1 Introduction

In a perfect market economy, the cost of raising an additional euro to finance the government’s spending is equal to one. However, once distortionary taxes are introduced, the marginal cost of public funds, MCPF or MCF, typically deviates from one. The MCPF is a concept that has been around for a long time. However, many different interpretations are available. Therefore, Section 2 of this Element is devoted to a brief historical review, from Adam Smith in the eighteenth century via Dupuit and Marshall in the nineteenth century to the most recent contributions.

As is noted in Section 2, the MCPF has far-reaching implications across a wide range of policy issues. However, in the rest of this Element, the focus is on the role of the MCPF in economic evaluations. An obvious approach to the derivation of concepts for the (social) marginal cost of public funds is to maximize a social welfare function subject to one or several constraints. Typically, the project whose welfare contribution is maximized provides a pure public good; see, for example, Auerbach and Hines (Reference Auerbach, Hines, Auerbach and Feldstein2002), Bastani (Reference Bastani2023), Gahvari (Reference Gahvari2006), and Jacobs (Reference Jacobs2018). However, this Element mostly takes a more “applied” approach and looks at how a small or marginal project affects monetary welfare, although a few maximization problems are discussed. The reason is that the chosen approach probably is more straightforward for a cost–benefit practitioner than the solution to a constrained optimization problem. Initially, the focus is on extremely simple economies. This approach illuminates the principal composition of the concept of the MCPF and illustrates its role in a cost–benefit analysis (CBA).

There is a slightly different approach from CBA that is termed the Marginal Value of Public Funds, MVPF; refer to Hendren and Sprung-Keyser (Reference Hendren and Sprung-Keyser2020, pp. 1222–24) for a comparison of this concept and a traditional CBA. Hendren and Sprung-Keyser (Reference Hendren and Sprung-Keyser2020, p. 1224) note, “Despite our advocacy for the value of the MVPF over a traditional cost-benefit analysis, it is perhaps reassuring to note that, in most cases, these two approaches generate similar conclusions.” In Subsection 3.3 we introduce a simple variation of the concept and compare it to a “conventional” CBA and the benefit–cost ratio.

Following Lundholm (Reference Lundholm2005) another concept is termed the social marginal cost of public funds, SMCPF, which uses a slightly different “exchange rate” between units of utility and monetary units, as is illuminated in Subsection 3.4. A potential problem with the concept is highlighted. As applied by Jacobs (Reference Jacobs2018), monetary benefits are measured in one “currency” while monetary costs are valued in another currency (with an unknown “exchange rate” between the two). Utility benefits are converted to monetary units using the private marginal utility of income. In contrast, utility costs are converted using the social marginal utility of income (that accounts for the impact of income effects on tax bases). However, as we show, if correctly undertaken, the approach will reduce to a conventional CBA.

There is another use of what is termed the SMCPF. In a multi-household economy, the SMCPF is a sum of individual marginal costs of public funds that are multiplied by distributional weights. Refer to, for example, Bessho and Hayashi (Reference Bessho and Hayashi2013). Distributional concerns are addressed in Section 7 of this Element.

The simple approach taken in the first sections of this Element is also useful in addressing another “competing” concept to the MCPF, namely the MEB, of taxation and to illustrate how the MEB is related to the MCPF. The approach employed in computable general equilibrium, CGE, models approximates an MEB by calculating the willingness to pay, WTP, to avoid a small tax increase divided by the associated change in tax revenue. This approach results in the problem that as the tax change is made smaller, one ultimately ends up in 0/0.

The chosen approach also allows us to check how the MCPF is affected by different “parameters,” such as price changes, social security fees, revenues earned by the project, unemployment, and what the concept looks like if a private actor runs the considered project.

Sometimes, the MCPF is defined independently of specific projects. This might seem reasonable, as it allows for separating the MCPF from individual project considerations. However, this is no problem-free approach. In particular, if the project under consideration does not constitute part of the government’s budget, why adjust the project’s costs by an MCPF? The general equilibrium foundations of the approach are far from self-evident, as is illuminated in Subsection A.5 of the Appendix. Another difference is that a definition based on a project assumes that there is a tax, which is a function of the considered project, and adjusts to balance the government’s budget. Without a project, the tax change can be exogenous, and the resulting surplus is stored or wasted. Finally, as is demonstrated already in Sections 3 and 4, in evaluating a project, the adjusted tax need not fall on an input used (or an output provided) by the project under evaluation. Nevertheless, we provide in Subsection 4.4 and Subsection A.2 of the Appendix digestion of the MCPF when there is no project.

Although the focus is on simple models, Section 6 introduces many goods and factors and an intertemporal world. Section 7 addresses the case with many agents, i.e., discusses distributional issues. The final and short section is devoted to a brief review of empirical approaches to estimating the MCPF.

There are virtually an infinite number of combinations of different taxes that can be used to finance a project. Only a selection of these combinations can be covered in this Element. A couple of omitted cases deserve to be mentioned. The hypothesis maintained in this Element is that most practitioners base discounting on the social rate of time preference. This justifies that decisions based on concepts like the social opportunity cost of capital are ignored. Such approaches typically draw on either sophisticated optimal control theory or dynamic programming. The alternative to a project is an investment rather than a tax increase, eliminating the need for an explicit MCPF consideration. The reader interested in reading about taxing capital is referred to Hashimzade and Myles (Reference Hashimzade and Myles2014), Chapters 7–8 in Dahlby (Reference Dahlby2008) and Sørensen (Reference Sørensen2011, Reference Sørensen2014). However, in Subsection 5.4, a tax on profit income is introduced and used to finance the considered public sector project. In contrast, Subsection 5.5 considers a private-sector project in a tax-distorted economy. Another omission refers to risk handling. A good overview of the field is provided by Smith (Reference Smith2022). An (2023) highlights the important impact of charitable giving and warm glow, i.e., non-welfarist approaches, on identifying the MCPF.

It is not necessary to raise taxes to finance a public sector project. An option is to displace other public sector activities. Because the aim is to look at the MCPF, this option is not considered in this Element. A discussion of what might be termed the marginal cost of public sector projects is found in Johansson and Kriström (Reference Johansson and Kriström2019).

The Element is structured as follows. Section 2 provides notes on the history of the MCPF. Section 3 considers the MCPF when lump-sum taxation is used to finance a project, but there also are fixed distortionary taxes on a good and labor. The concept of the social marginal utility of income, a competing concept to the private marginal utility of income, is also addressed. Section 4 abandons the assumption that lump-sum taxation can be used to finance projects and also looks at the concept of the MEB of taxation. Section 5 addresses diverse cases to highlight how different factors affect the MCPF. Section 6 generalizes the approach to an arbitrary number of goods and factors and an intertemporal world. Thus far, there is a single representative agent in the models. Section 7 discusses a few (non-Mirrlees and Mirrlees) multi-agent models to shed some light on how the MCPF is modified if there is an arbitrary number of agents. Section 8 provides a few thoughts on how to estimate the MCPF empirically. An Appendix is added. It provides further details of some of the issues dealt with in the Element.

2 Notes on the History of the MCPF

The ideas that led to the development of the MCPF can, perhaps not surprisingly, be traced back to “The Wealth of Nations” (Smith, Reference Smith1776, Ch 2, Part II). In his discourse on the nature of taxation and public expenditure, Smith posited that taxes “ought to be designed as to take out of the pockets of the people as little as possible, over and above what it brings into the public treasury of the state.” It seems clear that Smith was aware of what we today call deadweight loss. There was a cost of the tax “over and above” what a consumer had to pay for public services. At the time of his writing, there were, however, no tools available to measure that cost.

As pointed out by Musgrave (Reference Musgrave, Eatwell, Milgate and Newman1987, p. 1059), the introduction of consumer surplus by Dupuit (Reference Dupuit1844) – further developed by Marshall (Reference Marshall1890) – made it possible to rigorously measure the welfare loss imposed by different taxation schemes.Footnote 1 Developments of microeconomic theory in the twentieth century helped to clarify the MCPF concept, as well as suggested rigorous measurement approaches. The MCPF became a tool for evaluating the efficiency of tax policies.

However, the history of welfare measurement related to taxation started with the closely related concept of EB. In his survey of the literature, Boehne (Reference Boehne1968) credits the first rigorous economic analysis of EB (using indifference curves) with Barone (Reference Barone1912). The literature then mostly circled around the pros and cons of direct versus indirect taxation, in a partial equilibrium setting. A key contribution, according to Boehne (Reference Boehne1968, p. 25) was Joseph (Reference Joseph1939), who generalized Marshall, Hicks, and other frameworks available at the time. She studied the welfare economics of taxation and helped decrease its dependency (Boehne, Reference Boehne1968, p. 25) on a priori assumptions about (zero) price and income elasticities, including relaxing the “Marshallian” assumption of a constant marginal utility of money.

The next important step was to move from partial to general equilibrium analysis, with key contributions by Arnold Harberger, for example, Harberger (Reference Harberger1964). He showed how the analysis could be undertaken empirically in an ex-ante tax-ridden economy. In Harberger’s own words “...in the general equilibrium case you take account of preexisting distortions that are affected by your move, and if you’re just doing partial equilibrium, you don’t.” (Harberger and Just, Reference Harberger and Just2012, p. 11). The general equilibrium perspective proved essential for a deeper understanding of the MCPF in empirical applications.

The MCPF concept, as understood today, is often attributed to Pigou (Reference Pigou1948). He identified two types of costs with the tax system; administration and compliance together with what he called an “indirect damage” inflicted on the consumer beyond the costs of paying the tax. Administrative costs are the expenses incurred by the government to collect taxes, including the cost of running tax offices, paying salaries to the staff, and maintaining the technology infrastructure required for tax collection. Compliance costs cover expenses borne by taxpayers to comply with tax laws. His analysis has been interpreted to mean that he thought that the MCPF was greater than one.

A key contribution to the early literature on the MCPF was William Vickrey. He applied his ideas to the New York subway deficit in the 1950s, which would be covered by the city budget by increasing taxes. He estimated the cost of this financing to be 130 cents to the dollar. He compared this to alternative fare structures (pricing above marginal cost) that would imply welfare losses of less than 30 cents per dollar. As explained by Atkinson et al. (Reference Atkinson, Arrow and Arnott1997, p. 194) “… he seeks to precisely to implement the Ramsey conditions – but not against a fixed budget constraint; against a fixed MCPF, which is in principle a superior criterion (since it amounts to choosing optimally the level of the constraint).” Vickrey’s contribution stresses the importance of considering the full economic impact of taxation beyond the immediate revenue generated.

