Introduction

The burden of depression has increased significantly in recent decades (Lepine and Briley, Reference Lepine and Briley2011). It is estimated that in the European Union (EU) depression is the main mental health disorder contributing to disability-adjusted life years lost (DALYs) and a major contributor to the overall burden of disease (Wittchen et al., Reference Wittchen, Jacobi, Rehm, Gustavsson, Svensson, Jonsson, Olesen, Allgulander, Alonso, Faravelli, Fratiglioni, Jennum, Lieb, Maercker, van Os, Preisig, Salvador-Carulla, Simon and Steinhausen2011). Further understanding of the determinants of depression is therefore an important public health issue.

The era of democratised credit availability has led to a growing household debt-burden, which has been aggravated by continuing economic recession. Existing evidence shows that although debt provides a financial tool for consumption smoothing, it is also a risk factor for depression (Richardson et al., Reference Richardson, Elliott and Roberts2013). However, little is known about the association between household indebtedness and depression among older Europeans, even though, for reasons discussed below, older adults may be particularly susceptible to stress and other adverse mental health consequences arising from indebtedness.

In this paper, we investigate whether household debt status is associated with depressive symptoms in people aged 50 years and over in three European countries: Belgium, France and Germany; we also examine variations in this association by country. These three countries were chosen due to the similarities in their welfare state structures (Ferragina and Seeleib-Kaiser, Reference Ferragina and Seeleib-Kaiser2011), near levels of household indebtedness (Sierminska, Reference Sierminska2014), and shared economic downturn in 2008 and thereafter. Comparative social epidemiological research indicates that welfare state context and specific social policies are important factors that may modify health inequalities (Bergqvist et al., Reference Bergqvist, Yngwe and Lundberg2013). However, we are unaware of any previous research exploring the potential effect of country context in the debt–depression nexus. The three selected countries are under-represented in the literature on the debt–depression relationship (Richardson et al., Reference Richardson, Elliott and Roberts2013) and are particularly suitable for our purposes as there are quite similar contextual policy influences – with some minor but relevant variations discussed below.

Household debt and socio-economic status

Previous research focusing on mental health inequalities in advanced economies has shown that low socio-economic position (SEP) is an important risk factor for depression, and that psycho-social factors, especially stress, may contribute to this association (Lorant et al., Reference Lorant, Deliege, Eaton, Robert, Philippot and Ansseau2003). However, conventional measures of SEP – occupational status, income and education – may be inadequate for investigating inequalities in mental health, especially in the older population (Pollack et al., Reference Pollack, Chideya, Cubbin, Williams, Dekker and Braveman2007). Occupational measures are often outdated for the retired population, income does not necessary reflect real purchasing power, as older people are increasingly dependent on accumulated wealth, and education levels tend to be lower and much more homogenous than in younger cohorts (Grundy and Holt, Reference Grundy and Holt2001). Debt may capture various resource, stress and social dimensions of SEP that are not included in these other measures. Firstly, high interest rates, loss of creditworthiness and debt-collection action, such as home foreclosure, may have a serious impact on material resources and cause severe economic hardship, which is not fully revealed in income or wealth measures. Debt and debt payment difficulties may also involve social stigma (Georgarakos et al., Reference Georgarakos, Lojschova and Ward-Warmedinger2010), and payment defaults may make it difficult to secure rented housing or employment. Secondly, repayment difficulties and debt-collection actions cause psychological stress (Gathergood, Reference Gathergood2012; Drentea and Reynolds, Reference Drentea and Reynolds2015). This may especially be the case for older people who are often largely dependent on accumulated wealth from earlier life phases and have limited opportunities for increasing income.

It is important to note that there are some dimensions of debt which may have positive rather than negative effects (Berger et al., Reference Berger, Collins and Cuesta2016). Normal and manageable debt may, in fact, have a beneficial effect on an individual's welfare and health because of increased ability to smooth consumption over time (Clayton et al., Reference Clayton, Liñares-Zegarra and Wilson2015). However, when debt becomes unmanageable due to, for example, a sudden drop in repayment ability, it may have severe psychological, social and economic consequences (Richardson et al., Reference Richardson, Elliott and Roberts2013).

Debt and depression

Studies from Europe and the United States of America (USA) have found that debts or debt payment difficulties have an independent relationship with mental health, perceived stress, overall depression, maternal depression and early disability retirement due to mental illness (Fitch et al., Reference Fitch, Hamilton, Bassett and Davey2011; Richardson et al., Reference Richardson, Elliott and Roberts2013; Blomgren et al., Reference Blomgren, Maunula and Hiilamo2017). A meta-analysis by Richardson et al. (Reference Richardson, Elliott and Roberts2013) concluded that unsecured personal debt was a predictor of depression even after controlling for other socio-economic factors.

Only a few studies have looked at the implications of debt for mental health in older age groups. Longitudinal evidence is provided by Drentea and Reynolds (Reference Drentea and Reynolds2012) who found, when analysing US-based panel data, that debt status was a more consistent predictor of depression in older age groups than income or assets. This study concluded that the association was moderated by perceived stress about debt. Consistent with this, Lee and Brown (Reference Lee and Brown2007) found in analysis of US Health and Retirement Study data on people aged 65 and over that levels of consumer debt were a significant predictor of depression and that this association was stronger in women than men.

Despite increasing efforts to integrate debt measures into the health inequalities literature, serious gaps remain in our understanding of the debt–depression nexus. Previous studies have focused on single-country study populations without systematic country comparison which might provide insights into the possible role of the policy context. To our knowledge, no previous studies have looked at the debt–depression relationship among older adults in a comparative European context.

