1 Introduction

The US dollar’s supremacy and US global leadership have been increasingly questioned since the 2007–2008 global financial crisis. The fact that this crisis originated in the United States raised concerns about the reliability of US leadership and the rationality of preserving the dollar’s hegemonic position in the global financial system. This crisis also created an opportunity for rising powers to seek greater status and representation in global governance. In 2009, Russian President Reference MedvedevDmitry Medvedev (2009) hosted the first BRIC (Brazil, Russia, India, China) Summit in Yekaterinburg to explore how to “overcome the crisis and establish a fairer international system … and discuss the parameters for a new financial system.” Since South Africa joined BRIC in 2010, transforming BRIC into BRICS, the five members have achieved policy coordination in over seventy issue areas (Reference Kirton and LarionovaKirton and Larionova, 2018; Brazil MFA, 2020). BRICS’ foremost achievements have been in the area of financial cooperation, as evidenced by the establishment of the New Development Bank (NDB), the Contingent Reserve Arrangement (CRA), and various other financial coordination mechanisms.

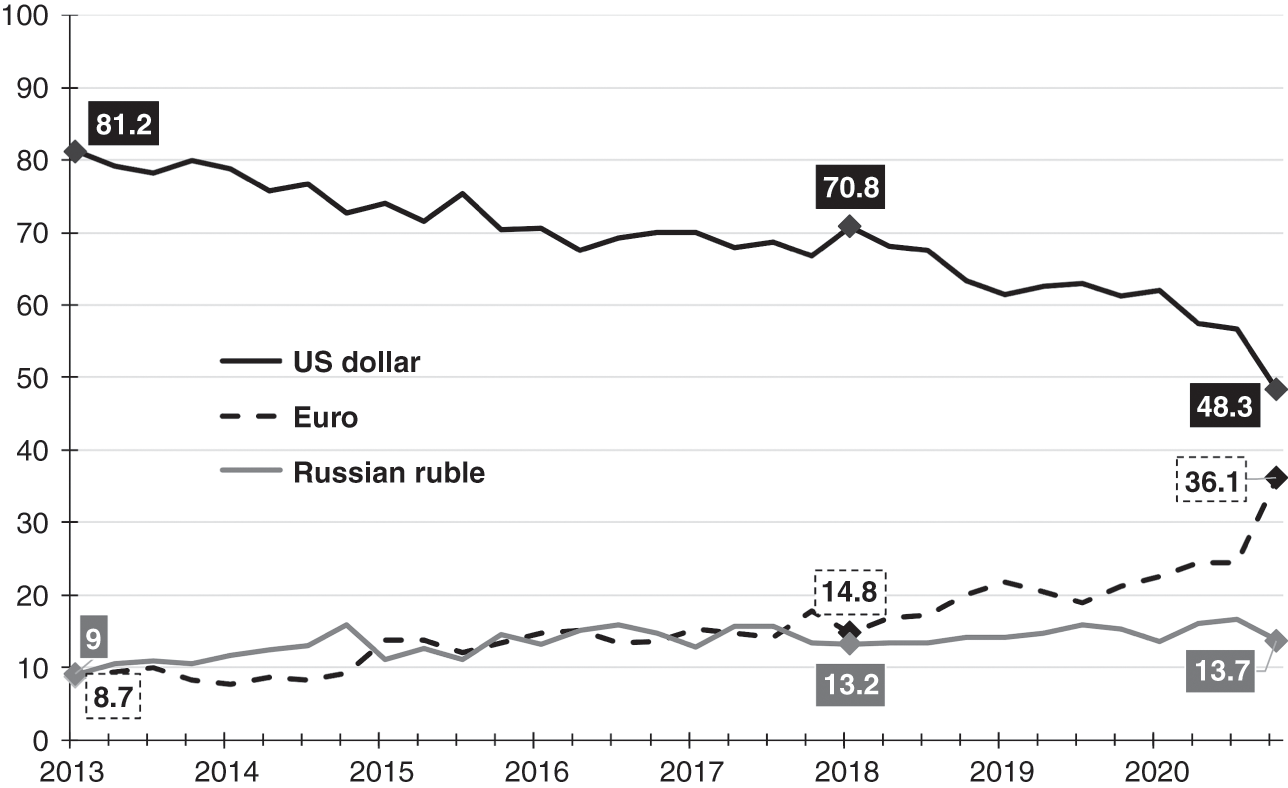

Despite the breadth of the BRICS countries’ financial cooperation and their growing interconnectedness, BRICS’ activities in the monetary realm have been understudied. Yet the stakes of BRICS’ de-dollarization initiatives are particularly high. The US dollar is the dominant currency in the global financial and monetary system and affects various aspects of global affairs. As such, the dollar’s power and prestige have been central to American global leadership (see also Reference Helleiner and KirshnerHelleiner and Kirshner, 2009, p. 1). The NDB’s commitment to using local currency finance rather than solely relying on the US dollar is merely the tip of the iceberg of BRICS’ de-dollarization initiatives.Footnote 1 It is also an open question whether the accelerated de-dollarization process in Russia and China, triggered by their growing tensions with the United States, is only a temporary change, or whether it forms a broader paradigm shift in global finance. To give this some context, the share of the US dollar in Russia–China bilateral trade settlement fell from nearly 90 percent in 2015 to 46 percent in 2020 (Reference SimesSimes, 2020). Moreover, Russia and China have launched their own cross-border payment mechanisms as alternatives to the US-dominated Society for Worldwide Interbank Financial Telecommunication (SWIFT) network. BRICS has also conceptualized a common BRICS Pay system for retail payments and transactions among member countries, which has been enabled by rapid progress in the financial technology (fintech) sector. Such de-dollarization initiatives are happening largely under the radar of contemporary scholarship. Leaders of these initiatives are reform-oriented rising powers, including strategic adversaries of the United States, that have expressed discontent with the existing US-led dollar-based global financial system. Could these empirical cases serve as the “canary in the coal mine” and represent a larger de-dollarization movement?

To systematically examine the nature and impact of these activities, this research seeks to answer a critical question: Can BRICS de-dollarize the US-led global financial system? The underlying assumption of this study is that the dominant currency status of the US dollar may not be permanent. The US dollar’s displacement of the previous hegemonic currency, namely, the British pound sterling, attests to this notion. The importance of examining BRICS’ challenge to the US dollar’s dominance lies in the group’s collective economic power. BRICS accounts for 24 percent of world GDP and over 16 percent of world trade (BRICS India, 2021). Thus, BRICS’ de-dollarization activities would not only impact inter-BRICS financial relations but also create a ripple effect globally. An examination of BRICS’ de-dollarization efforts can help answer the broader question of whether rising powers can gain followers and lead change at a global scale. Can de-dollarization champions within BRICS mobilize less interested BRICS members around this agenda? Can they expand their de-dollarization initiatives beyond BRICS and create economies of scale across several platforms that exclude the United States and other major Western powers such as the Shanghai Cooperation Organization (SCO)?

Analyzing BRICS as a de-dollarization coalition and how it could mobilize other actors will contribute new and needed insights to the scholarship on rising powers and their impact on US global leadership. This study examines how the US dollar’s dominant position in the global financial system, the very foundation of its global leadership, can be undermined. This topic has important national security implications for the United States. The United States relies upon the dollar’s dominant currency status to credibly exercise coercive economic statecraft and sanction its adversaries. An increasingly de-dollarized world would weaken the United States’ ability to alter the behavior of its adversaries and could consequently magnify US national security threats.

To investigate whether BRICS can de-dollarize the US-led global financial system, we develop an analytical framework called “Pathways to De-dollarization.” This framework explains how a rising power coalition can pursue de-dollarization to challenge the dollar hegemony. It complements existing scholarship on the dominant currency paradigm, currency statecraft, collective financial statecraft, and the political economy of rising power coalitions. Our framework conceptualizes two sets of risk mitigation strategies that rising powers can pursue simultaneously to reduce their rising risk exposure to the dollar’s hegemonic power: “go-it-alone” and “reform-the-status-quo.” Both enable a rising power coalition, such as BRICS, to pursue de-dollarization as a means of reducing risk exposure to the US dollar and US sanctions. More broadly, these de-dollarization strategies can help the rising power coalition achieve greater financial and geopolitical autonomy and/or increase its global influence. “Go-it-alone” de-dollarization strategies refer to initiatives to establish and govern new nondollar-based institutions and/or market mechanisms. Such measures enable coalition members to diversify currency risks and maintain open access to the global financial system when facing US sanctions. The expansion of these initiatives could lead to the formation of an alternative or parallel system that is independent of the US dollar and rules made by leading Western powers. In contrast, “reform-the-status-quo” initiatives refer to coalitional efforts to renegotiate the rules of the existing system. Such initiatives involve collective bargaining with incumbent powers to dilute the US dollar’s dominance. If successful, these reform-oriented initiatives would diversify the representation of currencies in the existing system. Following these two strategies, our framework analyzes institutional and market mechanisms through which a rising power coalition can attempt to de-dollarize the existing global financial system.

