The public health crisis created by COVID-19 presents an opportunity to evaluate the performance of mature democracies faced with the need to declare states of emergency and to confer extraordinary powers on political executives. Emergency powers in the context of a pandemic allow governments both to impose restrictions on personal freedoms (e.g. lockdowns, stay-at-home orders, travel bans, mask mandates) and to commit large-scale financial resources to manage the crisis. The broad powers to which governments have access in an emergency ‘open a window of opportunity to silence critics and weaken rivals’ (Levitsky and Ziblatt Reference Levitsky and Ziblatt2018: 94).

Legislatures are particularly at risk from what has been called ‘executive aggrandizement’ (Bermeo Reference Bermeo2016: 10). Unlike coups, during which executives are replaced, executive aggrandizement refers to the strengthening of existing executive authority via ostensibly legal processes and the weakening of accountability mechanisms, particularly the opposition's opportunities to scrutinize. One cross-national study concludes that executive aggrandizement is unrelated to the scale of the public health challenge posed by COVID-19: ‘There is no apparent relation between the severity of the disease and the decision to close parliament or limit its operation’ (Waismel-Manor et al. Reference Waismel-Manor, Bar-Siman-Tov, Rozenberg, Levanon, Benoît and Ifergane2020: 11).

It may be comforting to assume that established parliamentary democracies will resist the temptations presented by COVID-19, but responses are likely to be nuanced and dependent on circumstance (Przeworski Reference Przeworski2019: 78–9). The research reported here evaluates the performance of democratic accountability mechanisms in four parliamentary democracies – Canada, Australia, New Zealand and the UK – from 1 January 2020 to 30 June 2020. This time span covers the report of the first case of COVID-19, the activation of emergency powers, the implementation of governments’ pandemic response plans and the announcement of economic support packages. All four countries have Westminster-style parliamentary systems in which the executive is obliged to retain the confidence of the lower house (in New Zealand's case, the only chamber) to remain in power. Accountability is rendered in parliament, where the opposition's opportunity to challenge the government is a central requirement. Of course, these countries exhibit differences as well. Australia and Canada are federal systems, New Zealand has a unitary government, and the UK is a hybrid. These differences are important for the regulation of personal freedoms in the wake of COVID-19, but they matter less for the focus of this article, namely the fiscal policy response and its reception in each jurisdiction.

A pandemic crisis demands both a public health and a fiscal policy response. Fiscal policy, the marshalling of financial resources for macro-economic purposes, is largely a central government responsibility in all four of these countries. The need for a rapid response to the fiscal crisis creates an emergency environment that puts at risk established procedures for vetting and authorizing spending programmes. On the other hand, the management of public money is a major and routine component of democracy. In the last two decades, developed countries have adopted procedures and professional standards to improve transparency and accountability in public sector financial management (Alt Reference Alt2019). Since 1998, when the International Monetary Fund (IMF) called for transparency in government operations (Kopits and Craig Reference Kopits and Craig1998), economically developed countries have provided more frequent and clearer financial reports that are subject to independent audits. These mechanisms add a strong element of formal accountability to the political accountability provided by competitive elections and opposition scrutiny.

Governments’ fiscal responses to the pandemic offer a unique testing ground of the enduring power of these two types of accountability. The question is this: Will formal practices and procedures, combined with the norms of parliamentary government, hold up under emergency conditions? With framing and executing each country's fiscal response in mind, we score the four countries on adherence to nine practices that together comprise an index of democratic accountability. To make these assessments, we use information obtained from parliamentary records (e.g. Hansards), legislative provisions, government publications and reports from the media, think tanks and international organizations.

The accountability components, outlined in the index and explained in the Online Appendix, are integral to the rules and norms that sustain democratic practice. Respect for these rules and norms indicates resilience, generally defined as the ability to absorb a disturbance and either return to an original stable state or make adaptations without damaging system integrity (Klein et al. Reference Klein, Nicholls and Thomalla2004; Pimm Reference Pimm1984). Because our time frame is relatively short, our use of the concept applies primarily to the latter requirement: adaptations that do not threaten system integrity (Chaplin Reference Chaplin2020). Declarations of emergency are tests of resilience in both senses. Most constitutional democracies require emergency powers to be time limited and subject to oversight. Accountability mechanisms are expected to continue to operate, opposition parties to be given opportunities to review and criticize, and executives to refrain from using temporary powers to create permanent partisan advantage.

In what follows, we first address the concept of democratic accountability and outline our framework for its assessment. In the next section, we describe the context of emergency powers and the fiscal measures implemented in each country. We then go on to present our findings on democratic accountability, followed by a discussion about democratic resilience based on how these countries adapted to the emergency given their accountability status in ‘normal’ times. Finally, we present our conclusions and implications for future research.

Types and measures of democratic accountability

Central to democratic forms of government are the obligations to give account of and explain or justify actions and performance. All forms of accountability envisage both exposure/visibility and sanction/punishment (Borowiak Reference Borowiak2011). Mark Philp (Reference Philp2009) delimits democratic accountability by focusing on exposure, which he regards as core to the definition: ‘A is accountable with respect to M, when some individual, body or institution, Y, can require A to inform and explain/justify his or her conduct with respect to M’ (Philp Reference Philp2009: 32). Exposure implies the transparent imparting of information and the requirement to justify actions (Philp Reference Philp2009: 35).