The study context

Thanks in part to the increasing availability of cross-country data-sets, accumulating evidence indicates that social inequalities in health are bound to a country context and a specific social policy environment (e.g. Eikemo et al., Reference Eikemo, Bambra, Judge and Ringdal2008; Bambra, Reference Bambra2011). Country context and social policies may shape social inequalities in health through multiple channels. In brief, a state and its institutions may seek to prevent or mitigate socio-economic adversity, including household (over-) indebtedness by, for example, the provision of pensions and welfare payments and additionally, or alternatively, provide measures to alleviate health-related risks factors related to socio-economic disadvantage (Mackenbach, Reference Mackenbach2012; Angel and Heitzmann, Reference Angel and Heitzmann2015). State provision and regulation may also offset socio-economic consequences of poor health, such as costs of health care which in some contexts, such as the USA, may lead to indebtedness (Seifert and Rukavina, Reference Seifert and Rukavina2006). Welfare state context and social policies, including regulation of credit, may thus have an important modifying impact on the debt–depression nexus.

In terms of welfare state structure and health-care system, the countries selected for this study, Belgium, France and Germany, are relatively similar (e.g. Wendt, Reference Wendt2009). Social policy scholars have repeatedly included these countries in the same welfare state cluster, e.g. under a label of a Bismarckian or Conservative model, which is characterised by ‘status maintaining’ social policies with earnings-related income protection, a stronger role of the family in welfare provision than in Social Democratic societies and limited vertical redistribution (Ferragina and Seeleib-Kaiser, Reference Ferragina and Seeleib-Kaiser2011). It is noteworthy that old-age social security and income redistribution policies are similar in the three countries (Börsch-Supan and Nisticò, Reference Börsch-Supan, Nisticò and Papadimitriou2007). Furthermore, these countries share quite similar health-care systems (Bambra, Reference Bambra2005) characterised by high total and public health expenditure and moderate out-of-pocket health-care costs (Wendt, Reference Wendt2009), which limits the risk of indebtedness arising from health-care costs. Given the lack of any major dissimilarity in social policy institutions potentially influencing the debt–depression nexus, a first hypothesis might be that there are no differences between the countries in the debt–depression nexus.

However, the legal and institutional environment relating to debt may also have a strong influence on the lives of those in debt and here there is some indication of differences between the three countries. Hoffmann (Reference Hoffmann2012) has classified a number of EU countries by consumer insolvency policies into different debt discharge regimes according to how debtor-friendly they are, e.g. how strict are the legal conditions for debt discharges. The author classifies Germany and Belgium (which is influenced by German legislation) into the same cluster whereas France falls into a different cluster. According to other public policy comparisons, in France it is possible for private debts to be discharged through insolvency procedures in less than three years if some special requirements are fulfilled, whereas the minimum duration in Belgium and Germany is three to six years (Drometer and Oesingmann, Reference Drometer and Oesingmann2015). Furthermore, descriptive evidence suggests that while Germany and France have quite similar levels of debt relative to disposable income, consumer insolvency filings are more common in France (Ramsay, Reference Ramsay2012; see also European Commission, 2008: 95). These differences suggest that debt laws in France may be more debtor-friendly which might also indicate a more understanding public perception of indebtedness. Therefore, an alternative second hypothesis could be offered that the debt–depression association is less severe in the more debtor-friendly legal context of France.

Research questions

This study aims to investigate the following research questions:

• Is household debt associated with depressive symptoms among people aged 50 and over in three Western European countries?

• Does the association differ between these three countries?

Methods

Data

This study employs data from the Survey of Health, Ageing and Retirement in Europe (the Harmonized SHARE version D.2) Waves 1, 2, 4, 5 and 6 (2003/4, 2006/7, 2011, 2013 and 2015, respectively) for Belgium, France and Germany. Wave 3, which collected retrospective life history information, was not used as it did not include the necessary variables. The target population of SHARE is those who are aged 50 years and older at the time of the interview (excluding the institutionalised population), hold a known address and speak one (or more) of the country's official languages. Spouses of sample members were also interviewed, regardless of age. All parts of the data-generation process have been harmonised across countries (Börsch-Supan et al., Reference Börsch-Supan, Brandt, Hunkler, Kneip, Korbmacher, Malter, Schaan, Stuck and Zuber2013). In each wave, the data-set provides both cross-sectional information (from those subjects who participated only in one wave) and longitudinal data for subjects who participated in at least two waves. Response rates have varied between waves and countries with a previously estimated average response rate of almost 60 per cent (Penger et al., Reference Penger, Strobl and Grill2017). Refreshment samples were added in some countries in various years, resulting in some fluctuation in the size of the cross-sectional samples.

The data-sets we analysed were merged, cleaned and made comparable using the coding provided through the Gateway to Global Aging Data (2017). Some missing item responses were imputed for monetary variables (Angrisani et al., Reference Angrisani, Chien, Lin, Meijer, Phillips, Wilkens and Lee2017; Gateway to Global Aging Data, 2017). However, the proportion of fully imputed debt indicators was very low (ranging from 2 to 3% of observations) and did not vary in any consistent fashion by country or wave (see Tables S1A and S1B in the online supplementary material). We excluded spouses aged under 50 from our analyses as this group does not constitute a representative sample. Observations with missing information on the variables used in this study were dropped (912 observations for women and 684 observations for men). After these exclusions, the merged data, from all countries from all waves pooled, consisted of 31,409 observations from 13,767 women and 26,382 observations from 11,781 men (see Table S2 in the online supplementary material).

Measures

The outcome measure was the number of depressive symptoms measured by the Euro Depression (EURO-D) score, which is designed for cross-country comparisons and has been validated as a measure of depression (Prince et al., Reference Prince, Reischies, Beekman, Fuhrer, Jonker, Kivela, Lawlor, Lobo, Magnusson, Fichter, van Oyen, Roelands, Skoog, Turrina and Copeland1999). To construct the EURO-D measure, trained interviewers asked informants about 12 depression-related items, namely depression, pessimism, wishing death, guilt, irritability, tearfulness, fatigue, sleeping troubles, loss of interest, loss of appetite, reduction in concentration and loss of enjoyment over the last month. The sum of the dichotomous items ranging from 0 to 12 (higher score representing a higher number of depressive symptoms) is used as the outcome measure. Although the EURO-D score can be used as a dichotomous measure indicative of clinically significant depression, with a cut-point score of >3, we preferred to use it as a continuous variable which has been suggested as more appropriate for studies of population health (Prince et al., Reference Prince, Reischies, Beekman, Fuhrer, Jonker, Kivela, Lawlor, Lobo, Magnusson, Fichter, van Oyen, Roelands, Skoog, Turrina and Copeland1999; Castro-Costa et al., Reference Castro-Costa, Dewey, Stewart, Banerjee, Huppert, Mendonca-Lima, Bula, Reisches, Wancata and Ritchie2008). However, we additionally undertook some sensitivity analysis using the dichotomised score.

