Book contents

- China’s Public Finance

- Endorsement on Back Cover

- China’s Public Finance

- Copyright page

- Dedication

- Contents

- Figures

- Tables

- Preface

- About the Author

- 1 An Overview of China’s Public Finance

- 2 The Fall and Rise of Government Revenue

- 3 Value-Added Tax, Consumption Tax, and Other Taxes on Goods and Services

- 4 Individual Income Tax Reforms

- 5 Corporate Income Tax in China

- 6 The Size and Structure of Government Expenditure

- 7 Infrastructure Development and Financing

- 8 Social Security Reforms

- 9 Healthcare Reforms

- 10 China’s Growing Local Government Debt

- 11 Fiscal Relationship between the Central and Local Governments

- 12 Fiscal Reform for Equitable and Sustainable Growth

- References

- Name Index

- Subject Index

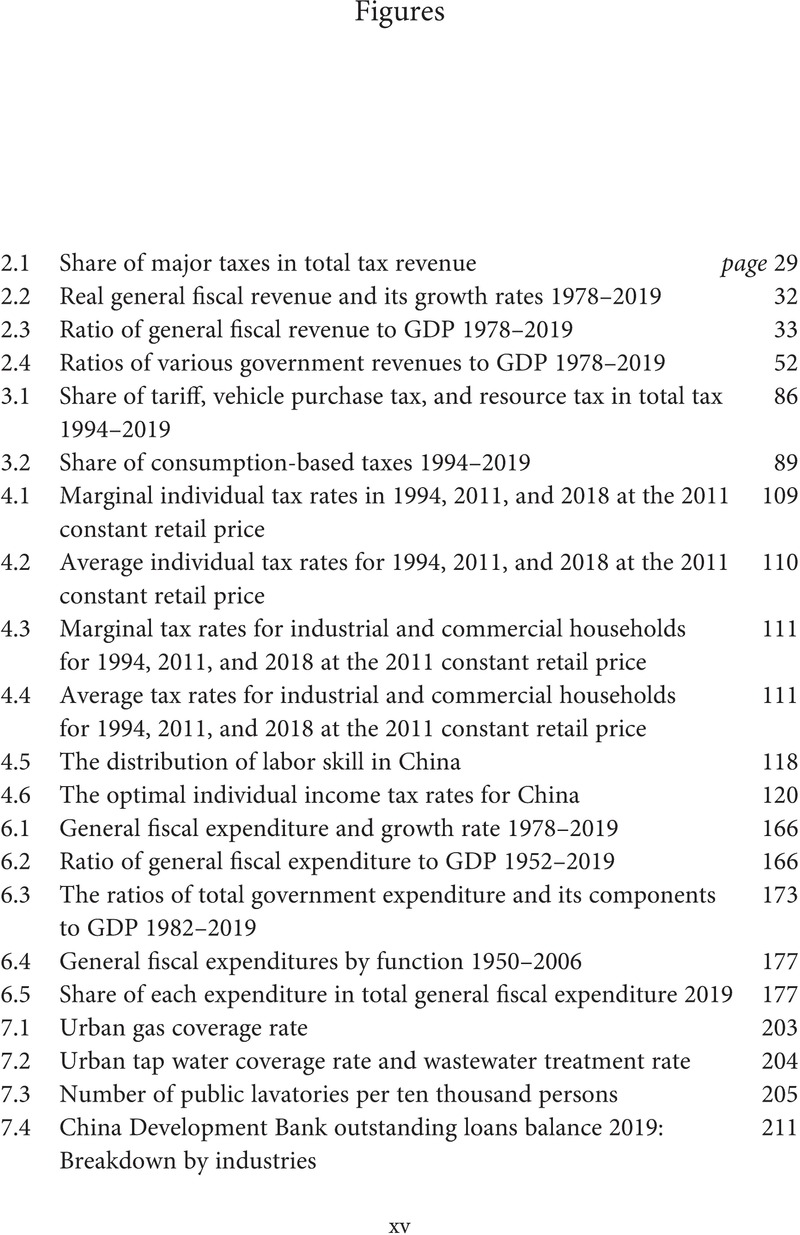

Figures

Published online by Cambridge University Press: 22 September 2022

- China’s Public Finance

- Endorsement on Back Cover

- China’s Public Finance

- Copyright page

- Dedication

- Contents

- Figures

- Tables

- Preface

- About the Author

- 1 An Overview of China’s Public Finance

- 2 The Fall and Rise of Government Revenue

- 3 Value-Added Tax, Consumption Tax, and Other Taxes on Goods and Services

- 4 Individual Income Tax Reforms

- 5 Corporate Income Tax in China

- 6 The Size and Structure of Government Expenditure

- 7 Infrastructure Development and Financing

- 8 Social Security Reforms

- 9 Healthcare Reforms

- 10 China’s Growing Local Government Debt

- 11 Fiscal Relationship between the Central and Local Governments

- 12 Fiscal Reform for Equitable and Sustainable Growth

- References

- Name Index

- Subject Index

Summary

- Type

- Chapter

- Information

- China's Public FinanceReforms, Challenges, and Options, pp. xv - xviPublisher: Cambridge University PressPrint publication year: 2022