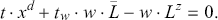

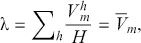

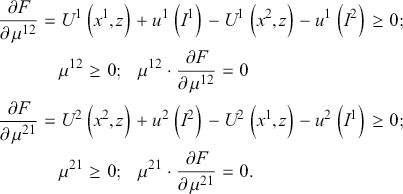

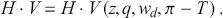

The literature has developed in various directions since Vickrey’s seminal work. Only a few examples are provided here. Gahvari (Reference Gahvari2006), building on Samuelson (Reference Samuelson1954) and Mirrlees (Reference Mirrlees1971) provides a tax model with heterogeneous agents (see section 7). He argues that tax policy should consider both the benefits of public goods and the diverse impacts of funding them on different agents. His analysis challenges, among other things, Pigou’s assertion that distortive taxation warrants a reduced supply of public goods (in modern terms, when ![]() ). For a summary of the optimal taxation literature that discusses Pigou’s assertion, see Tuomala (Reference Tuomala2016).

). For a summary of the optimal taxation literature that discusses Pigou’s assertion, see Tuomala (Reference Tuomala2016).

Hashimzade and Myles (Reference Hashimzade and Myles2014) expand the Barro endogenous growth model and discuss how the composition of public spending and the structure of taxation affect long-term economic growth. Earlier contributions had mainly focused on public spending as an aggregate. They showed that the composition of spending could make a difference in long-run growth. Spending on infrastructure or education may bolster productivity and, thereby, economic growth.

Part of the more recent literature deals with specific challenges, such as sector characteristics, informal economies, “green” double dividends, and tax evasion by multinationals. A few examples of this development follow.

Chetty et al. (Reference Chetty, Looney and Kroft2009) demonstrated that the economic incidence of a tax depends not only on statutory incidence but also on how salient the tax is to consumers. For instance, sales taxes included in the price (low salience) may generate smaller behavioral responses compared to taxes added at the point of sale (high salience), even if the monetary amounts are identical.

Cordano and Balistreri (Reference Vásquez Cordano and Balistreri2010) use a computable equilibrium model with data on Peru, showing that the cost of raising public funds can differ significantly depending on sector-specific characteristics. Sectors with inelastic demand, rigid supply constraints, or limited competition may face higher MCPFs, thereby influencing optimal tax policy design across sectors.

Auriol and Warlters (Reference Auriol and Warlters2012) include the informal economy in the general equilibrium assessment of the MCPF in 38 African countries, suggesting that the informal economy provides a relatively low-cost source of tax revenue. They also find a significant variation of the MCPF in different countries implying that a one-size-fits-all approach to taxation may not be optimal.

As noted, ongoing research underscores the importance of considering both the costs of raising public funds and the benefits of public goods provision, a good example being the “double dividend” debate related to green taxes. If green taxes, non-distortionary by definition, replace distortionary taxes they may lower the MCPF by reducing taxation inefficiencies. Whether or not there exists a double dividend is not clear, in general. We return to this issue in section 5. For a compact summary of the literature on green double dividends, see Jaeger (Reference Jaeger, Lundgren, Bostian and Managi2024).

Tax evasion by multinationals is another contemporary issue of significant interest. Johansson et al. (Reference Johansson, Kriström and Falck2023) study an electricity tax exemption used in Sweden to attract investments in data centers. This exemption tended to benefit multinationals, given the difficulty of taxing their profits. The lost tax revenue, estimated to be in the order of 100 million EUR might have to be replaced by distortionary taxes, potentially increasing the MCPF.

This capsule summary of the history of MCPF barely scratches the surface of the rich literature. For a detailed account of the MCPF concept and its development, a useful place to start is the comprehensive summary by Dahlby (Reference Dahlby2008).

3 The MCPF under Lump-Sum Taxation

In this section, the basic model used in this Element is introduced. The focus is on the case where lump-sum taxation is available. Mostly, there are distortionary taxes on a good and/or labor, otherwise the MCPF would equal one. A conventional CBA is compared to the Marginal Value of Public Funds and the benefit–cost ratio as a decision criterion. Finally, the SMCPF is introduced and contrasted to the MCPF. A weakness of the concept when applied in a social CBA is highlighted. The reader who wants to read more on CBA is referred to, for example, Boadway and Bruce (Reference Boadway and Bruce1984), Boardman et al. (Reference Boardman, Greenberg, Vining and Weimer2018), Brent (Reference Brent2006), de Rus (Reference de Rus2021), Florio (Reference Florio2014), Johansson and Kriström (Reference Johansson and Kriström2016, Reference Johansson and Kriström2018), Just et al. (Reference Just, Hueth and Schmitz2004), or Krutilla and Graham (Reference Krutilla and Graham2023). The typical project considered in this Element involves a public good. Most of the books referred to in Section 2 discuss how to value a public good. There are both stated preference and revealed preference methods. The former methods are based on surveys where agents typically are asked about their willingness to pay for, say, an environmental good, such as climate change. The latter methods draw on market prices. For example, if an agent is willing to pay for the gasoline needed to visit a natural park, the willingness to pay for the visit equals at least what is paid for the gasoline.

We do not discuss the optimal size of a government explicitly, although the optimal provision of a public good could be seen as a proxy for the optimal size of a government. A very recent contribution is provided by McCarthy (Reference McCarthy2024), who discusses the optimal size of a government. According to McCarthy (Reference McCarthy2024, p. 1), in an open economy debt must have deadweight costs equal to the MCPF, so pure Ricardian equivalence, i.e., the idea that consumers anticipate the future so if they receive a tax cut financed by government borrowing they anticipate future taxes will rise, cannot hold and government bonds must be negative net wealth. In a closed economy, however, these deadweight costs will shut down the possibility of government borrowing entirely, and the optimum size of the public sector returns to the pure modified Samuelson rule in the case of a balanced budget.

3.1 The Basic Model

Often, the MCPF is derived in splendid isolation. Then it is hard to see how to apply the concept in CBA. What cost should be multiplied by an MCPF? Can you simply multiply the considered project’s costs by a “multiplier” however defined? The intention here is to provide and discuss the concept in terms of a project. This makes it obvious that the concept of the MCPF is sensitive to the way an evaluator of a project defines the project’s costs, for example, at producer or consumer prices. Different concepts sometimes are taken to be identical.

Because distributional issues are out of scope initially, we assume there is a single representative agent. The indirect utility function of the representative agent is very simple to avoid not seeing the wood for the trees. There are just two private goods, one of which serves as the untaxed numéraire; refer to Auerbach and Hines (Reference Auerbach, Hines, Auerbach and Feldstein2002, pp. 1362–65) for a fine discussion of tax normalization. In addition, there is a public good, i.e., a good that benefits or can be consumed by all agents and typically is provided for free through taxation, which is used to generate cost–benefit rules.Footnote 2 There is also homogenous labor.

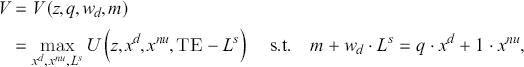

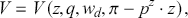

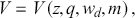

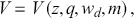

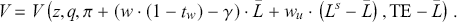

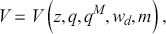

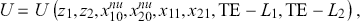

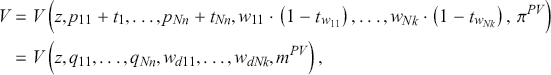

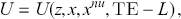

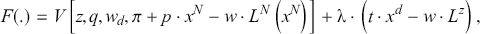

The resulting indirect utility function (assumed to be “well-behaved” in the sense of textbooks on microeconomics), which also serves as the social welfare function, is defined as follows:

(3.1)

(3.1)

where ![]() denotes the exogenous supply/provision of the public good,

denotes the exogenous supply/provision of the public good, ![]() denotes a taxed good,

denotes a taxed good, ![]() denotes the numéraire whose price is normalized to unity,

denotes the numéraire whose price is normalized to unity, ![]() denotes the consumer or end-user price of a commodity,

denotes the consumer or end-user price of a commodity, ![]() denotes the after-tax wage rate,

denotes the after-tax wage rate, ![]() denotes a unit tax

denotes a unit tax ![]() denotes a proportional tax,

denotes a proportional tax, ![]() denotes lump-sum income,

denotes lump-sum income, ![]() and

and ![]() denote profit incomes,

denote profit incomes, ![]() denotes a lump-sum tax, TE denotes the time endowment, and

denotes a lump-sum tax, TE denotes the time endowment, and ![]() denotes labor supply. Thus, we cover two types of common distortionary taxes and a lump-sum tax. In the general case, the demand functions for the private goods, have the same arguments as the indirect utility function. The same holds for the labor supply, but the arguments are suppressed to simplify notation. Note that one could interpret

denotes labor supply. Thus, we cover two types of common distortionary taxes and a lump-sum tax. In the general case, the demand functions for the private goods, have the same arguments as the indirect utility function. The same holds for the labor supply, but the arguments are suppressed to simplify notation. Note that one could interpret ![]() and

and ![]() as vectors. Then, the model covers, for example, a value-added tax (VAT) and different marginal income taxes on different types of labor. We will return to this interpretation later on. Subsection A.1 of the Appendix outlines the maximization problem behind the indirect utility function in equation (3.1).

as vectors. Then, the model covers, for example, a value-added tax (VAT) and different marginal income taxes on different types of labor. We will return to this interpretation later on. Subsection A.1 of the Appendix outlines the maximization problem behind the indirect utility function in equation (3.1).

