Nothing is more fundamental in setting our research agenda and informing our research methods than our view of the nature of the human beings whose behavior we are studying

1 Introduction and Overview

Behavioral Strategy and This Element

What is behavioral strategy? Where does it come from? Why is it important? One approach to answer these questions is to perform a little thought experiment. Imagine you are a high-level manager in the 1960s. Having attended business school (of which there were much fewer than now) you possess a highly diverse toolbox, derived from different disciplines, such as psychology, mathematics, political science, and economics. Yet when attempting to use these diverse tools, you soon realize they are based on widely different underlying assumptions about managers and employees, making them both incompatible and variably applicable in the real world. For example, the principles of negotiation you were taught, drawing on psychology and political science, are helpful in your managerial role in the company. In contrast, the economic principles you learned provide qualitative market- or industry-level predictions (Machlup, Reference Machlup1967), but are less useful for addressing many other issues you face as a manager. In economics, managers (like you) are assumed to be highly rational instantaneously choosing profit-maximizing input combinations. In practice, you know (too well) that managers are not capable of this.

In the face of managerial realities – complexity, limited information, political conflict, competing motivations, uncertainty, ill-defined goals, and power struggles – the need for strategy tools built on more realistic behavioral assumptions became apparent. Pioneering scholars in the field of strategy – Herbert A Simon (1948), Edith Penrose (Reference Penrose1959), Alfred Chandler (1962), Richard Cyert and James G March (Reference Cyert and March1963) – recognized that sound strategic management theory needs to come to grips with this reality. Thus, the field of strategy that emerged in the 1960s viewed managers as boundedly rational – that is, incapable of processing all available information, and therefore likely to make suboptimal decisions if evaluated through the lens of perfect rationality. With this auspicious start, one may expect strategy scholars to have made great strides in the understanding of boundedly rational managerial behavior, and at the very least to take great care in specifying behavioral assumptions about managerial behavior. However, much (perhaps most) strategy theory has not done this. Instead, the field became preoccupied with macro-level concepts such as industry or resource analysis, firm routines, capabilities, or competencies, and, more recently, with business models and ecosystems (Felin & Foss, Reference Felin and Foss2005). As a result, most strategy theorizing leaves assumptions about individuals unspecified and opaque.

In this Element, we delve into the field of behavioral strategy, which attempts to address this theoretical blindspot by using evidence-based behavioral assumptions as the foundation of strategic thinking. We see behavioral strategy as microfoundational: it seeks to ground theorizing (and explanation and prediction) in individuals and their interactions. Thus, instead of building theory around an organizational actor, who merely has limited information processing capacity, this research also assumes individuals have a variety of motivations and emotions, use heuristics, and are subject to cognitive biases. Yet, after surveying the research in behavioral strategy, we see that these intentions have only been partially fulfilled, and further, not all of what passes as behavioral strategy is actually microfoundational. Thus, a key purpose of this Element is to uncover the substantial “microfoundational potential” that remains untapped within the field of behavioral strategy.

A second key objective of the Element is to present the diversity of behavioral strategy research. A significant part of this tradition is rooted in the already well-researched behavioral theory of the firm (Cyert & March, Reference Cyert and March1963), which addresses firms’ responses to performance deviations from “aspiration levels” (basically, their quantified goals). As a result, scholars less acquainted with behavioral strategy typically equate the subfield with this perspective. Yet, many other streams of behavioral strategy research have developed more recently. By exposing readers to this work, we hope to demonstrate the diversity of behavioral strategy research, and inspire others to take up these novel research threads and weave them into an even more vibrant behavioral strategy tapestry than that created only with the behavioral theory of the firm.

The Relevance of a Behavioral Approach to Strategic Decisions

To start our journey into behavioral strategy, we need to go back to the very definition of “strategy” itself. A “strategy” is an action plan chosen by general management that allows an organization to create and capture value over an extended time period in a way that builds on the strengths of the organization (e.g., Chandler, 1962; Rumelt, Reference Rumelt, Schendel and Hofer1979). Since the 1960s, academics, consultants, and gurus have devised diagnostic and analytical frameworks to aid in strategy formulation and implementation. Yet, these tools often overlook the boundedly rational nature of managers and the psychological influences at play.

Take, for example, Michael Porter’s (Reference Porter1980) well-known Five Forces framework, a staple in strategy courses. It analyzes industry profit potential as driven by intraindustry rivalry, supplier and customer bargaining power, as well as the competitive threats posed by potential entrants and substitutes. In developing their firm’s strategy, managers are urged to take these forces into account and shield against them. There are several tacit psychological assumptions in this strategy development process, which remain that way because decision-making and decision-makers are not explicitly discussed in most presentations of the framework. Specifically, the framework implicitly assumes managers possess a uniform cognitive representation (or “mental model”) of the industry and complete information on various market elements like customers’ willingness to pay, supplier costs, and competitive motivations and actions. This overlooks the reality that managers may hold different interpretations of the same industry, even if they conduct a Five Forces analysis.

As both a research field and an emerging managerial practice, behavioral strategy is fundamentally about making these implicit psychological assumptions explicit by exploring the intersection of psychology and strategy to understand and improve strategic decision-making. While the field of psychology uses the term “behavioral” to mean “behaviorist,” echoing the stimulus-response theories of Pavlov and Skinner, this term takes on a distinctly different meaning in the field of strategy. Introduced in 2010 by Fox and Lovallo during their consulting work for McKinsey, behavioral strategy simply means “Strategy + Psychology.”

The importance of adding psychology to strategy in today’s world cannot be overstated, as recent events highlighted how it shapes decision-making and outcomes. For example, financial decision-makers’ cognitive biases and herd behavior contributed to the 2008 financial crisis. Similarly, social influences and behavioral biases among individual investors drove the recent GameStop stock market frenzy.

Historical examples abound, but the Covid-19 pandemic and the disruptions it induced in the global economy clearly underscore the importance of understanding how decision-makers interpret and adapt to major disturbances that produce deeply complex, highly uncertain strategic problems. To most decision-makers, the pandemic was a “black swan” in the sense of Taleb (Reference Taleb2007): an unknown (or at least something very much out of the ordinary) with massive negative consequences that required extensive sensemaking. For medical and health decision-makers, uncertainty was rampant, including the dynamics of the spread of the disease, the spatial variation in incidence, the epidemiological parameters, the role of superspreaders, and so on. Governments faced ambiguities about Covid-19’s economic impact, the set of possible policy actions, and the outcomes of such actions under different scenarios (Ehrig & Foss, Reference Foss2020). Corporate decision-makers also faced uncertainties regarding end markets, supply chains, and workforce consequences. Their responses differed markedly. For example, while most containerized shipping companies cut back on tonnage, one of the world’s biggest operators, Danish Maersk did not, dramatically increasing its earnings when the pandemic’s influence on trade patterns turned out to be less severe than anticipated (Maersk, 2023).

Most policy decision-making during the pandemic was characterized by “novelty, complexity and open-endedness” (Mintzberg et al., Reference Mintzberg, Raisinghani and Theoret1976: 250), and, initially, a lack of clarity on how to respond (Foss, Reference Foss2020). However, countries that had recently experienced major influenza-like epidemics (e.g., Taiwan) quickly implemented preventive measures. In other words, prior experience played a major role in how rapidly actors could react and how much search was required among available responses. The observed response patterns suggest the presence of anchoring effects stemming from, for example, dramatic footage of global spots that were particularly hard hit by the pandemic outbreak. They also showcase confirmation bias supporting the choice of such reference points and leading to escalation of commitment to the chosen courses of action. While the pandemic prompted policymakers to implement a range of measures to contain the spread of the virus and mitigate its impact on public health and the economy, the global political response to the crisis was chaotic, fragmented, and often myopic, which led some policymakers to delay or underfund public health interventions, such as testing and contact tracing, in favor of measures that had more immediate effects, such as lockdowns. Governments tried to muddle through in the face of uncertainty by imitating each other (Sebatu et al., Reference Sebhatu, Wennberg, Arora-Jonsson and Lindberg2020). In sum, the Covid-19 pandemic certainly highlighted the crucial role of psychology in shaping strategic decision-making and outcomes, particularly under uncertainty. Behavioral strategy (Powell, Lovallo, & Fox, Reference Powell, Lovallo and Fox2011) is vital in the broader world today, as suggested by the fact that psychological explanations are often invoked in explaining overall firm behavior and outcomes in both the popular business press (Forbes, Fortune, etc.), newspapers (Wall Street Journal, Financial Times), and magazines (Harvard Business Review, Sloan Management Review, McKinsey Quarterly). Additionally, well-known business failures (such as those of Blockbuster, Kodak, and Polaroid) that are a staple in MBA teaching, are at least partially attributed to senior managers’ cognitive limitations constraining the development of organizational capabilities and, ultimately, adaptation (e.g., Tripsas & Gavetti, Reference Tripsas and Gavetti2000). Given their frequency, these explanations further underscore the need for research-driven inquiries into these psychological aspects of firm performance.