The main exposure variable was household debt. Information on household debt was gathered from the household member, characterised as the ‘financial respondent’, able to provide the most reliable information about the household's financial situation. Respondents were asked about various items of household debt divided into: household housing debt referring to the total amount of outstanding mortgage, and household financial debt referring to outstanding debt other than a mortgage. For this study, both debt measures were first adjusted for Consumer Price Index and Purchasing Power Parity (PPP)Footnote 1 using Germany in 2010 as a reference point to allow comparison across time and between countries. Then, having any financial debt up to and including €5,000 was defined as ‘low financial debt’, with household financial debt over €5,000 defined as ‘substantial financial debt’. We also distinguished between those with ‘low’ and ‘substantial’ housing debt, in this case using a cut-point of €20,000 to distinguish the two groups. The rationale for these cut-points was that they equalled approximately the highest 10 per cent of the given debt type for all households in all countries and, therefore, represented a comparatively substantial debt burden.

We included in all analyses several control variables potentially associated with both mental health and household indebtedness. Key socio-economic measures included a three-category classification of education level (I: pre-primary, primary and lower secondary education; II: upper secondary and post-secondary, non-tertiary education; III: first and second stage of tertiary education); employment status (employed or self-employed; retired; unemployed, permanently sick or disabled; and in addition, home-maker for women); household gross wealth. Following previous work (e.g. Riumallo-Herl et al., Reference Riumallo-Herl, Basu, Stuckler, Courtin and Avendano2014), gross wealth, adjusted for country and time period, was converted to a log scale (ln).

Given its known association with indebtedness and with depression (Richardson et al., Reference Richardson, Elliott and Roberts2013), we controlled for physical health status using the number of self-reported diagnosed diseases with categories of zero, one, and two or more diagnosed diseases (these included high blood pressure, diabetes, cancer, lung disease, heart problems, stroke and arthritis). A dichotomous measure of obesity (Body Mass Index > 30) was also included (Munster et al., Reference Munster, Ruger, Ochsmann, Letzel and Toschke2009). Furthermore, two categorical disability measures were used, namely the number of limitations in activities of daily living with categories of zero, one, and two or more limitations, and the number of limitations in instrumental activities of daily living with the same categories as the former. In addition, given their potential association with debt and depression, measures of age (age and age-squared), marital status (partnered; never-married, divorced or separated; and widowed), housing status (owner versus not owner), household size (one or two versus three or more household members), time (wave dummies) and country × time interaction dummies were used where appropriate.

All variables were time-varying (measured at each wave) except country and education levels, which were stable over the study period. All analyses were undertaken separately for men and women given known differences in levels of depression and in measures of socio-economic status.

Statistical analyses

Following descriptive analysis, we fitted regression models to investigate the link between household debt and depressive symptoms with the number of depressive symptoms (EURO-D score) as the continuous outcome variable. Due to the nested nature of the data within individuals, linear mixed (‘multi-level’) models with random intercepts for subjects were utilised. These mixed models are the most appropriate for the study as the data included both cross-sectional and longitudinal observations and the method allowed inclusion of both time-invariant and time-varying co-variates and analysis of variation between and within individuals throughout the study period (Gardiner et al., Reference Gardiner, Luo and Roman2009). Clustered standard errors at individual level, or household level in the case of same-sex respondents from the same household, were used. We first analysed the association between depressive symptoms and socio-economic predictors in pooled analysis of all countries, controlling for health and disability indicators. Country × wave interaction controls were included to adjust for differences in depression and debt levels between countries and over time.

