Introduction

Measuring the informal economy (IE) and innovation within it remains difficult. This chapter provides two ways forward.

Even at the most basic level such as data on employment or production, activities in the IE are not regularly or exhaustively recorded in official national statistics. However, important progress has been made in defining informal employment and informal sector enterprises and providing basic data, as Chapter 1 showed.

Providing statistics on and analysis of innovation in the IE will, however, require additional work and the development of novel statistical approaches and indicators. Clearly, the measurement of innovation in the formal sector has improved in the course of the last two decades. Interest has also been growing in tailoring measurement tools to the needs of developing countries. Yet these efforts have hardly been applied to the informal sector. Besides, not all conventional innovation indicators may be appropriate in the context of the IE. The incentives for innovation and its impacts differ at times from those in the formal sector, in particular when a social or community dimension has to be factored in.

Building on the preceding chapters and existing work in the field, this concluding chapter aims to shape an agenda for the measurement of innovation in the IE.

The discussion is structured in three parts. The first discusses innovation measurement approaches applied to the formal sector, what can be learned from them, and whether the definitions and methods used could be transposed to the informal sector. The second reviews efforts to date to measure the informal sector and explores how to integrate them with efforts to measure the formal sector. This includes consideration of methodological issues relating to sampling and the use of general surveys. Finally, we evaluate the possibility of conducting semi-structured interviews and more ad hoc surveys in informal sectors or clusters within specific countries.

In the coming years, new efforts are planned to gather data and better measure innovation in developing countries, such as the third edition of the African Innovation Outlook. This will widen the scope of reporting and analysis to include coverage of innovations in the informal sector (AU-NEPAD 2014). The suggestions in this chapter are intended to lay important groundwork for future empirical work, to help develop appropriate indicators and support new approaches to innovation policy in developing countries. Pragmatic suggestions are formulated, pointing to potential opportunities and challenges. Two viable scenarios emerge: (i) adding a couple of innovation questions to existing large-scale surveys of the IE and/or (ii) conducting ad hoc questionnaire- and interview-based sectoral studies in selected countries, as was done for the country studies in this book. Both options can benefit from lessons learned in conducting the three different but mutually supporting types of innovation and IE surveys, and their respective expert communities, which have different but complementary skills.

Measuring Innovation in the Formal Sector and Applicability to the Informal Sector

What Innovation Surveys Are Carried Out in the Formal Sector?

Since the early 1980s, work has been undertaken to better understand and measure innovation by establishing concepts, guidelines and surveys. The Oslo Manual initiated by the Organisation for Economic Co-operation and Development (OECD) introduced standard definitions and indicators in 1992 (OECD 1992). In paragraph 146 of the third edition of the Manual: “An innovation is the implementation of a new or significantly improved product (good or service), or process, a new marketing method, or a new organizational method in business practices, workplace organization or external relations” (OECD/Eurostat 2005).Footnote 1

The guidelines have been revised since, in collaboration with Eurostat, the statistical office of the European Commission (OECD/Eurostat 1997, 2005). These guidelines are the starting point for the construction of innovation surveys, most notably the Eurostat Community Innovation Survey (CIS), developed in Europe, which has often been used as the model for ensuing innovation surveys across the world (see Box 8.1).

The harmonized Community Innovation Survey 2012 includes questions which follow eleven themes of inquiry:

(1) General information about the enterprise

(2) Product (good or service) innovation

(3) Process innovation

(4) Ongoing or abandoned innovation activities for product and process innovations

(5) Activities and expenditures for product and process innovations

(6) Sources of information and cooperation for product and process innovation

(7) Competitiveness of your enterprise’s product and process innovations

(8) Organizational innovation

(9) Marketing innovation

(10) Public sector procurement and innovation

(11) Strategies and obstacles for reaching your enterprise’s goals

On product innovation some of the questions are the following:

| 2.1 During the three years 2010 to 2012, did your enterprise introduce: | ||

| Yes | No | |

| Goods innovations: New or significantly | ||

| improved goods (exclude the simple resale of new | ||

| goods and changes of a solely aesthetic nature) | □ | □ |

| Service innovations: New or significantly improved services | □ | □ |

| 2.2 Who developed these product innovations? | ||

| Tick all that apply | ||

| Goods innovations | Service innovations | |

| Your enterprise by itself | □ | □ |

| Your enterprise together with other enterprises or institutions | □ | □ |

| Your enterprise by adapting or modifying goods or services originally developed by other enterprises or institutions | □ | □ |

| Other enterprises or institutions | □ | □ |

One central aspect of these innovation surveys is that they measure behavior. They ask if the enterprise introduced a new or significantly improved good or service, and they also ask about the introduction of novel organizational activity and marketing activity. The answers provide information about the firm as an innovative firm (OECD/Eurostat 2005, p. 47). There is also a question about ongoing or abandoned innovation activities, a positive response to which classifies the firm as innovation-active (OECD/Eurostat 2005, p. 59).

In this well-established innovation framework, innovation activities could include the acquisition of machinery, equipment, software and licenses, engineering and development work, design, training, marketing and R&D where undertaken to develop and/or implement a product or process innovation. Motives to innovate include the desire to increase market share or enter new markets, improve the product range, increase the capacity to produce new goods, reduce costs and so on. In addition to these questions, surveys of innovation in the formal economy include other questions, for example, on the sources of information for innovation, types and drivers of collaboration and expenditures on selected innovation activities.

The data obtained are classified by size of the enterprise (number of employees), geography and the industrial sector in which the enterprise operates. This allows size-dependent, geographical and sectoral differences to be revealed through micro-data analysis.