This “Pathways to De-dollarization” framework is applied to examine BRICS’ de-dollarization activities. By doing so, this study presents the first systematic analysis of de-dollarization initiatives by a rising power coalition. We find that BRICS members have demonstrated an unambiguous consensus and a strong commitment to promoting the use of local currencies in international settlements and building a nondollar alternative global financial infrastructure. They have simultaneously pursued both “go-it-alone” and “reform-the-status-quo” initiatives. For example, BRICS has established the NDB to de-dollarize development finance. The group has also been planning the launch of a common payment framework that can be integrated with a BRICS digital currency to de-dollarize global financial infrastructure. Most de-dollarization initiatives have taken place at the sub-BRICS level. For example, China has successfully launched the yuan oil futures contract, a new financial instrument to de-dollarize the global oil trade. Both China and Russia have developed their own cross-border messaging systems. BRICS has also collectively pursued reformist approaches, such as creating the dollar-based CRA, advocating for the reform of the IMF Special Drawing Rights, and forming a BRICS stock exchanges alliance within the existing system. Together, these initiatives suggest that BRICS has not only attempted to reform the existing system to better incorporate its interests but has also created a nascent de-dollarization infrastructure that supports global de-dollarization in the long term. BRICS’ collective efforts to establish an alternative nondollar financial system have the potential to completely immunize participants from both exchange and sanction risks stemming from the dollar’s dominance and US hegemonic position. In the long run, the BRICS de-dollarization infrastructure may even serve as the basis for a broader de-dollarization coalition that includes regional organizations. This coalitional de-dollarization infrastructure could be attractive to US allies who seek greater monetary autonomy and to continue trading with countries that are under US sanctions. For example, the Bank of England Governor Mark Carney (2019) told central bankers at the Jackson Hole Symposium that the dollar’s dominance is the “destabilizing asymmetry” growing “at the heart of international monetary and financial system.” He proposed a new Synthetic Hegemonic Currency possibly provided through a network of central bank digital currencies (Reference CarneyCarney, 2019). Similarly, the BRICS countries are in the process of developing a BRICS digital currency called BRICS Coin, which sets the stage for digital de-dollarization.

The emerging BRICS de-dollarization infrastructure does not yet allow the BRICS members to make a complete break from the existing US dollar-based financial system. BRICS de-dollarization initiatives are predominantly happening at the sub-BRICS level and have not achieved the necessary economies of scale to de-dollarize the existing global financial system. There are two major constraints that prevent BRICS from forming a unitary de-dollarization coalition. First, some BRICS members have closer relationships with the United States than with fellow BRICS members. This is evident in the case of India and its relationships with the United States and with China. While this prevents BRICS members from adopting a formal, cohesive de-dollarization strategy in the near term, they may still informally pursue de-dollarization initiatives. Second, some BRICS members, such as Brazil and South Africa, are less vulnerable to US sanctions and have economies that are more integrated into the dollar system than others. Thus, the BRICS members have neither group-level consensus on de-dollarization nor do they share the same sense of urgency to prioritize de-dollarization. All of them are interested in reducing their dependence on the US dollar, but not all want to be separated from the US-led global financial system. Most BRICS members still hold large amounts of US dollar assets in their reserves, so the weakening of the US dollar imposes losses on them.

Existing financial realities cannot be altered in the near term. Moreover, the potential benefits of de-dollarization come at a cost. Breaking away from the existing dollar-based global system and market structure is analogous to self-imposed isolation from the existing system. BRICS would face significant separation costs, with the most immediate ones being increased costs of cross-border transactions, more expensive capital raising in the dollar-based global markets, and reduced competitiveness of their firms in foreign markets due to a shortage of dollar funding. Whether the BRICS governments could credibly enforce de-dollarization initiatives at the firm level, especially on firms operating in foreign territories where the US dollar is the dominant and preferred currency, is questionable. Additionally, the dollar is also global investors’ choice of “safe haven” currency during major economic crises. Investors turned to US dollars during the 2007–2008 global financial crisis and the 2020 COVID-19-related economic turmoil, expecting the dollar to hold its value. In both crises, the US Federal Reserve expanded currency swap lines with several other central banks to provide dollar liquidity. A nondollar system would exacerbate issues created by a lack of access to dollar liquidity in times of crises. Such de-dollarization costs deter countries from willingly revolting against the dollar hegemony. Even Russia, a country that is now actively accelerating its de-dollarization process, is not voluntarily pursuing this agenda. As Russian President Putin said, “Russia did not want to give up the dollar as the reserve currency or means of payment, but it was forced to do it” (TASS Russian News Agency, 2021b).

This Element is organized as follows: Section 2 argues that the existing scholarship on currency power, economic statecraft, and BRICS as a coalition lacks a systematic explanation for BRICS coalitional behavior in the de-dollarization space. It introduces a new analytical framework to address this gap. Section 3 traces the emergence of de-dollarization in BRICS cooperation and evaluates BRICS’ collective commitment to de-dollarization. Section 4 analyzes BRICS “go-it-alone” initiatives to de-dollarize by establishing new institutions and new markets. Section 5 investigates BRICS’ “reform-the-status-quo” initiatives to disrupt the US-led global financial system from the inside. Section 6 presents the findings, discusses the implications of BRICS de-dollarization coalition for US global leadership, and concludes with suggestions for areas of future research.

2 A Coalitional De-dollarization Challenge?

This section discusses the three categories of scholarship that are most relevant for examining how rising powers could pose a coalitional de-dollarization challenge: (1) the international political economy literature on currency power, economic statecraft, and the international monetary system; (2) the international relations literature on rising powers and rising power alliances; and (3) the BRICS studies literature. While these three fields of study offer insights into some aspects of our research question, none of them explicitly addresses the question of rising powers’ monetary coalitions, especially BRICS as a de-dollarization coalition. To address this gap, we first introduce the empirical puzzle, then present the “Pathways to De-dollarization” framework, and finally discuss our research design and data sources.

2.1 An Understudied Issue: De-dollarization through BRICS

A major area of focus for existing scholarship on international monetary relations, currency power, and economic statecraft has been the establishment of the US dollar as the world’s dominant currency (both as the most commonly held reserve currency and as the most widely used currency for international settlement), and its implications for US global leadership. Scholars have thoroughly investigated the US dollar’s currency power from the perspective of the dollar’s international currency status.Footnote 2 Since the global financial crisis, many scholars have reevaluated the role of the US dollar in the global economy and with respect to US global leadership. They explained how the international use of the US dollar helped build American hegemony; how the dollar’s primacy serves as a source of US prestige; and how the United States has used the dollar to assert its global influence (Reference KirshnerKirshner, 2008; Reference GoldbergGoldberg, 2011; Reference SteinerSteiner, 2014). Some scholars argued that the root cause of global economic imbalance and the 2007–2008 global financial crisis was the lack of institutionalized currency cooperation (Reference LiuLiu, 2014; Reference Que and LiQue and Li, 2014). Thus, a proposed postcrisis solution for liquidity surpluses due to ultralow interest rates was to create a multicurrency global reserves system and reduce the dependence on the US dollar (Reference XiangXiang, 2014).

Historically, the establishment of a dominant currency and the transition from one dominant currency to another did not come as the result of unilateral or collective efforts made by states. For example, the death of the Dutch guilder as a dominant currency in Europe was not the product of the activism of the Bank of England. Rather, the guilder’s loss of reserve currency status was primarily due to a permanent market loss of confidence in the Bank of Amsterdam that suffered from policy insolvency, meaning the net worth was negative under its policy objectives (Reference Stella and LönnbergStella and Lönnberg, 2008; Reference Quinna and RoberdsQuinna and Roberds, 2016). Similarly, the Bretton Woods Conference formally recognized the US dollar’s global reserve currency status, without the US government imposing this status on other states (Reference Eichengreen and FlandreauEichengreen and Flandreau, 2008). The Japanese government’s attempt to internationalize the yen through multiple mechanisms, such as establishing an offshore market and increasing Japan’s foreign aid using the yen, failed due to Japan’s economic stagnation since the 1990s (Reference Wu and WuWu and Wu, 2014). The US dollar’s dominance has also been discussed relative to other rising international currencies. Potential challengers to the dollar hegemony are currencies with a growing influence in international monetary affairs. These include the euro, followed by the renminbi.Footnote 3 However, the inherent flaws with the euro and renminbi constrain these two currencies’ capacity to become the next dominant global currency. In the case of the euro, despite being the second most important global currency after the US dollar, its international role has largely stagnated over the past two decades. The financial market for euro-denominated assets lacks the size and depth of the dollar-denominated market, constraining the euro’s capacity to challenge the dollar hegemony in global financial markets. Similarly, the renminbi lags behind the dollar in financial market size and depth. It has the additional problem of a lack of free international capital flows. Thus, scholars have generally agreed that the US dollar remains the world’s dominant currency and that no alternative currencies have yet presented a credible challenge to its supremacy (Reference Helleiner and KirshnerHelleiner and Kirshner, 2009; Reference EichengreenEichengreen, 2012). Given the absence of a historical precedent of a rising power de-dollarization coalition, existing research has yet to sufficiently explain the mechanisms and prospects of BRICS’ collective de-dollarization initiatives.