In focusing on the concept's exposure elements, Philp distinguishes between political and formal accountability. Political accountability envisages a sovereign democratic public for whom elected politicians toil and who judge their efforts in periodic elections. Partisanship and opposition are critical elements (Philp Reference Philp2009: 38). Elected office-holders who provide accounts are subject to judgements by a variety of observers: those who are predisposed to find fault, those who are sceptical and mistrustful of all politicians, and those who are political supporters. In parliamentary democracies, the principal forum for political accountability is parliament itself. Westminster systems differ in important respects (Rhodes et al. Reference Rhodes, Wanna and Weller2009) but share a commitment to a regular, public confrontation between the executive and members of both the governing party and an institutionalized opposition (Meinel Reference Meinel2018). It is in parliament that the political executive proposes legislation and renders an account of its economic management. Political accountability requires that members of parliament be afforded the opportunity to participate in the scrutiny of legislation, a right derived from the concept of parliamentary privilege (Chaplin Reference Chaplin2020). Democracy is served to the extent that the scrutiny conducted by legislatures helps prevent the abuse of emergency measures and improve the acceptability and feasibility of government policies (Petrov Reference Petrov2020: 73). Transparency is a requirement, and both the availability of ministers and opportunities to interrogate them are tests of accountability. Any suspension of parliament or refusal to share information is often interpreted as a direct assault on political accountability.

Formal accountability refers to the fulfilment of defined roles and responsibilities. Whereas political responsibility relies on the flourishing of partisan critique, formal accountability depends on the impartial performance of formal duties. Formal processes and rules ‘frame the political system and define and limit the scope of political accountability’ (Philp Reference Philp2009: 39). Parliamentary democracies rely on judges, public servants and officers of parliament to be formally, not politically, accountable. They share a non-partisan commitment to professional standards agreed to in advance. Their work is pivotal to democratic resilience both because of its inherent capacity to generate trust (Rothstein Reference Rothstein2011) and because of its contribution to competitive democratic politics (Albert and Pal Reference Albert, Pal, Graber, Levinson and Tushnet2018: 118). Officers of parliament – auditors, ombudspersons, electoral commissioners and privacy commissioners – are particularly important. They ensure that politicians perform their formal responsibilities, not just their political tasks. In this way formal accountabilities frame political contestation. When formal accountabilities are ignored for political advantage, even in the name of political accountability, democracy becomes less resilient and recovery from crisis more problematic.

In a crisis such as COVID-19, where an economic as well as a public health response is required, non-partisan offices acquire prominence as key constitutional watchdogs of public business (Gay and Winetrobe Reference Gay and Winetrobe2008). Supreme Audit Institutions (i.e. auditor-generals’ offices) are particularly vital sources of independent and professional judgement for programme design and implementation. Parliament relies on auditors to vouchsafe the spending of public money and to identify deficiencies from a public accounting perspective. Similarly, independent fiscal institutions (i.e. parliamentary budget offices) promote transparency and accountability by providing timely independent analyses of government fiscal policies. Their opinions, which may be at variance with those of finance departments, are equally important in providing parliament with alternative interpretations of what is needed. In addition to independent institutions, timely and clear communication of budget information allows the public and the market to understand a government's intentions, to evaluate its results and to hold the government accountable for its budget outcomes (Lowry and Alt Reference Lowry and Alt2001). In this process, transparent budget information increases the political cost of operating unsustainable fiscal policies (Alt Reference Alt2019).

The principal contribution of this article is the development of accountability metrics that capture the key elements of formal and political accountability and apply them to four parliamentary democracies confronted with an economic crisis brought on by a public health crisis. The metrics follow Philp's (Reference Philp2009) definition of formal and political accountability. The criteria for political accountability concentrate on the mechanisms (committees, legislative debates and question periods) that facilitate the ‘answerability of those in office to partisan elements’ (Philp Reference Philp2009: 38). Accordingly, our index asks whether the majority of MPs have participated in the process of passing emergency bills (debating legislation), whether MPs have had an opportunity to review and amend any of the emergency bills before they were passed (debating legislation), whether deliberations in parliament have been made available to the public (communication and transparency) and whether the opposition leads an oversight committee to scrutinize government actions during the emergency (committees).

For Philp (Reference Philp2009: 38), formal accountability involves ‘non-partisan assessment of the conduct of public officials in light of the formal designation of the powers and responsibilities attached to their office’. Accordingly, our formal accountability criteria (outlined below) include limits on emergency legislation (‘acting within formal responsibilities’), timely government fiscal and economic updates (‘systems of regulation and reporting’), independent verification (‘scrutinize exercise of designated requirements’) and independent analysis (‘non-partisan assessments’).

For each of the nine criteria listed below, each country received a score of 0 (no), 1 (yes), or, in some cases, 0.5 when the criterion was only partially met. The criteria are as follows.

Formal accountability mechanisms

(1) Limits on emergency spending: whether there is a limit on the duration and level of emergency spending. 1 = limits on both duration and level; 0.5 = limits on either duration or level; 0 = no limits.

(2) Reporting: whether there is a timely government fiscal and economic update and a 2020 budget delivered between 1 January and 30 June 2020. 1 = yes; 0 = no.

(3) Independent verification: whether there are frequent reviews of the government emergency responses from auditors. 1 = monthly reviews; 0.5 = at least one review; 0 = no review.

(4) Independent analysis: whether there are frequent analyses of the impact of government fiscal measures by an independent fiscal institution. 1 = two or more analyses; 0.5 = one analysis; 0 = no analysis.

Political accountability mechanisms

(1) Political participation in parliament: whether the majority of MPs have participated, physically or virtually, in the process of passing emergency bills. 1 = more than 50% of MPs participated in at least one emergency legislative sitting; 0 = less than 50% of MPs participated.

(2) Political deliberation: whether MPs have had an opportunity to review and amend any of the emergency bills before they were passed. 1 = MPs reviewed and amended legislation; 0.5 = MPs reviewed and agreed to pass legislation with no amendments; 0 = no opportunities for MPs to review and/or amend legislation.

(3) Political transparency: whether deliberations in parliament have been made available to the public. 1 = all debates were made available; 0.5 = some debates were made available; 0 = no debate was available.

(4) Opposition oversight: whether there was an opposition-led oversight committee to scrutinize government actions during the emergency. 1 = a COVID-specific committee led by the opposition; 0.5 = an existing standing committee led by the opposition; 0 = a committee not led by the opposition.