Many countries outside high-income economies have adopted these standard innovation survey tools.Footnote 2 The UNESCO Institute for Statistics and a range of partners, notably RICYT (Red Iberoamericana de Indicadores de Ciencia y Tecnología) with its Bogotá Manual, have produced a set of guidelines on how to implement innovation surveys in developing countries. Estimates suggest that, to date, national innovation surveys have been carried out by ninety-five countries, fifteen of them in sub-Saharan Africa, plus Egypt, Libya, Morocco and Tunisia (see Table 8.1).Footnote 4 These surveys are mostly the result of the work on the African Science, Technology and Innovation Indicators (ASTII) program by NEPAD (The New Partnership For Africa’s Development), with involvement from the African Observatory of Science and Technology Innovation (AOSTI).Footnote 5

| Country | Year of implementation of most recent innovation survey | Reference period |

|---|---|---|

| Burkina Faso | 2009 | 2006–2008 |

| Ethiopia | 2011 | 2008–2010 |

| Gabon | NA | 2010–2012 |

| Ghana | 2012 | 2008–2010 |

| Kenya | 2012 | 2008–2011 |

| Lesotho | 2012 | 2009/10–2011/12 |

| Malawi | NA | NA |

| Mali | 2012 | 2008–2010 |

| Mozambique | 2009 | 2006–2008 |

| Nigeria | NA | 2008–2010 |

| Senegal | 2012 | 2009–2011 |

| South Africa | 2008 | 2005–2007 |

| Uganda | 2012 | 2008–2010 |

| United Republic of Tanzania (Tanzania) | NA | 2008–2010 |

| Zambia | 2012 | 2008–2010 |

| Egypt | 2011 | 2008–2010 |

| Libya | NA | NA |

| Morocco | 2010 | 2009–2010 |

| Tunisia | 2008 | 2005–2007 |

Note: Some of these countries conducted both R&D and innovation surveys as part of the NEPAD ASTII project, whereas others such as Nigeria and Zambia conducted only an innovation survey.

The ASTII innovation surveys follow the guidelines of the Oslo Manual and are based on the above-mentioned CIS. The areas of enquiry are (i) product innovation, (ii) process innovation, (iii) ongoing or abandoned innovation activities, innovation activities and expenditure, (iv) sources of information and cooperation for innovation activities, (v) effects of innovation during the last two years, (vi) factors hampering innovation activities, (vii) intellectual property rights and (viii) organization and marketing innovations.

Survey findings are well documented in the African Innovation Outlook (AU–NEPAD 2010, 2014) and in country-specific reports.

Are Innovation Surveys Designed for the Formal Sector Applicable to Measure Innovation in the Informal Economy?

The fact that innovation surveys are now largely deployed in Africa and other developing regions demonstrates significant progress, but some challenges remain.

First, among the existing formal sector innovation surveys, the sector coverage varies greatly,Footnote 6 some values are missing, and because of the differing survey methodologies used, in particular the range of sampling cutoffs, it is difficult if not impossible to make country comparisons. Second, micro and small enterprises in the formal sector might be omitted as well, as participating countries usually exclude firms with less than ten employees from the sample. Arguably, small and micro-enterprises, which are often on the verge between formal and informal activities, are particularly relevant for the study of innovation system in these countries. Third, by definition, none of these business surveys in the formal economy aims to survey innovation in the informal sector.

The first issue can be addressed over time as countries gain more experience and if more resources are available to them. The second issue is receiving attention by the communities designing the innovation surveys, and to ensure that the spectrum of formal micro-firms is not neglected. However, the third issue will continue to be a challenge if action is not taken to address it, as the informal sector will never be covered by full-scale enterprise innovation surveys.

We do not regard extending the large-scale innovation surveys to the IE as a viable option. An innovation survey is a business survey and the infrastructure is not present to support it in the informal sector. Adding questions addressing the IE to existing innovation surveys would require their scope and coverage to be expanded to cover the whole universe of economic activity. This would mean that most of the questions would not fit most of the observation units.

Moreover, it would be challenging to ensure that questions were tested in informal sector contexts and the survey was then administered accurately. Identifying and properly sampling informal sector entities, deploying a questionnaire and ensuring reliable responses from them is more challenging than when an innovation survey is sent to a standard list of firms in the formal sector, addresses of which can be easily found from business registers. Box 8.2 notes some further methodological difficulties.

Box 8.2 Methodological challenges in surveying the informal economy

Irrespective of which type of survey is used to ask innovation questions, methodical challenges exist for any statistical survey targeting the informal sector.

The first question is how to test the questions to get meaningful results. A CIS-like survey consists of a set of questions which ideally will have been tested with businesses in the language used to administer the survey plus a structure that may direct respondents to different parts of the questionnaire depending on their answers to earlier questions. Cognitive testing aims to address the common understanding of the question in the population being surveyed, but it should also take into account linguistic and cultural differences in other jurisdictions if the comparisons of survey results are to be meaningful.

Similar testing would need to be carried out in the informal sector to get a sense of the sort of innovation-related questions that we consider later in this chapter, in the section Review of Existing Informal Economy Surveys. Does one get meaningful results to classic innovation survey questions in the informal sector? How great is the likelihood of misinterpretation – if firms in the formal sector in advanced countries interpret CIS questions differently, how reliably does this predict problems in the informal sector as well?Footnote 8

Second, there are challenges in sampling. For a business survey to provide robust estimates of the variables measured, there must be a survey frame from which a sample is drawn. The frame could be a business register, or the membership list of an industry association or an administrative list used for other purposes than providing a survey frame such as records of firms that pay employment taxes or revenue taxes or records of the registration of firms as a precondition of their doing business.

There are two problems here with regard to the informal sector. There is unlikely to be a list of organizations that trade in the informal sector, and such organizations may not have the characteristics of formal sector firms. They may be extended families, interest, faith or tribal groups, or other informal consortia without registration, accounts or an established practice of reporting to government organizations.

In addition to the frame, there must be a means of conducting the survey. In developed countries, printed questionnaires are still mailed to respondents who then fill them out and return them. Web-based surveys may also be used. In the informal sector, these techniques are unlikely to work as possible respondents may lack a reliable postal address or Internet access, or indeed a sufficient level of literacy. Moreover, informal operators are unlikely to comply with any obligation to respond to an official statistical survey.