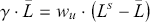

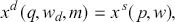

The public sector supplies the public good using labor ![]() as the sole input with

as the sole input with ![]() if the production function

if the production function ![]() is inverted. The sector’s budget constraint is written as follows:

is inverted. The sector’s budget constraint is written as follows:

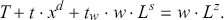

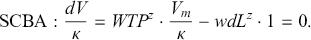

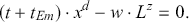

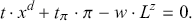

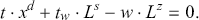

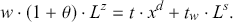

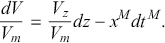

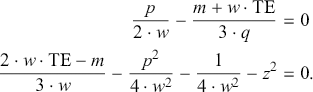

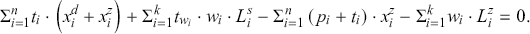

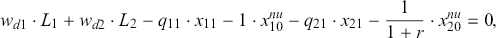

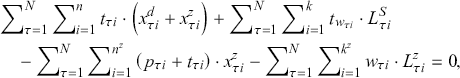

(3.2)

(3.2)

Thus, as mentioned in the previous paragraph, there is a unit tax on demand for the private good and a proportional tax on labor supply. Note that at least one tax must be endogenous and adjusted to “balance” the budget, i.e., just like ![]() , be a function of

, be a function of ![]() . Any compliance and similar costs discussed in Section 2 are ignored; refer also to the classification of cost items provided by Bos et al. (Reference Bos, van der Pol and Romijn2019). Equation (3.2) implies that the government’s budget is always balanced; there is no surplus or deficit. However, the balance requirement need not imply that all three tax instruments are always available.

. Any compliance and similar costs discussed in Section 2 are ignored; refer also to the classification of cost items provided by Bos et al. (Reference Bos, van der Pol and Romijn2019). Equation (3.2) implies that the government’s budget is always balanced; there is no surplus or deficit. However, the balance requirement need not imply that all three tax instruments are always available.

We will make two simplifying assumptions, often employed by analysts looking at the MCPF. First, preferences are weakly separable in ![]() and other goods. This means that

and other goods. This means that ![]() and

and ![]() , as well as the government’s budget, are unaffected by a ceteris paribus change in

, as well as the government’s budget, are unaffected by a ceteris paribus change in ![]() (except through

(except through ![]() , i.e.,

, i.e., ![]() and

and ![]() . Weak separability allows us to focus on the MCPF without considering any spending on

. Weak separability allows us to focus on the MCPF without considering any spending on ![]() but the direct WTP; without this assumption, a typical project also impacts the tax base (in a way that is hard to estimate). This is illuminated in equation (7.6) in Subsection 7.1 and Subsection A.1 in the Appendix. Second, following the tradition within the field, in general, price changes are ignored; refer to Gahvari (Reference Gahvari2006) for a discussion and justification. Nevertheless, Subsection 5.10 introduces a variation where the price of a commodity is flexible. In contrast, Subsection 5.11 looks at the case where general equilibrium prices are “driven” by the project under evaluation. An endogenous wage rate is considered in Subsection A.5 of the Appendix.

but the direct WTP; without this assumption, a typical project also impacts the tax base (in a way that is hard to estimate). This is illuminated in equation (7.6) in Subsection 7.1 and Subsection A.1 in the Appendix. Second, following the tradition within the field, in general, price changes are ignored; refer to Gahvari (Reference Gahvari2006) for a discussion and justification. Nevertheless, Subsection 5.10 introduces a variation where the price of a commodity is flexible. In contrast, Subsection 5.11 looks at the case where general equilibrium prices are “driven” by the project under evaluation. An endogenous wage rate is considered in Subsection A.5 of the Appendix.

3.2 A Simple Cost–Benefit Rule under Lump-Sum Taxation

In this subsection, the distortionary taxes ![]() and

and ![]() remain constant. Thus, the lump-sum tax

remain constant. Thus, the lump-sum tax ![]() is the main tax instrument. A simple, nontechnical interpretation of the MCPF when there are no distortionary taxes is as follows. Suppose the lump-sum tax is increased to yield an extra

is the main tax instrument. A simple, nontechnical interpretation of the MCPF when there are no distortionary taxes is as follows. Suppose the lump-sum tax is increased to yield an extra ![]() in tax revenue (but

in tax revenue (but ![]() is assumed to be reasonably small). The agent pays

is assumed to be reasonably small). The agent pays ![]() , and the tax revenue increases by

, and the tax revenue increases by ![]() , i.e.,

, i.e., ![]() . The amount

. The amount ![]() also reflects what the agent at most is willing to pay to avoid the increase in the tax. In any case, the MCPF equals one. Next, suppose there is a tax

also reflects what the agent at most is willing to pay to avoid the increase in the tax. In any case, the MCPF equals one. Next, suppose there is a tax ![]() on one of the consumption goods. Then, the tax revenue falls short of

on one of the consumption goods. Then, the tax revenue falls short of ![]() by an amount equal to

by an amount equal to ![]() because the increase in

because the increase in ![]() (typically) causes demand for

(typically) causes demand for ![]() to decrease through an income effect, counteracting the tax revenue increase. If there is a proportional tax on labor, there is (typically) a positive effect of

to decrease through an income effect, counteracting the tax revenue increase. If there is a proportional tax on labor, there is (typically) a positive effect of ![]() on labor supply. Then, the ratio of the

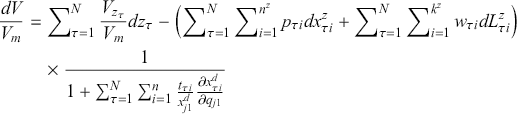

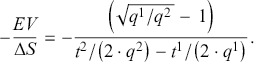

on labor supply. Then, the ratio of the ![]() paid, and the increase in tax revenue equals:

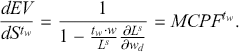

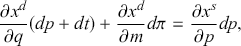

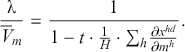

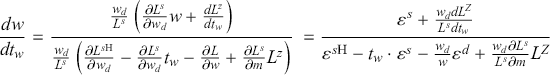

paid, and the increase in tax revenue equals:

This approximates the cost of raising an additional euro in tax revenue. If goods are normal, then ![]() while

while ![]() . If the change in the lump-sum tax is marginal, then the middle expression reduces to

. If the change in the lump-sum tax is marginal, then the middle expression reduces to ![]() in equation (3.4).

in equation (3.4).

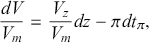

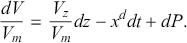

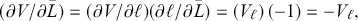

To provide a more formal derivation of this result, differentiate equation (3.1) with all prices and distortionary taxes kept constant, to obtain:

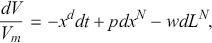

(3.3)

(3.3)

where ![]() denotes the marginal utility provided by the public good

denotes the marginal utility provided by the public good ![]() ,

, ![]() denotes the marginal utility of lump-sum income

denotes the marginal utility of lump-sum income ![]() , equal to the Lagrange multiplier associated with the agent’s budget constraint, and

, equal to the Lagrange multiplier associated with the agent’s budget constraint, and ![]() captures the marginal WTP for the public good. The increase in

captures the marginal WTP for the public good. The increase in ![]() is associated with a negative income effect. However, in itself, this cost–benefit rule is not very helpful.

is associated with a negative income effect. However, in itself, this cost–benefit rule is not very helpful.

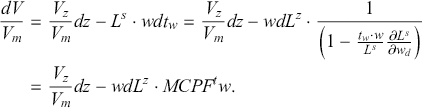

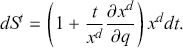

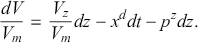

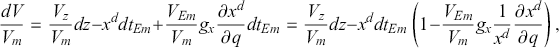

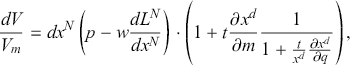

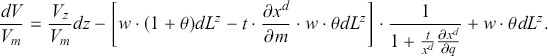

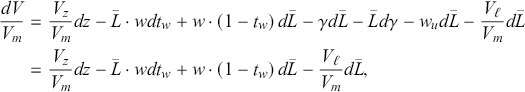

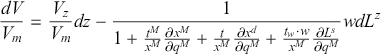

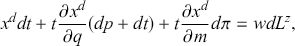

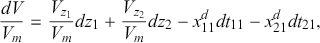

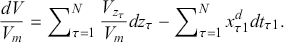

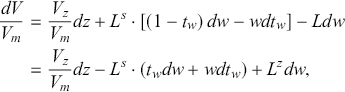

Using equation (3.2), the change in the lump-sum tax can be expressed as:

(3.4)

(3.4)

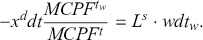

Recall that ![]() with

with ![]() kept constant so that

kept constant so that ![]() in (3.4). Equation (3.4) illuminates what we want to measure. The direct project cost multiplied by

in (3.4). Equation (3.4) illuminates what we want to measure. The direct project cost multiplied by ![]() equals the government’s total expenditure change, i.e.,

equals the government’s total expenditure change, i.e., ![]() . The two final terms of the denominator of

. The two final terms of the denominator of ![]() capture the income effects on demand for the consumption commodity and the labor supply when disposable income is reduced by a slight increase in the lump-sum tax, given

capture the income effects on demand for the consumption commodity and the labor supply when disposable income is reduced by a slight increase in the lump-sum tax, given ![]() . It is seen that if there are no distortionary taxes, then

. It is seen that if there are no distortionary taxes, then ![]() .

.

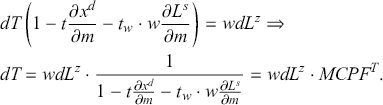

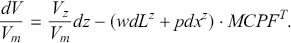

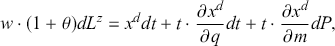

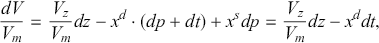

Combining equations (3.3) and (3.4), the following cost–benefit rule is obtained:

(3.3’)

(3.3’)

Thus, the WTP for a small increase in the provision of the public good is compared with the direct or upfront cost of providing the good multiplied by the ![]() .

.

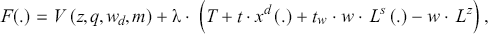

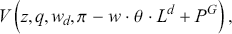

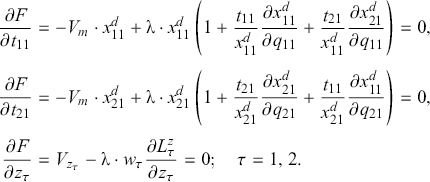

Alternatively, one could arrive at equation (3.3) by maximizing (3.1) subject to (3.2). Then, the government is seen as maximizing social welfare subject to its budget constraint. The Lagrangian is as follows:

(3.5)

(3.5)

where ![]() denotes a Lagrange multiplier.

denotes a Lagrange multiplier.