What Is “Behavioral Strategy”?

There is a long tradition in strategy research of drawing on psychology (especially cognitive psychology, which is very roughly the study of how people think). But as already suggested the increasingly turbulent business and social environment has underscored the relevance and explanatory power of behavioral strategy research, as it is uniquely positioned to shed light on decision-making in environments characterized by high levels of uncertainty (Cyert & March, Reference Cyert and March1963), complexity (Busenitz & Barney, Reference Busenitz and Barney1997), and urgency (Forbes, Reference Forbes2005). Specifically, behavioral strategy research draws on psychological theories and concepts – such as cognitive biases, emotions, motivations, and social influences – to understand how firms obtain and sustain competitive advantage (or, fail to achieve such advantage). This understanding helps managers and employees make decisions and take actions that enable their organizations to adapt to new challenges, sustain their performance, and ensure long-term survival. As such, it represents a vital area of inquiry for scholars and practitioners alike who seek to better understand the complexities of today’s world and help organizations thrive in the face of uncertainty. It is thus not surprising that behavioral strategy research is an increasingly important voice in the strategy field, especially following its institutionalization as a distinct subfield in 2013: the founding of the Behavioral Strategy Interest Group in the Strategic Management Society.

Yet, the field of strategy has not always been open to studying behavioral strategy. To underscore the importance of including cognitive biases in strategic decision-making research, Lovallo and Sibony (Reference Lovallo and Sibony2010) worked with McKinsey & Company to conduct a survey of 2,207 executives about the quality of strategic decision-making inside organizations. About 60 percent of respondents indicated that good and bad decisions occur with equal frequency, while 13 percent noted that good decisions were very infrequent. Probing into the reasons for this skepticism, the survey further examined the role of detailed analysis versus the structure of decision-making processes. The results revealed that decision process structure was six times more influential on decision quality than the depth of analysis. That is not to say analysis is unimportant. But, it highlights that a biased decision process can undermine even the most thorough analysis. Additionally, they discovered that implementing practices to debias decision-making could improve a company’s ROI by 6.9 percent, demonstrating the tangible benefits of high-quality decision-making.

While behavioral strategy is receiving increasing recognition and acceptance, there is still disagreement as to how to define this subfield. Powell, Lovallo, and Fox (Reference Powell, Lovallo and Fox2011: 1371) offered the following definition of behavioral strategy:

Behavioral strategy merges cognitive and social psychology with strategic management theory and practice. Behavioral strategy aims to bring realistic assumptions about human cognition, emotions, and social behavior to the strategic management of organizations and, thereby, to enrich strategy theory, empirical research, and real-world practice.

Other definitions of behavioral strategy have followed, either narrowing or expanding the subfield’s scope (see Gavetti, Reference Gavetti2012; Hambrick & Crossland, Reference Hambrick, Crossland, Augier, Fang and Rindova2018). A comparably narrow definition provided by Levinthal (Reference Levinthal2011) suggests that a behavioral approach to strategy involves systematically building from the idea of a “cognitive representation” of a decision problem (Levinthal, Reference Levinthal2011: 1519). Gavetti (Reference Gavetti2012) also refers to behavioral strategy as “the psychological underpinnings of a given phenomenon, where psychological broadly denotes ‘being about mental process’” (Gavetti, Reference Gavetti2012: 267). On the other hand, Rindova et al. (Reference Rindova, Reger, Dalpiaz and Dagnino2012) adopts a broad “socio-cognitive perspective” focusing on “the roles of managers’ and observers’ attention; the bounded rationality of their cognitions, intuitions, and emotions; and the use of biases and heuristics to socially construct ‘perceptual answers’ to traditional strategic management questions about how firms obtain and sustain competitive advantage” (Pfarrer et al., Reference Pfarrer, Devers and Corley2019: 768). Finally, Hambrick and Crossland make a distinction between behavioral strategy “tents” of varying sizes. The small tent interpretation “amounts to a direct transposition of the logic of behavioral economics (and behavioral finance) to the field of strategic management,” while the large tent conception includes “all forms and styles of research that consider any psychological, social, or political ingredients in strategic management” (Reference Hambrick, Crossland, Augier, Fang and Rindova2018: 25). However, the tent size favored by Hambrick and Crossland views behavioral strategy as a “commitment to understanding the psychology of strategists,” which falls in the middle.

As illustrated by these diverse views of behavioral strategy, many disagreements remain around the definition of behavioral strategy, its current scope (what it seeks to explain and how it explains it), and its boundaries (what is behavioral strategy proper amidst the huge literature that makes use of psychology for theorizing about organizations and strategies). Despite these disagreements, most understandings of this subfield anchor on Herbert A. Simon’s work and, more specifically, on the concept of bounded rationality.

Bounded rationality emerged from Simon’s field studies of decision processes in local government bureaus. In contrast to classical economics models of perfect rationality, he observed that individuals are not capable of making optimal decisions. Bounded rationality posits that decision-making is influenced by a range of cognitive and environmental factors, including incomplete information, time constraints, and computational limitations that, in turn, make individuals satisfice rather than maximize (i.e., select courses of action that are satisfactory – rather than optimal) (Simon, Reference Simon1955). Simon was explicitly committed to microfoundations, that is, the idea that we should seek to understand the characteristics and behaviors of aggregate social entities (such as organizations) in a manner that takes account of the nature and behavior of the individuals composing them (Simon, Reference Simon1991; Felin, Foss, & Ployhart, Reference Felin, Foss and Ployhart2015). He was also committed to the notion that the study of decision-making must be evidence-based (Simon, Reference Simon1978). Given that Simon’s work is the commonality across inceptions of behavior strategy, we propose a definition of behavioral strategy based on these Simonian methodological commitments, which also provides shared ground between the existing definitions:

Definition: Behavioral strategy is the body of thought that addresses strategic management issues (e.g., CEO and top management team behaviors, entry decisions, competitive interaction, firm heterogeneity) in a way that: 1) is microfoundational, 2) embraces a psychology-based understanding of the actions and interactions of individuals to explain exchange or firm-level strategy phenomena, and 3) grounds theorizing in realistic and robust evidence about behaviors and interaction.

Thus, behavioral strategy reinforces other influences that have shaped strategy research over the last few decades, particularly the increased emphasis on microfoundations (Felin & Foss, Reference Felin and Foss2005; Felin et al., Reference Felin, Foss and Ployhart2015) and on empirical methods that go beyond the regression-based analysis of archival data, as they do not allow for testing of underlying mechanisms. Behavioral strategy inherently requires mixed-methods approaches, involving various kinds of experimental and qualitative methodologies.