(5) Public communications: whether the government provides frequent, clear and coherent information to the public. 1 = yes; 0.5 = to some extent; 0 = no.

The formal accountability index of a country is calculated as the simple average of the value assigned to each of the four criteria. The political accountability index of a country is the simple average of the value assigned to each of the five criteria listed above. The overall accountability score of a country is the sum of its formal and political accountability indices divided by two.

In choosing these metrics, we have concentrated on the most important accountability processes and standards encompassed by Philp's definitions. We acknowledge that our criteria are not exhaustive and that their weighting and evaluation are to some degree subjective. As a result, the scoring based on this index should be considered approximate only. Our main purpose is to propose a set of operational measures of both political and formal accountability mechanisms during a crisis. The precise performance scores are less important than orders of magnitude and comparative rankings.

To provide a context for these accountability mechanisms, we first review the COVID-related fiscal measures adopted by the central governments in the four countries and the political decisions they made to advance the crisis agenda.

Fiscal responses to COVID-19 in four countries

In December 2019, Chinese authorities began to report cases of pneumonia caused by a new type of coronavirus (COVID-19) in Wuhan, China (WHO 2020). Shortly after, cases began to emerge in other countries, including Canada (25 January), Australia (25 January), the UK (31 January) and New Zealand (28 February). The World Health Organization officially declared COVID-19 a global pandemic on 11 March 2020. Learning the risks of COVID-19 for certain individuals, particularly older people and those with pre-existing medical conditions, governments took unprecedented action to contain the spread of the virus and support the economy.

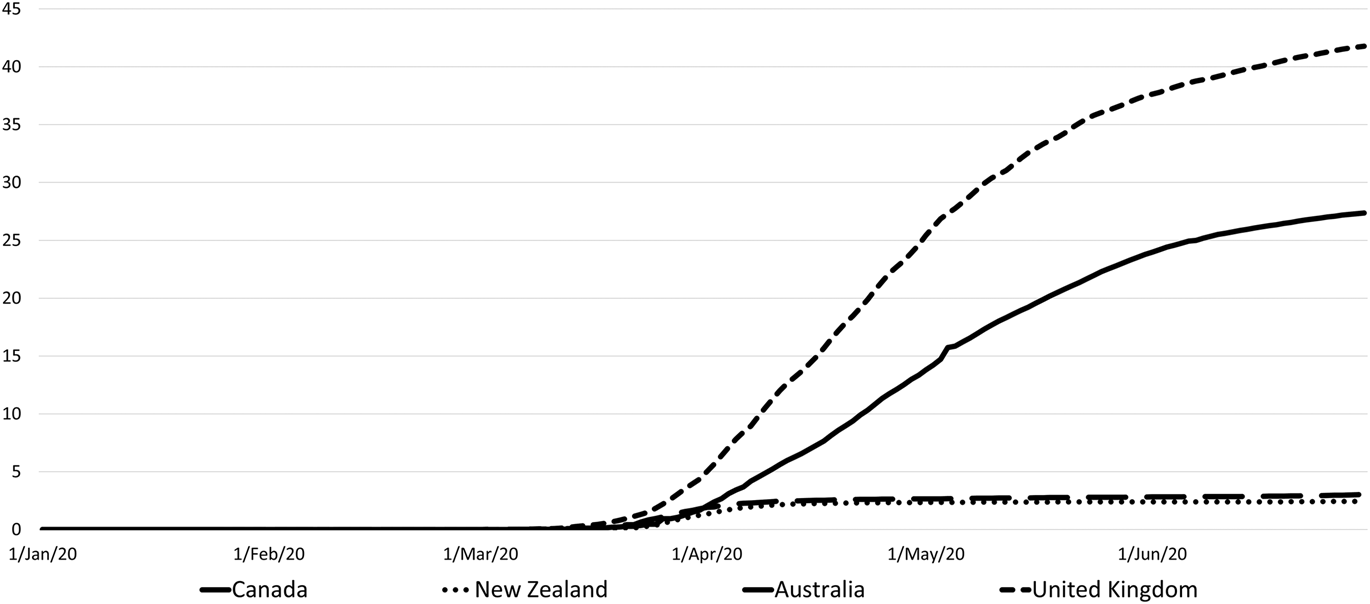

From social distancing to quarantine orders and border restrictions, COVID-19 containment strategies adopted in Australia, Canada, New Zealand and the UK varied both in stringency and timing. Australia acted promptly by banning travellers from China in early February. Measures in Australia gradually became more restrictive, arriving at a complete lockdown by the end of March, when the total number of coronavirus cases peaked (Wahlquist Reference Wahlquist2020). In Canada, restrictive measures escalated gradually, and a state of emergency declaration was left to each province. The New Zealand government introduced travel bans before reporting any COVID-19 cases and went into a strict national lockdown when the country had 102 cases and no deaths (Jones Reference Jones2020). Among the four countries, the UK's approach was the least restrictive. Lockdown measures were implemented on 24 March when cases and deaths surged (DHSCgovuk 2020). Figure 1 shows how the caseload unfolded in each country. The figure indicates that the UK and Canada faced more serious public health challenges than Australia and New Zealand.

Figure 1. Number of COVID-19 Cases per 10,000 Population (1 January–30 June 2020)

Source: World Health Organization (2020).

Quarantine and mobility restrictions led to widespread business closures and massive layoffs in all countries. These measures, although compatible with public health objectives, such as slowing, containing and, in some cases, eliminating COVID-19, had severe economic consequences, prompting significant government intervention. Broadly, fiscal policy measures in all four countries fall into three categories: support for businesses, support for individuals and support for specific sectors of the economy, with varying degrees of magnitude and responsiveness.