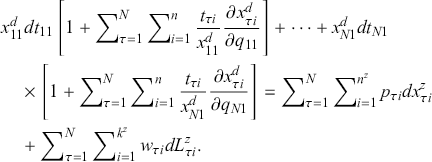

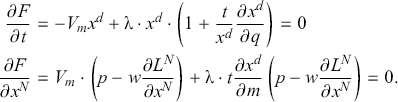

First-order conditions for an interior solution to the decision problem in equation (3.5) are:

(3.6)

(3.6)

where ![]() due to the assumption that preferences are weakly separable in

due to the assumption that preferences are weakly separable in ![]() and other goods. At the second-best optimum, the MCPF is defined as follows:

and other goods. At the second-best optimum, the MCPF is defined as follows:

(3.7)

(3.7)

This is seen from the first line in equation (3.6).

Multiplying the second line in equation (3.6) by one over ![]() converts the expression from units of utility to monetary units. Thus, at a second-best optimum, the CBA reads:

converts the expression from units of utility to monetary units. Thus, at a second-best optimum, the CBA reads:

(3.3”)

(3.3”)

This is the same rule as derived by differentiating the indirect utility function and stated in equation (3.3’), although (3.3”) is evaluated at the second-best optimum, and ![]() is ignored.

is ignored.

Several observations follow.

First, if there were no distortionary taxes, i.e., there is an optimal tax system, then the total cost of financing the project equals

so that

so that  . Then, equation (3.3”) replicates Samuelson’s (Reference Samuelson1954) rule for the optimal provision of a public good but for a single-agent society.

. Then, equation (3.3”) replicates Samuelson’s (Reference Samuelson1954) rule for the optimal provision of a public good but for a single-agent society.Second, with distortionary taxation, whether

exceeds or falls short of one is not obvious because if commodities are normal there are counteracting income effects:

exceeds or falls short of one is not obvious because if commodities are normal there are counteracting income effects:  while

while  in equation (3.7). Thus, if

in equation (3.7). Thus, if  , then

, then  , while if

, while if  , then

, then  .Footnote 3 The unit tax typically reduces demand for the taxed good and, hence, undermines the tax base, causing an extra cost. On the other hand, the income tax typically induces the agent to work more, hence adding to the tax base, and reducing the total cost of the considered project.

.Footnote 3 The unit tax typically reduces demand for the taxed good and, hence, undermines the tax base, causing an extra cost. On the other hand, the income tax typically induces the agent to work more, hence adding to the tax base, and reducing the total cost of the considered project.Third, we have assumed that one of the goods is subject to a unit tax. Shifting to constant ad valorem taxation implies that

is replaced by

is replaced by  in the

in the  ’s denominator.

’s denominator.Fourth, if the project is optimally sized, i.e., such that

, then the ratio between marginal benefits and direct costs equals the MCPF.Footnote 4

, then the ratio between marginal benefits and direct costs equals the MCPF.Footnote 4Fifth, the optimal provision of

is unaffected by the tax normalization rule, i.e., it does not matter whether there is an untaxed numéraire (as assumed here) or

is unaffected by the tax normalization rule, i.e., it does not matter whether there is an untaxed numéraire (as assumed here) or  or

or  is set equal to zero. The reason is that the tax normalization rule affects the MCPF and the marginal utility of income symmetrically. This can be seen using the middle line in equation (3.6); see Gahvari (Reference Gahvari2006, p. 1255) for details.

is set equal to zero. The reason is that the tax normalization rule affects the MCPF and the marginal utility of income symmetrically. This can be seen using the middle line in equation (3.6); see Gahvari (Reference Gahvari2006, p. 1255) for details.Sixth, multiplying the income effects in (A.4) by

and

and  , respectively,

, respectively,  can be interpreted in terms of income elasticities for the demand of the good and the supply of labor. That is, the percentage increase, if normal, in demand for the good (the percentage decrease of the supply of labor) as lump-sum income increases by one percent.

can be interpreted in terms of income elasticities for the demand of the good and the supply of labor. That is, the percentage increase, if normal, in demand for the good (the percentage decrease of the supply of labor) as lump-sum income increases by one percent.

The project is valued at the market wage before tax, i.e., at factor price. Thus, the project displaces production/employment elsewhere valued at ![]() or the value of the marginal product (although the MCPF modifies this outcome). This rule is slightly adjusted if the assumption of weak separability of the public good and other goods is abandoned; refer to Subsection A.1 in the Appendix for details. If the production of

or the value of the marginal product (although the MCPF modifies this outcome). This rule is slightly adjusted if the assumption of weak separability of the public good and other goods is abandoned; refer to Subsection A.1 in the Appendix for details. If the production of ![]() also requires the private good, given weak separability, the same principle applies as for labor, i.e., value at factor price. This issue is addressed in Subsection 5.1.

also requires the private good, given weak separability, the same principle applies as for labor, i.e., value at factor price. This issue is addressed in Subsection 5.1.

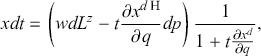

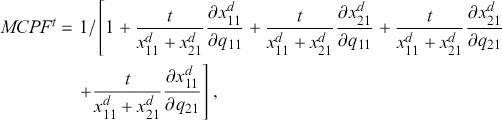

3.3 Extending the Analysis to Two Other Approaches

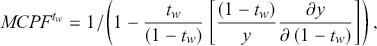

We have considered a simple CBA in which the project’s upfront cost is multiplied by ![]() and deducted from the project’s monetary benefits. Next, consider two other ways of empirically assessing the economic benefits and costs of marginally expanding the public good provision. The first one is the benefit–cost ratio, BCR. The other is the Marginal Value of Public Funds,

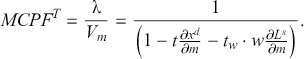

and deducted from the project’s monetary benefits. Next, consider two other ways of empirically assessing the economic benefits and costs of marginally expanding the public good provision. The first one is the benefit–cost ratio, BCR. The other is the Marginal Value of Public Funds, ![]() .Footnote 5 Drawing on the second line in equation (3.6), a small project should be undertaken if:

.Footnote 5 Drawing on the second line in equation (3.6), a small project should be undertaken if:

(3.8)

(3.8)

where ![]() denotes the willingness to pay for

denotes the willingness to pay for ![]() ,

, ![]() , and

, and ![]() of an increase in

of an increase in ![]() equals the WTP for the increase divided by the net cost of the increase. The first line provides a “conventional” CBA, where costs are adjusted by the MCPF. The second line evaluates the ratio of the benefits and total costs of the project.Footnote 6 The third line compares the project’s WTP per euro of (here only upfront) costs with its MCPF. According to Hendren and Sprung-Keyser (Reference Hendren and Sprung-Keyser2020, p. 8), “The

equals the WTP for the increase divided by the net cost of the increase. The first line provides a “conventional” CBA, where costs are adjusted by the MCPF. The second line evaluates the ratio of the benefits and total costs of the project.Footnote 6 The third line compares the project’s WTP per euro of (here only upfront) costs with its MCPF. According to Hendren and Sprung-Keyser (Reference Hendren and Sprung-Keyser2020, p. 8), “The ![]() of a tax change tells us how much individuals are willing to pay to avoid the tax increase per dollar of net government revenue that is raised.” That WTP equals

of a tax change tells us how much individuals are willing to pay to avoid the tax increase per dollar of net government revenue that is raised.” That WTP equals ![]() in equation (3.8). For comparisons of the properties of the three criteria in equation (3.8), refer to García and Heckman (Reference García and Heckman2022) and Hendren and Sprung-Keyser (Reference Hendren and Sprung-Keyser2020, Reference Hendren and Sprung-Keyser2022).

in equation (3.8). For comparisons of the properties of the three criteria in equation (3.8), refer to García and Heckman (Reference García and Heckman2022) and Hendren and Sprung-Keyser (Reference Hendren and Sprung-Keyser2020, Reference Hendren and Sprung-Keyser2022).

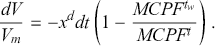

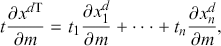

Note that converting the utility benefits and costs to monetary units does not affect the sign of the economic evaluation, i.e., all approaches preserve the sign of the change in utility ![]() . The change in utility is just scaled up or down. Dividing the marginal utility of the public good by the private marginal utility of income (after multiplication by

. The change in utility is just scaled up or down. Dividing the marginal utility of the public good by the private marginal utility of income (after multiplication by ![]() ) provides the WTP for a small change in the provision of the public good. This concept can be estimated using survey techniques, such as contingent valuation, or travel cost models. Similarly, estimating/approximating the MCPF can be done using economic variables such as income (and price) elasticities; our equation (3.8) can easily be restated to be expressed in terms of income elasticities. Such elasticities can be estimated using, for example, econometric techniques.

) provides the WTP for a small change in the provision of the public good. This concept can be estimated using survey techniques, such as contingent valuation, or travel cost models. Similarly, estimating/approximating the MCPF can be done using economic variables such as income (and price) elasticities; our equation (3.8) can easily be restated to be expressed in terms of income elasticities. Such elasticities can be estimated using, for example, econometric techniques.

3.4 The MCPF versus Diamond’s Social MCPF (SMCPF)

In this subsection, the properties of Diamond’s (Reference Diamond1975) concept, which we, following Lundholm (Reference Lundholm2005), term the SMCPF, are examined, but note that the term SMCPF is also used to refer to the SMCPF in multi-household economies; see, for example, Bessho and Hayashi (Reference Bessho and Hayashi2013). Subsubsection 3.4.1 introduces the concept, showing that an economic evaluation drawing on the SMCPF if correctly undertaken, reduces to a conventional CBA. In Subsubsection 3.4.2, a fundamental problem with the approach as applied by some authors is illuminated. Subsubsection 3.4.3 contains a numerical illustration of the fundamental problem with evaluations based on the SMCPF.