Prior research has identified a broad global trend toward financial sector de-dollarization, starting in the early 2000s and continuing until the global financial crisis. However, this trend has generally stalled or even reversed in many countries, with only a few exceptions, such as Peru (Reference Catão and TerronesCatão et al., 2016). Recent scholarship on economic statecraft has examined de-dollarization activities of countries that are subject to US sanctions and the impact of these activities on US foreign policy and the global monetary system. While acknowledging that countries under US sanctions have a shared incentive to de-dollarize their cross-border settlements, scholars disagree regarding the long-run impact of these individual de-dollarization initiatives on the US dollar’s dominance and on the global currency system (Reference Mathews and SeldenMathew and Selden, 2018; Reference McDowellMcDowell, 2020; Reference Andermo and KraghAndermo and Kragh, 2021). Despite the growing theoretical and policy debates on de-dollarization, the extant scholarship has not systematically examined coalitional de-dollarization initiatives conducted by a motivated group such as BRICS. Addressing this gap in the existing literature has not only theoretical relevance but also policy implications. An inability to comprehensively understand emerging de-dollarization coalitions could lead US policymakers to neglect and underestimate coalitional challenges to the US global financial leadership.

The contemporary international relations literature on rising power coalitions has developed primarily along the dichotomy between rising power alliances and the incumbent power. In this context, rising powers seek to increase their status and influence as agenda-setters and norm-makers in global governance.Footnote 4 The alliance concept has traditionally been defined from the hard security perspective as a “formal association of states for the use (or non-use) of military force, in specified circumstances, against states outside their own membership” (Reference SnyderSnyder, 1997, p. 4). Recent scholarship has argued that rising powers form versatile alignments rather than security-focused alliances, and that they are unlikely to pursue military alliances to challenge US leadership due to their economic and financial embeddedness in the existing system (Reference ChidleyChidley, 2014; Reference Han and PaulHan and Paul, 2020). In the absence of hard balancing and military threats from rising powers, some scholars suggest that rising powers used soft balancing or “nonmilitary tools to delay, frustrate and undermine” US global leadership (Reference PapePape, 2005). Such challenges ultimately depend on rising powers’ ambitions and whether they are reformers, reform-oriented status quo powers, revolutionaries, counterrevolutionaries, or rational revisionists (Reference LiptonLipton, 2017; Reference DreznerDrezner, 2019).

Existing scholarship has theorized about the conditions under which a rising power coalition would pursue various counter-hegemonic strategies. The coalition can challenge the incumbent leadership with a “go-it-alone” (Reference GruberGruber, 2000) approach: Its members could exclude the United States and operate outside of the existing system, thereby limiting US policy options rather than coercing or persuading the United States to change its ways. Existing global institutions are likely to be challenged in areas where the preferences of the incumbent and the rising powers diverge: these are the areas where states will be motivated to create new institutions (Reference HenningHenning, 2017; Reference Stephen and ParízekStephen and Parízek, 2019). To exercise collective financial statecraft, a rising power coalition can make reforms within the established system or establish new and competing structures, and it can use institutions and markets as the two venues for action (Reference Katada, Roberts and ArmijoKatada, Roberts, and Armijo, 2017; Reference Kruck and ZanglKruck and Zangl, 2020). Although scholars did not specify how a rising power coalition can challenge the dollar hegemony, they discussed the core choice of working inside versus outside the system.

Prior scholarship has analyzed rising powers’ coalitional counter-hegemonic challenges in the context of their institutional choices, including establishing new institutions and attempting to reform major existing institutions.Footnote 5 For example, the China-led Asian Infrastructure Investment Bank (AIIB) is an example of rising powers’ counter-hegemonic institutionalism, as it epitomizes the discontent of rising powers with US-led multilateral institutions and the tensions between rising powers and the United States in global economic governance (Reference Ikenberry and NexonIkenberry and Nexon, 2019). However, rising powers’ “market choices” and the relevance of the status quo of market instruments for coalitional mobilization have been less discussed. Existing literature has illuminated the potential use of blockchain-based self-executing contracts to achieve trade de-dollarization among small groups of countries, such as BRICS (Reference AggarwalAggarwal, 2020). Currency swaps and cryptocurrencies could also be used to de-dollarize global oil trade (Reference LadasicLadasic, 2017). But these proposals have not systematically evaluated the mechanisms through which a collective de-dollarization coalition could be mobilized, and how such a coalition could achieve economies of scale. As a result, existing literature has overlooked the challenge of rising powers’ monetary alliances. Thus, it risks underestimating the coalitional scope and credibility of a rising powers alliance, especially if the members of such an alliance have shared frustrations with the dollar and have the financial resources to create their own markets and institutions.

The question of whether BRICS can curb the dollar’s “exorbitant privilege” has received attention in the early literature on BRICS’ collective financial statecraft. Reference Bruetsch and PapaBruetsch and Papa (2013) examined BRICS associational dynamics in the currency realm and found that BRICS generated shared narratives to reduce the dollar’s privilege, but its members’ divergent interests and disagreements about possible solutions undermined coalitional efforts. Subsequently, scholars have evaluated BRICS’ performance both as a financial coalition and as an entity for collective mobilization. Most importantly, BRICS has led emerging markets in changing the global financial order by developing alternative sources of emergency assistance and development financing to create a system that better serves its interests and ideas (Reference Huotari and HanemannHuotari and Hanemann, 2014; Reference DreznerDrezner, 2019; Reference Kring and GallagherKring and Gallagher, 2019). However, while acknowledging that BRICS financial cooperation is deepening, scholars disagree on the prospects and credibility of BRICS’ initiatives to transform the existing global system. Some have doubts regarding BRICS’ potential to act as a system transformer, whereas others hold that the format of BRICS as an informal institution may allow it to gain considerable power (Reference Cooper and FarooqCooper and Farooq, 2013). Reference GallagherGallagher (2015) reconciled these scholarly differences by providing evidence to demonstrate that it is possible for BRICS to “take advantage of a fragmented and disparate global economic governance landscape to leverage benefits” under unique circumstances.

A prerequisite for BRICS to present itself as a credible de-dollarization coalition is its ability to create a robust coalition. Although existing literature has not explicitly discussed the robustness of BRICS’ collective de-dollarization initiatives, it has shown that BRICS has exercised “collective financial statecraft” to challenge the existing liberal international order (Reference Roberts, Armijo and KatadaRoberts et al., 2017). In particular, institutions such as the NDB and the CRA are examples of BRICS’ collective mobilization to reform global financial governance (Reference ChinChin, 2014; Reference Biziwick, Cattaneo and FryerBiziwick, Cattaneo, and Fryer, 2015; Reference Qobo and SokoQobo and Soko, 2015; Reference CooperCooper, 2017; Reference Suchodolski and DemeulemeesterSuchodolski and Demeulemeester, 2018). BRICS has not only transformed the traditional power structures within the existing system, such as the World Trade Organization, but also served as the foundation for broader developing-country coalitions to challenge US hegemony (Reference HopewellHopewell, 2017).

Other scholars are more critical of BRICS’ collective mobilization. Some argue that BRICS is unlikely to become a plausible anti-Western alliance that can credibly undermine US leadership and transform the existing international order (e.g., Reference LuckhurstLuckhurst, 2013). BRICS’ ability to change the existing system is arguably undermined by the group’s political, economic, and ideological heterogeneity (Reference Radulescu, Panait and VoicaRadulescu, Panait, and Voica, 2014; Reference TierneyTierney, 2014; Reference LiLi, 2019); the power asymmetry within BRICS (Reference PanditPandit, 2019); and its lack of a collective world order vision marketable to the broader international community (Reference NuruzzamanNuruzzaman, 2020). Even in development finance, which is often cited as evidence that BRICS is a counter-hegemonic group, scholars contend that the different development assistance models among individual members could weaken a coherent BRICS model (Reference LiLauria and Fumagalli, 2019). BRICS’ failed attempt at creating its own credit rating agency is a demonstration of the group’s limited capacity to transform the global financial order through collective institutional innovation (Reference Helleiner and WangHelleiner and Wang, 2018).

Finally, among prior scholarship that examined BRICS financial cooperation through the cases of the NDB and the CRA, a few evaluated the outlook of de-dollarization through these BRICS-governed multilateral financial institutions (Reference ChossudovskyChossudovsky, 2018; Reference KievichKievich, 2018). However, existing research has not fully investigated the wide range of de-dollarization initiatives that BRICS members have experimented with. Nor has it systematically explored the nature of BRICS’ “coalitional de-dollarization.” This extant research also lacks a comprehensive analysis of how BRICS has engaged with other non-BRICS actors to achieve economies of scale for their de-dollarization initiatives.

2.2 The Puzzle: Is BRICS a De-dollarization Coalition?

It is puzzling why BRICS remains understudied as a de-dollarization coalition for two reasons. First, given the aggregate size of the BRICS economies and markets, as well as the risk of sanctions, the BRICS countries should theoretically have the collective motivation to de-dollarize their international settlements to reduce currency and sanction risks. Historically, all five members have experienced US sanctions, with Russia and China still under various levels of US sanctions. The shared frustrations of the five members should provide strong incentives for them to mobilize toward de-dollarization. Second, reducing dependence on the US dollar and diversifying the global currency and financial system was a publicly declared priority for BRIC when the group first gathered in 2009. When South Africa joined in 2010, BRICS reiterated its shared interest in this issue. Since BRICS is the first rising power coalition with a strong commitment to reforming global financial governance, examining its de-dollarization initiatives presents a unique opportunity for advancing scholarly research on the political economy of coalitional de-dollarization.