Themes and Currents in Behavioral Strategy

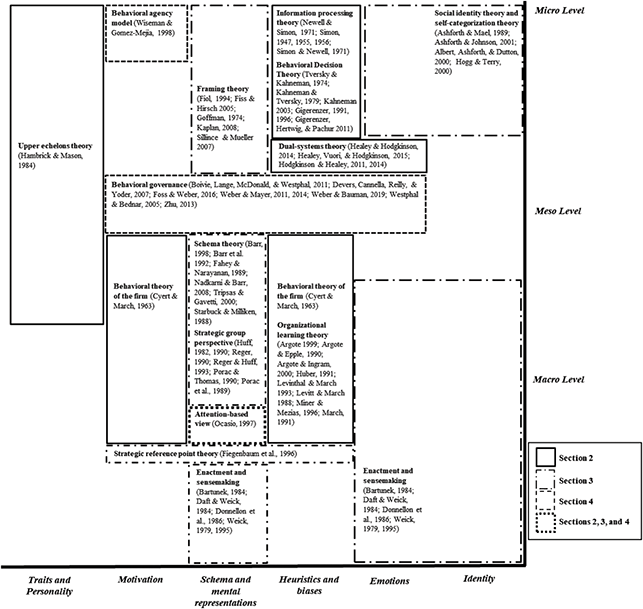

Simon’s notion of bounded rationality imprinted much of the subsequent psychology-based strategy literature, including what we consider today to be behavioral strategy. Figure 1 provides a visual summary of the major contributions in the behavioral strategy field, grouping them into major research traditions. These traditions are plotted based on the most commonly adopted psychological constructs impacting strategy outcome variables and the level at which a construct is theorized within each tradition (i.e., microlevel (individual), meso-level (group), and macro-level (organization)).Footnote 1 This figure thus acts as a roadmap of the behavioral strategy subfield, as well as of Sections 2–4 in this Element.

Figure 1 Major contributions in the behavioral strategy field

Building on Simon’s Bounded Rationality

As noted earlier, one traditional theme in behavioral strategy research hinges on premises that date back to Richard Cyert and James March’s book A Behavioral Theory of the Firm (Reference Cyert and March1963) – a truly foundational contribution in terms of the inspiration it has provided behavioral strategy scholars (and strategy scholars in general). In their behavioral theory of the firm (BTOF), Cyert and March (Reference Cyert and March1963) follow Simon in explicitly criticizing neoclassical economics, specifically the neoclassical theory of the firm (i.e., the basic iso-cost and iso-quant curve apparatus taught in basic microeconomics). The inspiration for key parts of their theory is explicitly drawn from Simon. Rationality in BTOF is best understood in terms of satisficing aspiration levels, which may be thought of as the smallest acceptable outcomes for a goal, the line between perceived successes and failures, or as rules for simplifying evaluations (Greve, Reference Greve1998). Moreover, quasi-resolution of conflict and priority rules govern which goal is addressed. Furthermore, firms are assumed to (only) act when they face a problem – when performance falls below an aspiration level – by searching for a solution. Additionally, similar to goal selection and performance assessment, this search is governed by rules (March & Simon, Reference March and Simon1958), specifying the proximity of search to the problem, the current state of the organization, and vulnerable areas inside of it. Thus, search is problemistic, “simple-minded” (governed by simple models of causality), path-dependent (based on organizational history and accumulated knowledge embedded in the standard operating procedures and routines of the organization), and reflective of managerial preferences and employees’ training and experience. From a methodological standpoint, A Behavioral Theory of the Firm commits to developing process-oriented models of the firm and linking them to the empirical world through decision-making simulations. As a result, this simulation approach has become a key tool for understanding and deriving nonobvious implications in subsequent behavioral theory of the firm research (Gavetti et al., Reference Gavetti, Greve, Levinthal and Ocasio2012; Puranam et al., Reference Puranam, Stieglitz and Pillutla2015).

Another traditional behavioral strategy research area directly descending from Cyert and March’s theory (Reference Cyert and March1963) is organizational learning research (Argote, Reference Argote1999; Levit & March, Reference Levitt and March1988; Argote & Greve, Reference Argote and Greve2007) which examines how organizations, seen as complex adaptive systems (Denrell & March, Reference Denrell and March2001), learn and draw inferences from experience (Levitt & March, Reference Levitt and March1988). Local (myopic) search is assumed as the main mechanism driving learning, resulting in suboptimal outcomes (Levinthal & March, Reference Levinthal and March1993). These studies typically rely on agent-based simulation models, including NK models and bandit models, characterizing choices of action as existing on performance landscapes (Levinthal, Reference Levinthal1997).

Another closely related traditional research stream builds on Cyert and March’s rule-based view of organizational decision-making to examine the implications of decision rules for a series of organizational processes and outcomes, including learning (Lant & Mezias, Reference Lant and Mezias1992), adaptation (Lant, Reference Lant1992), innovation (Mezias & Glynn, Reference Mezias and Glynn1993), and performance. Adjacent to these contributions, is the view that organizational routines perform the double role of (1) providing stability and encapsulating firm-specific knowledge (Nelson & Winter, Reference Nelson and Winter1982), and (2) generating organizational change (Feldman & Pentland, Reference Feldman and Pentland2003). This work augments March and Simon’s (Reference March and Simon1958) and Cyert and March’s conceptualization of routines as abstract and stable patterns shaping and guiding organizational behavior with human agency – organizational members’ doings and acts – to introduce changes to routines, and therefore organizational change and performance.

While we will refer to these foundational contributions and their direct descendants several times in the subsequent sections, because of their centrality and extraordinary influence in the organization sciences, they have already been the subject of excellent reviews by Argote and Greve (2006) (Carnegie’s School tradition), Baumann et al. (Reference Baumann, Schmidt and Stieglitz2019) (search in performance landscapes), Gavetti et al. (Reference Gavetti, Levinthal and Ocasio2007) (Carnegie’s School tradition), Gavetti et al. (Reference Gavetti, Greve, Levinthal and Ocasio2012) (behavioral theory of the firm), Posen et al. (Reference Posen, Keil, Kim and Meissner2018) (problemistic search), and Puranam et al. (Reference Puranam, Stieglitz and Pillutla2015) (bounded rationality).

However, as Figure 1 illustrates, behavioral strategy research encompasses more than these traditional streams, so we focus on the many other parts of behavioral strategy that explore topics beyond search and organizational learning, including, for example, Kahneman and Tversky’s (Reference Tversky1974, Reference Kahneman and Tversky1982) research on heuristics and biases (Section 2), the distinction between “hot” and “cold” cognition (e.g., Hodgkinson & Healey, Reference Hodgkinson and Healey2011) (Section 2), Weick’s thinking on managerial and organizational cognition (Weick, Reference Weick1979) (Section 3), and work based on cognitive or motivational psychological theories, such as regulatory focus theory (e.g., Weber & Mayer, Reference Weber and Mayer2011) (Section 4). We delve into each of these sections in more detail below.

Information Processing, Heuristics, and Biases

In the second section, we present work on microlevel biases and heuristics that build on the notion of bounded rationality (continuous-line-patterned areas in Figure 1). It originates from two major individual-level research traditions that predict organizational decision-making: information-processing research (Simon & Newell, Reference Simon and Newell1971) and behavioral decision research (Tversky & Kahneman, Reference Tversky and Kahneman1974; Kahneman & Tversky, Reference Kahneman and Tversky1979). Information processing research concerns human problem-solving and heuristics and views the decision-making process as a key unit of analysis (Simon & Newell, Reference Simon and Newell1971). In particular, organizational behavior is explained by the discrepancy between the real world and the simplified model of reality in the human mind (Simon, Reference Simon1955).

In behavioral decision research, bounded rationality leads humans to make fast decisions that produce systematic biases (or cognitive illusions). This research stream aimed to create an evidence-based map of bounded rationality “by exploring the systematic biases that separate the beliefs that people have and the choices they make from the optimal beliefs and choices assumed in rational-agent models” (Kahneman, Reference Kahneman2003: 1449). According to the two main exponents of this stream, Amos Tversky and Daniel Kahneman, fast thinking manifests itself in decision-makers relying on rules of thumb (heuristics) – such as representativeness, availability, and anchoring and adjustment – which lead to systematic divergences from the normative models of behavior in classical economic theories. Still lying within the behavioral decision research tradition but promoting a fundamentally different view of heuristics is the work on fast-and-frugal heuristics (Gigerenzer et al., Reference Gigerenzer and Todd1999; Gigerenzer, Hertwig, & Pachur Reference Gigerenzer, Hertwig and Pachur2011). Here, humans are seen as intuitive statisticians, who can adopt heuristics in a way that increases accuracy and minimizes effort, achieving what is defined as ecological rationality. Another important extension of behavioral decision research is represented by the dual-systems theory of cognition (Chaiken & Trope, Reference Chaiken, Trope, Press and handler1999). This theory builds on Kahneman and Tversky view’s of decision-making as dominated by two systems: a system that operates through largely automatic, preconscious processes involving the development of heuristics; and one that operates via more effortful, deeper, and analytical processes. Yet, in contrast to Kahneman and Tversky’s view of automatic thinking to be seen as the default mode and the main source of systematic biases, researchers in this stream view the two systems as operating simultaneously and emphasize the importance of humans’ capability to switch back and forth between these two processes depending on situational circumstances (Hodgkinson & Healey, Reference Hodgkinson and Healey2011).