As we will explain in more detail in the penultimate part of this chapter, the only option is often to use interviewers to obtain reliable responses in a personal conversation.

The bottom line is that efforts to survey innovation in the formal economy should focus on perfecting and harmonizing coverage (including all industrial sectors and sizes of firm), reliability and comparability of results within the formal economy. Informal economic activity should be surveyed separately.

However, it is still necessary to consider whether the definitions and questions in formal sector innovation surveys might offer any lessons or templates for surveying the IE, in particular by (i) adding a couple of innovation questions or a short module to existing large-scale surveys of the IE and/or (ii) conducting ad hoc questionnaire-based sectoral studies in selected countries, as done for the country studies in this book. Responses to some core questions on innovation collected from enterprises in the informal sector could provide policy-relevant information to firms in the informal and formal sectors and to governments.

At the outset, one might ask if conventional IP and innovation indicators are appropriate in the context of the IE. Innovation activities and actors and the underlying incentives for and impacts of innovation might all be different in the IE from their counterparts in the formal sector, whether of developed or developing countries. As a result, some or all existing indicators, survey instruments, notions of collaboration and linkages, and impact assessment tools may not apply directly in this setting.

A thorough review of existing innovation surveys in Africa in the light of our expertise in deploying innovation surveys in Africa’s formal sector allows us to draw the following conclusions.Footnote 7

Many of the questions in the CIS-like surveys used now in Africa in the formal sector are appropriate in the informal sector. The informal groups that approximate to firms will know whether they have introduced a new or significantly improved product to the market and whether they have improved their transformation or delivery process, their organization or their market development. They will also know, among other relevant things, what their information sources are, which partners they work with and where learning has occurred.

Some changes are needed, modifying or dropping existing questions and adding new ones. For instance, questions on the sources of information for innovation will have to be adjusted to be relevant to respondents in the informal sector. Adaptations are necessary when enquiring about “linkages between the informal and the formal sector,” “learning by imitation of the formal sector” or “innovation co-operation partners.”Footnote 9 The ways of learning by doing that prevail in the informal sector and the forms of apprenticeship also need to be reflected in the survey. When asking about methods for maintaining or increasing the competitiveness of product and process innovations (e.g. patents or other forms of formal IP, lead time, complexity, secrecy), it will be necessary to consider other options more relevant to informal sector actors, and to pose questions in a form that such actors will understand.

Some of the questions in CIS-like surveys do not apply to the informal sector. Technically, reliance on public sector procurement is one example. Similarly, public financial support for innovation activities from government such as subsidies will not be relevant either, although ongoing or emerging policy initiatives such as those described in Chapter 7 of this book will need proper reflection in any tailored survey.

Questions on R&D performance and the use of universities and government laboratories as sources of ideas for innovation and of collaboration will also need to be dropped from surveys or significantly adapted. Most other questions can be adapted to the informal sector but will need to be administered by trained interviewers once a survey sample has been identified.

In addition, new questions are required in order to understand the informal enterprise and its environment. As Chapters 2 and 3 have shown, informal sector actors are surrounded by various actors and underlying policy frameworks, some of which are different from those of the formal sector.

Finally, the question arises whether transposing formal sector innovation surveys to the informal sector is sufficient to grasp the breadth, depth and expected outcomes of innovation in the IE.

Clearly, innovation is only considered from the enterprise perspective in CIS-type innovation surveys. New products, processes or other enterprise innovations and their potential impacts on firm performance are the focus of purely behavioral questions which are not normative in nature, and which are only asked at the firm level without later economy-wide assessment of economic or social impacts. So a firm can report behavior that shows that it has innovated, but without being certain that this innovation has produced impacts in terms of increased revenues, process efficiency, reduced prices or increased quality. Furthermore, innovation surveys based on the Oslo Manual require innovations to be connected to the marketplace. And formal innovation surveys have a single time scale – usually the last three years; there is no monitoring of previously recorded innovation activities or economic or social outcomes over time.

Yet for the IE – and for innovation in developing countries more broadly – the desired measurement could be different and entail more than measuring innovation activity at the firm level in one period. Importantly, the focus on measuring innovation in a “market context” only might well not be sufficient to capture the fuller dimension of these activities.Footnote 10

Innovation as discussed in the literature on innovation in developing countries is based on concepts which go beyond enterprise innovation and typical firm incentives to innovate, such as increased revenue and market share (AU–NEPAD 2014). Academic and policy discussion of innovation and development now often focuses on themes such as “grassroots,” “frugal,” “inclusive” and/or “social innovation.”Footnote 11

There is no formally agreed official statistical definition of these innovation- and development-related terms, but various authors have attempted to define this field further. Mashelkar (Reference Mashelkar2012), for instance, describes “[i]nclusive innovation” as “any innovation that leads to affordable access of quality goods and services creating livelihood opportunities for the excluded population, primarily at the base of the pyramid and on a long-term sustainable basis with a significant outreach.” In most definitions and discussions, the purpose of innovation in terms of improving standards of living – including lower-cost goods and services that meet poor people’s ability to pay – receives attention. Affordability, opportunity and sustainability are connected to the innovation process and outcomes.

All of these definitions address specific issues such as inclusiveness or social outcomes which expand on the definition of innovation. No longer is it just putting a new or improved product on the market or finding a better way of getting there; more is required. This has implications for measurement.

Importantly, measuring the above types of innovation would require a focus on measuring the social contexts and outcomes of innovation. First, not all transfers in the informal sector are mediated by a market as transfers of goods or services may happen for social or other reasons. New concepts and innovation questions going beyond the Oslo Manual and CIS-type innovation surveys would be required to capture this dimension. Second, if innovation is intended to be “inclusive” or to meet other social objectives, from the measurement perspective it is not sufficient to record the intention of the firm. Actors other than firms, including entire communities, might need to be studied instead. This last point clearly goes beyond the challenge of measuring innovation in the informal sector.Footnote 12

Furthermore, a one-off survey of one particular entity might not be sufficient to establish whether the innovation did indeed result in greater inclusiveness or any other impact. For this to be done, some sort of survey, most likely a social survey, is required after the innovation has been introduced to the market to assess impacts and, potentially, the innovation’s sustainability.