While our purpose is to evaluate accountability and not responsiveness, it is worth noting that our chosen countries differed significantly in the speed with which they announced and implemented fiscal measures. New Zealand's first economic support package was delivered promptly (18 days after the first reported case). The NZ$12.1 billion (4% of GDP) Initial Economic Response Package, announced on 17 March by Prime Minister Jacinda Ardern, included wage subsidies, leave and self-isolation support, business tax changes, and support to the health sector and aviation industry (Beehive 2020). As the then Leader of the Opposition Simon Bridges conceded, ‘This government's speed at getting the wage subsidy scheme up and running reduced early economic calamity’ (New Zealand 2020e: 17777).

The other three countries announced their economic support measures approximately 45 days after the first case was recorded. Australia's first economic stimulus package of AU$17.6 billion (0.9% of GDP), announced by Prime Minister Scott Morrison, aimed to support business investments, household assistance and the aviation sector (Martin Reference Martin2020). Further measures were announced in March, including JobSeeker Payment, a supplement to existing income support programmes and a wage subsidy for employers (Prime Minister of Australia 2020). In Canada, the CA$1 billion package, announced by Prime Minister Justin Trudeau, included funding for research and medical supplies and support for indigenous communities (Harris Reference Harris2020). In late March, programmes to support individuals and businesses –the Canada Emergency Response Benefit (CERB) and the Canada Emergency Wage Subsidy (CEWS) – were announced. In April, a student aid package, including the Canada Emergency Student Benefit (CESB), was announced. In the UK, the first stage of the economic response to COVID-19 (£12 billion to support individuals and businesses) was announced on 11 March as part of Budget 2020 (40 days after the first reported case). It was not until a week later that the Treasury realized that ‘the effort to contain the virus would involve imposing very significant restrictions on the economy’ (UK House of Commons Public Accounts Committee 2020: 10).

Table 1 outlines the timeline and size of fiscal relief measures delivered by each country as of 12 June 2020, according to the IMF.

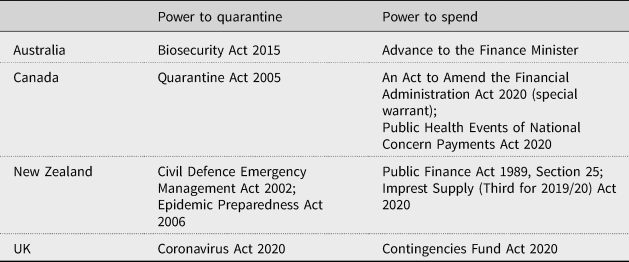

Before considering accountability mechanisms, it must be acknowledged that the power to declare an emergency in the first place is itself an important constraint that can be imposed on executive institutions. As Table 1 shows, all the countries we are considering have legal provisions enabling the political executive to declare an emergency and act without the direct approval of parliament. Australia and New Zealand used existing legislation and mechanisms to access emergency spending powers. Australia's Advance to the Finance Minister (AFM) enables the withdrawal of additional money from the Consolidated Revenue Fund provided that the finance minister can demonstrate that ‘there is an urgent need for expenditure’ (Parliament of Australia 2019). New Zealand's Public Finance Act 1989, Section 25, allows the minister of finance to spend during an emergency without parliamentary approval. This mechanism was invoked for four weeks (from 27 March to 23 April) in addition to parliamentary approval to spend up to NZ$52 billion on COVID-related measures.

Canada and the UK proceeded somewhat differently. Instead of invoking existing legislation, the two countries introduced new legislation to expand executive power during the COVID-19 crisis. Canada amended the Financial Administration Act (special warrant) to provide for payments out of the Consolidated Revenue Fund without parliamentary approval. Canada also passed Bill C-13, the Public Health Events of National Concern Payments Act, to allow the government to pay out of the Consolidated Revenue Fund ‘all money required to do anything in relation to that public health event of national concern’ (Public Health Events of National Concern Payments Act, Section 2).

The UK government passed the Coronavirus Act 2020, which allows government to enforce quarantine and lockdown restrictions, and the Contingencies Fund Act 2020, which increases the authorized capital limit of the fund from which government departments are allowed to make advances. Some MPs expressed concern that the latter legislation did not contain accountability measures as robust as those in existing emergency legislation, specifically the Civil Contingencies Act 2004's 30-day sunset clause, or expiry as decided by parliament (Civil Contingencies Act 2004, Section 27). Existing legislation, they argued, would have been quite adequate (United Kingdom 2020a: 85, 117).

Table 2 summarizes the emergency laws that granted the central governments in the four countries the power to quarantine and spend during the COVID-19 pandemic.

Table 2. Legislation Granting Emergency Powers during COVID-19

This legislation provided a legal basis for emergency powers and confirmed that, emergency or not, these democracies are rule-of-law regimes. It was what happened next, however, that constituted the democratic accountability test. Compared with the process of passing laws that grant emergency powers, formal and political accountability mechanisms are less salient and more easily overlooked in the assessment of democratic resilience.

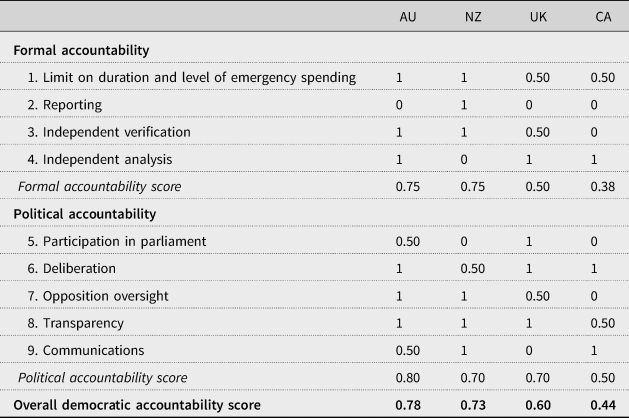

Accountability in four parliamentary democracies

In a democracy, large-scale fiscal measures need to be accompanied by high accountability standards. The four countries considered here have different formal and political accountability requirements for emergency fiscal responses. To assign a score on each of the nine accountability criteria introduced above, we conducted a content analysis of parliamentary records (e.g. Hansards), legislative provisions, government publications and reports from the media, think tanks and international organizations (e.g. IMF). Table 3 summarizes the scores on each government's fiscal policy response.