Interpretive Perspectives

The third section addresses the stream of work exploring enactment and the related notion of sensemaking (dashed-dotted-patterned areas in Figure 1) – which has received substantial attention (e.g., Hodgkinson, Reference Hodgkinson1997; Walsh, Reference Walsh1995). This stream challenges the notion of bounded rationality and its positivistic view of the world as an objective entity. In contrast, scholars belonging to this stream maintain a view of the environment as enacted – that is, socially constructed via a process of sensemaking through which individuals develop meaning from ambiguous environmental cues via local action, in turn, giving rise to even radically different perceptions of the business environment. Research in this interpretive stream can further be grouped into three traditions: micro- and meso-level work on schema and mental maps (Huff, Reference Huff1982, Reference Huff1990; Porac et al., Reference Porac, Thomas and Baden‐Fuller1989), micro- and meso-level work on social identity and identification (Ashforth & Mael, Reference Ashforth and Mael1989; Albert, Ashforth, & Dutton, Reference Albert, Ashforth and Dutton2000); and meso- and macro-level work on enactment and sensemaking (Daft & Weick, Reference Daft and Weick1984). The first sheds light on managers’ cognitive mapping process (Hodgkinson et al., Reference Hodgkinson, Maule and Bown2004), the content of these maps (Porac et al., Reference Porac, Thomas, Wilson, Paton and Kanfer1995; Reger & Huff, Reference Reger and Huff1993), and their implications for strategic decisions (e.g., Barr et al., Reference Barr, Stimpert and Huff1992). It also provides insight into divergences between managers’ cognitive maps and aggregation issues. The second tradition illuminates organizational members’ social identity construction and its impact on the firm (Ashforth & Mael, Reference Ashforth and Mael1989). The third stream focuses on the sensemaking process through which organizational members, when faced with disruptive events, collectively construct meaning and continue to enact the environment (Weick, Reference Weick1995). Therefore, in contrast to the first stream, which assumes that a frame of meaning (or cognitive map) is already in place, and one needs to connect a new cue to the existing frame (through the act of mapping), the second stream is more concerned with the “invention” of a new frame. In this section, we shed insight into the distinctive facets of this stream’s constitutive research traditions. We also discuss the difficulties of studying the mental representations and sensemaking processes of the organization’s top management team members.

Behavioral Governance

In the fourth section of the Element, we focus on the motivation-related part of the behavioral strategy landscape in Figure 1 (dashed-patterned areas), and, specifically, on the behavioral governance traditions. Work in this tradition aims at augmenting corporate governance theories (i.e., agency theory; Fama & Jensen, Reference Fama and Jensen1983; Jensen & Meckling, Reference Jensen and Meckling1976) and transaction cost economics (TCE; Williamson, Reference Williamson1975, Reference Williamson1985) with psychological theories and concepts to predict organizational outcomes, with a special focus on the role of governance – that is, “the formal structures, informal structures, and processes that exist in oversight roles and responsibilities in a corporate context” (Hambrick, Werder, & Zajac, Reference Hambrick, Werder and Zajac2008: 381) – in supporting cooperation among firms’ internal and external constituents (Westphal & Zajac, Reference Westphal and Zajac2013). In particular, work in this stream can be organized into three separate streams differing on the context of application, in terms of the “main agent(s)” to which they apply: (1) corporate leaders; (2) organizational members and employees; and (3) external stakeholders. Work focusing on corporate leaders examines executives’ behaviors, as guided by self-interest and personal risk preferences and characterized by bounded rationality, and how certain incentives (e.g., equitable compensation), structures, and systems, by acting on executives’ intrinsic, extrinsic motivation, and prosocial motivations can channel executives’ efforts in directions that contribute positively to organizational and/or societal outcomes (Devers, Cannella, Reilly, & Yoder, Reference Devers, Cannella, Reilly and Yoder2007).

Research in the second stream explores how different organizational designs induce different motivations, leading to specific types of opportunism or cooperation (Weber, Foss, & Lindenberg, Reference Weber, Foss and Lindenberg2023), as well as specific transaction costs (Foss & Weber, Reference Foss and Weber2016). Finally, work in the third stream examines how contract frames impact employees’ regulatory focus, emotions, perceptions, and behaviors (Weber & Mayer, Reference Weber and Mayer2011), inducing desired exchange behaviors (Weber, Mayer, & Macher, Reference Weber, Mayer and Macher2011) and impacting the relationship between firms. This section also builds on the second and third sections to examine efficient transaction governance decisions that take different organizational cognitive frames into account (Weber & Mayer, Reference Weber and Mayer2014).

Research Challenges in Behavioral Strategy

In the final section of the Element (Section 5), we present the major research challenges in behavioral strategy research and propose a roadmap to advance research in this field. We focus on definitional and methodological issues. From a definitional standpoint, we describe how existing behavioral strategy research has largely overlooked possible implications of branches of psychology beyond cognition (cf. Gigerenzer & Goldstein, Reference Gigerenzer and Goldstein1996), such as emotions, affect, intuition, and even motivation. Because of these tendencies, we note that there is a huge potential for future behavioral strategy research that has not yet been tapped, for example, examining the impact of strategic beliefs on firm performance, or the psychology of goals (Lindenberg & Foss, Reference Lindenberg and Foss2011), or motivational psychology, and how these aspects influence firm value creation. We also present potential issues with the widespread approach of anthropomorphizing organizations. From a methodological standpoint, we discuss the potential benefits of methodological pluralism to capture and account for the complex dynamics of real organizational settings.

2 Bounded Rationality, Heuristics, and Biases: From Simon to Computational Models

Introduction

While bounded rationality is foundational to most management thought, it is particularly important in a behavioral strategy context. A key purpose of this section is to trace thinking on bounded rationality from its earliest history in Simon (Reference Simon1947) through the heuristics and biases program of Kahneman and Tversky (Reference Tversky1974) to modern computational approaches and ecological rationality. As such, the section lays the foundations for subsequent sections. However, along the way, we will also note various limitations in the way behavioral strategy has dealt with bounded rationality, such as a tendency to reify the concept, specifically, move it to the organizational level without considering the aggregation process.

Bounded Rationality: Simon’s Grand Theme

From “Perfect” to “Bounded” Rationality

As its name suggests, bounded rationality was coined as a critique of the assumption of “perfect” rationality. Extreme assumptions often serve science well, and, arguably, the assumption of perfect rationality has, in many ways, served economics well, as it furthers tractability (i.e., decision problems can be represented as maximization problems), tends to lead to unique predictions (given certain assumptions on the maximization problem) and is not completely unrealistic (e.g., when a decision situation is sufficiently simple). And yet, the assumption has also been criticized for as long as it has been articulated (e.g., Veblen, Reference Veblen1898).

To understand what the critique is about, it is important to understand what the assumption entails and what it does not. Perfect rationality does not assume omniscience or perfect foresight. Economics has long since dispensed with those assumptions in favor of assumptions of “asymmetric and imperfect information.” Thus, information and uncertainty or risk are included in the set of constraints on the decision problem, but decision-makers are nevertheless assumed to be capable of maximizing and arriving at the best possible solution. This view – further refined in the 40s and 50s in the works of von Neumann and Morgenstern (Reference Neumann and Morgenstern1944), Friedman and Savage (Reference Friedman and Savage1948), and Luce and Raiffa (Reference Luce and Raiffa1957) – implicitly assumes that decision-makers have an unlimited capacity for processing the information they possess or acquire. Accordingly, any decision problem can potentially be addressed and handled immediately and perfectly.