The point here is that measuring innovation that meets certain economic or social objectives requires coverage of more than one time scale and several different groups of respondents: the producer, consumers, and so on. Such measurement is possible, but it requires more detailed approaches, more longitudinal studies and certainly more time and money. The ad hoc surveys of innovation in the IE used in this book offer some solutions to above challenges, as they aim to capture some of the social components of innovation.

Measurement of the Informal Sector to Date and Scope for Introducing Innovation Survey Questions

The previous section considered the usefulness of classic innovation survey questions in informal sector contexts and their possible adaptation. In this section we examine independent current initiatives to measure the informal sector, focusing again on Africa. We suggest how innovation survey questions might be included in existing informal sector indicator exercises by adding a couple of innovation questions or a short survey module to existing large-scale “combined surveys” of the IE.

Review of Existing Informal Economy Surveys

As described in Chapter 1, there have been ongoing statistical efforts to better define and measure the informal sector over the last three decades, with some notable progress.

During the past decade, many surveys of the IE have been carried out across Africa and some of them have addressed some issues regarding innovation. In a few countries they have started to be repeated. As major providers of information for labor force statistics and national accounts purposes, these data collections are expected to become more permanent and continuous and could be developed to include a set of core questions on innovation.

Since the early 1990s, and especially after the adoption of an international definition of the informal sector and recommendations for its measurement, mixed surveys – that is, surveys of informal establishments operated by members of sampled households – have blossomed in many countries, particularly in Africa where the concept was born in the early 1970s. Initially, resource constraints meant that many surveys remained limited to capitals, major cities or urban areas. More recently, their coverage has become more widespread, covering entire national territories.

ILO (2013) provides a detailed picture of the informal sector surveys, and we include some questionnaire extracts at Annex 2 and Annex 3 of this chapter.Footnote 13 Broadly, mixed surveys include the following approaches:

– The 1–2 or 1–2–3 surveys are two-stage or three-stage surveys with a labor force survey as the first stage allowing the identification of the informal economic units which are then surveyed in a second stage through an establishment questionnaire, the third stage being a budget-consumption survey of the households of informal operators.

– Ideally, the same questionnaire is used in all countries with marginal changes. Other types of mixed survey may differ from this approach in using a specific questionnaire in each country and also in that the first-stage survey is not always a labor force survey. In some countries, the survey can be limited to the first phase only, as, for example, in Mali.

– The dedicated modules of LSMS-typeFootnote 14 surveys can be considered, in a sense, as mixed surveys, with the difference that the module is not administered in a second stage but immediately, and within the premises of a household rather than an enterprise.

Mixed surveys require expanded samples in order to obtain a representative picture of detailed industries because their universe is not known.

Besides these mixed surveys, measurement of the informal sector is being attempted through various other surveys, including various types of combined survey:

– In some countries with an establishment or economic census or a functioning business register, establishment surveys might be a useful way of gleaning more information about the IE.

– Combined surveys of establishments and household surveys are a valid tool. Here, the existence of an establishment census allows area-based sampling of enterprises in parallel with household surveys for the capture of home-based and mobile activities.

– Dedicated modules on non-farm enterprises in traditional living standard surveys can foster our understanding of the informal sector.

– Labor force surveys or other types of household survey which focus on the criteria for the measurement of the informal sector are also in use.

Table 8.2 lists the various types of survey implemented at national level in Africa during the two past decades.Footnote 15

| Establishment census/survey | Mixed survey | Combined survey | LSMS-type surveys | |

|---|---|---|---|---|

| 1–2 or 1–2–3 | Other mixed | |||

| Algeria 2011–12 | Morocco 1999/2000 and 2006/07 | Mali 1989 | Egypt 2003, 2004, 2011 | Ghana 1995, 2000, 2008 |

| Tunisia 1997, 2002, 2007, 2012 | ||||

| Mauritania 1992 | Cape Verde 2009 | Chad 1995–96, 2011 | Nigeria 2010 | Rwanda 2005, 2011 |

| Guinea Bissau 2009 | ||||

| Mauritania 2012 | ||||

| Niger 2012 | ||||

| Senegal 2011 | ||||

| Rwanda 2006 | Burundi 2008 | Ethiopia 2003 | Kenya 2015 | Uganda 2009/10 |

| Cameroon 2005, 2010 | Kenya 1999 | |||

| DR Congo 2004/05, 2012 | ||||

| Comoros 2013 | Botswana 1999, 2007 | Madagascar 2001, 2002, 2004, 2005, 2010 | ||

| Madagascar 2012 | Mozambique 2004 | |||

| Namibia 2008 | ||||

| South Africa 2002, 2005, 2009, 2013 | ||||

Note: In italics: urban areas only.

Many countries have conducted or are conducting economic or establishment censuses, generally for national accounts purposes. These censuses are used as listing-based frames for business surveys, including surveys of the informal sector (except home-based or mobile activities), but must be used immediately after their completion as they go out of date rapidly.