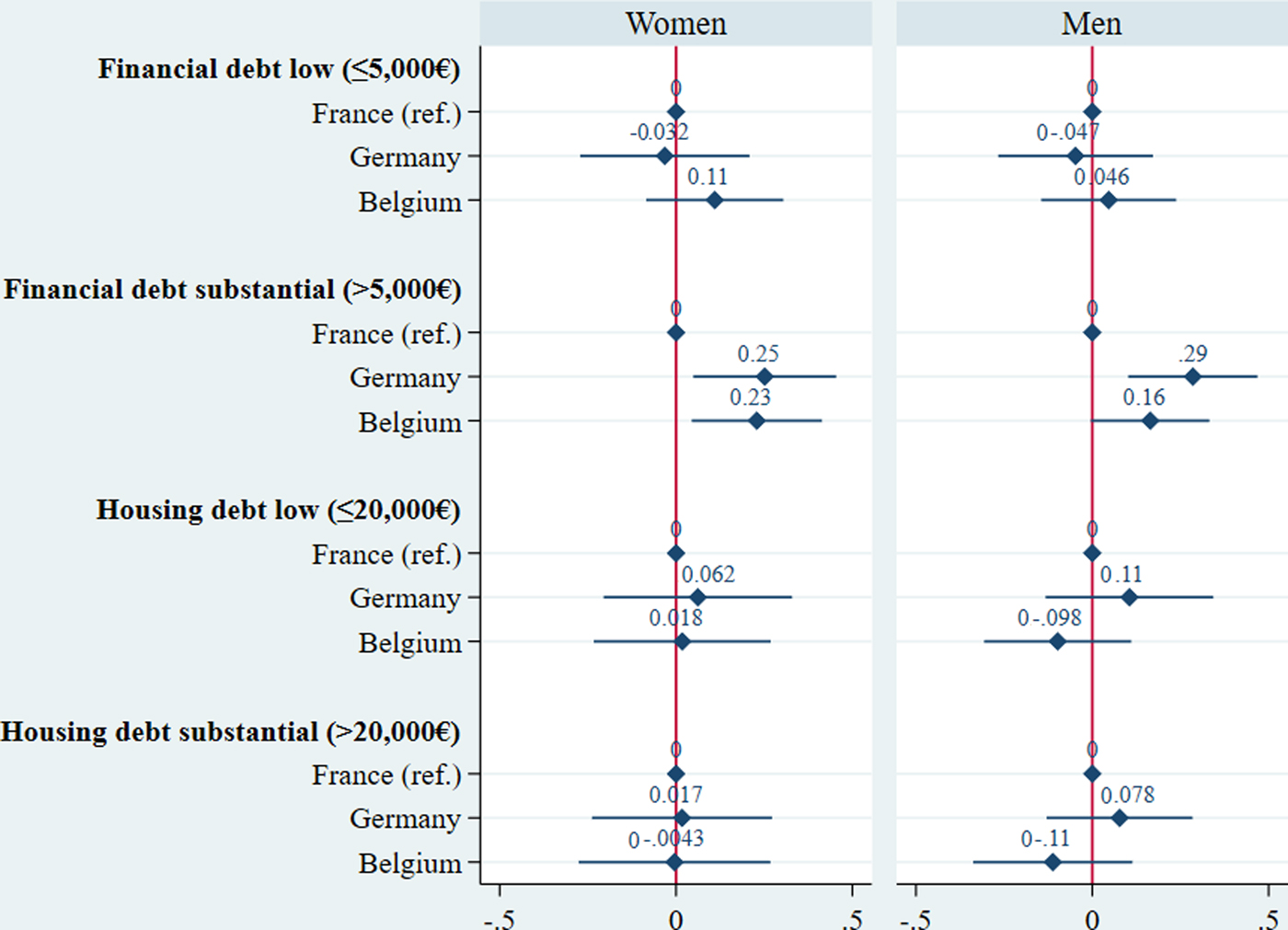

We then undertook the same analysis for each country separately. Additionally, a separate all-countries-pooled mixed-effect model with random intercepts for individuals including country × socio-economic variable interaction terms was fitted. The interaction terms indicate country differences in the socio-economic variable–depression associations, including the debt–depression nexus. In this model all other significant differences in socio-economic variable–depression associations were simultaneously accounted for with their interaction terms. The full model is shown in the online supplementary material (Table S3) but the magnitudes of the differences are shown in Figure 1, which presents unstandardised coefficients and 95 per cent confidence intervals (95% CI). Similarly, potential sex differences were separately checked with a sex interaction model with all countries pooled and clustered errors at the household level. The magnitude of the sex differences is shown in the online supplementary material (Figure S1). All statistical analyses were conducted using Stata 15 (Stata Corp, College Station, TX).

Figure 1. Country differences in debt–depression associations: unstandardised coefficients from the country interaction models.

Results

The mean age of respondents in all countries was around 65 years. Levels of depressive symptoms and household debt differed somewhat by country and sex (Table 1). France had the highest levels of depression, with an average of 3.24 depressive symptoms (EURO-D) in women and 2.29 in men. Overall, the percentage of people with low and substantial household financial debt was also highest in France. Proportions with low housing debt were rather low across countries, whereas substantial housing debt was more common in Germany, where an average of 11–12 per cent of respondents’ households had substantial housing debt. Germany also had the smallest proportion of women and men with the lowest education level and the highest proportions of employed participants.

Table 1. Debt levels and depression by country (all waves)

Notes: EURO-D: Euro Depression score. 1. I: pre-primary, primary and lower secondary education; II: upper secondary and post-secondary, non-tertiary education; III: first and second stage of tertiary education.

Table 2 presents the results for women from the country-specific and whole sample analysis, the latter based on pooled data for all the three countries and all waves. The magnitude of the country differences tested in a full interaction model is shown in Figure 1.

Table 2. Results from multi-level regression analysis of associations between socio-economic measures and depressive symptoms among women aged 50 and over in France, Germany and Belgium

Notes: b: unstandardised coefficient. 95% CI: 95 per cent confidence interval. Ref.: reference category. SD: standard deviation. 1. I: pre-primary, primary and lower secondary education; II: upper secondary and post-secondary, non-tertiary education; III: first and second stage of tertiary education. All models adjusted for age, age-squared, marital status, housing status, household size, physical health (instrumental activities of daily living, activities of daily living, the number of reported diseases and obesity) and country × wave interaction dummies.

Significance levels: † p < 0.1, * p < 0.05, ** p < 0.01, *** p < 0.001.

The analysis of the pooled data (last column of Table 2) showed that all socio-economic variables were associated with the number of depressive symptoms for women. Compared to those with no financial debt, having a low (b = 0.212; 95% CI = 0.124–0.299) and substantial financial debt (b = 0.282; 95% CI = 0.203–0.362) was associated with a higher depressive symptom score. Furthermore, having low or substantial housing debt was linked to a greater number of depression symptoms when compared to those without housing debt (b = 0.126; 95% CI = 0.025–0.227 and 0.298; 95% CI = 0.196–0.399, respectively).

The results of the country-specific models for women are broadly similar to the results from the pooled sample analysis. In all countries, education level, employment status and household debt were significantly associated with depression without consistent country differences. There were a few exceptions, however. Compared to those with no financial debt, having low financial debt was associated with a higher number of depressive symptoms in all countries but substantial financial debt was only weakly associated with depressive symptoms in France; the coefficient, although positive, was small (b = 0.136; 95% CI = 0.009–0.263). In contrast, this association was substantial in Germany (b = 0.387; 95% CI = 0.230–0.545) and Belgium (b = 0.350; 95% CI = 0.215–0.485). In Belgium, low and substantial financial debt compared to not having any financial debt had a similar or stronger effect size to having the lowest education when compared to the highest education level (b = 0.210; 95% CI = 0.079–0.341). Having low housing debt was not associated with a higher number of depressive symptoms in the country sub-groups, but substantial housing debt was significantly linked to a higher depressive symptom score in all countries. Country differences in associations between depressive symptoms and the debt indicators (see Table S4 in the online supplementary material) are presented in Figure 1. This shows that the association between substantial financial debt and depressive symptoms was greater in Belgium and Germany than in France, but there were no significant differences in associations between depressive symptoms and any of the other debt indicators.