If taken literally, it is easy to see how extreme this view is, as “there is a complete lack of evidence that, in actual human choice situations … these computations are in fact performed” (Simon, Reference Simon1955: 104). Providing this evidence, and, more generally, understanding how decision-makers actually make decisions and if general principles can be constructed about such decision-making, was a significant part of the multi- and interdisciplinary oeuvre of Herbert A Simon.

Simon (Reference Simon1947) points out that although we may intend to be rational, we do not have the wits to calculate the optimal solution for many decision situations. In Simon’s often-quoted phrase, we are boundedly rational: “intendedly rational, but limitedly so” (1947: 88). Of course, this is a negative definition in the sense that it tells us what bounded rationality is not rather than what it actually is (Foss, Reference Foss and Rizzello2003). However, exploring what bounded rationality entails for individual decision-making and, in particular, in an organizational context, has constituted a central scholarly effort in a number of related but distinct research streams over the last seven decades. This includes work in information processing (Simon & Newell, Reference Simon and Newell1971), within the broad Carnegie School (March & Simon, Reference March and Simon1958) – including, the behavioral theory of the firm (Cyert & March, Reference Cyert and March1963), the attention-based view of the firm (Ocasio, Reference Ocasio1997), and modern computational approaches that highlight the search and adaptation aspects of bounded rationality (Levinthal, Reference Levinthal1997; Puranam et al., Reference Puranam, Stieglitz and Pillutla2015) – as well as work on behavioral decision research from behavioral economics (Tversky & Kahneman, Reference Tversky and Kahneman1974; Kahneman & Tversky, Reference Kahneman and Tversky1979), top management teams (Ha0mbrick & Mason, Reference Hambrick and Mason1984), and even TCE (Williamson, Reference Williamson1996; see Section 4). The first major advance in the bounded rationality program is the expansion to consider satisficing and search.

Bounded Rationality in Individual Decision-Making: Information Processing, Heuristics, and Satisficing Search

In his Reference Simon1955 article, “A behavioral model of rational choice,” Simon centers his critique around two fundamental assumptions inherent in rational decision theory, namely (1) perfect computational powers on the part of decision-makers and (2) the existence of a well-defined set of conceivable actions which lead to certain consequences that can all be evaluated and compared, thereby translating into a complete preference ordering and a unique optimal action.

In place of such unrealistic assumptions, Simon (Reference Simon1955, Reference Simon1956) fundamentally redefines rationality from the “substantive” notion associated with standard economics to a more “procedural” notion (Simon, Reference Simon1978), whereby “an explanation of an observed behavior of the organism is provided by a program of primitive information processes that generates this behavior” (Newell, Shaw, & Simon, Reference Newell, Shaw and Simon1958: 151). Thus, the attention turns to decision-making and problem-solving (or search in later work) processes as guided by “programs.” In particular, when human beings are observed working on problems that are difficult but not unsolvable for them, their behaviors reveal basic properties that relate to how they process information, namely serial processing, small short-term memory, and infinite long-term memory with fast retrieval but slow storage (Simon & Newell, Reference Simon and Newell1971). These properties impose strong constraints on how individuals can seek solutions to problems in large problem spaces (cf. Simon & Newell, Reference Simon and Newell1971: 149). In these situations, regardless of how large the problem space is, heuristics direct problem solvers’ attention to small, promising regions of the problem space or “a set of possible outcomes … such that the pay-off is satisfactory … for all these outcomes,” while ignoring the rest, and to search around certain “behavior alternatives” until those “whose outcomes are all [in the set]” are identified (p.106). In other words, search involves refining the understanding of how actions map onto consequences in a sequential manner, which inherently depends on how information is embedded in problem spaces, extracted by heuristic processes, and used to guide search.

According to Simon, the simplest way to extract and use information for problem-solving is hill climbing. Using the heuristics of “always going upward,” decision-makers try to identify alternatives that are associated with a higher performance payoff compared with the current one. The choice of an efficient next step is dictated by means-end analysis–a type of heuristics that allows a decision maker to find differences between already explored alternatives and a goal state (Simon & Newell, Reference Simon and Newell1971). Therefore, search continues until an outcome that is “satisfactory” in terms of meeting the target is found (Simon, Reference Simon1947). As Simon (Reference Simon1955: 114) explains, satisficing as a decision heuristic has the advantage of being “computationally manageable,” and at the same intuitively realistic.

In this sense, Simon’s theory of decision-making is primarily a theory describing problem-solving programs and their role in making the decision-maker, as an information-processing system, adapt to the task environment (i.e., the objective problem space). Such a focus embeds a quest for generalizability and parsimony to make the theory applicable to a variety of problem situations as well as allowing for examination via mathematical and computational modeling. Indeed, as we discuss in the next section, Simon’s work inspired the development of an entire research program relying strongly on formal (mathematical and computational) modeling to describe and analyze the processes of search and adaptation in organizations (Puranam et al., Reference Puranam, Stieglitz and Pillutla2015).

Moving Bounded Rationality into the Firm: Problemistic Search and Attention

From Cyert and March to Computational Models

Although Simon’s (1947) concern with bounded rationality emerged from his close study (for his Ph.D. thesis) of decision-making in a public bureau, much of his early work on the topic, including his multiple collaborations with Alan Newell, mainly considers individual decision-making. Instead, the concept of satisficing search was extended to the organizational level by Cyert and March in their landmark Reference Cyert and March1963 book, A Behavioral Model of the Firm. As mentioned in Section 1, the most important elaboration of the book is the notion of problemistic search, that is search triggered by negative divergences between realized performance and aspiration levels (acceptable performance thresholds set by a dominant coalition of boundedly rational decision-makers through quasi-resolution of conflict (see Posen et al., 2020 for a review)). In doing so, Cyert and March emphasized the importance of feedback in guiding search (which had also appeared in Simon 1966).

Since Cyert and March (Reference Cyert and March1963), a substantial number of papers have been published following a basic scheme in which: (1) agents are equipped with models of their environments, (2) representations inform the choices agents make, (3) these choices are “tested” in the relevant environment generating feedback, and (4) the representations in the environmental model are adapted, resulting in novel choices (see Puranam et al., Reference Puranam, Stieglitz and Pillutla2015). This scheme underpins research on the behavioral theory of the firm, including research on the “exploitation-exploration tradeoff” (March, Reference March1991) and work that uses “NK models,” originally developed by theoretical biologist Stuart Kauffman (1993) and introduced to management research by Levinthal (Reference Levinthal1997).

Behavioral strategy using an NK model depicts organizations as moving on a “fitness landscape,” an N-dimensional space that maps each attribute (characteristic or policy dimension of an organization) and its performance consequences. Crucially, the topology of the landscape is determined by the degree of interdependence (i.e., complementarity) between the attributes, K. That is, K measures how many other attributes influence a given attribute. While a small value of K implies few peaks in the landscape or just a single one (a “smooth landscape”), a high value indicates many peaks (a “rugged landscape”). Even though the landscape exists in objective reality, the organization does not know its topology and therefore has to engage in search, either local (i.e., only changing one attribute) or global (“long jumps”; changing all attributes). It is intuitive that if the landscape has just one peak, this peak will be reached through local search. In contrast, in a rugged landscape, organizations that engage in only local search may get stuck on local peaks. While this seems to make global search generally attractive, such search is more costly to engage in. Thus, organizational search behavior results from a tradeoff between the benefits and costs of the two types of search. This line of research has been thriving since the late 1990s (Gavetti & Levinthal, Reference Gavetti and Levinthal2000; Puranam et al., Reference Puranam, Stieglitz and Pillutla2015), percolating widely beyond the community of modelers and resulting in empirical work investigating the impact of negative performance feedback on the likelihood and intensity of organizational and strategic changes (e.g., Audia & Greve, Reference Audia and Greve2006; Greve Reference Greve1998). This stream of empirical research has also shown that, especially under conditions of uncertainty, decision-makers selectively imitate the actions of other firms (Rhee et al., Reference Rhee, Kim and Han2006). In particular, to improve firm performance while avoiding the risks and costs of online search and experimentation, they learn vicariously by absorbing knowledge produced by other firms’ explorations (Baum et al., Reference Baum, Li and Usher2000; Levitt & March, Reference Levitt and March1988).