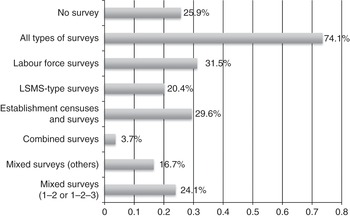

Table 8.3 and Figure 8.1 summarize data collection on the informal sector in Africa according to the type of survey. In sum, 44.5 percent of African countries have carried out a mixed or a combined informal sector survey in recent years and another 29.6 percent have implemented an informal sector survey of small establishments.

| Northern Africa | Western Africa | Middle Africa | Eastern Africa | Southern Africa | Africa | |

|---|---|---|---|---|---|---|

| Mixed surveys | 1 | 6 | 4 | 2 | 13 | |

| (1–2 or 1–2–3) | ||||||

| Mixed surveys | 1 | 1 | 3 | 4 | 9 | |

| (others) | ||||||

| Combined surveys | 1 | 1 | 2 | |||

| Establishment censuses and surveys | 4 | 9 | 1 | 1 | 15 | |

| LSMS-type surveys | 6 | 1 | 2 | 2 | 11 | |

| Labor force surveys | 4 | 1 | 3 | 8 | 16 | |

| Total number of countries | 4 | 14 | 6 | 4 | 12 | 40 |

Note: Several types of survey may be used in a country.

Figure 8.1 Proportion of countries using different types of survey in Africa

Note: Values in percent of 54 countries in Africa.

Is Innovation Covered in Existing Informal Sector Surveys? If So, How?

It is interesting to look at the content of the informal sector surveys to assess the potential for questions on innovation.

In particular, two types of survey should be considered for the purpose of surveying innovation in the IE: (i) mixed households/establishments surveys, which particularly suit countries with a large IE, and (ii) combined surveys, which associate a household survey with a separate establishment survey able to capture micro and small enterprises as well as small and medium enterprises, which often escape surveys on the formal sector.

The major objectives of the mixed/combined/establishment surveys are to collect data on employment and production for labor force statistics and the compilation of national accounts. The questionnaires are designed to assess the performance of informal micro-enterprises in terms of employment creation (characteristics of workers and of jobs) and generation of output, value added, production costs, entrepreneurs’ income and also – less systematically – capital formation and assets.

Regarding the characteristics of the workforce, the following information is most commonly collected: sex, age, education level, type of training received and needed, number of years of experience, skill level, stability, type and amount of remuneration.

Because they are embedded within very large questionnaires, the modules on non-farm enterprises operated by household members are strictly limited to the collection of quantitative data on labor, intermediate consumption and costs, assets, revenue and net income and inventory, as in the Ghana Living Standards Survey (GLSS). The only qualitative information refers to the most serious difficulties encountered in establishing (capital, credit, technical know-how, government regulations, other). Furthermore, as these surveys are not conducted within the premises of the establishment, they are unlikely to be a source of information on innovation.

Some other types of IE surveys do sometimes include questions which come closer to covering innovation (see Annex 2 and Annex 3), including questions about competition, difficulties/barriers and prospects. Stage 2 of the 1–2–3 surveys – the mixed informal sector surveys popularized in Western and Central Africa – are typical in this regard. These surveys produce information about the constraints confronting informal sector operators and the solutions that they adopt. They also collect some data on sub-contracting: Is the informal sector enterprise sub-contracting with other informal firms or home-based workers? Is the informal firm sub-contracted by some other informal or formal enterprise? However, it is difficult to capture from such questions in mixed surveys data resembling the questions about product, process, marketing or organizational innovation obtained through surveys of innovation in the formal economy.

Combined surveys such as those carried out in Egypt, Kenya and Nigeria are a better way of collecting data on innovation, for at least two technical reasons:

(1) Area-sampling based on establishment surveys ensures a sufficient number of economic units in the various detailed industries. Specifically, it allows for regular updating; for example, once the areas have been selected with a probability proportional to the number of establishments, a complete new enumeration of the selected areas can be implemented. Consequently, the detailed questions on innovation are likely to provide a more accurate picture than if they are addressed to a majority of lesser concerned IE actors, for example, street vendors or informal units dedicated to trade activities.

(2) Combined surveys allow flexible sampling ratios in order to reach a sufficient number of units in major industries and small and medium-sized establishments. They go beyond home-based or mobile activities and micro-enterprises and also target small and medium-sized entities, so covering a fuller range of informal economic activities. Traditional mixed surveys tend to cover a huge number of trade establishments but only a small number of manufacturing establishments and small and medium-sized establishments.

However, a realistic approach is required. First, combined surveys require an establishment census to be implemented at a single point in time, which is costly. Second, while combined surveys offer more flexibility in this regard, it is generally difficult to change the design of survey questionnaires where they have been tested and used for a long time. Third, this type of survey is better suited to more advanced developing countries such as Kenya and Nigeria, where the number of small enterprises is significant and not well covered by the surveys of the formal sector. Less developed countries are unlikely to be well covered by such an approach. There is a need to ensure that the scope and coverage of informal sector surveys are geared to the size of firm, and that discrepancies between the scope and coverage of innovation surveys and the scope and coverage of informal sector surveys do not effectively exclude intermediate enterprises.

With these caveats in mind, we can suggest a starting point for integrating innovation questions in combined surveys.

Some of the few existing combined surveys already make a significant effort in this direction. The Kenya Micro Small and Medium Enterprise (MSME) Survey is a good example. The questionnaire is comprised of several modules (see Annex 3 for some portions of the questionnaire), including questions designed to collect information on entrepreneurial dynamics and innovation:

(1) The modules on employment and workers collect data on skills development received and required by operators, as well as in-service training for employees.

(2) The module on business expenditure collects information on the cost of licenses issued, advertising costs, product innovation, process innovation and social responsibility.

(3) The module on access to information and amenities includes access to electricity, telephone and computer services.

(4) The module on business income and seasonal variations includes a section titled “Product, Process and Marketing Innovation” with four questions that resemble CIS-type innovation surveys:

(a) During the period 2009 to 2013, did you introduce new or significantly improved goods or services? Yes/No

(b) During the period 2009 to 2013, did you introduce new or significantly improved methods of manufacturing or producing goods or services?

(c) During the period 2009 to 2013, did you implement a new marketing method involving significant changes in product design or packaging, product placement, promotion or pricing?

(d) Please estimate the total turnover in 2013 of goods and services innovations introduced in 2013 (Kenyan shilling, KSh).