Table 3. Democratic Accountability Mechanisms: COVID-19 Fiscal Policy Responses

Notes: AU = Australia; CA = Canada; NZ = New Zealand; UK = United Kingdom.

The rationale for these scores is presented in the context of each country's performance and explained in detail in the Online Appendix. As we acknowledge above, our assessment is approximate and, undoubtedly, open to debate. Our contribution to the assessment of democratic resilience lies less in the particular scores assigned than in the means of assessment itself.

Australia

We awarded Australia the highest average formal accountability score (0.75) and the highest average for overall democratic accountability (0.78). Australia's relatively high formal accountability is the result of the limits placed on the duration and level of spending during the emergency through the Advances to the Finance Minister (AFMs), which were accompanied by frequent independent verifications from the auditor and independent analyses from an independent fiscal institution. Senator Katy Gallagher (member of the opposition and shadow minister for finance) asked the auditor-general for Australia to develop an audit programme for the government's response to COVID-19 (ANAO 2020a) and a performance audit on the government's debt management (ANAO 2020b). The Australian National Audit Office (ANAO) agreed to provide monthly assurance reviews to parliament on the implementation of the AFMs. These reviews are part of a multi-year strategy for performance audits of the government response. For these reasons, Australia receives a full mark for the ‘independent verification’ dimension of formal accountability. During our study period, Australia's Parliamentary Budget Office published several key documents: research on the impacts of COVID-19 and the government response (i.e. medium-term fiscal projection scenarios) and two reports on the government finances, which belong to ‘a series of monthly publications designed to track the effect of COVID-19 and the associated policy response on the Commonwealth's fiscal position’ (PBO Australia 2020). The Economic and Fiscal Update was delivered on 23 July and additional forecasts and projections were provided in the 2020–21 Budget tabled on 6 October. Because the reporting criteria assesses the government's delivery of these key accountability documents and these were provided outside this study's time frame, Australia scored a ‘0’ on this requirement.

Australia's score for political accountability is also the highest of all four countries (0.80). Australia achieved a half score for maintaining the political forum and allowing MPs to participate in political debates about emergency spending. When the House of Representatives convened to pass a set of stimulus package bills on 23 March, 59% of the 150 MPs attended the proceedings. However, when parliament was recalled on 8 April for a second round of emergency law-making, less than 40% of MPs attended. During the prolonged adjournment of parliament, a group of 10 former judges, leading lawyers, integrity experts and public servants wrote to the prime minister calling for parliament to resume (Knaus Reference Knaus2020), referring to the adjournment of parliament as ‘an undemocratic and unprecedented response to the COVID-19 outbreak’. They called for the continuity of parliamentary business through other means (e.g. virtually, as in the UK).

Despite the reduced number of sittings available to pass emergency legislation, the authorizing legislation was introduced and discussed by members of the House and the Senate. These deliberations resulted in proposed amendments to the first emergency bill by the Senate (Samara Centre of Democracy 2020); thus, we assigned full marks for this criterion. All proceedings were made available to the general public through ParlView, allowing us to award a score of ‘1’ for transparency.

Unlike the upper houses in Canada and the UK, the Australian Senate is elected by proportional representation and shares substantially the same law-making powers as the House of Representatives, except the authority to initiate money bills. The Senate is also distinctive thanks to its status as an ‘opposition forum’ where the governing party is often in the minority (Thomas Reference Thomas2009: 394). It is assisted in this regard by a robust committee system responsible for parliamentary scrutiny. The Select Committee on COVID-19, chaired by the opposition, was established by the Senate on 8 April 2020 to inquire into the government's response to the crisis. In addition to the COVID-specific committee, the existing Senate Standing Committee for the Scrutiny of Delegated Legislation provides parliamentary oversight of all delegated legislation – that is, regulations designed to implement COVID-19 measures. Thus, we awarded ‘1’ to Australia on opposition oversight.

Regarding the communication criterion, the prime minister's public messages lacked some clarity at the beginning of the emergency, but these improved as the government sought and followed expert advice (Mao Reference Mao2020). As Eric Windholz (Reference Windholz2020: 106) suggests, incorporating advice from medical experts, particularly during a crisis, increases ‘the prospect of evidence-based decision-making, and minimizes the risks of miscommunication and misunderstanding’.

New Zealand

New Zealand received the second highest average for overall democratic accountability (0.73). The government and the audit institution have been effective in keeping the public informed on the evolving economic and fiscal situation, and the country scored ‘1’ on both the ‘reporting’ requirement and the ‘independent verification’ criterion of formal accountability. In contrast to the other countries in this study, New Zealand was able to provide an Economic and Fiscal Update in May, along with its 2020 Budget. New Zealand's Treasury began providing weekly economic updates and projections in April, along with interim monthly financial statements (Treasury New Zealand 2020). Acknowledging the need for increased monitoring and reporting, the controller and auditor-general of New Zealand agreed to publish monthly controller updates on the government spending associated with COVID-19 (Controller and Auditor-General of New Zealand 2020). As there is no parliamentary budget office (PBO) in New Zealand, a ‘0’ was assigned for ‘independent analysis’.

New Zealand received full marks for establishing a COVID-19 dedicated committee to scrutinize the government response and for transparent parliamentary and committee proceedings. The House established an Epidemic Response Committee, led by the opposition and with opposition majority, to review and report on the government's management of COVID-19. Leader of the House Chris Hipkins referred to the committee as ‘a mechanism, whereby the Opposition in particular, will be able to continue to scrutinize the Government and the actions that the Government is taking, even though the House will not be sitting’ (New Zealand 2020c: 17317). Meetings were carried out by Zoom and made available to the public by parliament's broadcasting system, Parliament TV.

