 to 26 per cent in 2015–18. For structurally developed, the share of employment in agriculture was low to start with at 13 per cent in 1990–94. By the time we reach the period 2015–18, more workers are employed in non-manufacturing industry in these countries than in agriculture, and services at 56 per cent provide the largest employment by far. Here, we observe a fall in the share of employment in manufacturing over time, from 21 per cent in 1990–94 to 14 per cent in 2015–18.

Table 5 Share of employment by stages of structural transformation over time, by broad sectors and by country group

| Country Group | Period | Agriculture | Manufacturing Ind. | Non-manufacturing Ind. | Business Services | Non-Business Services |

|---|---|---|---|---|---|---|

| Underdeveloped | 1990−94 | 77% | 5% | 2% | 1% | 15% |

| Underdeveloped | 1995−99 | 75% | 5% | 2% | 1% | 16% |

| Underdeveloped | 2000−04 | 72% | 6% | 3% | 1% | 19% |

| Underdeveloped | 2005−09 | 67% | 7% | 3% | 2% | 22% |

| Underdeveloped | 2010−14 | 62% | 7% | 4% | 2% | 24% |

| Underdeveloped | 2015−18 | 57% | 8% | 5% | 2% | 27% |

| Developing | 1990−94 | 42% | 12% | 7% | 3% | 35% |

| Developing | 1995−99 | 39% | 12% | 7% | 4% | 38% |

| Developing | 2000−04 | 36% | 12% | 7% | 4% | 41% |

| Developing | 2005−09 | 33% | 12% | 8% | 5% | 42% |

| Developing | 2010−14 | 30% | 12% | 9% | 6% | 44% |

| Developing | 2015−18 | 26% | 12% | 9% | 7% | 46% |

| Developed | 1990−94 | 13% | 21% | 10% | 8% | 48% |

| Developed | 1995−99 | 11% | 19% | 10% | 9% | 51% |

| Developed | 2000−04 | 9% | 17% | 10% | 11% | 53% |

| Developed | 2005−09 | 8% | 16% | 10% | 12% | 54% |

| Developed | 2010−14 | 7% | 15% | 10% | 14% | 55% |

| Developed | 2015−18 | 6% | 14% | 10% | 14% | 56% |

Notes: (a) Ind. Is Industry, Serv. Is Services, (b) Business Serv. Includes business and financial services; (c) Non-manufacturing Ind. comprises Mining, Utilities, and Construction; (d) Non-business services is Trade, Transport, Government, and Other Services.

It is clear from Table 5 that for structurally underdeveloped economies, most of the growth of employment in the service sector occurs in non-business services rather than business services. This is very different from what is experienced in structurally developing and developed economies, where the most rapid increase in employment for any particular sector is observed in the business services sector; for structurally developing economies, it rises from 3 per cent of total employment in 1990–94 to 7 per cent in 2015–18, and for structurally developed economies, it rises from 8 per cent in 1990–94 to 14 per cent in 2015–18. In contrast, the business services sector remains a paltry 2 per cent of total employment in structurally underdeveloped economies in 2015–18.

The sectoral employment data, by stages of structural transformation, reveal several stylized facts about the patterns of structural transformation, which has also been noted in the previous literature. Firstly, the higher stage of structural transformation, the lower the share of workers in agriculture. Secondly, the lower the stage of structural transformation, the lower the share of workers in manufacturing and non-manufacturing industry. Thirdly, the higher the stage of structural transformation, the higher the share of workers in business and non-business services.