From March and Simon to the Attention-Based View

Further implications of bounded rationality at the organizational level were added through work from Simon’s collaboration with the political scientist James G. March and, more recently, by Ocasio’s (Reference Ocasio1997) attention-based view of the firm. In Simon’s (1948) original view, the main role of organizations was to structure the attention of individual decision-makers by offering both a physical and cognitive division of labor (member A works on problems of type Z, while B works on type Y problems, etc.) (Dearborn & Simon, Reference Dearborn and Simon1958). In the book Organizations, March and Simon explicitly focus on providing a theory for when, where, and how organizations search for information about urgent problems, alternatives, and their consequences. More specifically, they illustrate that organizations structure and channel the allocation of cognitive effort and attention through the division and spatial allocation of labor, and decide which problems should be worked on based on “decision premises” (March & Simon, Reference March and Simon1958). We will return to some of these aspects in Section 4.

Building on March and Simon (Reference March and Simon1958), Ocasio (Reference Ocasio1997) formulated the attention-based view of the firm in an article published almost four decades after their classic work. Ocasio interprets bounded rationality as individuals’ limited attentional capacity. Attention is the “noticing, encoding, interpreting, and focusing of time and effort on issues (problems, opportunities, threats …) and answers (alternatives, projects, procedures, …)” (Ocasio, Reference Ocasio1997: 188). A key purpose of organizations is therefore to direct attention in the best possible manner (Joseph & Gaba, Reference Joseph and Gaba2020). While the main emphasis is on the attention of the firm’s top decision-makers, Ocasio develops a more general theory that picks up on Simon (Reference Simon1947) and March and Simon (Reference March and Simon1958) in showing how organizations sculpt decisions by defining and allocating the stimuli that channel attention (cf. Ocasio, 2011). Thus, organizational problems (“Hey, demand dropped in market x,” “Ugh, a machine broke down”) in a specific unit selectively trigger the attention of that unit’s employees.

Heuristics and Biases and Ecological Rationality

The Heuristics and Biases Program

A key theme in Simon’s idea of bounded rationality is that decision-makers often rely on cognitive shortcuts because they lack the processing capacity to make fully informed decisions (Schwenk, Reference Schwenk1984; Simon, Reference Simon1956). Satisficing is one such heuristic, enabling decision-makers to economize on cognitive resources as compared to computationally more demanding approaches, such as maximizing. The downside is, of course, that decision-makers may choose and stick to inferior alternatives. This basic duality is central in the behavioral decision research initiated by the behavioral economists Tversky and Kahneman (Reference Tversky and Kahneman1974) (see Kahneman (Reference Kahneman2003) for a summary), and often referred to as the heuristics and biases program (Kahneman, Reference Kahneman2003, 2011; Kahneman & Tversky, Reference Kahneman and Tversky1979). Additionally, it is now seen as an important instance of “dual processing theory” which stresses the “twin imperative of having to process information deliberatively and in detail, but also being able to cut through such detail with minimal cognitive effort to perform tasks more efficiently” (Hodgkinson et al., Reference Hodgkinson, Burkhard and Foss2023: 1042). Notably, the heuristics and biases program, albeit originating directly from Simon’s bounded rationality notion, was framed as a new paradigm departing from “bounded rationality, satisficing, and simulations” through the reliance on empirical evidence – mainly of an experimental nature (Sent, Reference Sent2004: 742).

The key idea in the heuristics and biases program is that the manifold heuristics that decision-makers utilizeFootnote 2 are likely to result in a rich set of cognitive biases, rendering the decision-making process systematically flawed – at least if evaluated related to a perfect rationality ideal. The search for such biases has become a major industry, with the number of biases at 188 at last count.Footnote 3 While it is debatable how distinct many of these biases truly are (Oeberst & Imhoff, Reference Oeberst and Imhoff2023), representativeness and availability biases, both stemming from the tendency to focus attention on supposedly typical features of a decision situation, are among the more well-known ones (Hodgkinson et al., Reference Hodgkinson, Burkhard and Foss2023; Kiesler & Sproull, Reference Kiesler and Sproull1982). Other well-known biases (probably so well-known that an explanation is not necessary) are hindsight, self-serving, overconfidence, anchoring, and confirmation biases.

One of the most influential theories in this program is Kahneman and Tversky’s (Reference Kahneman and Tversky1979) prospect theory. Conceived as an alternative to expected utility theory, it provides a model for predicting individual decision-making under risk in contexts of isolated gambles characterized by simple choices with two clear prospects or alternatives and stated probabilities (Kahneman, Reference Kahneman2003). The theory is based on the following three core assumptions: (1) decision-makers weigh assured outcomes more than probable outcomes, (2) they simplify decision-making by focusing on differences between choices rather than their commonalities, and (3) they tend to be risk-averse in the domain of (small) gains and risk-seeking in the domain of (small) losses. As a result, decision-makers prefer an assured gain over an uncertain gain with a marginally higher expected value and prefer an uncertain loss over an assured loss with a marginally lower expected value (Bromiley & Rau, Reference Bromiley and Rau2022; Holmes et al., Reference Holmes, Bromiley, Devers, Holcomb and McGuire2011).

Prospect theory has been very popular in strategy research (see e.g., Holmes et al., Reference Holmes, Bromiley, Devers, Holcomb and McGuire2011; Hoskisson et al., Reference Hoskisson, Chirico, Zyung and Gambeta2017). It is typically applied to the top management team or the organization to explain the relationship between a firm’s negative performance and its risk-taking (e.g., risky actions such as acquisitions, divestitures, and new product introductions). The application of prospect theory to firm strategic decisions has not come without criticism (Bromiley, Reference Bromiley2010; Bromiley & Rau, Reference Bromiley and Rau2022). While prospect theory examines the behavior of an individual decision-maker confronted with a simple well-structured problem with clear prospects or alternatives and known probabilities, the problems organizations are confronted with are generally complex, collective, and involve a substantial level of uncertainty. Explicit examinations of the validity of prospect theory to predict individual choices in more complex contexts similar to organizational ones have provided far from reassuring results (e.g., Bromiley, Reference Bromiley2010; Spiliopoulos & Hertwig, Reference Spiliopoulos and Hertwig2023).

This aggregation issue emerges in most strategy research building on the heuristics and biases program. Another example is the upper echelons research area founded by Hambrick and Mason (Reference Hambrick and Mason1984), who were early adopters of the heuristics and biases program (e.g., Barnes, Reference Barnes1984; Das & Teng, Reference Das and Teng1999) (see the review and discussion in Hodgkinson et al., Reference Hodgkinson, Burkhard and Foss2023). In their foundational work and that built on it, executives’ and senior managers’ characteristics and traits were grafted onto behavioral theories of decision-making (cf. Hambrick, Reference Hambrick2007) to show the heuristic nature of their decision-making and the possibly biased nature of the resulting firm-level strategic decisions and outcomes (e.g., Chen et al., Reference Chen, Crossland and Luo2015; Li & Tang, Reference Li and Tang2010; Wesley et al., Reference Wesley, Martin, Rice and Lubojacky2022). As suggested, these studies tend to take an aggregate view without delving into how biases and heuristics may be either mitigated or accentuated by social interactions and dynamics between firm leaders. Moreover, the bulk of this work focuses primarily on top-manager overconfidence (Burkhardt et al., Reference Burkhard, Sirén, van Essen, Grichnik and Shepherd2022), with Hodgkinson et al. (Reference Hodgkinson, Burkhard and Foss2023) identifying approximately 50 percent of published papers in this area addressing this particular bias.

In contrast to the work on decision-making in top management, even less attention has been paid to how heuristics and biases at lower organizational levels impact value creation. In one such application, Foss and Weber (Reference Foss and Weber2016) consider framing and social comparison biases that may arise in exchanges between members and units in firms. They argue that different hierarchical structures induce different biases, giving rise to predictable frictions in internal exchanges. Given that this line of research is very recent, this area represents a significant research opportunity in behavioral strategy.