(5) The module on capital and technology comprises six questions which also survey the amount and sources of initial and additional capital, the types of equipment, the type and sources of technological advice and support, and the use of information and communication technologies.

(6) The module on business organization and marketing comprises seven specific questions on marketing relating to how prices are set, information about buyers, sub-contracting, marketing innovation (advertising, etc.) and customer feedback mechanisms.

In sum, questions on all four types of innovation are included, in addition to questions about various sources of information (technical advice, customer feedback, etc.) and cooperation.

Building on this excellent start and the formal innovation survey questions, four to five innovation survey questions could be formulated and surveyed through combined surveys in a more systematic manner and in more countries. The African Observatory for Science, Technology and Innovation (AOSTI) could be asked to review the results of the resulting country initiatives and to convene meetings to review what is working in more than one country, which could give rise to an African-wide measurement initiative.

Assessment of Informal Sector Innovation via Qualitative, Structured Interviews and Questionnaires

An alternative option is to undertake more ad hoc surveys based on semi-structured interviews in particular sub-sectors or clusters of the IE in specific countries. This is the method applied for the sector- and country-specific studies featured in this book and for most existing sector-specific studies on the informal sector.Footnote 16

In the context of the IE, and given the aforementioned methodological challenges, this more flexible and qualitative survey approach is often more satisfactory.

Indeed, personal interviews using semi-structured questionnaires are often the only way of securing high-quality survey replies, especially from respondents in remote locations. The respondent does not need reading or writing skills, and the statistical infrastructure requirements are also much lower than those for a large-scale official statistical survey.

Alongside such practical considerations, this method might also be better in contributing to our understanding of how innovation happens in the IE, where ideas from innovation come from, how skills are acquired, how the benefits are appropriated, and what the economic and social context and outcomes of the innovation are. The approach allows for a mixture of open-ended and closed questions. The interviewer can adapt the interview in light of the responses more dynamically than if a rigid, written-only survey tool was employed. A more open and qualitative format might also be necessary in light of the huge heterogeneity of the informal sector; a single standard questionnaire with identical terms and questions might not appropriately capture important nuances.

Importantly, the structured interview technique is often the only way of building trust with the respondent so as to obtain any reply at all. The experience with the personalized surveys featured in this book showed that gaining the trust of interviewees was critical to obtain reliable answers, particularly when asking about such sensitive topics as the sources of knowledge which contributed to innovation or which appropriation methods, including secrecy, the respondent was relying on to protect his or her innovation. For this reason, the first, rare field studies of the informal sector in the 1970s and 1980s combined qualitative, more anthropological survey approaches with other statistical techniques (see Box 8.3). These methods are well accepted outside economics and statistics, in particular in the disciplines of law, management, political science, sociology and anthropology.

Box 8.3 Early studies on apprenticeship, learning by doing, knowledge sharing and innovation in the informal sector in Tunisia

What follows is largely based on the knowledge acquired at the end of the 1970s and the beginning of the 1980s from structured interviews with a sample of artisans in Tunisia. The respondents were based in the main cities and worked in furniture-making, shoe-making, metal-working, textile and clothing and mechanical repairs. From hundreds of hours of tape-recorded interviews transcribed and translated from spoken Tunisian Arabic, several interesting observations emerge with regard to innovation, IP and transmission of knowledge.

The entrepreneur-craftsmen were identified through the so-called snowball method, that is, they were introduced to the interviewer by a mutual acquaintance. There was no reference to the informal sector when they were approached, because no one would have admitted belonging to what could be seen as an illegal sector. The research method was qualitative and anthropologic. After a brief presentation of the objectives of the study, the interview started by asking about the interviewees’ biography: how they learned their craft, how they had opened and run their own workshop, how they organized their work, their suppliers, clients, workers, how they presently saw their role toward their own apprentices and what they regarded as their main problems at a time of stiff competition.

To give a sense of the complex and nuanced insights generated, one lesson learnt concerned the important role of apprenticeship in the sector. Many of the entrepreneurs interviewed explained that they had to steal the secret of their trade from their “master,” to test their knowledge hidden from their boss, but ultimately to show him the results in order to be acknowledged, gain his confidence and receive “the key to the workshop” and eventually his blessing to open their own shop. This kind of selection is interesting. It involves a highly effective means of education, learning by doing, which also gives the young apprentice a sense of responsibility. Furthermore, the existence of a “secret” clearly shows that small entrepreneurs have a precise sense of their IP, and that they are eager to protect it from competitors and safeguard their reputation. They know perfectly well what innovations they have introduced and what “makes the difference” between their work and that of others.

Interestingly, the resulting study was the first step in what was to become the first national survey of the informal sector for national accounts purposes.

However, this area of enquiry is still recent and workable survey templates are only developing. In the remainder of this chapter, we suggest some general lessons and good practice based on recent survey work performed in the informal sector.

Conducting this type of ad hoc, semi-structured survey is far from straightforward. It requires particular methods, survey forms, interview techniques and experience.

Specifically, when surveying the informal sector three main non-probability sampling techniques are often used separately or together to make the sample more representative, namely (i) purposive, (ii) snowball and (iii) quota sampling methods. All three approaches are time-intensive, as the actual interview process might involve making initial contact, then reverting to the respondent once or several times to go through the survey questions. Some learning by doing by the interviewer also occurs, as the interview techniques and the nature of the questions can be perfected or adapted over time and case by case.

In the case of purposive sampling, a sample is drawn purposively from available lists or association members; for example, Essegbey et al. (Reference Essegbey, Awuni, Essegbey, Akuffobea and Micah2014) used a list of registered Traditional Herbal Medicine Practitioners in Ghana obtained from the Traditional Medicine Practice Council (TMPC). In this case, the researcher needs to exercise their judgment in selecting the units that are being targeted.