Table 3 presents equivalent results for men. In line with the results for women, education level, being unemployed or disabled, wealth and financial debt were significantly associated with depression score in the pooled sample of men (last column of Table 3). Low and substantial financial debt were significantly associated with a higher number of depressive symptoms (b = 0.217; 95% CI = 0.133–0.301 and b = 0.202; 95% CI = 0.130–0.274, respectively). The effect size of having low financial debt when compared to not having any financial debt was higher or similar to the effect of having the lowest education level compared to the highest education level (b = 0.144; 95% CI = 0.063–0.226). In contrast to women, the association between low housing debt and depressive symptoms was not statistically significant and the association with substantial housing debt was milder compared to women (p for the sex interaction = 0.011; see Figure S1 in the online supplementary material). On the other hand, the coefficient of being out of work (unemployed, permanently sick or disabled) was significantly higher for men (p for the sex interaction < 0.001).

Table 3. Results from multi-level regression analysis of associations between socio-economic measures and depressive symptoms among men aged 50 and over in France, Germany and Belgium

Notes: b: unstandardised coefficient. 95% CI: 95 per cent confidence interval. Ref.: reference category. SD: standard deviation. 1. I: pre-primary, primary and lower secondary education; II: upper secondary and post-secondary, non-tertiary education; III: first and second stage of tertiary education. All models adjusted for age, age-squared, marital status, housing status, household size, physical health (instrumental activities of daily living, activities of daily living, the number of reported diseases and obesity) and country × wave interaction dummies.

Significance levels: † p < 0.1, * p < 0.05, ** p < 0.01, *** p < 0.001.

The country-specific analysis for men shows similarly that there were no consistent country differences in the socio-economic predictors of depression, although a few exceptions exist. In all countries, low levels of financial debt were linked to a higher number of depression symptoms without significant country differences in this association (Table 3; Figure 1). In line with results for women, there was a noteworthy difference between the countries in the effect of substantial financial debt. This did not have a significant association with the number of depressive symptoms in France, whereas it was significantly linked to the higher depression score in Germany (b = 0.354; 95% CI = 0.213–0.494) and Belgium (b = 0.219; 95% CI = 0.099–0.339) when compared to those not having this debt. In general, household debt was not associated with the depressive symptoms score although substantial housing debt was linked to depression with a small effect size in Germany (b = 0.158; 95% CI = 0.025–0.291). However, the full interaction model showed that the housing debt effect was not significantly different compared to the other countries (Figure 1).

Sensitivity analyses

Fixed-effects modelling of associations between changes in debt and changes in depressive symptoms

Three types of alternative analysis were carried out as a form of sensitivity analysis. First, for the longitudinal sub-group, linear fixed-effect ‘within’-person regression models were conducted to test whether changes in socio-economic variables, including household debt status, predicted changes in depressive symptoms. Fixed-effect models control for unobserved differences between individuals’ time-invariant characteristics (e.g. personality and childhood experiences) that are potentially linked to the outcome variable (Firebaugh et al., Reference Firebaugh, Warner, Massoglia and Morgan2013). The fixed-effect models (Table 4) largely confirmed the results with regard to household financial debt and substantial housing debt. A change from not having any financial debt to substantial financial debt was associated with an increase in depressive symptoms for women (b = 0.127; 95% CI = 0.030–0.224) and weakly also for men (b = 0.087; 95% CI = −0.001–0.175). Furthermore, the within-individual association between substantial housing debt and depressive symptoms was as strong and of similar magnitude to the coefficient obtained from the random intercept model for women (b = 0.305; 95% CI = 0.158–0.451). However, it must be noted that only some 22 per cent of participants with two consecutive observations experienced a change in financial debt value and only 10 per cent experienced a change in housing debt value. As a result of this, and the smaller sample available for this longitudinal analysis, the statistical power in the within-individual analysis is not comparable with that of the random-effect model presented above.

Table 4. Results from analysis of the association between changes in debt measures and changes in Euro Depression score, among women and men aged 50 and over in France, Germany and Belgium (fixed-effect analyses, longitudinal sub-group)

Notes: b: unstandardised coefficient. 95% CI: 95 per cent confidence interval. Ref.: reference category. All models adjusted for age, age-squared, marital status, housing status, household size, wealth, employment, physical health (instrumental activities of daily living, activities of daily living, the number of reported diseases and obesity) and country × wave interaction dummies.

Significance levels: † p < 0.1, * p < 0.05, ** p < 0.01, *** p < 0.001.

Results using a dichotomised depression indicator

The second sensitivity analysis checked whether the results were robust when using a dichotomised depression measure using EURO-D > 3 as a cut-point. A logistic regression with random intercepts for individuals was undertaken focusing on between- and within-individual variation (Rabe-Hesketh and Skrondal, Reference Rabe-Hesketh and Skrondal2008). This sensitivity analysis (Table 5) showed that the results from the pooled analysis were robust even when the outcome was the dichotomised depression measure. After adjustments, both women and men with a substantial financial debt had around 1.5-fold (odds ratio (OR) = 1.51; 95% CI = 1.34–1.71 for women; OR = 1.42; 95% CI = 1.23–1.64 for men) higher odds of having a depression score above the cut – indicating symptoms that would be clinically identified – compared to those without any financial debt.

Table 5. Results from random intercept logistic regression (RE) and fixed-effect logistic regression (FE): outcome measure depression (Euro Depression score > 3) at Waves 1, 2, 4, 5 and 6

Notes: OR: odds ratio. 95% CI: 95 per cent confidence interval. Ref.: reference category. 1. I: pre-primary, primary and lower secondary education; II: upper secondary and post-secondary, non-tertiary education; III: first and second stage of tertiary education. All models adjusted for age, age-squared, marital status, housing status, household size, wealth, physical health (instrumental activities of daily living, activities of daily living, the number of reported diseases and obesity) and country × wave interaction dummies.

Significance levels: † p < 0.1, * p < 0.05, ** p < 0.01, *** p < 0.001.