The BRICS countries also face a dilemma: While they would prefer to have alternatives to the US dollar as the dominant currency, the dollar’s depreciation would decrease the value of their large holdings of dollar-denominated assets. Thus, they need to balance between their desire for greater international influence and financial autonomy and the material costs of weakening the US dollar’s dominant currency position. This balancing is not only a critical issue for BRICS, but it also has direct policy implications for other countries and regional organizations. Given BRICS’ political and economic significance, its coalitional de-dollarization initiatives will directly impact the US dollar’s dominance in the existing global financial system and US global leadership.

While outlining this research puzzle, it is also important to clarify that de-dollarization in this study should not be confused with replacing the US dollar with another global hegemonic currency. BRICS de-dollarization initiatives are not about the group’s collective support for renminbi internationalization or the internationalization of any other national currency. This research focuses on coalitional de-dollarization pathways and seeks to capture important mechanisms that the five members have pursued to reduce their dependence on the US dollar. Additionally, this research focuses on de-dollarization in the context of international settlements rather than domestic monetary de-dollarization.

2.3 The Analytical Framework: Pathways to De-dollarization

Our analytical framework builds on the assumption that given the tangible costs of being completely isolated from the dollar-based system, members of a rising power coalition do not voluntarily initiate a wholesale revolution against the system. Instead, their de-dollarization initiatives are likely to be reactive to the dollar’s dominance, seeking to correct the “destabilizing asymmetry” (Reference CarneyCarney, 2019) of the dollar’s hegemonic power in the global economic and financial system. Thus, they aim to mitigate the risk of being subject to the US dollar’s hegemonic power so as to achieve higher autonomy and seek broader influence in the global system.

A de-dollarization coalition is likely to emerge when members of the dollar-based system are dissatisfied with the international status quo, including the dollar’s exorbitant privilege, the incumbent US global leadership, and the existing rules and norms. Rising powers continuously renegotiate the international status quo as they seek to increase their influence and status, aspiring to become rule-makers and agenda-setters in global finance (Reference CohenCohen, 2005a, 2005b, Reference Cohen2018). However, their dissatisfaction with the system is particularly pronounced and gives rise to a counter-hegemonic coalition when they face direct threats to their financial and geopolitical autonomy. Such threats include being targeted by hostile and coercive policies or having the existing system experience a severe crisis or a shock. The former occurs when, for example, the international financial infrastructure (e.g., SWIFT) is deployed to coerce a targeted actor to change its behavior (Reference Farrell and NewmanFarrell and Newman, 2019; Reference Drezner, Farrell and NewmanDrezner, Farrell, and Newman, 2021). This leads the actor to turn against the hegemon and build coalitions to resist external pressure. In the latter case, the shared frustration with the crisis and the perceived decline of the existing dollar-based system enabled the rise of coalitional de-dollarization initiatives. Coalitions can help their members survive the crisis and steer the system toward their preferred outcomes. For the de-dollarization coalition to materialize, coalitional members must have the political and economic capacity to influence the dollar system (Reference GoddardGoddard, 2018).

Our proposed “Pathways to De-dollarization” framework conceptualizes various channels through which a rising power coalition and its members can mitigate the risk of operating in the dollar-based system. Rising powers can mitigate this risk using two main approaches (drawing on Reference HirschmanHirschman, 1970; Reference GruberGruber, 2000). One approach is to hedge the risk by developing an alternative nondollar-based system that allows rising powers to maintain direct economic and financial connections with other countries in the world without resorting to the dollar-based system. This is the “go-it-alone” strategy, referring to de-dollarization policy options outside the existing dollar-based system and building new, nondollar structures. The other approach is to pursue risk insurance and risk diversification by using “voice” to initiate changes and improve the existing dollar-based system. This is the “reform the status quo” strategy, referring to the pursuit of reforms within the existing system to dilute the dollar’s dominant currency status.

These two approaches are not mutually exclusive. First, the “go-it-alone” strategy can create an “exit” from the existing system. However, this strategy cannot be completely separated from the existing system because it still depends on it to mobilize the necessary resources to challenge the system. Second, rising powers may use the potential “exit” as a source of leverage when reforming the existing system, so the threats of exit and parallel institutions serve as a means to increase voice in incumbent institutions (Reference LipscyLipscy, 2015). Finally, in their pursuit of autonomy and influence, rising powers can engage with both institutional mechanisms and market mechanisms to implement both strategies. Table 1 visualizes the Pathways to De-dollarization framework by offering an illustrative list of common pathways.

Table 1 Pathways to de-dollarization: Institutional and market mechanisms (an illustrative list)

| Risk mitigation mechanisms | Risk mitigation strategy | |

|---|---|---|

| “Go-it-alone” | “Reform-the-status-quo” | |

| Institutions | Create new multilateral financial institutions for nondollar financing outside the existing institutions | Strengthen central banks’ self-defense against the dollar hegemony and improve emergency access to dollar liquidity |

| Promote and popularize nondollar institutions through broader engagement | Reform and diversify existing global reserve currency structure | |

| Markets | Create new alternative nondollar financial instruments and assets in the market | Diffuse the dollar’s dominance as the vehicle currency and promote the use of local currency in cross-border transactions |

| Create and promote alternative nondollar financial infrastructures for the market | Rearrange global equity market structure and create nondollar equity markets alliance | |

Based on this analysis, we propose the following:

Proposition 1: When rising powers seek greater financial and geopolitical autonomy in response to a perceived threat of sanctions and currency risk, they are likely to focus on developing and accelerating “go-it-alone” strategies that emphasize the creation of new nondollar-based institutional and market mechanisms. While developing alternative institutions and markets is a long-term project and requires significant resources, rising powers would pursue fairly low-cost and near-term “reform-the-status quo” strategies to increase access to the existing trading system and global capital by using nondollar currencies and diffusing the dollar’s dominance. A rising power coalition can promote the use of local currency in the existing global trading system to weaken the US dollar’s dominant vehicle currency status. Its members can reduce their own holdings of US dollar reserves or dollar-denominated assets to defend themselves from currency and sanction-related risks. The coalition can also seek to diversify the existing global currency composition by promoting alternative currencies, such as other national currencies, supranational currencies, or even digital currencies. Finally, coalitional members can also create and expand nondollar-based equity markets in the existing global financial system to divert capital away from the dollar-based markets.

Applied to the BRICS context, we hypothesize that Russia, as a country continuously under Western sanctions, as well as other economies that are negatively affected by the dollar volatilities, would be leading BRICS’ “go-it-alone” de-dollarization strategy, mobilizing other BRICS countries around de-dollarization initiatives and using a wide range of de-dollarization pathways. Threatened rising power coalition members would not only seek to mobilize other BRICS countries around a de-dollarization agenda but are likely to also promote nondollar mechanisms to attract more participants – non-incumbent powers and non-Western organizations such as the Shanghai Cooperation Organization (SCO) to create the economies of scale.