The snowball interview technique, also called the chain referral sampling method, is commonly used for the identification of rare populations for which registers do not exist. The researcher starts with some recommended interviewees, then asks them to help refer subsequent interviewees. In the case of the study of informal home and personal care product manufacturers in South Africa featured in Chapter 4 of this book, for instance, an initial set of nine companies was identified in collaboration with two technology incubators and two business incubators (Kraemer-Mbula and Tau Reference Kraemer-Mbula and Tau2014). The rest were referrals emanating from the interviewees. Konté and Ndong (Reference Konté and Ndong2012) also provide an example of a case study in the ICT sector where the sample was built using this technique of interviewing traders in a market, gaining trust and introductions to other traders who, in turn, provided links to more traders. Experience shows that interviewees are more willing to provide names of other potential participants after they have responded to the interview themselves.

When sampling following these first two methods, care must be taken to try and survey the relevant populations in a representative manner, that is, having a fair distribution in terms of gender, hierarchical levels (e.g. master versus apprentice, head of the entity versus informal worker), types of actors in the informal sub-sector, and so on.

The starting point for the quota sampling method is that a preliminary knowledge of the population to be surveyed already exists. Quota sampling then consists of selecting an equal and small number of various pre-determined fractions of the population in terms of gender, age, activity and so on, and proceeding to pick respondents using “itineraries.” An itinerary is defined in the area to be surveyed, and all units in that itinerary are surveyed until a fraction is completed. Once a fraction is completed, no more units from within that fraction will be surveyed. The process continues until all fractions are completed.Footnote 17

In all three methods, bilateral interviews are sometimes replaced by focus group discussions.

Rather than just surveying the innovative firm or entity as in CIS surveys, it is attempted in these ad hoc interview-based approaches also to survey a broader set of actors of the relevant innovation ecosystem (see Kraemer-Mbula and Tau Reference Kraemer-Mbula and Tau2014, Bull et al. Reference Bull, Daniels, Kinyanjui and Hazeltine2014 and Essegbey et al. Reference Essegbey, Awuni, Essegbey, Akuffobea and Micah2014). Specifically, the following entities are also surveyed: (i) formal companies supplying informal manufacturers, including contract manufacturers; (ii) the customers of the IE entity, which often play an important role as source of knowledge (see Chapter 3), (iii) government and regulatory bodies, (iv) intermediary organizations engaged in knowledge transfer, (v) associations representing the informal cluster (e.g. the jua kali association), (v) NGOs working to promote innovation and the understanding of IP in the informal sector, and finally, (vi) agencies providing training and skills.

In terms of interview and survey format, rigorous interview guidelines and formats must be agreed at the outset and followed throughout the survey deployment. As outlined above, the interview templates include both open and closed questions to allow them to capture unexpected phenomena and personal experiences that would inform the study (Kraemer-Mbula and Tau Reference Kraemer-Mbula and Tau2014). The aim in interviewing is to generate a conversation with the respondent, preferably at the location where manufacturing and/or retailing of products takes place. As Fu et al. (Reference Fu, Zanello, Essegbey, Hou and Mohnen2014) put it, relevant findings sometimes emerge during informal discussion with a respondent before or after the interview.

One option is to leave interviewing in the hands of few experienced interviewers, obviously limiting the sample size but ensuring that nuances can be captured appropriately. The other option is to aim at a more standard questionnaire which is followed rigorously with closed questions, such as yes-or-no answers or a set of response options. In this case, more general staff enumerators can be recruited and trained for data collection. The potential closed answers need careful prior study to appropriately anticipate the range of potential replies in the particular IE sub-sector or cluster.

Where possible, and as usual for official statistical surveys, questionnaire surveys should be tested in a pilot before the full survey is rolled out. It can be helpful to conduct a preliminary study based on in-depth case studies of a small sample of respondents in the IE, to better design the more formal questionnaire and survey work later (see Fu et al. Reference Fu, Zanello, Essegbey, Hou and Mohnen2014).

In practical terms, all interviews are recorded and transcribed, helping to gather the data and for purposes of later data cleaning and validation. The data can be collected manually or with the aid of Personal Digital Assistants (PDA).Footnote 18 As in the case of Chapters 3–5, visual documentation through pictures is undertaken to complement the interview results. They illustrate the range of innovative products or processes, the variations in details of specific products, and the adaptation of products that takes place.

As with regular surveys, it is helpful if the benefits of the survey are clear to the respondent (so-called benefit sharing), for example, by indicating that the survey results with help influence policy and or that the survey will positively impact on the informal sector. Also, promising to validate responses with respondents and to share the overall results of the survey is known to increase the number and the quality of responses (so-called validation and restitution). Restitution is also a matter of ethics in social sciences.

In terms of substance, the survey questions deployed for the studies in this book draw on approaches and questions used in formal CIS-type innovation surveys. Importantly, however, the shared template also relies on significant adaptation to the informal sector generally, and to the specific sub-sector being studied.

Annex 1 contains the survey templates used in the fieldwork for this book (annexes 1.1, 1.2 and 1.3). It also contains surveys for a case study in Uganda (Kawooya Reference Kawooya, de Beer, Armstrong, Oguamanam and Schonwetter2014) and a study of the ICT sector in Senegal (Konté and Ndong Reference Konté and Ndong2012) (annex 1.4 and annex 1.5 respectively).

The sequence of questions, their exact content and formulation varies across our various survey tools, but they feature the following central elements:

The first survey section usually asks general information about the interviewee – standard demographic variables such as age or gender. Interestingly, and as opposed to formal enterprise innovation surveys, the questionnaire is focused strongly on the respondent himself or herself, be it the owner or an employee. Questions as to his or her educational background and time spent in the cluster are included. The religious or ethnic group and language of the respondent are surveyed as well.

In addition, respondents are asked about the nature of the firm and work, such as the type of business, its field of activity, its premises, its geographical location and, when the owner is surveyed, the numbers of employees, revenues and other firm performance indicators.