The final sensitivity analysis undertaken was a conditional (fixed-effect) logistic regression studying intra-individual changes in the dichotomised depression status and household debt status (Allison, Reference Allison2009). This analysis was conducted for a considerably smaller sub-group who experienced changes in the dichotomised depression measure during the study period. The analysis confirmed that the effect of financial debt on depression was evident also when focusing on within-individual changes (Table 5). If a person changed from not having any financial debt to having a substantial financial debt within the study period, his or her odds of being depressed were multiplied by 1.23 (95% CI = 1.00–1.51 for women; 95% CI = 1.02–1.50 for men).

Discussion

In this paper, we investigated the relationship between household debt and depressive symptoms in a sample of the population aged 50 and over from Belgium, France and Germany, and differences in this relationship between these countries. The results showed that in all countries, after control for measures of socio-economic position, physical health and disability, financial debt in some form was associated with a higher number of depressive symptoms for both men and women, although low and substantial housing debt was associated with depressive symptoms only for women. There were no consistent differences between the countries in the household debt–depression nexus except that substantial financial debt was not significantly associated with a higher number of depressive symptoms in France for either men or women.

Earlier studies have shown that debt-based measures are independently associated with depression, suicide and other indications of mental illness (Hatcher, Reference Hatcher1994; Jenkins et al., Reference Jenkins, Bhugra, Bebbington, Brugha, Farrell, Coid, Fryers, Weich, Singleton and Meltzer2008; Richardson et al., Reference Richardson, Elliott and Roberts2013). The results yielded here are consistent with this research. For men, the effect of having a low level of financial debt, compared with no debt, on depressive symptoms was of equal magnitude to the effect of having the lowest education level compared to the highest. On average, after all relevant adjustments, women with substantial financial debt had nearly 0.3 higher number of symptoms of depression (on a scale of 0–12) compared to those without any financial debt. The figure for men was around 0.2.

Rather few earlier relevant studies have used a range of measures of debt and depression, so an accurate comparison of these effect sizes with results from previous research is not possible. However, it can be briefly noted that the effect of having any financial debt on a dichotomous indicator of depression (tested in the second sensitivity analysis) seems somewhat lower than found in the previous nationally representative cross-sectional studies in the United Kingdom (UK) conducted by Meltzer et al. (Reference Meltzer, Bebbington, Brugha, Farrell and Jenkins2012) and Jenkins et al. (Reference Jenkins, Bhugra, Bebbington, Brugha, Farrell, Coid, Fryers, Weich, Singleton and Meltzer2008). However, this may be because neither of these previous studies included the range of control for other indicators of SEP, and of health, that we included here, because of the age differences in the samples or potentially because of a difference between the UK and the countries we considered.

The finding that housing debt was a stronger predictor of depression for women confirms earlier findings about the gendered nature of the debt–depression nexus (Nettleton and Burrows, Reference Nettleton and Burrows1998; Lee and Brown, Reference Lee and Brown2007). One potential explanation for this is that women may worry more about household housing debt because they tend to be more risk-averse (Jianakoplos and Bernasek, Reference Jianakoplos and Bernasek1998). Moreover, joint housing debt may be more stressful for women because their wealth and income tend to be linked to that of their spouse. Women are also likely to lose economically in the event of a divorce (Andress and Hummelsheim, Reference Andress and Hummelsheim2009), and evidence shows that women are likely to suffer more debt problems after a divorce (Fisher and Lyons, Reference Fisher and Lyons2006). Furthermore, debt may have other gendered effects on various areas of life (see e.g. Dwyer et al., Reference Dwyer, Hodson and McCloud2013), and further studies are needed to study these effects in later age.

Interestingly, the effect of financial debt did not seem to differ notably between low and substantial debt categories. This might be because a substantial debt burden may be qualitatively different from the low financial debt category. A higher proportion of debt in the low financial debt category may be in the form of unsecured loans with high interest rates (e.g. credit card debt or smaller consumer credits) causing more stress and fear of, or actual, debt-collection actions. In contrast, the substantial financial debt might be associated with large non-housing assets which are, if necessary, more easily repayable through liquidation (e.g. car loans) and have lower interest rates. This finding highlights the need for a debt–depression scrutiny also with qualitatively oriented debt measures, such as reported debt problems, arrears or payment defaults.

An association between debt and depression does not necessarily imply that debt leads to depression. Firstly, the association might be the other way round, i.e. depression and poor mental health might increase the risks of indebtedness. One potential mechanism for a reverse link, especially when it comes to the effect of low financial debt, is the well-established predatory strategy of some consumer credit companies which target their loans on more vulnerable people (Autio et al., Reference Autio, Wilska, Kaartinen and Lähteenmaa2009). A further potential inverse mechanism might be due to decreased financial judgement or cognitive capacity among people with depressive symptoms, and costs arising from the depression (e.g. reduced work). It is also possible that personal characteristics, such as risk-taking propensity, may be related to both depression and household indebtedness (Meltzer et al., Reference Meltzer, Bebbington, Brugha, Farrell and Jenkins2012). However, in our longitudinal analysis we undertook fixed-effect sensitivity analysis studying within-individual changes which controlled for potential third-factor influence related to unobservable time-invariant characteristics (Tables 4 and 5). Results of this were mainly consistent, although weaker than our main analysis and, therefore, suggest that an explanation based on personality characteristics is unlikely to explain fully the associations between debt and depression that we found in the main analysis. Our analysis also indicated other measures of socio-economic position or differences in physical health and disability did not account for the associations found between debt and depressive symptoms.

Finally, the reason behind the link might be a causal relationship between indebtedness and depression, although in this observational study we are not able to provide hard evidence of this. Nevertheless, given the evidence presented here and elsewhere (Gathergood, Reference Gathergood2012; Hojman et al., Reference Hojman, Miranda and Ruiz-Tagle2013), it is not unreasonable to hypothesise for future studies that such a causal link exists. Previous work has suggested that stress and social norms related to debt are important mechanisms mediating the link between debt and depression (Drentea and Reynolds, Reference Drentea and Reynolds2012, Reference Drentea and Reynolds2015; Gathergood, Reference Gathergood2012). Moreover, there may be various other mechanisms linking the two, such as a lack of material resources due to repayment and debt-collection actions, health-related behavioural factors (Drentea and Lavrakas, Reference Drentea and Lavrakas2000), health-care access (Alley et al., Reference Alley, Lloyd, Pagan, Pollack, Shardell and Cannuscio2011), social isolation or sense of failure.