3.4.1 Why the SMCPF Is Superfluous in Economic Evaluations: A Novel Result

The concept examined so far converts utility units to monetary units using the private marginal utility of income. There is an alternative approach that instead uses what is termed the social marginal utility of income as the exchange rate between units of utility and monetary units. This variable accounts for income effects on tax bases. The associated marginal cost measure is termed the SMCPF; see, for example, Diamond (Reference Diamond1975) and Jacobs (Reference Jacobs2018); Jacobs seems to be today’s leading proponent of the approach.Footnote 7

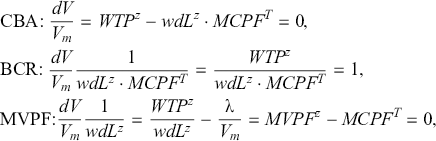

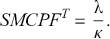

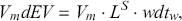

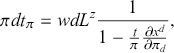

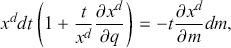

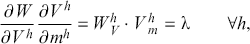

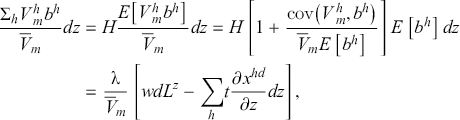

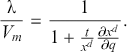

To arrive at the SMCPF, consider the social marginal utility of lump-sum income, a concept due to Diamond (Reference Diamond1975):

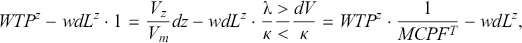

(3.9)

(3.9)

where the right-hand side equals ![]() . Thus, the Diamond (Reference Diamond1975) definition includes the social value of income effects on tax bases. The SMCPF is defined as follows:

. Thus, the Diamond (Reference Diamond1975) definition includes the social value of income effects on tax bases. The SMCPF is defined as follows:

(3.10)

(3.10)

If both ![]() and

and ![]() are normal, then

are normal, then ![]() while

while ![]() in equations (3.9) and (3.10). Hence, if both

in equations (3.9) and (3.10). Hence, if both ![]() and

and ![]() are strictly positive, then it is unclear whether

are strictly positive, then it is unclear whether ![]() exceeds or falls short of

exceeds or falls short of ![]() .

.

Using (3.9) in the first line of equation (3.6) to eliminate ![]() , one finds that at the second-best tax optimum

, one finds that at the second-best tax optimum ![]() . Thus, at this optimum, the SMCPF equals one. We presume that this result explains why some economists recommend using the SMCPF in economic evaluations.

. Thus, at this optimum, the SMCPF equals one. We presume that this result explains why some economists recommend using the SMCPF in economic evaluations.

At a second-best tax optimum, the social CBA can be stated as follows:

(3.11)

(3.11)

The ![]() approach in equation (3.11) requires that the WTP is adjusted by the ratio of

approach in equation (3.11) requires that the WTP is adjusted by the ratio of ![]() and

and ![]() . This might seem impossible in practice, but there are attempts to estimate the marginal utility of income. Refer, for example, to Groom and Maddison (Reference Groom and Maddison2019), who provide estimates for the UK, and Layard et al. (Reference Layard, Mayraz and Nickell2008) who found that the marginal utility of income declines somewhat faster than in proportion to the rise in income. Nevertheless, noting that

. This might seem impossible in practice, but there are attempts to estimate the marginal utility of income. Refer, for example, to Groom and Maddison (Reference Groom and Maddison2019), who provide estimates for the UK, and Layard et al. (Reference Layard, Mayraz and Nickell2008) who found that the marginal utility of income declines somewhat faster than in proportion to the rise in income. Nevertheless, noting that ![]() at the second-best optimum so that

at the second-best optimum so that ![]() in equation (3.11), and using equation (3.7), monetary benefits in equation (3.11) can be expressed as

in equation (3.11), and using equation (3.7), monetary benefits in equation (3.11) can be expressed as ![]() , and the SCBA becomes:

, and the SCBA becomes:

(3.11’)

(3.11’)

Multiplying through by ![]() , using the fact that

, using the fact that ![]() , the left-hand side becomes

, the left-hand side becomes ![]() , and the MCPF is shifted to the cost side. Thus, at the second-best optimum, the outcome replicates the one of a conventional CBA. To the best of our knowledge, this is a novel result. In any case, there seems to be no reason to turn to the SMCPF, at least not if the purpose is to undertake a CBA.

, and the MCPF is shifted to the cost side. Thus, at the second-best optimum, the outcome replicates the one of a conventional CBA. To the best of our knowledge, this is a novel result. In any case, there seems to be no reason to turn to the SMCPF, at least not if the purpose is to undertake a CBA.

3.4.2 Why the Standard Application of the SMCPF Is Problematic: A Novel Result

The SCBA stated in equation (3.11’) differs from the definition suggested by Jacobs (Reference Jacobs2018), who, as mentioned in Section 3.4.1, seems to be today’s leading proponent of the SMCPF approach. Refer also to Holtsmark (Reference Holtsmark2019). Bos et al. (Reference Bos, van der Pol and Romijn2019) argue in favor of the SMCPF being set equal to one but have been strongly criticized by Boardman et al. (Reference Boardman, Greenberg, Vining and Weimer2020). According to Jacobs (Reference Jacobs2018, footnote 28), the Dutch government assumes that ![]() in its cost–benefit analyses of public sector projects.

in its cost–benefit analyses of public sector projects.

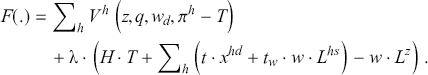

Jacobs (Reference Jacobs2018) calculates the left-hand side expression in the following comparison:

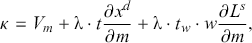

(3.12)

(3.12)

where ![]() is identical to equation (3.11’), at least one of the distortionary taxes

is identical to equation (3.11’), at least one of the distortionary taxes ![]() and

and ![]() is strictly positive but fixed, and

is strictly positive but fixed, and ![]() at the second-best optimum.Footnote 8 The left-hand expression in (3.12) is seemingly a conventional CBA. However, the following expression in (3.12) reveals that this outcome is achieved by converting utility benefits and costs to monetary units using different and unobservable “exchange rates” (

at the second-best optimum.Footnote 8 The left-hand expression in (3.12) is seemingly a conventional CBA. However, the following expression in (3.12) reveals that this outcome is achieved by converting utility benefits and costs to monetary units using different and unobservable “exchange rates” (![]() and

and ![]() , respectively).Footnote 9 Thus, the properties of

, respectively).Footnote 9 Thus, the properties of ![]() are not preserved by the two left-hand side expressions in (3.12), in general. The exception occurs if (and only if)

are not preserved by the two left-hand side expressions in (3.12), in general. The exception occurs if (and only if) ![]() , i.e., when there are no income effects in equation (3.9), implying that

, i.e., when there are no income effects in equation (3.9), implying that ![]() .Footnote 10 If

.Footnote 10 If ![]() exceeds (falls short of) one, then the two left-hand side expressions in (7) underestimate (overestimate) the social profitability of the considered project, i.e.,

exceeds (falls short of) one, then the two left-hand side expressions in (7) underestimate (overestimate) the social profitability of the considered project, i.e., ![]() . This assumes that the SMCPF equals one for the nonoptimal

. This assumes that the SMCPF equals one for the nonoptimal ![]() -level suggested by the two left-hand side expressions in equation (3.12). There seems to be no support for this assumption except when the utility function is quasi-linear. This is further illuminated in Subsection 3.4.3.

-level suggested by the two left-hand side expressions in equation (3.12). There seems to be no support for this assumption except when the utility function is quasi-linear. This is further illuminated in Subsection 3.4.3.

Hence, the two left-hand side expressions in (3.12) do not replicate a Samuelson (Reference Samuelson1954) second-best optimal level for the provision of the public good, in general. The exception occurs if ![]() , because then

, because then ![]() at the same

at the same ![]() -quantity (optimum) as prescribed by the two left-hand side expressions in (3.12).

-quantity (optimum) as prescribed by the two left-hand side expressions in (3.12).

3.4.3 A Numerical Illustration of the Results

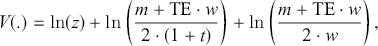

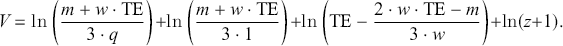

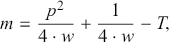

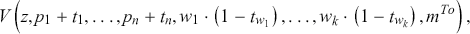

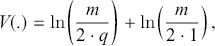

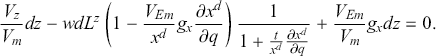

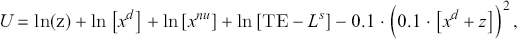

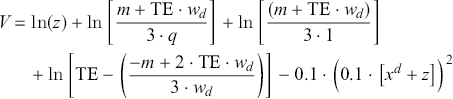

Next, we provide a simple numerical example illustrating the main point made in the previous subsubsection. Suppose we have the following (logarithmic) Cobb-Douglas type of indirect utility function:

(3.13)

(3.13)

where the second argument on the right-hand side refers to ![]() , with

, with ![]() , TE denotes the time endowment, the final argument refers to

, TE denotes the time endowment, the final argument refers to ![]() , i.e., leisure time, and

, i.e., leisure time, and ![]() .

.

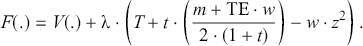

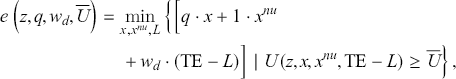

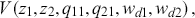

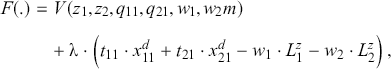

The Lagrangian is stated as follows:

(3.14)

(3.14)

Thus, ![]() . In what follows,

. In what follows, ![]() will be set equal to

will be set equal to ![]() , and TE to 24.

, and TE to 24.

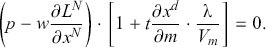

First-order conditions for an interior solution are as follows:

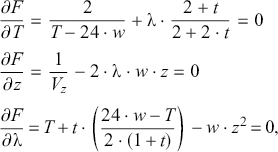

(3.15)

(3.15)

where we have used the fact that ![]() , when the private sector faces constant returns to scale and earns zero profits. Solving this equation system, one finds that:

, when the private sector faces constant returns to scale and earns zero profits. Solving this equation system, one finds that: ![]() ,

, ![]() , and

, and ![]() .

.

(The same solution is obtained if labor serves as numéraire.) Assuming that the private sector uses labor as the sole input and faces constant returns to scale, the equilibrium wage equals ![]() when

when ![]() laborers are required per unit of the good. In what follows, it is assumed that

laborers are required per unit of the good. In what follows, it is assumed that ![]() . It can be shown that

. It can be shown that ![]() ; to obtain this result, evaluate

; to obtain this result, evaluate ![]() for

for ![]() . Hence,

. Hence, ![]() , i.e., exceeds one whenever

, i.e., exceeds one whenever ![]() .

.