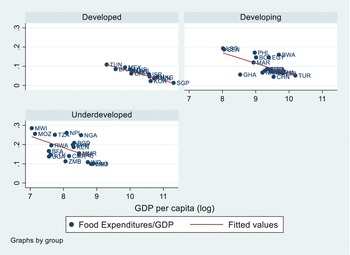

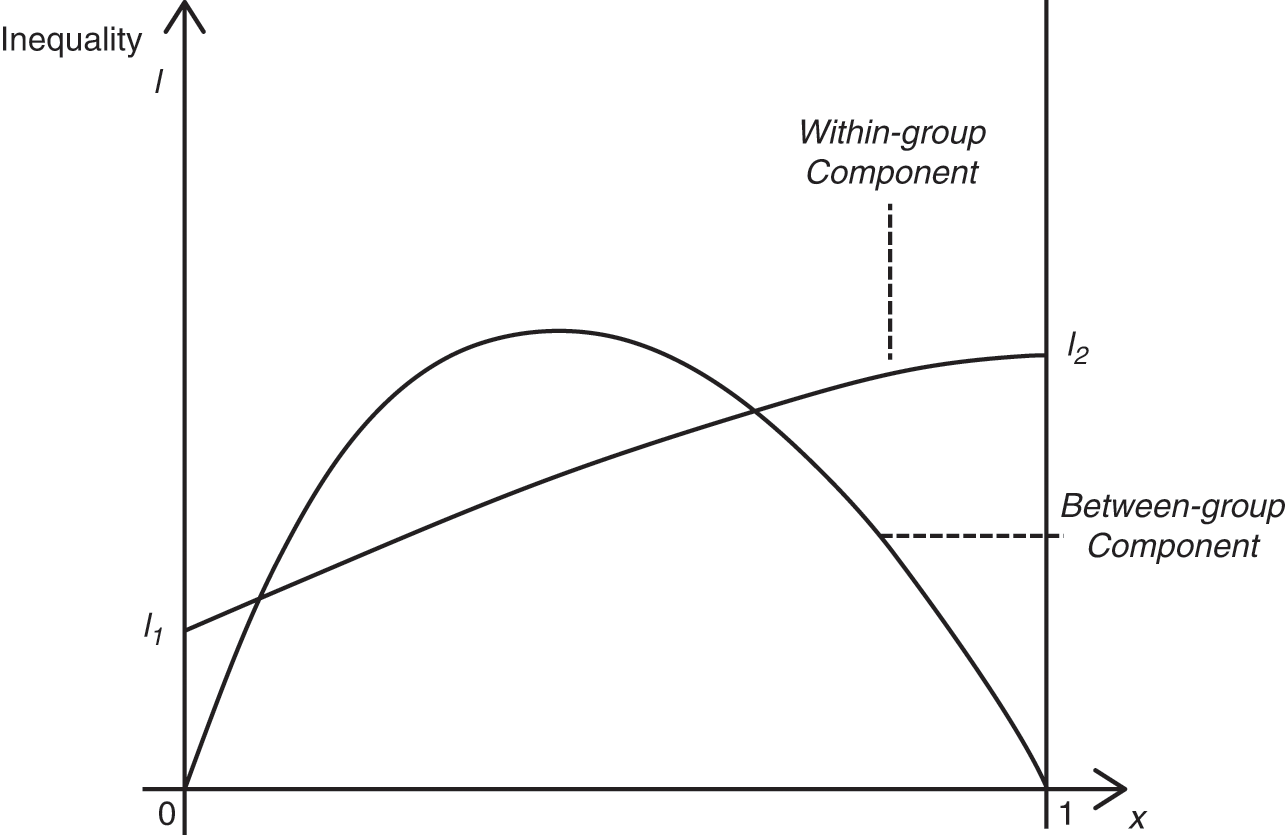

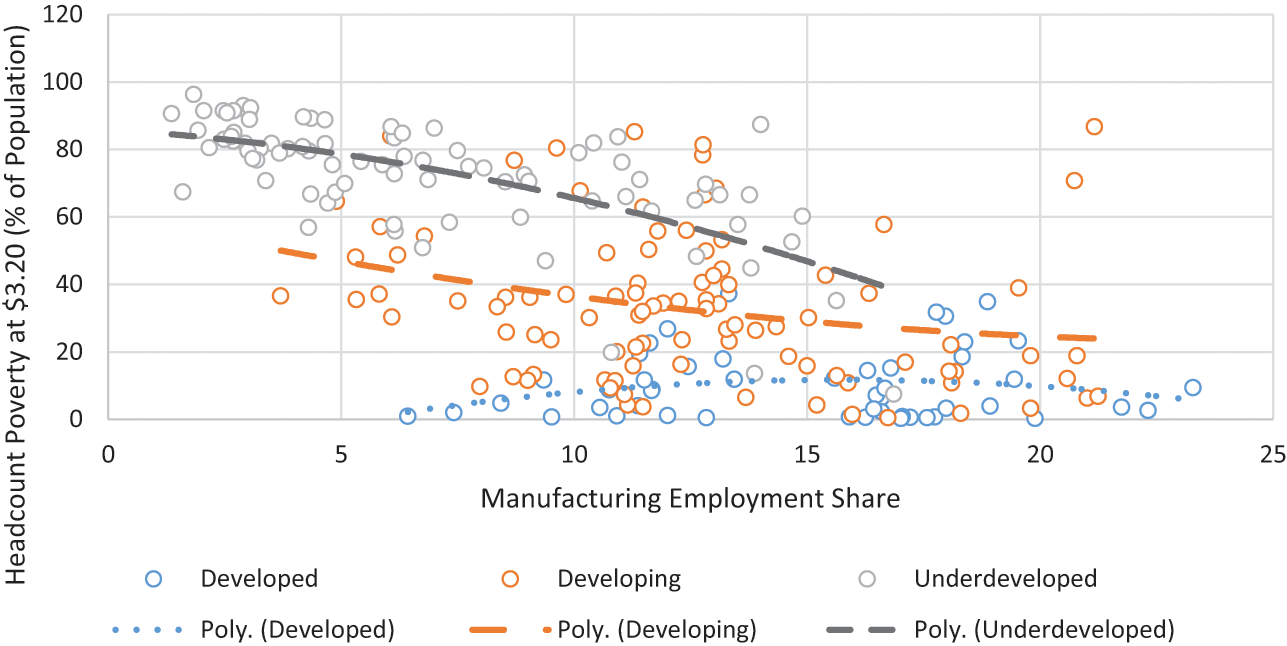

In Section 2, we discussed the Classical approach to structural transformation (as in the work of W. Arthur Lewis), which argued that countries at lower levels of economic development have dualistic labour markets, with large number of workers in the so-called traditional sector, and relatively few workers in the modern sector. We clearly see this feature of economic underdevelopment in the patterns of structural transformation that we observe with the ETD data. If we equate the traditional sector with the agricultural sector, then we see that the largest proportion of workers in the structurally underdeveloped countries are in this sector (around 57 per cent in 2015–18), and with very few workers in the so-called modern sectors – manufacturing industry, non-manufacturing industry, and business services (8, 5, and 2 per cent respectively in 2015–18).Footnote 25 In contrast, there is less evidence of such dualism in the structurally developing and structurally developed countries. Clearly, the challenge of economic development for the structurally underdeveloped countries is to move a large proportion of their workers from agriculture to manufacturing, non-manufacturing industry, and business services.