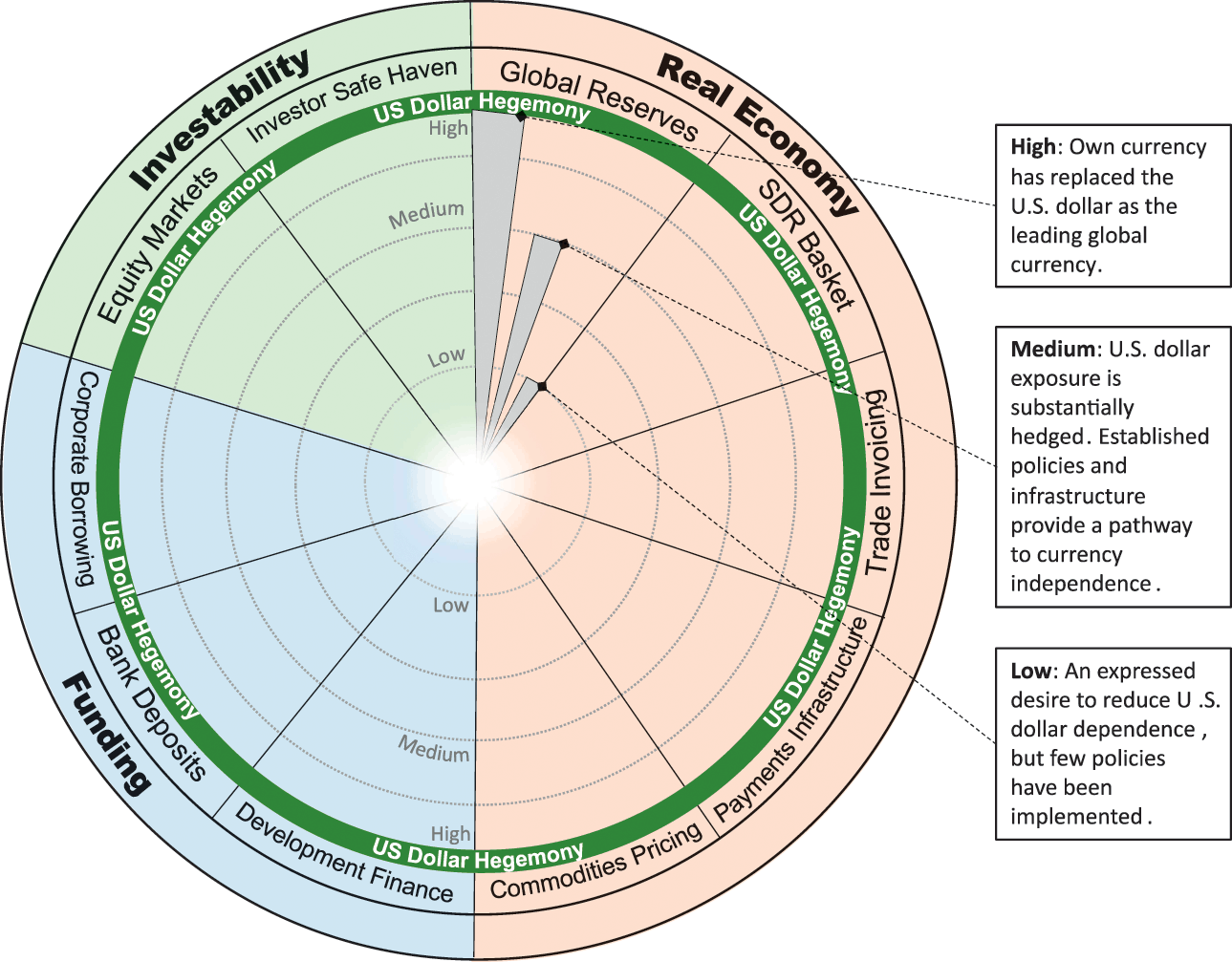

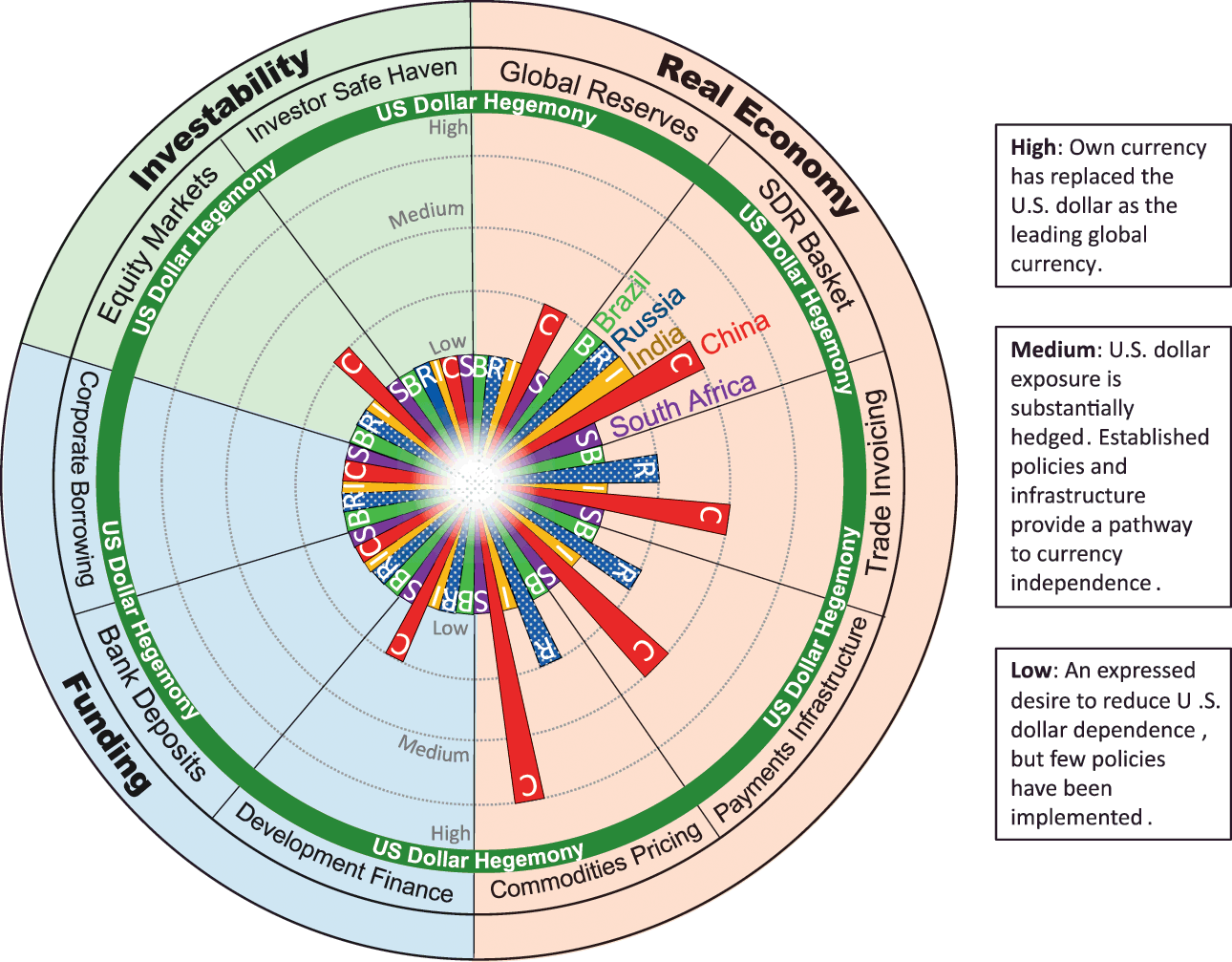

Proposition 2: When rising powers are not under an immediate threat of sanctions, they are likely to stay loyal to the US dollar system and prioritize “reform the status quo” strategies in the near term. The dominant currency paradigm literature suggests that the US dollar’s wide use in international transactions pulls other countries into the dollar-based system (Reference Gopinath, Boz, Casas, Díez, Gourinchas and Plagborg-MøllerGopinath et al., 2020; Reference Gopinath and SteinGopinath and Stein, 2021). However, while some path dependence can be assumed in the short term, ambitious rising powers seeking to diversify the system will use both “reform the status quo” and “go-it-alone” de-dollarization strategies to increase their financial and geopolitical influence. Figure 1 visualizes the key areas of US dollar hegemony that a larger de-dollarization mobilization needs to consider.

Figure 1 A visualization of the US dollar’s dominance

Figure 1 categorizes the various expressions of the US dollar’s dominant currency status into three primary areas: real economy, funding, and investability. These three overarching categories cover the specific areas that constitute the structural constraint that any reactive de-dollarization initiative has to consider. More specifically, the US dollar is the dominant global reserve currency and enjoys the highest weight in the Special Drawing Rights (SDR) basket. It is also the dominant invoicing currency in international trade; the leading currency across global financial infrastructure; and, it has the dominant pricing power in major global commodities. The dollar also dominates the space of development financing, bank deposits, and global corporate borrowing. Finally, the dollar is the leading currency in terms of investability as it dominates global equity markets and is the primary safe-haven currency in times of economic and financial crises. Applied to the BRICS context, since all of the five BRICS countries seek greater financial and geopolitical influence, we hypothesize that they will challenge the dominance of the US dollar by deploying de-dollarization pathways that address these strategic areas, and we measure the level of the challenge on a spectrum from low to high.

Finally, the most comprehensive and effective challenge to the dollar hegemony is if a rising power coalition wages a systematic coalitional de-dollarization campaign and uses a combination of both “go-it-alone” and “reform-the-status-quo” approaches that challenge all the specified areas in which the dollar enjoys dominance. A coalition that can most effectively achieve de-dollarization is one that creates a nondollar club good (e.g., a new institution or market mechanism) that it can govern and use as leverage. Such a coalition can promote the good through broader engagement and even popularize it as a public good to establish an alternative nondollar global system. The “go-it-alone” strategy is more likely than the “reform-the-status-quo” approach to generate such new nondollar club goods. Successful de-dollarization initiatives can not only help rising powers bypass coercive actions but also be weaponized for coercive purposes, and rivals might be denied access. As the initiators of such de-dollarization mechanisms, rising powers would be the dominant rule-makers in a de-dollarized system, likely constraining US policy space and enjoying higher status than their followers.

2.4 Research Design

To examine BRICS’ de-dollarization pathways and whether BRICS can de-dollarize the US-led global financial system, we apply the introduced framework and analyze a wide range of BRICS-related data using qualitative methods, including process tracing, interviews, content analysis, and archival research and quantitative analysis of BRICS-relevant financial data.

First, we combine process tracing and content analysis to identify the key milestones in BRICS’ financial cooperation and de-dollarization initiatives between 2009 and 2021. We investigate the existence of a BRICS de-dollarization agenda and identify the prominent actors in the de-dollarization space. We triangulate key events across different sources ranging from credible local sources in BRICS countries to international media. Second, to evaluate the consistency of BRICS’ commitment to de-dollarization over time, we analyze a variety of archival sources, including speeches and essays by BRICS policymakers, BRICS declarations, BRICS think tank reports, NDB press releases and funding operations, and BRICS Business Council reports. Third, to get a more accurate picture of BRICS policy preferences, we rely upon semi-structured interviews with experts, officials (current and former), central bankers, and financial professionals in BRICS countries who have either participated in BRICS policymaking or published on the issue of BRICS financial cooperation. We identified experts based on our analysis of BRICS documents, credible news reports, BRICS think tanks’ members, and academic publications in leading journals.