Regarding the second research question, the study showed a robust association between household debt and depression in all the three countries considered. We did not find consistent differences between the countries in the effect of housing and low financial debt on depression, which might be due to the similar welfare state structure and the relatively similar economic environment during the study period. It is also noteworthy that we did not find any major differences between the countries in the other socio-economic predictors of depression, namely wealth, labour market status and education, except a somewhat stronger association between lowest education level and depressive symptoms among women in Germany compared to women in the other two countries. Previous comparative studies on socio-economic status and health have shown that inequalities in general health are comparable between these three continental European countries and moderate or low when compared to other countries (e.g. Mackenbach et al., Reference Mackenbach, Stirbu, Roskam, Schaap, Menvielle, Leinsalu and Kunst2008). The fact that we similarly did not find any consistent country differences in socio-economic predictors of depression is consistent with this.

The only country-specific debt–depression nexus and socio-economic predictor of depression was that substantial financial indebtedness was not associated with depressive symptoms for men and the association was weaker for women in France compared to the other two countries. The magnitude of the country difference in the debt–depression nexus was substantial for both sexes. Although this finding might be due to differences in sample composition or other unaccounted factors, we offer here two potential explanations worthy of more investigation. The first potential explanation is that the more debtor-friendly legal environment in France attenuates the debt–depression association (Hoffmann, Reference Hoffmann2012), an explanation we call here an institutional explanation. The more debtor-friendly legal environment, indicating a shorter jurisdictions period for debt-discharges and/or more understanding attitudes towards those in debt, in France might alleviate the stress and hopelessness related to substantial financial debt. No country differences were found in associations between low financial debt and depressive symptoms, but it might be that the consumer debt legal environment is only relevant when the debt burden is substantial and significant.

The second, alternative, explanation for the country difference found here might be the fact that substantial financial debt was generally more common in France and therefore it might be less associated with feelings of shame and stigma. This explanation for the country differences can be called as a social norm explanation. Evidence for the social norm explanation is provided by Gathergood (Reference Gathergood2012) who found in analyses of UK panel data that the effect of debt problems on psychological health was smaller in the UK areas where estimated indebtedness levels were higher and vice versa. This he interpreted as evidence that local (neighbourhood) social norms are important in the debt–depression nexus, possibly as a result of reduced shame and stigma about debt in areas where it was more common. Consistent with this, Angel (Reference Angel2016), in a study of associations between self-rated health (which is associated with depression) and indicators of over-indebtedness (arrears, etc.) across 25 EU countries, reported weak descriptive evidence that countries with a stronger association between self-reported health and over-indebtedness had lower proportions of persons with arrears. However, this explanation would not account for our finding that it was only the association between substantial debt – not lower levels of debt – and depressive symptoms that seemed stronger in France.

All and all, this explorative study can only offer hypothetical explanations for the country differences as we did not have data before and after the introduction of any major consumer debt legislation and we lacked information regarding the qualitative element of the debt measures. For example, it is also possible that the substantial debt burden comprised more stressful loans, i.e. those yielding debt-collection actions, in Belgium and Germany than in France. Given that we are unaware of any previous cross-country comparative studies on the debt–depression nexus, detailed analyses of country comparisons are needed, also with qualitative measures of indebtedness, to verify our country difference finding, to explore potential explanations in more detail, and to test both institutional and social norm explanations (while the two are interactive and not mutually exclusive).

Lastly, it is important to consider the implications of our main finding from the perspective of older people. Traditional economic models of saving conceptualise older age as a life-phase reliant on consumption of accumulated wealth from earlier life-phases (e.g. Danziger et al., Reference Danziger, Van Der Gaag, Smolensky and Taussig1982). For this age group, incomes are not usually increasing and persons are more dependent on social security, family and earlier savings. However, this reliance on accumulated savings or pensions may make older people particularly vulnerable to fiscal and economic shocks affecting returns on savings and the value of pensions. Additionally, in some cases older people may be called upon to provide support to adult children affected by economic downturns or experience other events, such as a deterioration in health or bereavement, involving a loss of income, loss of capacity to gain income or increased expenditure (e.g. Brandt and Deindl, Reference Brandt and Deindl2013; Heath and Calvert, Reference Heath and Calvert2013). These changes in circumstances may lead to taking on debt, but also a reduced capacity to meet repayments of existing or new debts resulting in socio-economic and psychological stress.

Methodological consideration

The main strength of this study was the use of a population-representative cross-national data-set with comparative measures and large samples of both cross-sectional and longitudinal participants. The follow-up design from up to five data-points allowed a detailed analysis of the relationship under study. Furthermore, the models controlled for several potential confounding factors. Additionally, this study used a well-validated outcome measure of depressive symptoms designed for country comparisons (Prince et al., Reference Prince, Reischies, Beekman, Fuhrer, Jonker, Kivela, Lawlor, Lobo, Magnusson, Fichter, van Oyen, Roelands, Skoog, Turrina and Copeland1999), and also verified the results using a dichotomised measure of clinically significant depression.

Several limitations must be taken into consideration in the interpretation of the results. The data excluded the institutional population (potentially correlated with depression), which decreases the national representativeness of the results. The internal validity of the data might be compromised due to selection bias related to mortality and drop-outs from the longitudinal sample. Furthermore, the differences in the sample size and composition (cross-sectional observations versus longitudinal observations) between the waves and countries may weaken the reliability of the country comparison part. Also, our data consisted of some imputed values for item missingness, although the results did not differ significantly when fully imputed debt values were deleted.