On 19 March the House adopted new procedures to facilitate the activities of the House and the committees during the pandemic, including allowing remote participation and restricting the number of MPs in the Chamber (New Zealand 2020b: 17235). The House then went into recess. When the House was recalled to approve emergency legislation on 25 March, fewer than 20 of the 120 MPs participated in the approval of the two bills that granted the government power to quarantine and to spend (Samara Centre for Democracy 2020). These circumstances result in a ‘0’ for participation in the political forum.

The New Zealand government's rapid response was possible in part due to parliament's (temporary) support of government measures combined with ‘exceptional unity across party lines’ (Duncan Reference Duncan2020). Paul Goldsmith, the opposition spokesperson for finance, made the following observation at the 25 March sitting, when parliament met to pass emergency legislation before adjourning until 28 April:

Ordinarily, we wouldn't be wildly enthusiastic about rushing through legislation involving tax and social security changes. Ordinarily, you would want to spend many months having a select committee process and making sure that things have been done properly and we're not having unintended consequences, but we understand the need to move swiftly. This is part of the Government's COVID-19 response. (New Zealand 2020c: 17300)

However, fast-tracking legislation poses potential problems, such as weaker deliberation. This was evident on 30 April when a draft bill – COVID-19 Response (Taxation and Other Regulatory Urgent Measures) – intended to be reviewed the following week, was mistakenly approved without MPs realizing that it was a different version of the bill that they meant to approve that day (Coughlan Reference Coughlan2020). Due to the lapse in careful consideration of this legislation, we awarded New Zealand 0.50 on the ‘political deliberation’ criterion of political accountability. The incident was labelled an ‘administrative error’ by the government but left the opposition ‘rightly upset’ and distrustful of government intentions (Tibshraeny Reference Tibshraeny2020). When another bill (COVID-19 Public Health Response Bill 2020) was introduced to provide expansive powers to the police to enforce social-distancing rules and restrictions on gatherings as the country reopened the economy (Wade Reference Wade2020), it did not receive support from the National Party and ACT New Zealand (Devlin Reference Devlin2020). During the first reading of the bill, Simon Bridges stated, ‘In recent times we have got it wrong; passing things that we didn't even know we were passing. So, the room for error in this bill, I suggest, is incredibly high, given the legal complexities’ (New Zealand 2020d: 17612).

United Kingdom

In the UK, the Office for Budget Responsibility (OBR) has been the most prominent formal accountability mechanism. Instead of developing its own set of economic forecasts, the government's economic and finance ministry, HM Treasury, publishes a monthly compilation of independent forecasts and compares them with those reported by the OBR. Because the budget was tabled in March, as originally scheduled, the OBR's Economic and Fiscal Outlook accompanying the budget documents did not reflect the global pandemic and its impact on the UK (HM Treasury 2020). However, since then, the OBR has produced several independent analyses, including monthly coronavirus reference scenarios, a fiscal sustainability report, the coronavirus policy monitoring database and commentaries on monthly statistical bulletins (OBR 2020). Similarly, ‘to support Parliament in its scrutiny of the UK government's response to COVID-19’ (NAO 2020), the National Audit Office (NAO) published in May the first of a series of COVID-related reports. Because the NAO reviews appeared less frequently than other supreme audit institutions, the UK scored a 0.50 for ‘independent verification’.

The UK scored high on three mechanisms of political accountability: participation in parliament, deliberation and transparency. Because the UK was ‘sitting as usual’ until its adjournment, the majority of MPs participated in deliberations that took place on or before 25 March. Thereafter, in April and May, business at the House of Commons was conducted by a virtual hybrid parliament.

Between 19 and 24 March, the UK Parliament amended two pieces of emergency legislation – the Coronavirus Bill and the Contingencies Fund Bill. The Coronavirus Bill's sunset clause sets the legislation to expire at the end of two years from the date of Royal Assent. The Leader of the Opposition (Labour Party) Jeremy Corbyn expressed general support for the bill but demanded that the House of Commons vote every six months until the expiration date to determine if the powers granted by the bill should continue (Cowburn Reference Cowburn2020). Amendments were made to the bill during its second reading to include a new clause (a six-month parliamentary review) to provide ‘an opportunity for the House of Commons to express a view on the continued operation of the bill's temporary provisions every 6 months’ (United Kingdom 2020a: 156). The Contingencies Fund Act 2020 received support from the opposition and passed without amendment (United Kingdom 2020b). In reference to the bill, Jesse Norman, the financial secretary to the Treasury, observed, ‘this is not new spending or a blank cheque. All advances will have to be repaid once the main supply estimates are voted on in the summer, when the House will have the opportunity to scrutinize and debate whether the resources have been allocated in the normal way’ (United Kingdom 2020b). Regarding the transparency of deliberations, debates in the House of Commons have been broadcast through Parliamentlive TV.

Scrutiny of the government response to COVID-19 in the UK has been carried out by an existing committee of parliament, the House of Commons Public Accounts Committee, chaired by a member of the opposition. According to the Whole of Government Response to COVID-19 Report, the government ‘failed to consider specifically in advance how it might deal with the economic impacts of a national disease outbreak’ (UK House of Commons Public Accounts Committee 2020: 3), adding that ‘overall there has been unclear planning and advice for lifting lockdown in a number of sectors’. A COVID-specific committee was established by the upper house, as in Australia. However, rather than scrutinize, its role has been to develop a forward-looking assessment of the long-term economic, social and international implications of the pandemic.

Public approval of the UK government's handling of the crisis fell by more than 20 points from the beginning of the lockdown on 23 March to 23 June (Smith Reference Smith2020). ‘The government was slow to act, didn't give coronavirus the priority and attention it deserved and has made some significant mistakes,’ said Professor John Ashton, a former regional director of public health in England (Perrigo Reference Perrigo2020). In general, its communications with the public have been criticized for their lack of clarity and consistency (Freedman Reference Freedman2020; Maddox Reference Maddox2020).