We apply the analytical framework by examining a wide range of BRICS de-dollarization initiatives comprising the use of both institutional and market mechanisms to mitigate BRICS members’ risk exposure to the dollar’s hegemonic power. These initiatives include the NDB and development finance de-dollarization; global oil trade de-dollarization; global financial infrastructure de-dollarization through BRICS alternatives to SWIFT; BRICS promotion of de-dollarization initiatives by engaging with non-BRICS members; self-defense measures in US-led institutions against the dollar’s dominance; reforms of the global reserve currency structure; efforts to diffuse the dollar’s dominance as the vehicle currency in trade; and BRICS’ activities in global equity markets. Our Pathways framework allows us to identify and evaluate what members have achieved, and the benchmark of strategic de-dollarization areas illustrates what BRICS should do to de-dollarize. The combination of the two approaches allows us to zoom in and examine the specific strategies each BRICS member pursues, as well as distinguish the BRICS countries leading de-dollarization efforts from the less active members. The resulting analysis allows us to evaluate the overall level of the BRICS’ de-dollarization challenge.

To understand the extent of collective mobilization along the pathways proposed in our framework, we introduce a two-dimensional matrix measuring the effectiveness of de-dollarization initiatives and the level of coalitional strength. The benchmark for a high level of effectiveness is the creation of nondollar institutions and/or market instruments or market infrastructure. Following our conceptualization, the “go-it-alone” strategy leads to a higher level of de-dollarization effectiveness, as it targets the creation of new nondollar mechanisms. In contrast, the “reform-status-quo” strategy yields lower effectiveness due to its lack of mechanism innovations. We measure coalitional strength by the number of participants in a de-dollarization initiative. This is because cross-border settlements in international trade and finance require counterparties and the formation of a nondollar global financial system requires broad participation of state actors and non-state actors. A higher number of participants means that a de-dollarization initiative is more robust. Unilateral initiatives may be potentially scaled to the coalitional level, but they represent a low level of coalitional strength. The coalitional strength increases as more members of the rising power coalition jointly participate in de-dollarization initiatives. Once the coalition builds full consensus, it demonstrates greater coalitional strength. When the rising power coalition expands its de-dollarization initiatives beyond the group members and mobilizes a broader coalition, the coalitional strength is the highest. As Figure 1 illustrates, the combination of high effectiveness and high coalitional strength is in the upper right cell, which features the formation of an alternative nondollar global financial system that is governed by rising powers and not the United States (Figure 2).

Figure 2 Measuring coalitional de-dollarization initiatives

Note: n = number of participants in a de-dollarization initiative (state and non-state actors N = number of formal members in the rising power coalition (in the case of BRICS, N = 5, including Brazil, Russia, India, China, and South Africa).

We augment our qualitative analysis with quantitative data from the NDB’s annual reports, its project database, SWIFT reports and statistics, Bank for International Settlements international locational banking statistics, treasuries holdings data from Bloomberg, the Treasury International Capital System, commodities futures data from the Shanghai Futures Exchange, BRICS reserves data and trading data from the People’s Bank of China, Bank of Russia, South African Reserve Bank, Reserve Bank of India, Central Bank of Brazil, ICE Benchmark Administration, and World Gold Council, and BRICS voting rights data and SDR quota from the World Bank and the IMF.

3 BRICS as a De-dollarization Coalition

This section investigates whether BRICS can be considered a de-dollarization coalition. Combining process tracing with content analysis, it first analyzes how BRICS as a financial coalition has addressed the issue of diversifying the US dollar-based global financial and currency system since the group’s establishment in 2009. Next, this section assesses the state of BRICS currencies in global currency markets in order to examine the dynamics of BRICS currencies relative to the dollar’s dominant position. Finally, it investigates individual BRICS countries’ perspectives on de-dollarization to evaluate the convergence of their interests; who is advocating for de-dollarization and how; and how mobilization around de-dollarization takes place.

3.1 Key Milestones in the Evolution of BRICS as a Financial Coalition

The first BRIC summit in 2009 concluded with a clear statement from its leaders: “[w]e are committed to advancing the reform of international financial institutions, so as to reflect changes in the global economy … We also believe that there is a strong need for a stable, predictable and more diversified international monetary system” (BRIC, 2009). Financial cooperation has been a consistent theme during every annual BRICS summit ever since and has been covered in joint summit declarations. Several key milestones energized BRICS’ commitment to diversifying the existing system. For example, between 2012 and 2017, BRICS established the NDB, collectively pushed for the use of local currency in development finance, and launched the CRA. In 2020, BRICS identified empowering local currencies as its long-term agenda item, thereby cementing its importance for the group in the future.

The first milestone is the establishment of the NDB and the CRA, which was initially proposed in 2012 and 2013 respectively, though both materialized in 2014. These two institutions resulted from the BRICS members’ frustration with their limited progress in reforming the Bretton Woods institutions. BRICS created the NDB and CRA to mirror the functions of the World Bank and the IMF respectively, but operate under BRICS ownership and control. The NDB and CRA were both designed to help BRICS reduce their dependence on US dollar financing and the IMF. For example, in the Agreement on the New Development Bank, BRICS states that the NDB “may provide financing in the local currency of the country in which the operation takes place” (NDB, 2014). This statement positioned the NDB as a development finance intermediary that uses local currencies to mobilize capital in international markets and provides financing for its members (see Section 4). This local currency financing function makes the NDB resemble the BRICS own “mini–World Bank.” However, the NDB yields greater benefits than the World Bank for BRICS members: NDB loans have fewer strings attached, and local currency loans allow borrowers not to increase external US dollar debt. The CRA was hailed as “BRICS’ own IMF” by President Putin because it “creates the foundation for an effective protection of (our) national economies from a crisis in financial markets” (RT, 2014). It makes pooled dollar reserves of USD100 billion available to provide liquidity support for members in times of a modest-sized balance of payment (BoP) crisis (BRICS, 2013). Yet, the CRA is not a lender of last resort; rather, it provides the members with the first line of defense before they have to seek conditional help from the IMF (see Section 5).

The most recent de-dollarization milestone was achieved amid the COVID-19 pandemic at the BRICS 2020 Summit when BRICS agreed to reinforce and advance the current de-dollarization processes. Under Russia’s chairmanship in 2020, the group jointly issued the Strategy for BRICS Economic Partnership 2025. This Strategy reiterated the members’ long-standing commitment to reforming the Bretton Woods institutions. More importantly, it identified several “priority areas of partnership” directly related to de-dollarization, including: to promote the use of local currencies in mutual payments, to strengthen BRICS cooperation on payments systems, to collaborate on the development of new financial technologies, to advance the CRA mechanism, to continue cooperation on establishing the BRICS Local Currency Bond Fund, and to continue to facilitate the NDB in development financing while expanding the use of local currencies (BRICS, 2020).

Over the past two decades, BRICS has shown consistent commitment to reforming the global financial system and diversifying the global currency structure. Catalyzed by the global financial crisis and the COVID-19 pandemic, the group has implemented targeted policies and broadened areas of cooperation to help members reduce their dependence on the US dollar. The recent military conflict between India and China did not prevent the coalition members from deepening their economic partnership. This suggests that there is a political will to pursue the economic agenda, and that de-dollarization will remain an important issue for BRICS despite their divergence in other areas.

3.2 The Gradual Rise of BRICS Currencies

As BRICS incrementally implemented specific policies for de-dollarization, BRICS national currencies have progressively gained more market share in the dollar-based global currency system, albeit remaining at relatively low levels compared to the US dollar. The most direct way for BRICS to reduce their dependence on the US dollar is to increase the use of their own national currencies in cross-border transactions. According to the latest Bank for International Settlements Triennial Survey (2019), the Chinese renminbi was the 8th most actively traded currency, ranking just after the Swiss franc. This is a significant increase from its ranking of 35th in 2001. Additionally, the renminbi is now the most actively traded emerging market currency. It reached 4.3 percent of total global turnover in 2019, a significant rise compared with 0.1 percent in 2004. The Indian rupee was the second most traded BRICS currency, in 16th position worldwide and accounting for 1.7 percent of global trade. The Russian ruble, Brazilian real, and South African rand were in 17th, 20th and 33rd position, respectively (Table 2).