Evaluating ![]() , one finds that it equals

, one finds that it equals ![]() , implying that

, implying that ![]() at the second-best optimum. Therefore, a SCBA of the kind stated on the left-hand side of (3.12) reads:

at the second-best optimum. Therefore, a SCBA of the kind stated on the left-hand side of (3.12) reads:

(3.12’)

(3.12’)

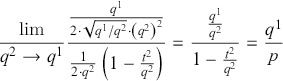

This approach suggests that the second-best optimum occurs at ![]() . It is easily verified that the following holds for this expression:

. It is easily verified that the following holds for this expression:

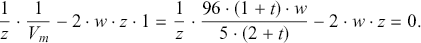

(3.16)

(3.16)

Thus, the limit of the expression as ![]() approaches zero equals the second-best solution (which, due to the separability of the utility function, equals the first-best solution, although the utility reaches its maximum for

approaches zero equals the second-best solution (which, due to the separability of the utility function, equals the first-best solution, although the utility reaches its maximum for ![]() . This can also be seen from equation (3.9), according to which

. This can also be seen from equation (3.9), according to which ![]() for

for ![]() , implying that a SCBA of the kind stated in the left-hand side of (3.12) coincides with a conventional CBA if there are no distortionary taxes. However, a SCBA of the kind stated in equation (3.12’) provides an incorrect answer whenever

, implying that a SCBA of the kind stated in the left-hand side of (3.12) coincides with a conventional CBA if there are no distortionary taxes. However, a SCBA of the kind stated in equation (3.12’) provides an incorrect answer whenever ![]() . In the considered C-D case, it overestimates the optimal

. In the considered C-D case, it overestimates the optimal ![]() -level whenever

-level whenever ![]() , and the overestimation increases in

, and the overestimation increases in ![]() . In addition, if

. In addition, if ![]() , then there is no reason to believe that

, then there is no reason to believe that ![]() at the

at the ![]() -level suggested by equation (3.12’). Recall that increasing

-level suggested by equation (3.12’). Recall that increasing ![]() beyond the second-best optimum requires additional workers and, hence, additional tax revenue.

beyond the second-best optimum requires additional workers and, hence, additional tax revenue.

These claims can be further illuminated by evaluating equation (3.14) with ![]() fixed at

fixed at ![]() and

and ![]() fixed at, say, 2, i.e., proceeding as if

fixed at, say, 2, i.e., proceeding as if ![]() represents a second-best optimum, given

represents a second-best optimum, given ![]() . Thus, solve the first and final lines of (3.15) with

. Thus, solve the first and final lines of (3.15) with ![]() . This causes utility to decrease from around 6.63 when

. This causes utility to decrease from around 6.63 when ![]() is fixed at its second-best optimal level

is fixed at its second-best optimal level ![]() to around 6.57 when

to around 6.57 when ![]() , and the SMCPF, estimated as

, and the SMCPF, estimated as ![]() , equals 19/14, i.e., is no more equal to one (but is lower than the second-best one). Evaluating (3.12’), but with the

, equals 19/14, i.e., is no more equal to one (but is lower than the second-best one). Evaluating (3.12’), but with the ![]() instead of equal to 1, one finds that a marginal increase in

instead of equal to 1, one finds that a marginal increase in ![]() from

from ![]() causes a loss of around 12.75. (Using

causes a loss of around 12.75. (Using ![]() calculated at the second-best optimum to value monetary benefits, the loss increases to 16.1.) Thus, in the current C-D example, the SMCPF approach, as implemented by Jacobs (Reference Jacobs2018) and others, overestimates the second-best optimal level of provision of the public good. Moreover, the SMCPF deviates from one at the suggested optimum.

calculated at the second-best optimum to value monetary benefits, the loss increases to 16.1.) Thus, in the current C-D example, the SMCPF approach, as implemented by Jacobs (Reference Jacobs2018) and others, overestimates the second-best optimal level of provision of the public good. Moreover, the SMCPF deviates from one at the suggested optimum.

A conventional CBA multiplies the second line in equation (3.15) by ![]() , which leaves the optimal

, which leaves the optimal ![]() -level unchanged. The same holds if the equation is multiplied by

-level unchanged. The same holds if the equation is multiplied by ![]() (and the resulting expression can be converted so that the SCBA equals the CBA, as shown following equation (3.11’)).

(and the resulting expression can be converted so that the SCBA equals the CBA, as shown following equation (3.11’)).

4 Ramsey Taxation

Lump-sum taxation is not necessarily available or used. Then, we end up in what here is termed a Ramsey world; refer to Ramsey (Reference Ramsey1927). In this subsection, we consider both a unit tax on a good and proportional income taxation. The MEB is also introduced, and the problem of using the concept in economic evaluations is highlighted.

4.1 A Unit Tax on a Good

Suppose that the commodity tax ![]() is used to balance the government’s budget, with

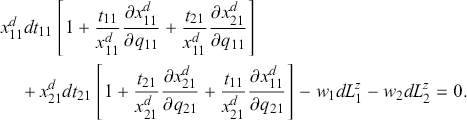

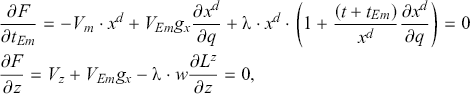

is used to balance the government’s budget, with ![]() . Then, proceeding as in equations (3.3) and (3.4), one obtains:

. Then, proceeding as in equations (3.3) and (3.4), one obtains:

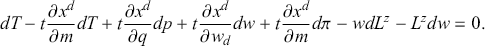

(4.1)

(4.1)

where the marginal utility of income, as usual denoted ![]() , equals the Lagrange multiplier associated with the agent’s budget constraint in equation (A.3) in the Appendix, and

, equals the Lagrange multiplier associated with the agent’s budget constraint in equation (A.3) in the Appendix, and ![]() is obtained by differentiating (3.2) with

is obtained by differentiating (3.2) with ![]() .Footnote 11 Thus, the sign of the tax elasticity of the taxed commodity in the denominator of the MCPF determines whether

.Footnote 11 Thus, the sign of the tax elasticity of the taxed commodity in the denominator of the MCPF determines whether ![]() exceeds or falls short of unity. For almost all goods (except Veblen and Giffen), the price – and hence the tax – elasticity is negative, implying that the tax increase decreases the tax base. Therefore, one expects that

exceeds or falls short of unity. For almost all goods (except Veblen and Giffen), the price – and hence the tax – elasticity is negative, implying that the tax increase decreases the tax base. Therefore, one expects that ![]() but finite; recall that the tax elasticity is typically a fraction of the price elasticity because

but finite; recall that the tax elasticity is typically a fraction of the price elasticity because ![]() is much smaller than

is much smaller than ![]() , the consumer price. Refer to Subsection 5.10 for the case where the producer price also adjusts. Note that (4.1) can be expressed in terms of a price elasticity

, the consumer price. Refer to Subsection 5.10 for the case where the producer price also adjusts. Note that (4.1) can be expressed in terms of a price elasticity ![]() , where

, where ![]() denotes the price elasticity of demand for the commodity. That is,

denotes the price elasticity of demand for the commodity. That is, ![]() reflects the percentage change in demand for the good when its end-user price is increased by one percent.

reflects the percentage change in demand for the good when its end-user price is increased by one percent.

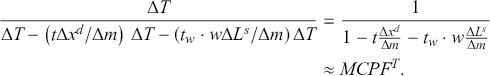

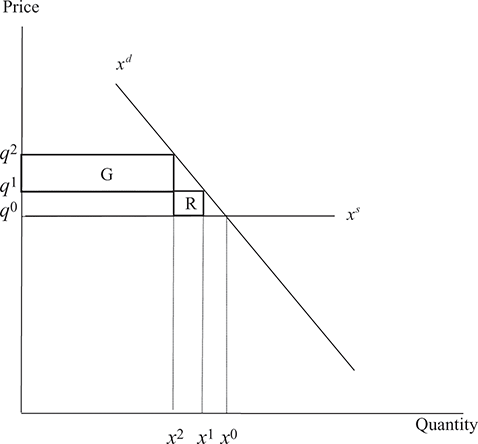

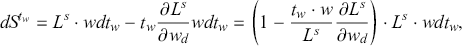

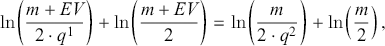

A graphical illustration is provided in Figure 1. The initial tax is ![]() , so the consumer price equals

, so the consumer price equals ![]() , where the producer price remains constant (and

, where the producer price remains constant (and ![]() . Total tax revenue equals

. Total tax revenue equals ![]() , where

, where ![]() denotes the equilibrium quantity. Next, suppose that the tax is increased to

denotes the equilibrium quantity. Next, suppose that the tax is increased to ![]() , causing the consumer price to increase to

, causing the consumer price to increase to ![]() . The tax revenue increases to

. The tax revenue increases to ![]() . The area in the figure referred to as G captures an increase in tax revenue, while the area referred to as R refers to a contraction in revenue. The net increase in tax revenue equals G – R. Provided the increase in the tax is small, R could also be seen as a (rough) proxy for the value of lost output (where the opportunity cost per unit equals

. The area in the figure referred to as G captures an increase in tax revenue, while the area referred to as R refers to a contraction in revenue. The net increase in tax revenue equals G – R. Provided the increase in the tax is small, R could also be seen as a (rough) proxy for the value of lost output (where the opportunity cost per unit equals ![]() .Footnote 12 This assumption allows a neat simplification of the approximation of the MCPF in equation (4.1’).

.Footnote 12 This assumption allows a neat simplification of the approximation of the MCPF in equation (4.1’).

Figure 1 The partial impact of a tax hike

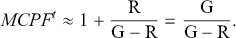

According to Dahlby (Reference Dahlby2008, p. 29), one can approximate the MCPF by adding the initial euro paid in tax to obtain:

(4.1’)

(4.1’)

This measure captures the euro surrendered to the government plus the approximated loss in net output per euro of added tax revenue. For a small increase in the tax, the right-hand side expression could be interpreted as (approximately) the loss of consumer surplus per euro of additional tax revenue. However, it does not make sense to base (non-marginal) welfare evaluations on ordinary or Marshallian demand functions; in general, they do not reflect WTP or the willingness to accept (WTA) compensation. Refer to Figure A.1 in the Appendix for further discussion.