Canada

Canada scored relatively poorly on both formal and political accountabilities. The lack of a timely fiscal and economic update and independent verification drove its average formal accountability score down to 0.38. An economic and fiscal ‘snapshot’ was delivered in lieu of a fiscal update in early July after pressure from the opposition (Drummond Reference Drummond2020). The opposition reaction was negative: ‘No budget. No fiscal update. But instead an economic “snapshot” … We need a fiscal update to tell us how deep our financial hole is & how we will dig out of it’, tweeted Pierre Poilievre, opposition finance critic, on 17 June. The House of Commons asked the auditor general of Canada to review spending under the executive's expansive powers. The Office of the Auditor General (OAG) agreed to deliver audit reports ‘as completed’ in winter 2020 and spring 2021 (OAG Canada 2020). In the meantime, the Parliamentary Budget Office had been providing COVID-19 analyses, including costing the economic response plan, scenario analysis and cost estimates of proposed changes to the CERB programme.

Canada's political accountability score is low mainly due to the absence of the normal political forum and a lack of scrutiny from an opposition-led parliamentary committee. Parliament adjourned on 13 March, remaining suspended until 21 September 2020. From the start of the adjournment period, the House of Commons was recalled several times to pass emergency legislation. In the first months, deliberations took place with a small number of MPs present in the chamber and then in a hybrid format (Aiello Reference Aiello2020).

The Standing Committee on Finance, chaired by a Liberal (government) MP, was instructed in March by the House of Commons to review the COVID-19 Emergency Response Act and, more recently, government spending programmes, including the Canada Student Service Grant (CSSG) and the government's controversial involvement with WE Charity (discussed below). To examine the government's response to the pandemic, the House established a Special Committee on the COVID-19 Pandemic (COVI). The committee was chaired by Speaker Anthony Rota (a Liberal MP) and comprised all MPs (the Committee of the Whole). COVI meetings and proceedings at the chamber have been televised, except for one of the most important debates during this emergency, that of Bill C-13 on 24 March. These considerations account for Canada's 0.50 score for transparency.

Despite the reduced number of MPs participating, and opposition parties’ agreement to expedite the law-making process (Gunn Reference Gunn2020), political deliberation provided opportunities for the opposition to make significant changes to the bills as they proceeded through parliament. A draft of the Public Health Events of National Concern Payments Bill (within Bill C-13: COVID-19 Emergency Response Act) had a late sunset clause that would have given the government spending powers without parliamentary approval until 31 December 2021 (Curry and Fife Reference Curry and Fife2020). Similarly, Bill C-12 would have given government special warrant until 30 September 2020. The opposition demanded that the expiration dates of the spending powers and special warrants be amended to 30 September 2020 and 23 June 2020, respectively. As Andrew Scheer, leader of the opposition, said:

What we were not prepared for was the government's attempted undemocratic power grab. The Liberals shamefully tried to use a public health crisis to give themselves the powers to raise taxes, debt and spending without parliamentary oversight. However, after hours of negotiation, the government now has backed down from that position, and Conservatives have secured … concessions. (Canada 2020: 2082)

This summary indicates the extent to which the four central governments adhered to both formal and political accountability requirements in their pandemic fiscal responses. In addition, Table 3 shows that a country with a higher formal accountability score also tends to have a higher political accountability score, and vice versa. The ranking of the four countries’ formal and political accountability scores is almost the same. It is premature to draw firm conclusions about the relationship between these two types of accountability mechanism, but their correlation gives us some confidence that our index is tracking democratic accountability in general.

How resilient are these parliamentary democracies?

How robust are parliamentary democracies to threats of executive overreach? One way to answer this question is to look at the accountability record of the four countries in ‘normal’ times and compare it with their accountability scores during a crisis.

An indicator of fiscal accountability in a normal time is drawn from the Open Budget Survey, a widely used survey organized by the International Budget Partnership. The Open Budget Survey (OBS) 2019 examines three criteria in common budgeting practices: transparency (i.e. public access to fiscal information), public participation in the budget process, and budget oversight. Budget oversight includes legislative oversight from parliament and audit oversight from the supreme audit institution. Because our own metrics do not include measures of public participation in the budget process, we exclude them from consideration. Table 4 summarizes the results of the survey for the four countries regarding transparency and oversight for the year 2019.

Table 4. Accountability Before the Pandemic in 2019 (on a scale of 0 to 100)

Source: International Budget Partnership (2020).

As seen in Table 4, New Zealand scored high on budget transparency, legislative oversight and audit oversight before the crisis. Australia scored high on audit oversight. On the other hand, Canada had been performing relatively poorly in legislative oversight before the crisis, and its weakness compared with the executive branch is not a new phenomenon (Potter Reference Potter2010). The government's decision to suspend parliament's regular sittings until September in the midst of the crisis weakened the opposition even more (Turnbull Reference Turnbull2020).

Interestingly, although different metrics are applied in Tables 3 and 4, the ranking of the average accountability scores for the four countries is similar. This correspondence suggests that when democracies have already established robust accountability mechanisms before a crisis, they are more likely to maintain high accountability standards and resist actions that deviate from regular practice. One of the biggest challenges during the COVID-19 crisis has been to maintain parliament's accountability forum and its scrutiny function. During an emergency, it is critical to recognize the role of the opposition, give MPs a voice to raise their concerns, and ensure these conversations happen ‘in the right context’ (Turnbull Reference Turnbull2020). Legislative committees should be active as means of public engagement as well as financial scrutiny (Hendriks and Kay Reference Hendriks and Kay2017). Absent these conditions, opportunities for executive aggrandizement increase.

The WE Charity controversy in Canada illustrates the temptations that arise when circumstances demand extraordinary measures. In this case, the federal government awarded a $43.53 million contract to WE Charity for the administration of a $912 million Canada Student Service Grant, part of the COVID-19 financial support programmes for post-secondary students (CBC News 2020). Although the charity was recommended by the permanent public service, the organization had ties with family members of the prime minister and minister of finance and was not obliged to go through a competitive process (CBC News 2020). The prime minister and his minister of finance were subject to intense criticism for failing to recuse themselves from cabinet discussions on determining who was going to run the CSSG programme, but this criticism was cut short by the prorogation of parliament and the dissolution of committees.