Table 2 Over-the-counter foreign exchange turnover by currencies (net-net basis, percentage shares of average daily turnover)

| Currency | 2004 | 2007 | 2010 | 2013 | 2016 | 2019 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Share | Rank | Share | Rank | Share | Rank | Share | Rank | Share | Rank | Share | Rank | ||

| Leading global currencies | USD | 88.0 | 1 | 85.6 | 1 | 84.9 | 1 | 87.0 | 1 | 87.6 | 1 | 88.3 | 1 |

| EUR | 37.4 | 2 | 37.0 | 2 | 39.0 | 2 | 33.4 | 2 | 31.4 | 2 | 32.3 | 2 | |

| JPY | 20.8 | 3 | 17.2 | 3 | 19.0 | 3 | 23.0 | 3 | 21.6 | 3 | 16.8 | 3 | |

| GBP | 16.5 | 4 | 14.9 | 4 | 12.9 | 4 | 11.8 | 4 | 12.8 | 4 | 12.8 | 4 | |

| BRICS currencies | CNY1 | 0.1 | 29 | 0.5 | 20 | 0.9 | 17 | 2.2 | 9 | 4.0 | 8 | 4.3 | 8 |

| INR1 | 0.3 | 20 | 0.7 | 19 | 0.9 | 15 | 1.0 | 20 | 1.1 | 18 | 1.7 | 16 | |

| RUB1 | 0.6 | 17 | 0.7 | 18 | 0.9 | 16 | 1.6 | 12 | 1.1 | 17 | 1.1 | 17 | |

| BRL1 | 0.3 | 21 | 0.4 | 21 | 0.7 | 21 | 1.1 | 19 | 1.0 | 19 | 1.1 | 20 | |

| SAR2 | 0.0 | 33 | 0.1 | 33 | 0.1 | 33 | 0.1 | 34 | 0.3 | 26 | 0.2 | 33 | |

| Other currencies | 36 | - | 42.9 | - | 40.7 | - | 38.8 | - | 39.1 | - | 41.4 | - | |

| Total3 | 200 | - | 200 | - | 200 | - | 200 | - | 200 | - | 200 | - | |

1. Turnover for years prior to 2013 may be underestimated owing to incomplete reporting of offshore trading in previous surveys. Methodological changes in the 2013 survey ensured more complete coverage of activity in EME and other currencies.

2. Turnover may be underestimated owing to incomplete reporting of offshore trading.

3. Because two currencies are involved in each transaction, the sum of the percentage shares of individual currencies totals 200 percent instead of 100 percent.

Comparing the currency ranking position changes from 2004 to 2019, the increase in the renminbi’s active trading turnover was the largest. The growth in trading turnover for other BRICS currencies was not as rapid but nonetheless steady. In contrast, the shares of leading global currencies, especially the euro, Japanese yen, and the British pound sterling have generally decreased, although they were still three of the top four most actively traded currencies. Trading in US dollars decreased for the two surveys in 2007 and 2010, largely due to the global financial crisis and the US dollar liquidity crunch, but it quickly recovered in the following years (Table 2 and Figure 3).

Figure 3 Currency distribution of over-the-counter (OTC) foreign exchange turnover.

This currency trading activity comparison reveals that the US dollar still maintains its absolute dominance in the currency market. However, the collective market share of BRICS currencies, especially renminbi, has slowly increased, but it is still far smaller than the US dollar’s market share. However, the small increase in the market share of BRICS currencies did not cause the US dollar’s market share to decrease, as the US dollar’s share has remained stable. As the BRICS countries implement their currency internationalization policies, trading activities of BRICS currencies will slowly increase. This increase may not necessarily come at the expense of the US dollar; rather, it may erode the market share of other major currencies, as data from 2004 to 2019 demonstrates.

BRICS currencies’ slight gain in the OTC foreign exchange market cannot credibly challenge the dollar’s dominance in international settlements in any meaningful way. BRICS’ insignificant currency share in global markets at present is disproportionate to their combined weight of approximately 16 percent of global trade (BRICS India, 2021). This discrepancy illustrates both the dollar’s dominance and the difficulty of achieving de-dollarization.

3.3 BRICS Members’ Perspectives on De-dollarization

Recognizing the heterogeneity within BRICS, the analysis now turns to investigating whether BRICS members have demonstrated a shared interest in de-dollarization by examining their respective official discourses.

China’s advocacy for reforming the dollar-based global financial system can be traced back to the 1997 Asian financial crisis. In the aftermath of this crisis, Dai Xianglong, then Governor of the People’s Bank of China (PBoC), stated:

“The current international monetary and financial system can no longer accommodate the needs of international economic and financial development, and, therefore, the system needs to be reformed …. The role of international reserve currency played by a few countries’ national currency has been a major source of instability in the international monetary system … The current international financial system cannot solve the balance of payments imbalance, which has repeatedly been the cause of international financial crises”.

Following the 2007–2008 global financial crisis, Dai’s successor Zhou Xiaochuan (Reference ZhouZhou 2009) openly discussed the necessity of reforming the international monetary system and called for the creation of “an international reserve currency that is disconnected from individual nations” because the prevailing system’s deficiencies were “caused by using credit-based national currencies.” Zhou’s view is believed to represent the thoughts of leading Chinese officials who see the era of a US dollar-dominated world is coming to an end.Footnote 6 In 2011, President Hu Jintao commented that “[t]he current international currency system is the product of the past” (Washington Post, 2011).

Although there is no indication that high-level Chinese policymakers explicitly discussed dethroning the US dollar as the leading reserve currency, we find that Chinese academics and observers have frequently criticized dollar hegemony and proposed various means to challenge it. Such proposals have recently proliferated due to the deterioration of US - China relations, and growing threats of US sanctions against China in strategic areas such as advanced technology. Strategic rivalry with the United States provides incentives for China to self-insure against risks in the US-led global system, not just for economic reasons but also for geopolitical and strategic reasons. Compared with other BRICS members, China has more resources and is better positioned to promote de-dollarization across several platforms, including but not limited to BRICS. For example, China has been adjusting its strategies for renminbi internationalization through the development of offshore renminbi markets and through bilateral currency swaps in the context of the Belt and Road Initiative. Chinese state-owned commercial banks are also more potent and more globalized compared to banking institutions in other BRICS members. China’s policy banks, especially the China Development Bank and Exim Bank of China, now provide as much development financing as the World Bank does (Reference Ray and SimmonsRay and Simmons, 2020).

Russia has been actively promoting the idea of de-dollarization through BRICS, and its primary motivation for doing so is its geopolitical rivalry with the United States. In 2012, Sergei Ryabkov, Russian Deputy Foreign Minister at the time, publicly expressed Russia’s concerns over the US dollar’s role as the settlement unit of international trade and banking transactions and affirmed that “it is necessary to become less dependent on the dollar” (Reference LabetskayaLabetskaya, 2012). President Reference PutinPutin (2017) expressed in an article that the BRICS members “are ready to work together with our partners to promote international financial regulation reforms and to overcome the excessive domination of the limited number of reserve currencies.” Soon after his article was published, Ryabkov disclosed that it is a “vital need” for Russia to “intensify work related to import substitution, reduction of dependence on US payment systems, on the dollar as a settling currency” (Reference NikolskayaNikolskaya, 2017).

President Putin began his fourth presidential term in May 2018 with a strong commitment to further de-dollarize the Russian economy and defend Russia’s economic sovereignty against US sanctions. In his speech at the Russian parliament Putin called for “getting free of the dollar burden” in the global oil trade and in the Russian economy because the monopoly of the US dollar was “unreliable” and “dangerous” for global trade and the economies of many countries in the world (TASS, 2018). In August 2018, discussions on the need to de-dollarize the Russian economy intensified in the Russian government after the US Congress introduced a new bill that targeted Russian financial institutions. In October 2018, the Putin administration backed a tentative de-dollarization plan designed to limit Russia’s exposure to future US sanctions by reducing the use of the US dollar in international settlements and conducting international business using alternative currencies (Invesforesight, 2018; RT International, 2018).

Brazil initially shared Russia’s enthusiasm for making BRICS a de-dollarization coalition. Former Brazilian President Lula da Silva argued that “BRICS was not created to be an instrument of defense, but to be an instrument of attack. So we could create our own currency to become independent from the US dollar in our trade relations … The United States was very much afraid when I discussed a new currency and Obama called me, telling me, ‘Are you trying to create a new currency, a new euro?’ I said, ‘No, I’m just trying to get rid of the US dollar. I’m just trying not to be dependent’” (Reference EscobarEscobar, 2019). It is not irrational for President Lula to have proposed de-dollarizing Brazil’s trade. The US dollar dominated Brazil’s exports invoicing, as high as 94 percent, although exports to the United States were only 17 percent of Brazil’s total exports (Reference Casas, Díez, Gopinath and GourinchasCasas et al., 2017). Our interviews suggest that there are three primary reasons that incentivized Brazil to follow Russia and China’s de-dollarization initiatives but not take the lead. First, Brazil’s severe economic crisis since 2014 following the end of the commodity boom has fragmented the country’s politics and led to the rise of the right-wing Bolsonaro administration. Under President Bolsonaro, the Brazilian government has sent mixed signals regarding its BRICS policy and has moved closer to Western powers. Second, Brazil has become more reliant on commodities exports, making the country more exposed to volatilities in global markets and currency risks (see also Reference Nogueira BatistaNogueira Batista Jr., 2019). According to UNCTADstat, Brazil’s commodity exports represented 56.5 percent of total exports in 2008–2009. This number has increased to 66.6 percent over the past ten years. Third, China has been Brazil’s most important trading partner, and the economic and financial ties between the two countries have increasingly become closer. The use of local currencies in bilateral settlements is beneficial for both sides. Brazil’s close economic and financial ties with China and the real risks to the Brazilian economy due to its dependence on the US dollar suggest that Brazil is unlikely to openly champion BRICS de-dollarization initiatives. However, it is open to playing along and following them.

