No CrossRef data available.

Article contents

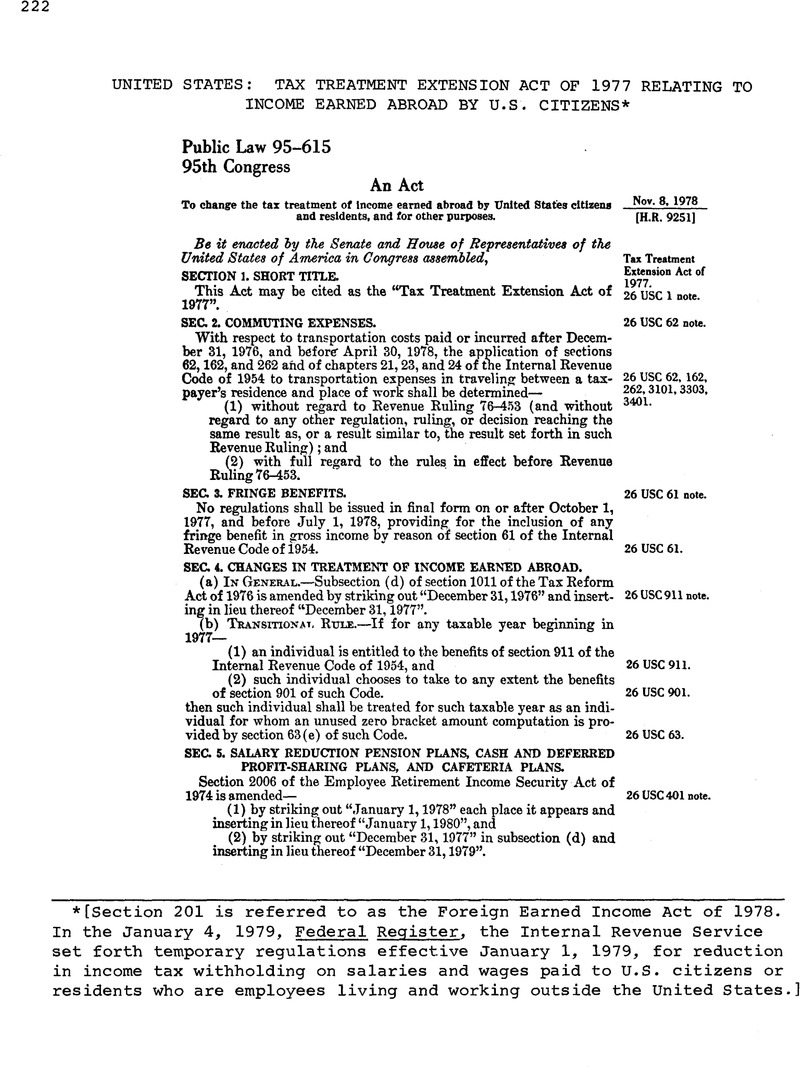

United States: Tax Treatment Extension Act of 1977 Relating to Income Earned Abroad by U.S. Citizens*

Published online by Cambridge University Press: 20 March 2017

Abstract

- Type

- Legislation and Regulations

- Information

- Copyright

- Copyright © American Society of International Law 1979

Footnotes

[Section 201 is referred to as the Foreign Earned Income Act of 1978. In the January 4, 1979, Federal Register, the Internal Revenue Service set forth temporary regulations effective January 1, 1979, for reduction in income tax withholding on salaries and wages paid to U.S. citizens or residents who are employees living and working outside the United States.]

References

* [Section 201 is referred to as the Foreign Earned Income Act of 1978. In the January 4, 1979, Federal Register, the Internal Revenue Service set forth temporary regulations effective January 1, 1979, for reduction in income tax withholding on salaries and wages paid to U.S. citizens or residents who are employees living and working outside the United States.]