Episodes like this one may be treated either as anomalies or evidence of a necessary trade-off between expediency and accountability. On matters of necessity, observers point to countries such as Finland, where, according to Kaisa-Maria Kimmel and Rosa Maria Ballardini (Reference Kimmel and Ballardini2020), ‘principles of democratic decision-making have been respected in the handling of the pandemic, as parliamentary oversight functions well, and the Parliament still wields the highest legislative power’. Summary judgements like this one are reassuring, but they acquire much more validity if they are the product of a systematic assessment of how accountability mechanisms actually work. The assessment tool we have constructed is a beginning and could doubtless be interrogated further to help account for some of the differences we observed in the four countries we examined.

Extensions to the analysis presented here would likely include consideration of the quality of leadership that democratic processes produce in the first place. David Erbo and Suthan Krishnarajan (Reference Erbo and Krishnarajan2018: 720) argue that ‘bureaucratic quality’, defined in terms of competence, efficiency and autonomy, matters for democratic stability in economic crises because it helps form a ‘crisis shield’ that strengthens democratic resilience. As they point out, competence leads to ‘prudence in policymaking’, and prudence, in the form of rapid and decisive decision-making, set New Zealand apart from the other countries examined here. Although the opposition deemed the government's measures ‘excessively hard’ (New Zealand 2020e: 17777), New Zealand was the only country able to eliminate the virus, at least temporarily. In this context, competence also implies having the ability to forecast the progress of the disease and plan for contingencies. As Minister of Health David Clark told New Zealand's House of Representatives on 5 March, ‘We always knew that COVID-19 would arrive in New Zealand and have been preparing since January in line with the comprehensive pandemic plan’ (New Zealand 2020a: 16687). The plan included public access restrictions to parliament and measures to continue with legislative activities during the emergency. In contrast, the UK Treasury was slow to realize ‘that the effort to contain the virus would involve imposing very significant restrictions on the economy and what kinds of schemes would be needed’ (UK House of Commons Public Accounts Committee 2020: 10).

The issue of competent and well-motivated leadership takes us beyond the themes of democratic accountability featured in this article. It is a reminder, however, that democracies are more resilient if they are able to produce welcome results in the face of crisis. Formal and political accountabilities oblige incumbents to own these results, and they are more likely to do so if the results are praiseworthy.

Conclusion

In established democracies – those with competitive elections and entrenched human rights – the challenge to democratic norms and practices comes mostly from incumbents rather than insurgents. What Milan Svolik (Reference Svolik2015) calls ‘incumbent takeovers’ is evidenced primarily in the weakening or dissolving of the opposition. Compared with presidential systems, parliamentary democracies are more resistant to incumbent takeover, perhaps because authority is already concentrated in the executive, and so a complete takeover is not imperative (Maeda Reference Maeda2010: 1141). Established parliamentary democracies are vulnerable, instead, to what we have described as executive aggrandizement, the progressive erosion of official opportunities to question and criticize executive actions and thereby to extract a measure of accountability.

Whether democracies are able to resist the threat of executive aggrandizement depends on their resilience – that is, their ability to use existing mechanisms of democratic accountability to adapt to new conditions without surrendering system integrity. Students of parliamentary government from around the world have provided assessments, some quite optimistic, about the capacity of legislatures to perform their roles under stressful conditions (e.g. Griglio Reference Griglio2020); others are more critical (e.g. Bar-Siman-Tov Reference Bar-Siman-Tov2020). Using a framework developed to assess accountability systematically, we scored the performance of these mechanisms in four parliamentary democracies: Australia, Canada, New Zealand and the UK between 1 January and 30 June 2020. The results of this analysis allow us to draw the following conclusions.

First, impressionistic assessments of accountability performance need to be augmented by a clear conceptual appreciation of what accountability requires and a set of operational measures that identify specific aspects of performance. We have built an index of accountability on the distinction between political and formal accountability and introduced specific associated requirements. While the public's attention is naturally and appropriately fixed on the actions of politicians, we have drawn attention as well to formal accountability, with its emphasis on adherence to professional norms and responsibilities. Formal requirements are particularly important during crises when the temptation to dispense with established procedures is at its highest.

Second, to strengthen the likelihood that accountability measures will be adhered to, it is important that the scope and scale of executive authority be outlined in advance, and legislation conferring authority invoked only when parliament acknowledges a genuine emergency. Emergency legislation should include opportunities for regular review to ensure close parliamentary oversight and sunset clauses to signal a return to normality. Even with parliamentary agreement to fast-track emergency legislation, every draft bill should receive reasonable consideration before its approval. Crises provide opportunities to strengthen resilience, but they also expose vulnerabilities. In this study, countries that demonstrated a strong performance before the pandemic maintained relatively high accountability standards during the crisis; already weak accountability mechanisms showed less resistance to the expanding power of the executive.

Finally, it is easier to be accountable when outcomes are favourable, but favourable outcomes depend on adherence to the norms of democratic accountability. The democracies that suffered reversals of various kinds during and after the Great Recession were those with not only poor economic performance but also high levels of corruption and little respect for the rule of law. What Larry Diamond describes as ‘deficient political institutions and norms’ (Diamond Reference Diamond2011: 29) contribute to economic poor performance, and poor performance invites further erosion of democratic accountability. Avoiding poor outcomes means investing in good governance, including adherence to established norms. Democratic resilience is more likely to be observed when governments both manage crises and adapt parliamentary business to crisis conditions.

Supplementary material

To view the supplementary material for this article, please visit https://doi.org/10.1017/gov.2021.24.

Acknowledgements

The authors thank Scott Cameron and conference participants for helpful comments. This study is supported by an Insight Grant #435-2019-0716 of the Social Sciences and Humanities Research Council (SSHRC) of Canada.