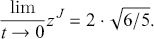

Equation (4.1’) goes to ![]() as the change in the tax goes to zero. Nevertheless, it is possible to relate the approach to equation (4.1) by considering a marginal tax increase from

as the change in the tax goes to zero. Nevertheless, it is possible to relate the approach to equation (4.1) by considering a marginal tax increase from ![]() . Then, G shrinks to a line of length

. Then, G shrinks to a line of length ![]() . Thus, the tax revenue increases by

. Thus, the tax revenue increases by ![]() (per unit of

(per unit of ![]() ;

; ![]() also reflects a gain in consumer surplus of a marginal decrease in the tax when

also reflects a gain in consumer surplus of a marginal decrease in the tax when ![]() remains constant. R reduces to the negative of the tax

remains constant. R reduces to the negative of the tax ![]() times the induced reduction in demand, i.e., to

times the induced reduction in demand, i.e., to ![]() . Thus, this area could also be seen as the marginal increase in the deadweight loss (from the initial triangle). Then, (4.1’) is modified to read:

. Thus, this area could also be seen as the marginal increase in the deadweight loss (from the initial triangle). Then, (4.1’) is modified to read:

(4.1”)

(4.1”)

This replicates equation (4.1).

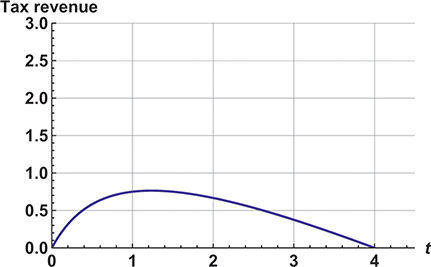

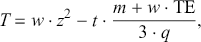

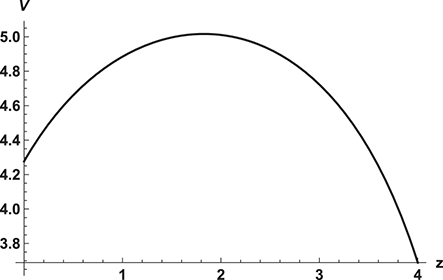

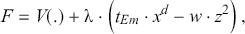

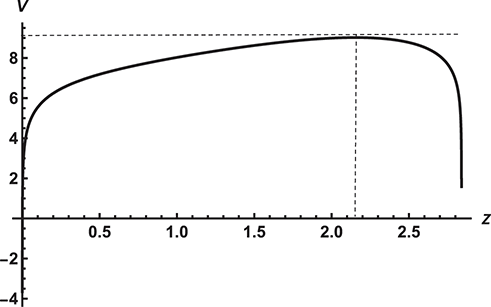

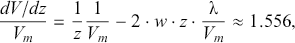

The MCPF can also be related to the Laffer curve. Such a curve is illustrated in Figure 2, drawing on a Stone-Geary type of demand function: ![]() with

with ![]() . The tax revenue equals

. The tax revenue equals ![]() , reaching a maximum at

, reaching a maximum at ![]() . The slope of the Laffer curve, i.e., the change in tax revenue as

. The slope of the Laffer curve, i.e., the change in tax revenue as ![]() changes, equals the denominator of equation (4.1) multiplied by

changes, equals the denominator of equation (4.1) multiplied by ![]() .Footnote 13

.Footnote 13 ![]() equals one for

equals one for ![]() and goes to infinity – the denominator in (4.1) goes to zero – as one approaches the maximum of the Laffer curve; the slope equals zero at the top of the curve. In this case,

and goes to infinity – the denominator in (4.1) goes to zero – as one approaches the maximum of the Laffer curve; the slope equals zero at the top of the curve. In this case, ![]() is undefined to the right of the maximum of the Laffer curve.

is undefined to the right of the maximum of the Laffer curve.

Figure 2 A Laffer curve

However, the Laffer curve need not have a negatively sloped segment. For example, if preferences are Cobb-Douglas, say, ![]() , tax revenue will approach a maximum as the tax rate (and the

, tax revenue will approach a maximum as the tax rate (and the ![]() ) go to infinity; commodities are essential, implying that the agent cannot “survive” with zero consumption.

) go to infinity; commodities are essential, implying that the agent cannot “survive” with zero consumption.

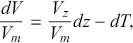

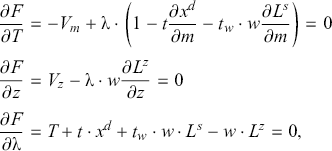

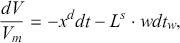

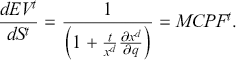

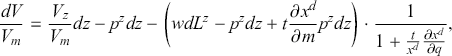

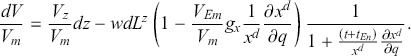

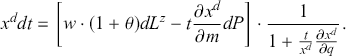

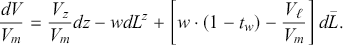

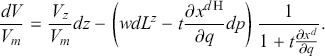

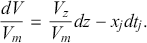

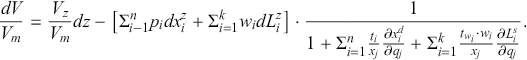

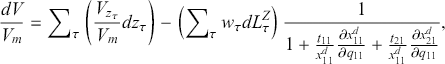

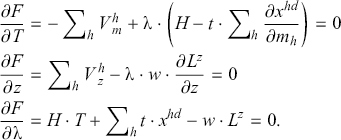

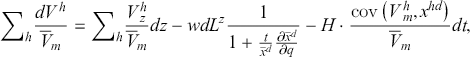

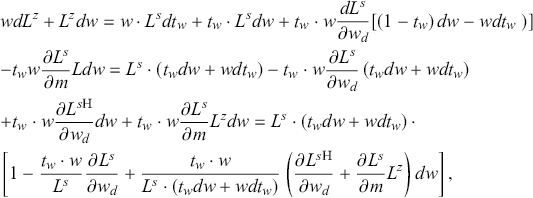

4.2 A Proportional Income Tax

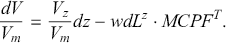

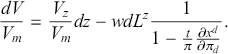

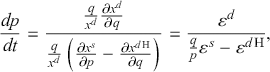

Next, assume the project cost is covered by raising the wage tax with ![]() . Then, the cost–benefit rule equals:

. Then, the cost–benefit rule equals:

(4.2)

(4.2)

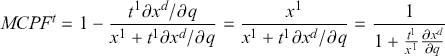

In this case, the MCPF is obtained by differentiating (3.2) with ![]() .Footnote 14 The tax elasticity of labor supply determines whether the MCPF exceeds or falls short of unity. If labor supply is increasing in

.Footnote 14 The tax elasticity of labor supply determines whether the MCPF exceeds or falls short of unity. If labor supply is increasing in ![]() , then the elasticity is positive, and

, then the elasticity is positive, and ![]() exceeds one because the tax increase undermines the tax base. At the same time,

exceeds one because the tax increase undermines the tax base. At the same time, ![]() falls short of one if the increase in the tax rate stimulates labor supply, i.e., if

falls short of one if the increase in the tax rate stimulates labor supply, i.e., if ![]() so that the supply curve for labor is backward-bending and equals one if labor supply is completely inelastic. The

so that the supply curve for labor is backward-bending and equals one if labor supply is completely inelastic. The ![]() can also be expressed in terms of the elasticity of labor supply. That is, the percentage change in labor supply as the disposable wage increases by one percent. Simply multiply the tax elasticity in equation (4.2) by

can also be expressed in terms of the elasticity of labor supply. That is, the percentage change in labor supply as the disposable wage increases by one percent. Simply multiply the tax elasticity in equation (4.2) by ![]() and rearrange terms.

and rearrange terms.

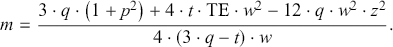

A Laffer curve with a similar shape as the one depicted in Figure 2 is obtained if labor income is taxed and the supply of labor equals ![]() with

with ![]() , and a TE equal to 24. Given

, and a TE equal to 24. Given ![]() , tax revenue equals

, tax revenue equals ![]() and reaches a maximum at

and reaches a maximum at ![]() .

.

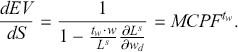

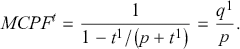

In an empirical study, it might be advantageous to base the estimation on the elasticity of taxable income instead. Given a proportional income tax, this concept measures how taxable income changes in response to net-of-tax rate changes, where the net-of-tax rate is one minus the marginal tax rate; refer to, for example, Acheson et al. (Reference Acheson, Stanley, Kennedy and Morgenroth2018), Saez (Reference Saez2001), Gruber and Saez (Reference Gruber and Saez2002), and Saez et al. (Reference Saez, Slemrod and Giertz2012). In the simple case considered here, if taxable income is denoted ![]() , and there is a proportional income tax

, and there is a proportional income tax ![]() , then one calculates

, then one calculates ![]() to estimate the elasticity. After some calculations, one obtains:

to estimate the elasticity. After some calculations, one obtains:

(4.3)

(4.3)

where the elasticity of taxable income is contained within square brackets.

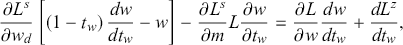

4.3 A Simple Tax Reform

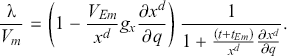

Let us consider a simple tax reform where holding ![]() constant, the income tax is increased, and the commodity tax is reduced:

constant, the income tax is increased, and the commodity tax is reduced:

(4.4)

(4.4)

where ![]() and

and ![]() . The tax reform is such that the total tax revenue remains unchanged. Based on equation (3.2), after some calculations, one obtains:

. The tax reform is such that the total tax revenue remains unchanged. Based on equation (3.2), after some calculations, one obtains:

(4.5)

(4.5)

Thus:

(4.6)

(4.6)

Hence, using (4.6) in (4.4), the tax reform has the following impact on monetary welfare:

(4.7)

(4.7)

The tax reform, with ![]() and

and ![]() , is welfare-improving if

, is welfare-improving if ![]() . At the second-best optimum, the marginal cost of raising funds is the same for the two considered taxes, i.e., welfare cannot be increased by marginally shifting from one tax to the other, as seen from (4.7). However, the direct cost of a project must still be multiplied by an MCPF as long as there are distortionary taxes, and the benefit side must be added.