Finally, Kahneman and Tversky’s original goal “to obtain a map of bounded rationality” recently re-gained momentum in work examining individual-level beliefs and strategic choices (Kahneman, Reference Kahneman2003) using neurocognitive experiments. To do so, a group of behavioral strategy scholars directly examine decision-makers’ mental processes via brain imaging techniques (e.g., Laureiro-Martínez, Brusoni, & Zollo, Reference Laureiro-Martínez, Brusoni and Zollo2010; Laureiro-Martínez, Brusoni, Canessa, & Zollo, Reference Laureiro‐Martínez, Brusoni, Canessa and Zollo2015). While holding some promise, this approach may risk excessively detaching decision-making from its organizational context, thereby losing external validity (cf. Felin et al., Reference Felin, Foss and Ployhart2015). Moreover, the nature of brain imaging methodology may change the nature of the decision-making task, perhaps reducing its internal validity. We will return to some of these issues in the final section of the Element.

Ecological Rationality

Whereas most research in the heuristics and biases tradition emphasizes the downside of heuristics (i.e., biases), the ecological rationality program accentuates their upside. Picking up on Simon’s (Reference Simon1955) idea, this approach focuses on the skilled application of heuristics by decision-makers. So in this research, a heuristic is seen as “a strategy with the goal of making decisions more quickly, frugally, and/or accurately than more complex methods” (Gigerenzer & Gassmeier, Reference Gigerenzer and Gaissmaier2011). Strikingly, Gigerenzer and his co-authors show that heuristics are not second-best approximations to maximizing rationality, but may often lead to faster and better outcomes, particularly in uncertain, ambiguous environments with few useful data points (e.g., Gigerenzer & Gaissmaier, Reference Gigerenzer and Gaissmaier2011). As with the neuroscience approach to behavioral strategy, the study of ecologically rational, fast, and frugal heuristics in organizations in general and in strategy in particular is still in its infancy. Pioneer work has been done by Bingham and Eisenhardt (Reference Bingham and Eisenhardt2011), who studied the formation of heuristics during the internationalization processes of six technology-based ventures. However, except for Luan, Reb, and Gigerenzer (Reference Luan, Reb and Gigerenzer2019), there is still very little research examining the formation and use of heuristics at the firm level and their implications for organizational decision-making and strategic adaptation. Again, the dearth of research on this important topic represents an important opportunity for work in behavioral strategy.

Conclusion: Simon’s Incomplete Revolution

This section briefly outlines the history of the evolution of bounded rationality originally proposed by Simon (Reference Simon1947). On one hand, the revolution around rationality, information processing, and behavior that Simon initiated has been exceedingly successful. As a result, the implications of bounded rationality have become increasingly concrete in such concepts as satisficing search (Simon, Reference Simon1955), representations (March & Simon, Reference March and Simon1958, discussed in Chapter 3), aspiration levels and problemistic search (Cyert & March, Reference Cyert and March1963), and limited attention (Ocasio, Reference Ocasio1997). It is also more clear how it is embedded in an organizational context (Simon, 1947; March & Simon, Reference March and Simon1958; Cyert & March, Reference Cyert and March1963; Ocasio, Reference Ocasio1997), linked to top manager decision-making (Hambrick & Mason, Reference Hambrick and Mason1984; Hodgkinson et al., Reference Hodgkinson, Burkhard and Foss2023), articulated in terms of the competing heuristics and biases (Tversky & Kahneman, Reference Tversky and Kahneman1974) and ecological rationality (Gigerenzer & Gassmeier, Reference Gigerenzer and Gaissmaier2011), and formalized relying on modeling techniques like NK-modeling and other computational models (Puranam et al., Reference Puranam, Stieglitz and Pillutla2015). In other words, bounded rationality evolved through refinement, extension, application, and formalization, which is how successful scientific ideas usually advance. Indeed, it is not amiss to suggest that bounded rationality is the way in which most management scholars view human rationality.

On the other hand, there is significant imprecision and inconsistency in the basic conceptualization and model of bounded rationality in management research, as well as its application to organizations and their strategies. A fundamental critique of this work (which does not apply to Simon’s research) is that it focuses on errors rather than success of decision-making. As the ecological rationality critique implies, the heuristics and biases program itself is strongly representative of this tendency, but so too is bounded rationality research on, for example, the exploitation/exploration tradeoff (March, Reference March1991). This critique also suggests that much bounded-rationality research implicitly accepts the standard optimization model as its normative benchmark – rationality is “bounded” relative to this benchmark (Foss, Reference Foss and Rizzello2003). Indeed, formal treatments of bounded rationality make ample use of standard probabilistic reasoning (e.g., Kahneman, Reference Kahneman2003), and some of the best-developed and most influential models of bounded rationality (notably, prospect theory, Kahneman & Tversky, Reference Kahneman and Tversky1979) are models that assume environments characterized by risk. However, strategy formulation and implementation often involve epistemic conditions to which probabilistic tools are less well suited, notably Knightian uncertainty (i.e., decision-makers do not confront a given state space, cannot place probabilities on outcomes, etc.). There are some obvious links, as, for example, the inability to put meaningful probabilities to outcomes or identify the full set of possible outcomes (both manifestations of Knightian uncertainty) may result from bounded rationality. But, at least so far bounded-rationality research has said little about decision-making and behaviors under uncertainty rather than risk (Mousavi & Gigerenzer, Reference Mousavi and Gigerenzer2014). Furthermore, as Hodgkinson and Healey (Reference Hodgkinson and Healey2011) argue, most interpretations of bounded rationality in strategy are through the lens of “cold cognition.” inherently downplaying the importance of affect and emotions.

Although research has made several significant advances in how bounded rationality is applied in the context of firm strategy, many aspects are still unclear in this research program. For instance, despite the importance and centrality of problemistic search in strategy research, how problem identification, diagnosis, and solving occur in an organization remains something of a black box (Posen et al., Reference Posen, Keil, Kim and Meissner2018). Additionally, while both March and Simon (Reference March and Simon1958) and Cyert and March (Reference Cyert and March1963) theorized about how firms establish priorities in the presence of multiple goals and corresponding aspiration levels (e.g., different goals and aspiration levels for different units), empirical evidence of the mechanisms regulating the allocation of attention is scant (cf. Mazzelli et al., Reference Mazzelli, Nason, De Massis and Kotlar2019). Moreover, while research distinguished between social and historical sources of aspiration levels, the mechanisms driving choices of such levels, including why particular social referents are chosen, remain less well understood.

More fundamentally, significant challenges remain in bringing bounded rationality to bear at all organizational levels, and not just the individual and the dominant coalition or top management team levels (Hambrick, Reference Hambrick2007). Indeed, bounded rationality is an individual-level construct developed from the observation of decision-makers solving rather simple problems in controlled environments – as was the case for several of the constructs in the heuristics and biases program. Therefore, by applying it unreflectively to predict firm strategic decisions and outcomes, we may incur the risk of “forfeiting the intellectual challenges thrown off by real-world problems” (Fischhoff, Reference Fischhoff1996: 246). In Section 5, we will offer some ideas on how to approach and circumvent this fundamental problem. In sum, while Simon’s (1947) introduction of the notion of bounded rationality set in motion what may well be described as a revolution, that revolution remains quite unfinished, offering significant opportunities for research in the subfield of behavioral strategy.

3 Managerial and Organizational Cognition: Interpretive Microfoundations of Strategy

Introduction

In recent years, the strategy field dramatically increased its exploration of the cognitive dimensions underlying firms’ strategic decisions (e.g., Hodgkinson, Reference Hodgkinson1997; Walsh, Reference Walsh1995). This movement was driven by a recognition that managerial cognition plays an instrumental role in shaping strategic outcomes, fostering innovation, and ensuring organizational adaptability in increasingly volatile and complex environments. This section provides an overview of the historical development of theory and research applying cognitive psychology and social cognition to the analysis of behavior in organizations. Although it originated with Simon’s (1947) notion of bounded rationality, this research tradition took a very different path, relying on Weick’s (Reference Weick1979) idea of enacted sensemaking and individuals’ subjective differences in perception. The section covers three important theoretical perspectives in this stream: (1) schema theory and the related construct of mental maps/representations, (2) social identity theory and self-categorization, and (3) enactment and sensemaking, along with the related view of organizations as interpretative systems. Finally, it discusses some theoretical and empirical challenges in moving forward in the study of these topics. Overall, the section offers an overview of the microfoundational work examining how managers actively perceive, interpret, constitute, and act upon their business environments, and in turn, how these cognitive processes affect firm behavior and outcomes.