The measures of household debt and wealth were provided by the financial respondent of a household having the most up-to-date information about the household's financial situation. However, potential reporting bias still exists due to, for example, cognitive limitations or shame which might have influenced reporting. Previous studies indicate that people tend to under-report their credit card debt (Zinman, Reference Zinman2009), which might partly explain the finding that the substantial financial debt category was not a notably stronger predictor of depression than low financial debt.

Moreover, the debt measures used were insufficient to differentiate manageable and unmanageable debt, and we lacked information on payment difficulties or arrears. It is argued that debt may have a detrimental effect on mental health only when it is associated with stress or debt-collection actions (Drentea and Reynolds, Reference Drentea and Reynolds2012). Normal and manageable debt may even have a positive effect on health and wellbeing through improved consumption power (Clayton et al., Reference Clayton, Liñares-Zegarra and Wilson2015).

We considered continuous debt variables inappropriate for this study because the debt–depression relationship is not easily modelled and clearly non-linear. In financial and housing debt measures, a simple cut-point of approximately the highest 10 per cent of the adjusted monetary amount of the given debt type within the study population was used in separating low and substantial debt burden categories. Although this cut-point is arguably somewhat arbitrary, it is justified as no universal metrics of debt status exist (Betti et al., Reference Betti, Dourmashkin, Rossi and Ping Yin2007). A validation check using interactions between the monetary amount of the given debt and the corresponding debt categories provided also some support for our cut-point; a continuous debt amount was more strongly associated with a higher number of depressive symptoms within the low financial debt category than within the substantial debt category (see Table S4 in the online supplementary material). However, for the housing debt we did not find any significant interactions between the continuous debt measure and categories suggesting that for this debt measure debt status might be more important than the actual amount per se.

Furthermore, we re-estimated all our models using a continuous natural logarithm debt scale measure, in which lower amounts of debt are given more weight than higher amounts of debt. Using this continuous debt measure verified our main findings. First, ln scale of financial debt was significantly associated with a higher number of depressive symptoms in all countries, but the association was weaker in France (significant at the 10% significance level). Secondly, ln scale of housing debt was associated with depressive symptoms for women without significant country differences but not for men in Belgium and France (see Figures S3 and S4 in the online supplementary material). Additionally, to account for differences in consumption power between the three countries, we used the PPP value-adjusted monetary variables (debt and wealth) to provide comparative estimates to the country comparison part. However, it is worth noting that our analyses without the PPP adjustments yielded similar results.

We did not employ previously used debt-to-income-based measures for this study, as these do not investigate the effect of debt per se, being a combination of two variables, which both have their own distinct socio-economic dimensions. Debt-to-wealth measures are unsuitable at older ages as risk of misclassifications of debt-to-wealth measures is high. Nevertheless, to evaluate the potential protective effect of high wealth on the debt–depression nexus, we ran a sensitivity check with the full all-countries-pooled model with an interaction term for dichotomous financial debt (low or substantial) and wealth quartiles (see Figure S4 in the online supplementary material). This analysis showed that those with financial debt had higher depression scores in almost all wealth quartiles compared to those without any financial debt, although the effect sizes were indeed significantly larger in the lower than the higher wealth groups. Therefore, further studies are needed to investigate the co-occurrence effect of debt with other socio-economic dimensions on depression. Lastly, we did not adjust our models for household income as household wealth is a measure of cumulative income. In our data-set, there was no comparable household net income variable available in all five waves used in the present study. Nevertheless, we ran our models with four waves for which a comparable household income measure was available. This did not change our results and showed that household income (logarithm converted) was generally a non-significant predictor of depressive symptoms when controlling for the other socio-economic predictors.

Conclusion

Having a small or substantial amount of financial debt was a robust predictor of depression for older European adults included in this study. Furthermore, this study found that the association existed in some form in all three countries studied. However, some variations in France indicate the need to investigate further the effect of legal policies on the association between debt and depression. Measures and dimensions of indebtedness should be taken into consideration in future work on social inequalities in depression in Europe. Further work is needed to investigate in detail the effect of country context utilising various debt and debt problem measures, and to understand the interaction between household debt and other socio-economic disadvantages.

Policy implications

The finding that even low financial debt is associated with depression highlights the importance of consumer protection and regulation of the companies making even smaller financial loans including consumer credits and payday loans. Moreover, this study suggested that having a substantial financial debt did not affect strongly depressive symptoms in France; the country with arguably the most debtor-friendly legal system in continental Europe. Therefore, further evidence would be needed to evaluate the practices regarding the debt-discharge legal environment in continental Europe and debt advice services in order to mitigate the mental health concern related to debt. Studies are needed to investigate the debt–depression nexus before and after major debt legislative change.

Supplementary material

The supplementary material for this article can be found at https://doi.org/10.1017/S0144686X18001113.

Data

This paper uses data from SHARE Waves 1, 2, 4, 5 and 6 (DOIs: 10.6103/SHARE.w1.610, 10.6103/SHARE.w2.610, 10.6103/SHARE.w3.610, 10.6103/SHARE.w4.610, 10.6103/SHARE.w5.610, 10.6103/SHARE.w6.610), see Börsch-Supan et al. (Reference Börsch-Supan, Brandt, Hunkler, Kneip, Korbmacher, Malter, Schaan, Stuck and Zuber2013) for methodological details. The SHARE data collection has been primarily funded by the European Commission through FP5 (QLK6-CT-2001-00360), FP6 (SHARE-I3: RII-CT-2006-062193, COMPARE: CIT5-CT-2005-028857, SHARELIFE: CIT4-CT-2006-028812) and FP7 (SHARE-PREP: No. 211909, SHARE-LEAP: No. 227822, SHARE M4: No. 261982). Additional funding from the German Ministry of Education and Research, the Max Planck Society for the Advancement of Science, the US National Institute on Aging (U01_AG09740-13S2, P01_AG005842, P01_AG08291, P30_AG12815, R21_AG025169, Y1-AG-4553-01, IAG_BSR06-11, OGHA_04-064, HHSN271201300071C) and from various national funding sources is gratefully acknowledged (see www.share-project.org).

Acknowledgements

AH would like to acknowledge Dr Steen Mangen (London School of Economics and Political Science) for his supervision and commitment in the design phase of this study.