One particularity of these IE surveys is that in addition to religion and ethnic group, they also often enquire about social values which might have helped in contributing to the economic success of the entity, such as solidarity, sharing, dialogue, hospitality, courage and reserve, as in Konté and Ndong (Reference Konté and Ndong2012).

The remaining sections cover in different forms the themes discussed in Chapter 2, namely (i) the level and nature of innovation activities, including with questions relating to imitation and adaptation versus originality (“Is this product your original design?”), (ii) sources of information and knowledge, (iii) innovation partners and collaborators, with a focus on useful network and linkages, (iv) innovation endowment and capacity in terms of skills, apprenticeships, teaching and learning (“Where did you learn the process of making the product from?”), (v) obstacles to innovation, (vi) support measures and the role of the national or local governmental authorities, and finally, given the specific focus of our questionnaires, (vii) the role of various methods to appropriate innovation investments such as lead time, secrecy and formal IP rights.

The language of questions about innovation activities is simpler than that used in formal sector innovation surveys. Examples are: “Have you originated a new product/changed the process of producing the product since you started working? Why? Where did you learn about the new process? Do you do any research to improve the process of production? Did any of the following institutions assist you in overcoming production weaknesses? What benefits did you have from the change in process?”

The surveys also broach the topic of product design, enquiring whether the design is original or modified.

With respect to the various forms of innovation, and similar to the Kenyan MSE survey mentioned in the section above on “Measurement of the informal sector to date and scope for introducing innovation survey questions,” a number of questions are devoted to commerce and marketing strategies as they relate to pricing, customer relations and supplier relations.

A central concern of these questionnaires is also to identify the potential desire to scale up activity and the obstacles to scaling-up.

Significant attention is then spent on apprenticeships and on-the-job or other training, and the supply and diffusion of skills, for example: “Where have you learnt your craft? What is the relationship with your trainer? Do you provide training on production processes?” A number of questions try to disentangle the possible shared sources of knowledge in the cluster, such as “Are your products based to some extent on indigenous and/or traditional knowledge?” The portability of skills and knowledge from one job to another is also an area of enquiry (“When you move jobs, do you keep or share the secrets of production from your previous employer?”).

The topic of knowledge flows and collaboration in the cluster, and reasons for and against it, is also surveyed intensively. A number of questions are particularly concerned with the determinants of cooperation, for example, underlying personal relationships such as family ties or friendships, or factors which relate to geographical proximity or belonging to the same association, cluster, community or another social or professional group. Care is applied when surveying collaboration among the different potential partners (e.g. suppliers, producers and customers). The role of private or government associations as a source of information and knowledge is surveyed.

To conclude, significant portions of the interviews are also dedicated to the different methods which informal sector participants might use to appropriate their innovation efforts, ranging from lead time and secrecy to more formal IP rights, for example: “What mechanisms do you use to protect your innovation or innovative ideas? Are you concerned with possible commercialization of your innovations without your knowledge or consent? What forms of appropriation are most appropriate for your sector (list of options indicated)?”

As Chapters 3–7 of this book show, the surveys generated rich and interesting insights into informal sector innovation and knowledge sharing. As with the previous qualitative work described in Box 8.3, it could be argued that the experience and results generated from these surveys are a necessary stepping-stone toward better formulating and deploying large-scale formal innovation surveys as well.

Conclusions and Next Steps

The suggestions in this chapter are intended to lay important groundwork for future empirical work, for the development of appropriate indicators and to support new approaches to innovation policy in developing countries.

Two viable scenarios emerge: (i) adding a couple of innovation questions or a small survey module to existing large-scale surveys of the IE and/or (ii) conducting ad hoc questionnaire- and interview-based sectoral studies in selected countries. As discussed in this chapter, option (i) is only relevant for countries able to produce population estimates and where the possibility of running combined surveys exists.

To facilitate progress on option (i), further work should be encouraged to develop a core set of innovation-related survey questions, some from Eurostat’s CIS and some from the informal sector surveys that we have described. In Africa, this work could be supported by AOSTI and AU/NEPAD.

At the outset, a short set of questions could be suggested to the stakeholders of the mixed surveys, if they were convinced of the value of such an approach for the understanding of the dynamics of the informal sector in Africa. Stakeholders might, for example, include Afristat and DIAL, Eurostat and Paris21, and the ILO. But the better approach is combined surveys. To this end, the stakeholders to be approached are the departments of economic statistics within the national statistical offices and at the African Centre of Statistics at UNECA, and also employers’ associations in certain countries which are sometimes involved in the design and implementation of such surveys (for instance in Nigeria).

After experience is gained, a standardized AU survey of IE activities, including innovation and IPR use, could be considered. The theme could be picked up in future editions of the African Innovation Outlook.

Work in other regions should be considered too, in particular Latin America and South East Asia.

The OECD started to revise the Oslo Manual in 2015, and there will be consideration of new areas of interest such as public sector innovation, user innovation and social innovation. There could also be a discussion of where innovation happens – in the formal sector and in the informal sector – and how guidelines for each would differ. It helps that the AU (both AOSTI and NEPAD), South Africa, RICYT (and Chile, Colombia and Mexico), Brazil, China, India and the Russian Federation are involved in the revision process.

In the meantime, the second option of more ad hoc questionnaire- and interview-based surveys in selected countries is the more promising one. Studies and results can be obtained more quickly, and sector studies based on more qualitative work could be more effective in helping us develop a rich understanding of innovation in the informal sector. In turn, this will also help formulate better questions to be included in systematic large-scale surveys as developed under option (i). The survey templates, experiences and results generated as part of this book, and summarized in this chapter, could be helpful to further research. Similarly, work will be needed to build common approaches among the academic and statistical community on how to better run these surveys. Ideally, AOSTI would agree to act as an archive for and coordinator of the related discussion as this work moves forward.

Taken together, this work will be an important contribution to our developing understanding of innovation in the informal sector.