Simon’s Bounded Rationality Challenged: Weick’s Interpretative Perspective

As discussed in Chapter 2, Simon’s (1947) notion of bounded rationality is foundational in understanding human decision-making in organizations. At its core, bounded rationality posits that decision-makers are unable to make perfectly rational decisions due to cognitive limitations and the complexity of real-world situations. They thus strive for rationality within the boundaries of their cognitive capacities and information availability (March & Simon, Reference March and Simon1958). This realist perspective considers the environment as an external entity, independent of individuals’ perceptions or beliefs, and views knowledge as something that is discovered, measured, and generalized. As a result, the focus of this perspective is to arrive at, as much as possible, an objective understanding of the world in the face of uncertainty.

Yet, in the late 1970s and early 1980s, Karl Weick challenges this goal of an objective understanding of reality in Simon’s bounded rationality through his work on enactment and the related notion of sensemaking. He argues that sensemaking, a continuous process through which individuals develop meanings based on local actions and experiences, gives rise to a variety of subjective – and potentially divergent – perceptions of the business environment (Weick, Reference Weick1979). Thus, instead of viewing the world as a homogenous reality to be uncovered, Weick espouses a constructivist approach, viewing the environment as continuously formulated and reformulated through social interactions and interpretations.

Influenced by Weick’s work as well as by a burgeoning interest in cognition in the field of social psychology (cf. Fiske & Taylor, Reference Fiske and Taylor1984), management scholars in the early 1980s began to embrace the view of the environment as socially constructed (e.g., Bartunek, Reference Bartunek1984; Daft & Weick, Reference Daft and Weick1984; Huff, Reference Huff1982; Spender, Reference Spender1989; Walsh & Fahey, Reference Walsh and Fahey1986). As a result, researchers examine how managers use cognitive frames to make sense of the environment, and how this sensemaking shapes their strategic choices and actions (Daft & Weick, Reference Daft and Weick1984; Kaplan, Reference Kaplan2011).

Naturally, this move toward a socially constructed view translates into significant methodological shifts. Aligning with its objectivist worldview, research building on Simon’s notion of bounded rationality predominantly deploys computational models and quantitative tools, intending to reveal and quantify overarching cognitive patterns (e.g., Simon & Newell, Reference Simon and Newell1976). In contrast, the emerging interpretive trend utilizes qualitative methodologies, such as cognitive mapping techniques (e.g., repertory grid technique), ethnographic studies, in-depth interviews, and narrative inquiries. Unlike models or quantitative approaches, these qualitative approaches allow for the exploration of multifaceted cognitive processes, the dynamism of sensemaking, and the contextually embedded construction of knowledge (e.g., Bougon, Weick, & Binkhorst, Reference Bougon, Weick and Binkhorst1977).

Yet, the study of such cognitive processes continues to pose substantial theoretical and methodological challenges due to fragmentation, construct proliferation, aggregation issues, and validity concerns.

Theoretical Perspectives on Managerial and Organizational Cognition

Three major perspectives pervade existing interpretative work on cognition in organizations: (1) schema theory including mental maps/representations (e.g., strategic groups and framing), (2) social identity theory and self-categorization, and (3) sensemaking and the related view of organizations as interpretative systems.

Schema Theory, Mental Representations, and Frames

Schemas are cognitive structures through which individuals recognize, process, organize, and interpret information from their environment. Rooted in cognitive psychology, schema theory posits these mental frameworks guide humans’ perceptions, beliefs, and actions by providing a structured means of understanding. In essence, schemas are the “mental templates” that individuals use to categorize the world (Walsh, Reference Walsh1995).

When applying this theory, strategy scholars tend to assume information converges and is interpreted at the top manager level (Fahey & Narayanan, Reference Fahey and Narayanan1989; Lyles & Schwenk, Reference Lyles and Schwenk1992). Thus, researchers examine how managers’ schemas influence their interpretations of complex business environments, their expectations of how these may evolve (Gick & Holyoak, Reference Gick and Holyoak1983), and their subsequent strategic decisions (Kaplan, Reference Kaplan2011). To do so, these scholars generate managers’ mental maps or representations, which are “tangible” expressions of schemas, by outlining managerial perceptions and beliefs of the internal and external environment of the firm. These mental maps may include firm structure, technology, industry landscapes, stakeholder interplay, and competitive dynamics (Kaplan, Reference Kaplan2011). For instance, prominent work by Huff (Reference Huff1982), Porac et al. (Reference Porac, Thomas and Baden‐Fuller1989), and Reger and Huff (Reference Reger and Huff1993) shed light on the role mental maps play in shaping managerial perceptions of strategic groupings and competitive positioning. While some of these studies indicate strategists within a given sector tend to hold highly similar representations of the competitive landscape (e.g., Porac et al., Reference Porac, Thomas and Baden‐Fuller1989; Reger & Huff, Reference Reger and Huff1993), others suggest these representations reflect subjective perceptions (Rindova & Fomburn, Reference Rindova and Fombrun1999), prompting radically different strategic groupings across firms in the same industry (e.g., Hodgkinson & Johnson, Reference Hodgkinson and Johnson1994) within the same timeframe (e.g., Fahey & Narayanan, Reference Fahey and Narayanan1989). One such example is from Kilduff (Reference Kilduff2019), in which he argues that managers may interpret certain firms as relational rivals (similar to long-standing university rivals), increasing the likelihood of nonrational competitive actions and reactions, exceeding those predicted from market conditions.

Closely related to schema theory is framing theory (Goffman, Reference Goffman1974), where frames define the way experience is organized, described, and presented (Cornelissen & Wener, Reference Cornelissen and Werner2014; Fiss & Zajac, Reference Fiss and Zajac2004; Hodgkinson et al., Reference Hodgkinson, Bown, Maule, Glaister and Pearman1999). By influencing the categorization process (Starbuck & Milliken, Reference Starbuck, Milliken and Hambrick1988), frames determine the perceived importance, urgency, or relevance that managers attribute to issues and events (Jackson & Dutton, Reference Jackson and Dutton1988), activate expectations about potential outcomes (Goffman, Reference Goffman1974), shape how attention is allocated (Benner & Tripsas, Reference Benner and Tripsas2012; Ocasio & Joseph, Reference Ocasio, Joseph, Szulanski, Porac and Doz2005), and influence how strategy is formulated (Dutton, Fahey, & Narayanan, Reference Dutton, Fahey and Narayanan1983; Kaplan, Reference Kaplan2008) and implemented (Thomas, Clark, & Gioia, Reference Thomas, Clark and Gioia1993).

One prolific stream of this strategy research examines how frames impact decision-makers’ categorizations and responses to stakeholder evaluations (Bitektine, Reference Bitektine2011; Elsbach, Reference Elsbach2003). For example, some studies show that the way decision-makers frame stakeholders’ feedback results in more or less symbolic responses (e.g., Bass et al., Reference Bass, Pfarrer, Milosevic and Titus2023; Nason, Bacq, & Gras, Reference Nason, Bacq and Gras2018; Wang et al., Reference Wang, Jia, Xiang and Lan2022). In contrast, another stream highlights how mental representations and frames, despite their advantages for information processing and meaning construction, lead to rigidities (Benner & Tripsas, Reference Benner and Tripsas2012; Gilbert, Reference Gilbert2006; Lovallo, Clarke, & Camerer, Reference Lovallo, Clarke and Camerer2012) that can, in turn, introduce biases or blind spots in the strategic decision-making process (e.g., Barr et al., Reference Barr, Stimpert and Huff1992; Tripsas & Gavetti, Reference Tripsas and Gavetti2000). This work suggests that socialization with other relevant actors, including social class peers, business advisors, and family members may alter preexisting schemas, potentially reducing this negative effect (Bartunek & Moch, Reference Bartunek and Moch1987; Nason, Mazzelli, & Carney, Reference Nason, Mazzelli and Carney2019; Strike & Rerup, Reference Strike and Rerup2016).