. At the second-best optimum, the marginal cost of raising funds is the same for the two considered taxes, i.e., welfare cannot be increased by marginally shifting from one tax to the other, as seen from (4.7). However, the direct cost of a project must still be multiplied by an MCPF as long as there are distortionary taxes, and the benefit side must be added.

4.4 The MCPF versus the MEB

According to Ballard and Fullerton (Reference Ballard and Fullerton1992), one can speak of a Dasgupta-Stiglitz-Atkinson-Stern tradition or MCPF-tradition in which MCPF may be larger or smaller than one and of a Harberger-Pigou-Browning tradition or an MEB tradition in which the MCPF is always larger than unity (a claim that can be challenged, for example, if the tax is addressing a negative externality or if an increase in a labor tax increases labor supply). Dahlby (Reference Dahlby2008, pp. 42–47) provides a good historical survey of alternative approaches.

The EB is typically defined for discrete tax changes, see, for example, Fullerton (Reference Fullerton1991), but here we initially focus on the marginal case. Let us use the wage tax as an example. Initially, ![]() with equivalent variation,

with equivalent variation, ![]() = 0. Then, we look at a marginal EV such that:

= 0. Then, we look at a marginal EV such that:

(4.8)

(4.8)

where the marginal equivalent variation ![]() is the maximal sum of money the agent is willing to pay to avoid the increase in the labor tax, with

is the maximal sum of money the agent is willing to pay to avoid the increase in the labor tax, with ![]() ; refer to Subsection 5.6 for more on income-compensated or Hicksian WTP/WTA measures. The impact of the proposed tax increase on the government’s budget when

; refer to Subsection 5.6 for more on income-compensated or Hicksian WTP/WTA measures. The impact of the proposed tax increase on the government’s budget when ![]() equals:

equals:

(4.9)

(4.9)

where ![]() denotes the net surplus of the government’s budget, with

denotes the net surplus of the government’s budget, with ![]() . Combining equations (4.8) and (4.9) yields:

. Combining equations (4.8) and (4.9) yields:

(4.10)

(4.10)

Thus, ![]() equals the MCPF caused by a marginal tax increase. However, the MEB is obtained by deducting

equals the MCPF caused by a marginal tax increase. However, the MEB is obtained by deducting ![]() from

from ![]() i.e.,

i.e., ![]() . This is done to get the change in EB. Dividing

. This is done to get the change in EB. Dividing ![]() by the change in tax revenue

by the change in tax revenue ![]() yields the EB per euro of additional tax revenue. Thus,

yields the EB per euro of additional tax revenue. Thus, ![]() .

.

Drawing instead on the concept of the equivalent surplus, labor supply is kept constant. Then, (4.10) reveals that ![]() equals unity while

equals unity while ![]() equals zero. This is so because the tax increase has no impact on labor supply, i.e.,

equals zero. This is so because the tax increase has no impact on labor supply, i.e., ![]() in (4.10).

in (4.10).

One can also define the MEB for a commodity. The marginal EV now equals:

(4.8’)

(4.8’)

The surplus is changed as follows:

(4.9’)

(4.9’)

Hence:

(4.10’)

(4.10’)

This replicates (4.1). Holding demand constant, i.e., turning to an equivalent surplus, the expression equals one because ![]() .

.

One could also consider a discrete change in the income (or the commodity) tax and evaluate ![]() . However, evaluating

. However, evaluating ![]() for

for ![]() (or

(or ![]() results in

results in ![]() because both

because both ![]() and

and ![]() go to zero as the tax change goes to zero. (This is why, for example, Auriol and Warlters (Reference Auriol and Warlters2012, p. 61) add one-ten-thousandth of a percentage point to the existing tax rate.) However, in the second step, we differentiate

go to zero as the tax change goes to zero. (This is why, for example, Auriol and Warlters (Reference Auriol and Warlters2012, p. 61) add one-ten-thousandth of a percentage point to the existing tax rate.) However, in the second step, we differentiate ![]() and

and ![]() with respect to

with respect to ![]() to obtain

to obtain ![]() and

and ![]() . In the final step, we evaluate

. In the final step, we evaluate ![]() for

for ![]() , i.e., employ l’Hôpital’s rule. Using this approach, one can replicate (4.10) and (4.10’). For more on l’Hôpital’s rule, see, for example, page 481 in Varian (Reference Varian1992) or Section 8.8.3 in Johansson and Kriström (Reference Johansson and Kriström2016). A numerical illustration is found in Subsection A.2 of the Appendix, which also provides a graphical illustration of the EB.

, i.e., employ l’Hôpital’s rule. Using this approach, one can replicate (4.10) and (4.10’). For more on l’Hôpital’s rule, see, for example, page 481 in Varian (Reference Varian1992) or Section 8.8.3 in Johansson and Kriström (Reference Johansson and Kriström2016). A numerical illustration is found in Subsection A.2 of the Appendix, which also provides a graphical illustration of the EB.

It seems to be a standard in the CGE literature to estimate EV/![]() for a small tax increase and interpret it as a measure of the MCPF; see, for example, Auriol and Warlters (Reference Auriol and Warlters2012, p. 58), Barrios et al. (Reference Barrios, Pycroft and Saveyn2013, p. 10) or Vásquez Cordano and Balistreri (Reference Vásquez Cordano and Balistreri2010, p. 259). Nevertheless, except in the marginal case, EB + 1 and MCPF are two different concepts addressing different issues; see, for example, Auerbach and Hines (Reference Auerbach, Hines, Auerbach and Feldstein2002, p. 1386). Hence,

for a small tax increase and interpret it as a measure of the MCPF; see, for example, Auriol and Warlters (Reference Auriol and Warlters2012, p. 58), Barrios et al. (Reference Barrios, Pycroft and Saveyn2013, p. 10) or Vásquez Cordano and Balistreri (Reference Vásquez Cordano and Balistreri2010, p. 259). Nevertheless, except in the marginal case, EB + 1 and MCPF are two different concepts addressing different issues; see, for example, Auerbach and Hines (Reference Auerbach, Hines, Auerbach and Feldstein2002, p. 1386). Hence, ![]() is not applicable when evaluating non-marginal projects welfare effects. That said, CGE is a potent tool for evaluating the social benefits and costs of large projects.

is not applicable when evaluating non-marginal projects welfare effects. That said, CGE is a potent tool for evaluating the social benefits and costs of large projects.

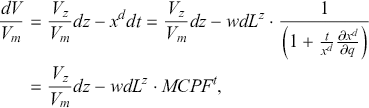

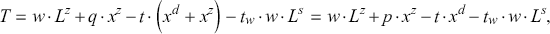

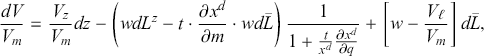

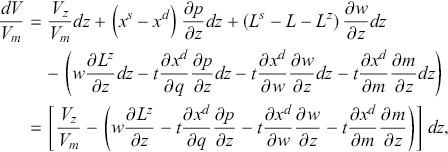

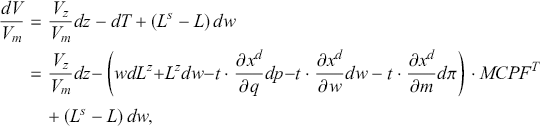

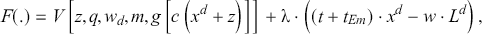

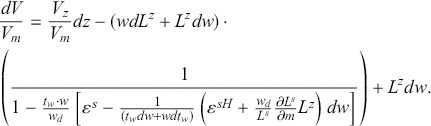

5 A Smörgåsbord of Further Topics in Variations of the Basic Model

The MCPF is typically defined “in splendid isolation” as a tax reform or related to a project involving a public good. In this section, we go beyond this practice and examine how a number of factors affect a CBA and the MCPF in variations of the basic model introduced in Sections 3 and 4. A few more technical issues are placed at the end of the section.

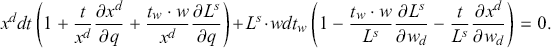

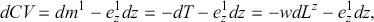

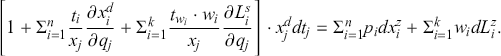

5.1 A Produced and Taxed Input

Let us assume that the production of the public good also requires the taxed private good as an input. Moreover, the input is taxed at the same rate as consumption. Then, the government’s budget constraint is modified to read:

(5.1)

(5.1)

where ![]() , and

, and ![]() denotes the government’s demand for the private good. Thus, what the government pays to itself in the form of taxes vanishes from the constraint. Hence, the input is valued at factor price. The modified cost–benefit rule reads:

denotes the government’s demand for the private good. Thus, what the government pays to itself in the form of taxes vanishes from the constraint. Hence, the input is valued at factor price. The modified cost–benefit rule reads:

(5.2)

(5.2)

Thus, the definition of the MCPF remains unchanged by introducing a taxed input. This fact explains why the project under evaluation in this Element mainly uses labor as the sole input.

However, once both inputs have been introduced, let us point to another way of approximating the total project cost. Suppose that the supply of the produced input is infinitely elastic. Then, ![]() in the differentiated version of equation (5.1), and

in the differentiated version of equation (5.1), and ![]() is valued at factor price. If the supply is completely inelastic, then private consumption, valued at

is valued at factor price. If the supply is completely inelastic, then private consumption, valued at ![]() per unit, is displaced, i.e.,

per unit, is displaced, i.e., ![]() . Hence,

. Hence, ![]() in equation (5.2) is replaced by

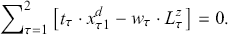

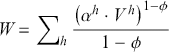

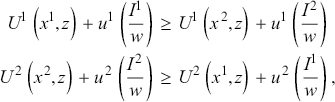

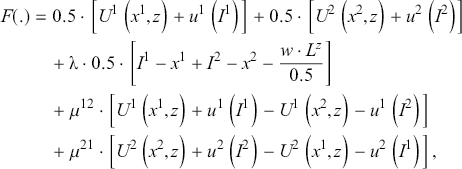

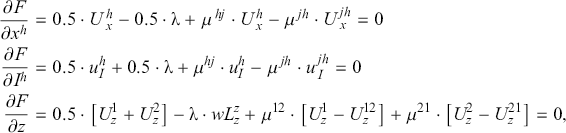

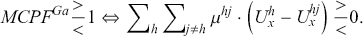

in equation (5.2) is replaced by ![]() (also in the case where the input is untaxed so that