India was reluctant to join a BRICS de-dollarization coalition from the very beginning despite its support for other key issues on the BRICS agenda, such as reforming the IMF and World Bank (Economic Times, 2009). When Russia and China proposed to create a new global super-sovereign reserve currency to replace the US dollar in 2009 (Reference ShchedrovShchedrov, 2009; Reference ZhouZhou, 2009), India distanced itself from such a challenge to the US dollar’s supremacy but instead preferred a more modest approach of increasing the IMF’s SDR. The Indian government considered this Sino-Russian proposal more ideological than substantive and did not want to challenge the US dollar and upset the United States, especially at a time when the United States was pressuring Pakistan on counterterrorism (Economic Times, 2009). While the United States treats Russia and China as strategic competitors, it considers India as an important ally in the Indo-Pacific region and an important strategic partner. India’s rivalry with China and the recent military standoff between the two countries have further prevented India from supporting China’s attempt to replace the US dollar.Footnote 7 In the context of BRICS, this means India will not support an explicit BRICS mobilization to dethrone the US dollar.

This by no means suggests that India is satisfied with the US dollar’s dominance and would not seek to reduce its dependence on the US dollar. On the contrary, India not only has a strong interest in promoting the use of local currency in trade but also has taken initiatives to explore how to accomplish this. In 2012, India’s Ministry of Commerce and Industry convened a Task Force to examine the use of the rupee in India’s bilateral trade. The Task Force Report favored the idea of extending rupee trade to some oil-exporting countries (Reference Dash, Sharma and NizamiDash, Sharma, and Nizami, 2019). The Indian government formed a multi-agency task force with representatives from India’s economic policymaking agencies to draw up a list of countries with which India could trade in rupees.Footnote 8 India has also taken the lead in promoting BRICS financial cooperation and building BRICS financial institutions. For example, it was at the behest of the Indian finance minister that the BRICS in 2012 commissioned a joint working group to study the viability of setting up a BRICS Development Bank, which led to the creation of the NDB that promotes the use of local currencies in development finance. India has also promoted greater use of the rupee in international transactions in light of aggressive steps by China to internationalize the renminbi and US sanctions on Russia and Iran in 2018, which disrupted India’s oil payments in US dollars. The increase in currency exchange volatilities – especially growing volatilities in the US dollar – provides another incentive for India to de-dollarize its trade settlement, as India is among the most dollarized countries in trade invoicing (Reference GajaraGajara, 2020). To give some context, 86 percent of India’s imports relied on US dollar invoicing despite only 5 percent of India’s imports originating in the United States. Similarly, 86 percent of India’s exports were invoiced in US dollars, while only 15 percent of India’s exports were to the United States (Reference Casas, Díez, Gopinath and GourinchasCasas, et al., 2017; Reference Gopinath and ZwaanstraGopinath and Zwaanstra. 2017). Therefore, although India is unlikely to play an explicit role in a BRICS coalition aiming to dethrone the US dollar, it will implicitly help reduce dollar dependence by supporting initiatives that promote the use of local currencies in trade and development finance.

South Africa saw US sanctions imposed against it in 1986 mostly lifted by 1991, and with the dismantling of apartheid, the relationship between the two countries has improved (Reference FriedmanFriedman, 1991). The strength of this relationship partly explains South Africa’s lack of a strong de-dollarization agenda. In the course of our research, we did not find any public records of South African leaders promoting the idea of BRICS as a de-dollarization coalition. Yet, South Africa follows Russia and China’s de-dollarization efforts. Our interviews with scholars in South Africa reveal that South African policymakers are keenly aware of the risks associated with the US dollar’s privilege.Footnote 9 Both the real economic risk and transaction risk due to the US dollar’s dominance incentivize South Africa to go along with BRICS’ initiatives to promote the use of local currencies in trade. South African leaders have publicly expressed South Africa’s interests in this issue. Following the 2011 BRICS Summit, South African Trade and Industry Minister Rob Davies said that BRICS members could protect themselves from exchange volatilities and benefit considerably by trading directly in their own currencies and cutting out unstable internationally convertible currencies – specifically, the US dollar (Brand South Africa, 2011). During the 2013 BRICS Summit, Davies reiterated South Africa’s interest in working out a mechanism within BRICS to settle trade in local currencies and emphasized that currency market volatility in developing countries “takes place not really because of any dynamics in our own country but because of dynamics in the world economy” (Economic Times, 2013). This reflects the challenging macroeconomic conditions that developing countries face in global markets as price takers whose currency risk can be triggered by factors beyond their control. Davies’ comments expressed not only South Africa’s frustration over its lack of autonomy in achieving economic security in global markets but also a shared frustration among developing countries within and beyond the BRICS group. There has not been any formal reporting about a unilateral South African push for de-dollarization, but the country has supported BRICS’ general agreement on promoting the use of local currencies in international trade and finance. South Africa has also accepted broader use of the Chinese renminbi and has included renminbi in its foreign exchange reserves to diversify currency risk. SWIFT data shows that between 2013 and 2015, the number of South Africa’s renminbi payments increased by 191 percent, and by June 2015, the value of direct payments in renminbi between South Africa and China/Hong Kong reached 31.3 percent (SWIFT, 2015).

To summarize, BRICS has demonstrated a consistent commitment to reforming the US dollar-based global financial system, as evidenced by the group’s deepening cooperation on de-dollarization. Although not all BRICS members want to explicitly challenge the US dollar, there is a shared interest in reducing their dependence on it. All BRICS members have taken concrete steps towards de-dollarization with the aim of achieving greater autonomy. BRICS has also implemented targeted policies to help members reduce their dependence on the US dollar through the promotion of local currencies in trade and investment, both at the BRICS level and the sub-BRICS level.

Our analysis shows that there have been clear leaders within BRICS attempting to steer the group toward a de-dollarization coalition, namely Russia and to a lesser extent China. Their primary motivation for de-dollarization includes rising geopolitical rivalries with the United States and the growing risk of US sanctions. Our analysis reveals that Russia and China have taken different approaches to de-dollarization. In line with our first proposition, Russia has been far more aggressive in its attempts to protect its economy from US sanctions and has been the most enthusiastic advocate of de-dollarization within BRICS. Russian policymakers are vocal about the topic in public, laying out the case for de-dollarization and its importance. In contrast, China has made less noise but has been more capable of making substantive changes. China has not openly talked about de-dollarization, but it has emphasized its desire to “diversify” the system. The diversification of the system is a positive framing that focuses on China’s prioritization of the system’s stability and equality rather than the potentially counter-hegemonic nature of such actions. BRICS is one of several platforms it can use to pursue de-dollarization.

Our analysis also shows that the followers in BRICS de-dollarization coalition are neither passive nor silent. Brazil, India, and South Africa have all supported BRICS joint statements on reforming the existing dollar-centered global financial system over the past two decades. Moreover, they each have also sought opportunities to promote the use of local currencies in international trade and development financing. Their consensus and practices concerning de-dollarization suggest that de-dollarization does not only take place in countries that are in geopolitical competition with the United States or under US sanctions. Rather, de-dollarization is important for developing countries that are price takers in global markets and lack autonomy in controlling their own economic security. Therefore, it is a real priority for these countries to diversify and reduce their risk exposure to exogenous shocks and exchange volatilities due to the US dollar’s dominance. This creates a baseline of shared interests among all countries that are subject to the US dollar’s privilege, whether they are US allies or adversaries.

4 “Go-It-Alone” Strategy: Establishing New Institutions and Market Mechanisms

This section examines BRICS’ “go-it-alone” strategy through both institution-building and market-building that create critical components for an alternative nondollar global financial system. As a rising power coalition, BRICS has created a group-level de-dollarization club good with a relatively high level of effectiveness by establishing and using the NDB to de-dollarize development finance. BRICS has also shown a commitment to developing other new de-dollarization club goods such as a common BRICS payment system to facilitate settlement using local currencies and a BRICS digital currency. At the sub-BRICS level, members have launched nondollar national payment systems that could form the basis for a BRICS alternative to the US dollar-dominated SWIFT. They have also been exploring options for central bank digital currencies, and China has already launched its digital renminbi. China has successfully launched a new nondollar market instrument, yuan oil futures, to de-dollarize global oil trade. Collectively, BRICS members have leveraged their overlapping membership in non-Western multilateral organizations (e.g., the SCO) to promote the use of local currencies in international trade and finance and create new outreach opportunities for broader de-dollarization.

4.1 The New Development Bank and De-dollarizing Development Finance

The NDB has already raised funds in local currencies as part of its goal to “break away from the tyranny of hard currencies,” as the NDB President Mr. Kamath put it (RT International, 2017). It has implemented a local currency lending program that not only helps member countries mitigate the borrowers’ foreign exchange risk but also supports the development of local capital markets. The NDB also prioritizes the “use of borrowing country legislation, regulations and oversight procedures” whenever possible, as it sees “using national system as the best way to strengthen a country’s own capacity and achieve better long-term development results” (NDB, 2017, pp. 15–16). Through these programs, the NDB helps the BRICS countries improve their financial autonomy by reducing their reliance on dollar financing.